What is a Discount Rate and Why is it Important?

A discount rate is a crucial concept in finance that plays a vital role in investment decisions. It represents the rate of return an investor demands for taking on a certain level of risk. In essence, it is a measure of the time value of money, which is the idea that a dollar received today is worth more than a dollar received in the future.

Understanding discount rates is essential in various fields, including corporate finance, investment analysis, and capital budgeting. In corporate finance, discount rates are used to evaluate the viability of projects and determine the cost of capital. In investment analysis, discount rates help investors calculate the expected return on investment and make informed decisions. In capital budgeting, discount rates are used to evaluate the feasibility of projects and allocate resources efficiently.

When asking “how do you find the discount rate,” it is essential to understand the significance of this concept in finance. A thorough comprehension of discount rates enables investors to make informed decisions, minimize risk, and maximize returns. Discount rates have a direct impact on investment decisions, as they influence the calculation of net present value (NPV) and internal rate of return (IRR). A higher discount rate reduces the NPV and increases the IRR, making a project or investment less attractive.

Understanding the Time Value of Money

The concept of time value of money is fundamental to understanding discount rates. It is the idea that a dollar received today is worth more than a dollar received in the future. This is because money received today can be invested to earn interest or returns, making it more valuable than the same amount received in the future.

The time value of money has a direct impact on investment decisions. When evaluating investment opportunities, investors must consider the time value of money to determine the present value of future cash flows. This is where discount rates come into play. By applying a discount rate to future cash flows, investors can calculate the present value of those cash flows and make informed investment decisions.

For example, suppose an investor expects to receive $100 in one year. If the investor can earn a 5% return on investment, the present value of that $100 would be approximately $95.24. This means that the investor would be indifferent between receiving $95.24 today and $100 in one year, assuming a 5% discount rate. Understanding the time value of money and how to apply discount rates is crucial in making informed investment decisions.

When asking “how do you find the discount rate,” it is essential to consider the time value of money. A thorough comprehension of this concept enables investors to accurately calculate discount rates and make informed investment decisions. In the next section, we will provide a step-by-step guide on how to calculate discount rates, including the formula, variables, and assumptions involved.

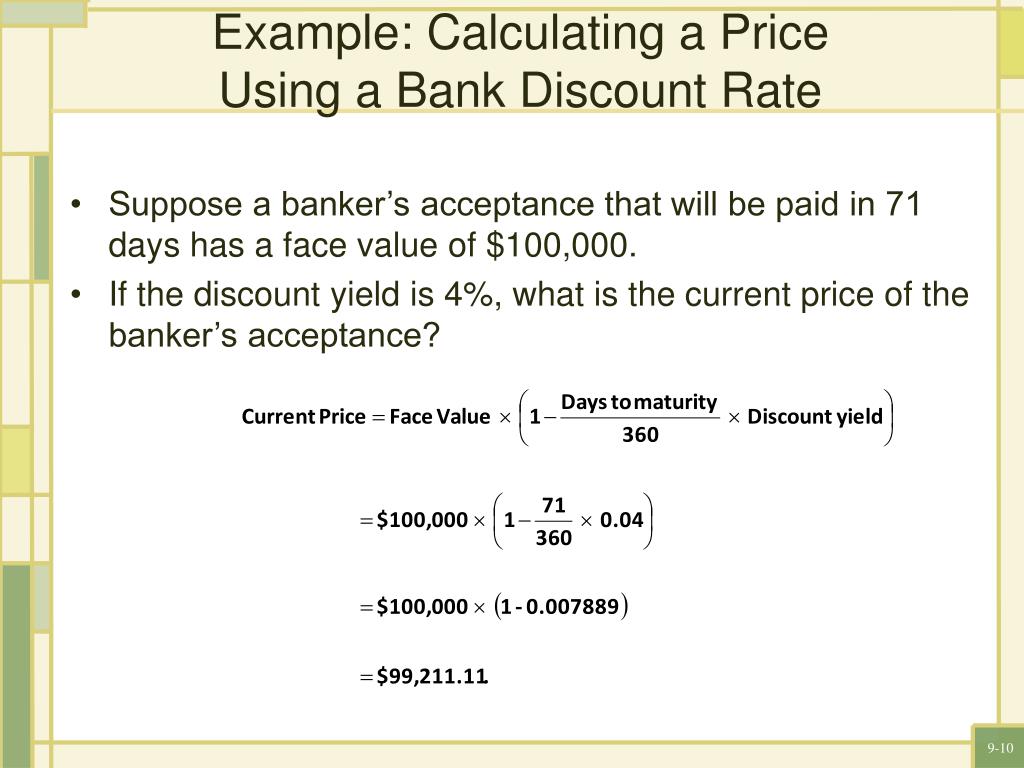

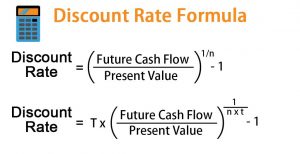

How to Calculate Discount Rates: A Step-by-Step Guide

Calculating discount rates is a crucial step in investment analysis and capital budgeting. The discount rate is used to determine the present value of future cash flows, and it is essential to understand how to calculate it accurately. In this section, we will provide a step-by-step guide on how to calculate discount rates, including the formula, variables, and assumptions involved.

