Decoding Investment Growth: Annualized Versus Total Returns

Context_1: Understanding investment returns is critical for making informed financial decisions. Investors need to know how to accurately measure and interpret the performance of their investments. There are several ways to present investment returns, each offering a different perspective. Two common methods are annualized returns and cumulative returns. Knowing what is the difference between annualized and cumulative returns is essential for comparing investment options fairly and understanding their true performance over time. This article will clarify what is the difference between annualized and cumulative returns, providing a detailed explanation of each.

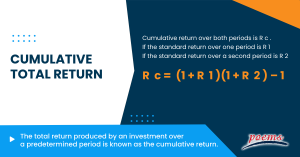

Cumulative returns, often referred to as total returns, represent the overall percentage change in an investment’s value over a defined period. Understanding cumulative returns is essential for investors seeking to gauge the actual profit or loss generated by their investments. This metric provides a straightforward view of investment performance, reflecting the aggregate impact of gains, losses, and any income received, such as dividends or interest, throughout the investment timeframe. When considering what is the difference between annualized and cumulative returns, remember that cumulative returns show the real outcome of an investment.

To calculate cumulative returns, one needs to determine the total percentage change in the investment’s value from the initial investment to the final value. The formula is relatively simple: [(Final Value – Initial Value) / Initial Value] * 100. For example, consider an investment that begins with an initial value of $1,000. Over a five-year period, the investment grows to a final value of $1,600. Using the formula, the cumulative return would be [($1,600 – $1,000) / $1,000] * 100 = 60%. This indicates that the investment has yielded a total return of 60% over the five-year holding period. This calculation encompasses all fluctuations in value and any income generated during that time, providing a clear picture of the investment’s overall performance. When asking what is the difference between annualized and cumulative returns, realize cumulative is the total gain.

It’s important to note that cumulative returns do not provide insight into the year-by-year performance of the investment. They simply present the aggregate result. While a 60% cumulative return over five years might seem impressive, it doesn’t reveal whether the investment experienced consistent growth or significant volatility during that period. For a more standardized measure that allows for comparison across different timeframes, annualized returns are used. Understanding what is the difference between annualized and cumulative returns involves recognizing that cumulative returns reflect the actual total gain, while annualized returns provide a normalized yearly rate. Investors must consider both metrics to gain a comprehensive understanding of investment performance.

Annualized Returns Demystified: Smoothing Out Investment Fluctuations

Annualized returns offer a standardized view of investment performance. Understanding “what is the difference between annualized and cumulative returns” starts with defining annualized returns. This calculation represents the hypothetical earnings from an investment if held for one year. Even if the investment’s actual duration differs, the annualized return provides an estimated yearly rate. It essentially smooths out returns, enabling easier comparison between investments held for varying periods. This is particularly useful when evaluating investments with different time horizons. For instance, an investment held for six months can be compared directly with one held for two years using annualized returns.

The key benefit of annualized returns lies in their ability to level the playing field. Instead of comparing the total gain of a five-year investment with that of a one-year investment, annualized returns translate both into equivalent yearly figures. This “what is the difference between annualized and cumulative returns” question is important because it allows investors to assess the true efficiency of their investments on a year-by-year basis. It’s important to remember that this is a smoothed representation. Actual year-to-year returns may vary significantly due to market volatility and other factors. Annualized return is a tool to assess the relative efficiency of an investment.

Annualized return is not a guarantee of future performance. Understanding “what is the difference between annualized and cumulative returns” helps investors to be more aware of each metric benefits. It is an estimation based on past performance. However, it offers a valuable benchmark for comparing diverse investment options. This standardization simplifies the investment decision-making process, making it easier to identify potentially better-performing assets. By understanding annualized returns, investors gain a clearer perspective on the long-term growth potential of their investments and can make informed decisions aligned with their financial goals. Remember to consider other factors, such as risk tolerance and investment objectives, when making investment choices.

