Dynamic Reinforcement Learning (DRL): A Brief Introduction

Dynamic Reinforcement Learning (DRL) is an advanced machine learning technique that combines the principles of reinforcement learning and dynamic programming. DRL focuses on optimizing decision-making processes in complex, uncertain environments. Unlike traditional reinforcement learning methods, DRL employs a more sophisticated approach to learn from experience, adapt to changing conditions, and make more informed decisions over time. This adaptive nature of DRL makes it particularly suitable for addressing intricate decision-making problems in various domains, including finance and portfolio management.

DRL operates by learning a policy, which is a mapping from states to actions, through repeated interactions with the environment. The agent, or the decision-maker, observes the current state, selects an action based on the policy, and receives a reward signal as feedback. The goal of DRL is to maximize the expected cumulative reward over time. By continuously updating the policy based on the observed outcomes, DRL can adapt to new situations, learn from mistakes, and refine its decision-making process, making it an attractive choice for modern portfolio management.

The integration of DRL and Modern Portfolio Theory (MPT) offers a novel approach to portfolio management, combining the strengths of both methodologies. By leveraging DRL’s adaptive learning capabilities and MPT’s risk management principles, investors can optimize portfolio allocation, manage risk, and enhance overall performance. As the financial industry continues to evolve, the convergence of DRL and MPT is expected to play a significant role in shaping the future of portfolio management and investment strategies.