The formula to calculate the discount rate is:

Discount Rate = (Expected Return on Investment / Expected Cash Flow) x (1 + Expected Growth Rate)

Where:

– Expected Return on Investment is the rate of return an investor expects to earn from an investment.

– Expected Cash Flow is the future cash flow expected from an investment.

– Expected Growth Rate is the rate at which the cash flow is expected to grow.

For example, suppose an investor expects to earn a 10% return on investment, with an expected cash flow of $100 and an expected growth rate of 5%. The discount rate would be:

Discount Rate = (10% / $100) x (1 + 5%) = 10.5%

When asking “how do you find the discount rate,” it is essential to understand the variables and assumptions involved in the calculation. The expected return on investment, expected cash flow, and expected growth rate are critical inputs that can significantly impact the discount rate calculation.

Common pitfalls to avoid when calculating discount rates include using incorrect assumptions, inaccurate data, and misunderstanding the formula. It is essential to ensure that the inputs are accurate and realistic to obtain a reliable discount rate.

In the next section, we will discuss the key factors that influence discount rates, including risk, inflation, and opportunity cost. Understanding these factors is crucial in accurately calculating discount rates and making informed investment decisions.

Factors Affecting Discount Rates: Risk, Inflation, and Opportunity Cost

When asking “how do you find the discount rate,” it is essential to consider the key factors that influence discount rates. These factors can significantly impact the calculation of discount rates and, ultimately, investment decisions. In this section, we will discuss the three primary factors that affect discount rates: risk, inflation, and opportunity cost.

Risk is a critical factor in discount rate calculation. Investments with higher risk profiles require higher discount rates to compensate for the increased uncertainty. For example, a startup with a high-risk business model would require a higher discount rate than a established company with a stable cash flow. This is because investors demand a higher return for taking on more risk.

Inflation is another key factor that affects discount rates. Inflation erodes the purchasing power of money over time, making future cash flows less valuable. As a result, discount rates must be adjusted to account for inflation. For instance, if the expected inflation rate is 2%, the discount rate would need to be increased to reflect the reduced purchasing power of future cash flows.

Opportunity cost is the final factor that influences discount rates. Opportunity cost represents the return an investor could earn from an alternative investment with a similar risk profile. When calculating discount rates, investors must consider the opportunity cost of investing in a particular project or asset. For example, if an investor can earn a 10% return from a similar investment, they may require a higher discount rate from a new investment to justify the opportunity cost.

Understanding these factors is crucial in accurately calculating discount rates and making informed investment decisions. By considering risk, inflation, and opportunity cost, investors can determine the appropriate discount rate for a particular investment and make informed decisions about where to allocate their capital.

In the next section, we will explore real-world applications of discount rates, including case studies and examples from various industries. This will provide a practical understanding of how discount rates are used in different contexts and highlight the importance of accurate discount rate calculations.

Real-World Applications of Discount Rates: Case Studies and Examples

In various industries, discount rates play a crucial role in investment decisions and project evaluations. Understanding how to calculate discount rates accurately is essential to make informed decisions. In this section, we will explore real-world examples and case studies of how discount rates are used in finance, real estate, and project management.

In finance, discount rates are used to evaluate investment opportunities, such as stocks, bonds, and mutual funds. For instance, a financial analyst may use a discount rate to calculate the present value of future cash flows from a stock, determining whether it is a worthwhile investment. In real estate, discount rates are used to evaluate property investments, considering factors such as rental income, property appreciation, and maintenance costs.

In project management, discount rates are used to evaluate the feasibility of projects, considering factors such as initial investment, expected returns, and risk. For example, a project manager may use a discount rate to calculate the net present value (NPV) of a project, determining whether it is worth pursuing. A positive NPV indicates that the project is expected to generate more value than it costs, making it a worthwhile investment.

For instance, consider a real estate investment trust (REIT) that is evaluating a potential property acquisition. The REIT expects the property to generate $100,000 in annual rental income, with an expected growth rate of 3%. Using a discount rate of 8%, the REIT can calculate the present value of the future cash flows, determining whether the investment is worthwhile. If the present value is higher than the acquisition cost, the REIT may decide to pursue the investment.

These examples illustrate the importance of accurate discount rate calculations in various industries. By understanding how to calculate discount rates, professionals can make informed investment decisions, evaluate project feasibility, and optimize resource allocation. In the next section, we will discuss common mistakes to avoid when calculating discount rates, providing tips and best practices to ensure accurate calculations.

Common Mistakes to Avoid When Calculating Discount Rates

When calculating discount rates, it’s essential to avoid common mistakes that can lead to inaccurate results. These mistakes can have significant consequences, such as misallocating resources or making poor investment decisions. In this section, we will discuss common pitfalls to avoid when calculating discount rates.

One common mistake is using incorrect assumptions about the investment or project. For instance, assuming a constant growth rate or ignoring inflation can lead to inaccurate discount rates. It’s essential to use realistic assumptions that reflect the investment’s or project’s characteristics.

Another mistake is using inaccurate or outdated data. This can include using historical data that is no longer relevant or ignoring changes in market conditions. It’s crucial to use current and reliable data to ensure accurate discount rate calculations.

Misunderstanding the formula or calculation process is another common mistake. This can include incorrectly applying the discount rate formula or neglecting to consider the time value of money. It’s essential to have a thorough understanding of the formula and calculation process to avoid errors.

Additionally, failing to consider the risk associated with an investment or project can lead to inaccurate discount rates. This can include ignoring the potential risks or using an overly optimistic discount rate. It’s essential to consider the risk profile of the investment or project when calculating the discount rate.

To avoid these common mistakes, it’s essential to follow best practices when calculating discount rates. This includes using realistic assumptions, accurate data, and a thorough understanding of the formula and calculation process. By avoiding these common mistakes, professionals can ensure accurate discount rate calculations and make informed investment decisions.

For example, when asking “how do you find the discount rate,” it’s essential to consider the investment’s or project’s characteristics, including the risk profile and expected returns. By using accurate data and realistic assumptions, professionals can calculate a discount rate that reflects the investment’s or project’s true value.

By avoiding common mistakes and following best practices, professionals can ensure accurate discount rate calculations and make informed investment decisions. In the next section, we will discuss various tools and resources available for calculating discount rates, including financial calculators, spreadsheets, and online resources.

Discount Rate Calculation Tools and Resources

Calculating discount rates can be a complex task, but with the right tools and resources, it can be made easier and more accurate. In this section, we will discuss various tools and resources available for calculating discount rates, including financial calculators, spreadsheets, and online resources.

Financial calculators, such as the Texas Instruments BA II Plus or the Hewlett Packard 10bII+, are specialized calculators designed specifically for financial calculations, including discount rate calculations. These calculators can perform complex calculations quickly and accurately, making them a valuable tool for professionals.

Spreadsheets, such as Microsoft Excel or Google Sheets, are another popular tool for calculating discount rates. By using formulas and functions, users can create complex models to calculate discount rates and perform sensitivity analysis. Spreadsheets also allow users to easily update assumptions and recalculate the discount rate.

Online resources, such as financial websites and online calculators, are also available for calculating discount rates. These resources often provide pre-built formulas and templates, making it easy to calculate discount rates quickly and accurately. Some popular online resources include Investopedia, Calculator.net, and NerdWallet.

When using these tools and resources, it’s essential to understand the underlying formulas and assumptions. This includes understanding how to input data, select the correct formula, and interpret the results. By doing so, professionals can ensure accurate discount rate calculations and make informed investment decisions.

For example, when asking “how do you find the discount rate,” using a financial calculator or spreadsheet can help professionals quickly and accurately calculate the discount rate. By inputting the relevant data, such as the investment’s expected returns and risk profile, professionals can calculate the discount rate and make informed investment decisions.

In conclusion, various tools and resources are available for calculating discount rates, each with its advantages and limitations. By understanding how to use these tools and resources, professionals can ensure accurate discount rate calculations and make informed investment decisions.

Conclusion: Mastering the Art of Discount Rate Calculation

In conclusion, understanding discount rates and their calculation is crucial for making informed investment decisions. By grasping the concept of discount rates, considering the time value of money, and avoiding common mistakes, professionals can accurately calculate discount rates and make informed decisions.

Throughout this article, we have discussed the importance of discount rates in various fields, including corporate finance, investment analysis, and capital budgeting. We have also provided a step-by-step guide on how to calculate discount rates, discussed the key factors that influence discount rates, and highlighted real-world applications of discount rates.

When asking “how do you find the discount rate,” it’s essential to consider the investment’s or project’s characteristics, including the risk profile and expected returns. By using accurate data and realistic assumptions, professionals can calculate a discount rate that reflects the investment’s or project’s true value.

By mastering the art of discount rate calculation, professionals can make informed investment decisions, optimize resource allocation, and drive business growth. Whether in finance, real estate, or project management, accurate discount rate calculations are essential for achieving success.

In today’s fast-paced business environment, staying ahead of the curve requires a deep understanding of discount rates and their calculation. By applying the knowledge and concepts discussed in this article, professionals can unlock the secret to calculating discount rates and make a lasting impact in their respective fields.