Understanding Modern Portfolio Theory (MPT): Key Concepts and Principles

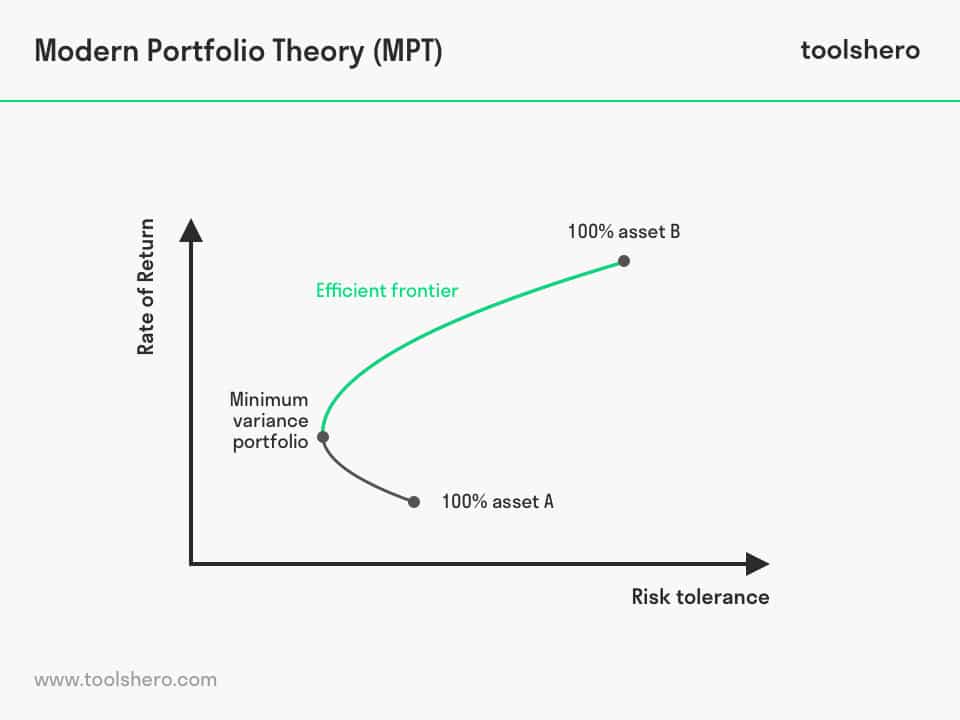

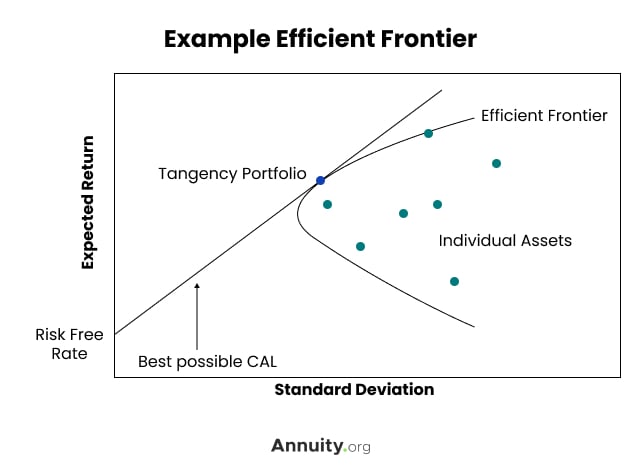

Modern Portfolio Theory (MPT) is a cornerstone of investment analysis and portfolio management, developed by Harry Markowitz in 1952. MPT offers a systematic, quantitative approach to constructing portfolios that balance risk and return, making it a valuable tool for investors and financial professionals alike. At the heart of MPT lies the concept of diversification, which suggests that investors can reduce portfolio risk by investing in a variety of assets that have low correlations with each other.

MPT introduces two critical concepts: risk and return. Return is the gain or loss on an investment, typically measured as the percentage change in the investment’s value over a specific period. Risk, on the other hand, represents the uncertainty associated with the expected return, often quantified using statistical measures such as standard deviation or variance. MPT posits that investors are risk-averse, meaning they prefer a less risky portfolio for a given level of return or a higher return for a given level of risk.

MPT helps investors construct efficient portfolios, which are portfolios that offer the maximum possible return for a given level of risk or the minimum possible risk for a given level of return. By analyzing the risk and return characteristics of individual assets and their correlations, MPT enables investors to optimize portfolio allocation and achieve a more balanced risk-reward profile. This is particularly important in volatile markets, where asset prices can fluctuate significantly, and investors need to manage risk effectively to protect their investments and capitalize on opportunities.

The integration of DRL and MPT offers a promising avenue for enhancing portfolio management. By combining MPT’s risk management principles with DRL’s adaptive learning capabilities, investors can create dynamic, responsive portfolios that optimize allocation, manage risk, and adapt to changing market conditions. This new approach to asset management can potentially lead to improved performance, better risk-adjusted returns, and more informed decision-making, ultimately benefiting investors and the financial industry as a whole.

The Convergence of DRL and MPT: A New Approach to Asset Management

Dynamic Reinforcement Learning (DRL) and Modern Portfolio Theory (MPT) represent two powerful approaches to decision-making and investment management, respectively. By integrating DRL and MPT, investors and financial professionals can create dynamic, responsive portfolios that optimize allocation, manage risk, and adapt to changing market conditions. This new approach to asset management offers several potential benefits, including improved performance, better risk-adjusted returns, and more informed decision-making.

One of the primary advantages of combining DRL and MPT is the ability to optimize portfolio allocation continually. DRL’s adaptive learning capabilities enable the system to analyze market data, identify patterns, and adjust portfolio weights accordingly. By leveraging MPT’s risk management principles, DRL can balance the portfolio’s risk and return, ensuring that the investor’s risk tolerance and investment objectives are met.

Another benefit of integrating DRL and MPT is the enhanced management of risk. MPT’s focus on diversification and correlation helps reduce portfolio risk, while DRL’s real-time decision-making capabilities enable the system to respond to market changes quickly. By combining these approaches, investors can create portfolios that are not only diversified but also adaptive to changing market conditions, further reducing risk and increasing stability.

Furthermore, the convergence of DRL and MPT can lead to the development of more sophisticated trading algorithms. By incorporating DRL’s ability to learn from experience and adapt to new information, these algorithms can make better-informed trading decisions, capitalizing on market opportunities and minimizing losses. This can result in improved portfolio performance, better risk-adjusted returns, and a more proactive approach to portfolio management.

In summary, the integration of DRL and MPT offers a promising avenue for enhancing portfolio management. By combining MPT’s risk management principles with DRL’s adaptive learning capabilities, investors can create dynamic, responsive portfolios that optimize allocation, manage risk, and adapt to changing market conditions. This new approach to asset management can potentially lead to improved performance, better risk-adjusted returns, and more informed decision-making, ultimately benefiting investors and the financial industry as a whole.

Real-World Applications of DRL and MPT: Case Studies and Success Stories

Dynamic Reinforcement Learning (DRL) and Modern Portfolio Theory (MPT) have been successfully applied in various real-world scenarios within the financial industry. These applications demonstrate the potential of integrating DRL and MPT to optimize portfolio allocation, manage risk, and adapt to changing market conditions.

One notable example is the application of DRL and MPT in high-frequency trading (HFT). By combining DRL’s real-time decision-making capabilities with MPT’s risk management principles, financial institutions have developed adaptive trading algorithms that can quickly respond to market changes and optimize trading strategies. These algorithms have resulted in improved performance, better risk-adjusted returns, and a more proactive approach to portfolio management.

Another example is the use of DRL and MPT in asset allocation for pension funds and insurance companies. These institutions often manage large, diverse portfolios and require sophisticated risk management techniques. By integrating DRL and MPT, these organizations can create dynamic, responsive portfolios that balance risk and return while meeting regulatory requirements and stakeholder expectations.

Moreover, the integration of DRL and MPT has been applied to robo-advisory services, which provide automated investment advice based on individual investor profiles and preferences. By leveraging DRL’s adaptive learning capabilities, these services can create personalized investment strategies that optimize portfolio allocation and manage risk in real-time. This has resulted in increased accessibility to professional investment advice and improved investment outcomes for retail investors.

Lastly, the use of DRL and MPT in quantitative investment strategies has gained traction in recent years. By combining DRL’s ability to learn from experience and adapt to new information with MPT’s risk management principles, investment managers can create sophisticated models that capitalize on market opportunities and minimize losses. This has led to the development of innovative investment products and strategies that offer improved performance and better risk-adjusted returns.

In conclusion, the integration of DRL and MPT has shown promising results in various real-world applications within the financial industry. By combining MPT’s risk management principles with DRL’s adaptive learning capabilities, investors and financial professionals can create dynamic, responsive portfolios that optimize allocation, manage risk, and adapt to changing market conditions. As advancements in AI, machine learning, and data analytics continue to shape the financial landscape, the potential applications and benefits of DRL and MPT are likely to expand, offering new opportunities for investors and financial professionals alike.

How to Implement DRL and Modern Portfolio Theory (MPT) in Your Portfolio Management Strategy

Integrating DRL and Modern Portfolio Theory (MPT) into your portfolio management strategy can offer significant benefits, such as improved allocation, risk management, and adaptability to changing market conditions. To successfully implement these techniques, consider the following steps:

- Understand the Basics: Familiarize yourself with the fundamental concepts of DRL and MPT. Gain a solid understanding of how these techniques work and how they can be applied to portfolio management. This may involve reading academic papers, attending workshops, or consulting with experts in the field.

- Identify the Right Tools: Implementing DRL and MPT requires specialized tools and resources. Consider using programming languages such as Python or R, which offer extensive libraries and frameworks for machine learning and data analysis. Additionally, explore platforms and services that provide pre-built models, data sources, and infrastructure for implementing DRL and MPT.

- Assemble a Skilled Team: Implementing DRL and MPT in portfolio management requires a diverse set of skills, including data science, finance, and software engineering. Assemble a team with the necessary expertise to design, develop, and maintain your DRL and MPT models. This may involve hiring new talent, partnering with external experts, or providing training to existing staff.

- Develop a Proof of Concept: Before fully committing to a DRL and MPT strategy, develop a proof of concept to test the feasibility and effectiveness of your approach. This may involve creating a simplified model, using historical data, and comparing the results to traditional portfolio management techniques.

- Iterate and Improve: Portfolio management is an ongoing process, and it’s essential to continuously monitor and improve your DRL and MPT models. Regularly review your models’ performance, identify areas for improvement, and update your models as needed. This may involve incorporating new data sources, refining your algorithms, or adjusting your asset allocation strategies.

Implementing DRL and MPT in portfolio management requires careful planning, the right tools, and a skilled team. By following these steps, investors and financial professionals can harness the power of these techniques to optimize allocation, manage risk, and adapt to changing market conditions. As advancements in AI, machine learning, and data analytics continue to shape the financial landscape, it’s essential to stay informed about emerging trends and opportunities in this rapidly evolving field.

Challenges and Limitations of DRL and Modern Portfolio Theory (MPT): Navigating Potential Pitfalls

Integrating DRL and Modern Portfolio Theory (MPT) in portfolio management offers numerous benefits, but it’s essential to be aware of the potential challenges and limitations. Addressing these issues can help ensure the successful implementation and long-term viability of your portfolio management strategy.

- Data Quality: DRL and MPT models rely on high-quality data to make informed decisions. Poor data quality can lead to inaccurate models, suboptimal allocation, and increased risk. To mitigate this risk, ensure that your data sources are reliable, up-to-date, and free from errors or inconsistencies.

- Computational Complexity: DRL models can be computationally intensive, requiring significant processing power and time to train and execute. This can lead to increased costs and longer decision-making cycles. To address this challenge, consider using cloud-based infrastructure, parallel processing, or specialized hardware to optimize performance and reduce computational complexity.

- Regulatory Compliance: The financial industry is subject to numerous regulations and compliance requirements, which can impact the use of DRL and MPT in portfolio management. It’s essential to ensure that your models comply with relevant regulations and guidelines, such as data privacy laws, financial reporting standards, and risk management requirements.

- Model Interpretability: DRL models can be complex and difficult to interpret, making it challenging to understand the underlying decision-making processes. This can lead to a lack of trust in the models and difficulty in explaining the rationale behind certain decisions. To address this challenge, consider using techniques such as explainable AI, model visualization, or sensitivity analysis to improve model interpretability and transparency.

- Ethical Considerations: The use of AI and machine learning in portfolio management raises ethical considerations, such as fairness, accountability, and transparency. It’s essential to ensure that your models are designed and implemented in a way that aligns with ethical principles and avoids potential biases or discrimination.

Navigating the challenges and limitations of integrating DRL and MPT in portfolio management requires careful planning, the right tools, and a skilled team. By addressing these issues, investors and financial professionals can harness the power of these techniques to optimize allocation, manage risk, and adapt to changing market conditions. As advancements in AI, machine learning, and data analytics continue to shape the financial landscape, it’s essential to stay informed about emerging trends and opportunities in this rapidly evolving field.

The Future of DRL and Modern Portfolio Theory (MPT): Emerging Trends and Opportunities

As AI, machine learning, and data analytics continue to advance, the integration of DRL and MPT in portfolio management is poised for significant growth and innovation. Here are some emerging trends and opportunities to watch:

- Deep Learning Advancements: Deep learning techniques, such as convolutional neural networks (CNNs) and recurrent neural networks (RNNs), can enhance DRL models by improving their ability to process and analyze large, complex datasets. These advancements can lead to more accurate predictions, better risk management, and more effective portfolio optimization.

- Natural Language Processing (NLP): NLP can be used to extract insights from unstructured data sources, such as news articles, social media posts, and financial reports. By incorporating NLP into DRL models, investors can gain a more comprehensive understanding of market conditions and make more informed decisions.

- Explainable AI: As DRL models become more complex, there is a growing need for explainable AI techniques that can help investors understand the underlying decision-making processes. Explainable AI can improve model interpretability, build trust, and ensure regulatory compliance.

- Multi-Agent Systems: Multi-agent systems, where multiple DRL models interact and learn from each other, can be used to simulate complex market dynamics and improve portfolio optimization. By incorporating multi-agent systems into MPT, investors can better manage risk, adapt to changing market conditions, and optimize allocation.

- Quantum Computing: Quantum computing has the potential to revolutionize portfolio management by enabling the processing of vast amounts of data at unprecedented speeds. By integrating quantum computing with DRL and MPT, investors can gain a competitive edge and make more informed decisions in real-time.

Embracing the power of DRL and Modern Portfolio Theory (MPT) requires a forward-thinking approach and a commitment to staying informed about emerging trends and opportunities. By incorporating these advancements into your portfolio management strategy, you can optimize allocation, manage risk, and adapt to changing market conditions. As the financial landscape continues to evolve, it’s essential to stay ahead of the curve and harness the potential of these innovative techniques to achieve long-term success.

Conclusion: Embracing the Power of DRL and Modern Portfolio Theory (MPT) for Modern Portfolio Management

In today’s rapidly changing financial landscape, the integration of DRL and Modern Portfolio Theory (MPT) offers a powerful approach to portfolio management. By combining the adaptive decision-making capabilities of DRL with the risk management principles of MPT, investors can optimize portfolio allocation, manage risk, and adapt to changing market conditions.

DRL and MPT provide a comprehensive framework for addressing complex decision-making problems in portfolio management. By leveraging the strengths of both techniques, investors can gain a competitive edge and achieve long-term success. The potential benefits of integrating DRL and MPT include improved risk-adjusted returns, enhanced decision-making, and increased efficiency in portfolio management.

As AI, machine learning, and data analytics continue to advance, it’s essential to stay informed about emerging trends and opportunities in the integration of DRL and MPT. By embracing the power of these innovative techniques, investors can make more informed decisions, manage risk more effectively, and adapt to changing market conditions. Staying ahead of the curve in this rapidly evolving field is critical to achieving long-term success in portfolio management.