How to Calculate Annualized Return: A Step-by-Step Guide

Annualized return is a crucial metric when evaluating investments, especially when comparing options with different investment durations. It essentially translates the total return into an equivalent yearly rate, allowing for a more standardized comparison. Understanding how to calculate it is key to grasping what is the difference between annualized and cumulative returns. The formula and steps below will help demystify the process.

The formula for calculating annualized return is as follows: Annualized Return = [(1 + Total Return)^(1 / Number of Years)] – 1. Let’s break this down with examples. First, consider an investment held for less than a year. Suppose you invest in a stock and after 6 months (0.5 years), your total return is 10%. To annualize this, you would calculate: Annualized Return = [(1 + 0.10)^(1 / 0.5)] – 1 = (1.10)^2 – 1 = 1.21 – 1 = 0.21 or 21%. This means that, hypothetically, if the investment continued to perform at the same rate, you would earn 21% in a full year. This demonstrates what is the difference between annualized and cumulative returns, as the cumulative return was only 10%, but the annualized return projects a full year.

Now, let’s examine an investment held for longer than a year. Imagine you invest in a mutual fund and after 3 years, your total return is 33.1%. To calculate the annualized return: Annualized Return = [(1 + 0.331)^(1 / 3)] – 1 = (1.331)^(0.333) – 1 ≈ 1.1 – 1 = 0.1 or 10%. In this scenario, despite the total return being 33.1% over three years, the annualized return is 10%. This standardized rate provides a clearer picture of the investment’s average yearly performance. When discerning what is the difference between annualized and cumulative returns, remember that the annualized return provides a smoothed, comparable rate, while the cumulative return represents the actual profit made over the entire investment period. The annualized return offers a more level playing field when comparing investments with different time horizons.

Cumulative vs. Annualized: Key Differences Explained

Understanding investment performance requires distinguishing between cumulative and annualized returns. Cumulative returns, also known as total returns, reflect the actual percentage change in an investment’s value over the entire investment period. They answer the question: “How much did I actually gain or lose?” Annualized returns, conversely, provide a standardized yearly rate of return. This standardization is crucial for comparing investments with different time horizons. The key difference between annualized and cumulative returns lies in their purpose: cumulative returns show the total impact of an investment, while annualized returns offer a comparable yearly performance metric. An investor needs to know what is the difference between annualized and cumulative returns.

A primary difference between annualized and cumulative returns is the time frame they represent. Cumulative returns are straightforward; they represent the total percentage gain or loss over the entire holding period, regardless of its length. If an investment grows by 50% over five years, the cumulative return is simply 50%. Annualized returns, however, transform this five-year gain into an equivalent annual rate. In this case, the annualized return would be lower than 10% per year due to the effects of compounding, showcasing what a consistent yearly return would need to be to achieve that 50% growth over five years. What is the difference between annualized and cumulative returns really boils down to time; one reflects the entire period, the other, a standardized year.

Consider this example to further clarify what is the difference between annualized and cumulative returns. Imagine two investments: Investment A grows by 10% in one year, while Investment B grows by 20% over two years. The cumulative return for Investment A is 10%, and for Investment B, it’s 20%. However, to compare their performance fairly, we need to calculate the annualized return for Investment B. Using the annualized return formula, Investment B’s annualized return is approximately 9.54% per year. This comparison reveals that Investment A actually performed better on a yearly basis, even though Investment B had a higher cumulative return. What is the difference between annualized and cumulative returns in this case? Annualized returns allow for an apples-to-apples comparison, revealing the true performance relative to time.

When to Use Each Metric: Choosing the Right Return for the Job

Selecting the appropriate return metric hinges on the specific analytical goal. Cumulative returns are most beneficial when evaluating the actual profit or loss generated by an investment over its entire duration. This provides a clear picture of the total investment performance, regardless of the time involved. For example, if an investor wants to know the overall gain from a stock held for five years, the cumulative return will offer that answer directly. Understanding what is the difference between annualized and cumulative returns is important here. What is the difference between annualized and cumulative returns becomes clear when you consider the investment timeframe.

Annualized returns, conversely, shine when comparing investments with differing time horizons. They standardize returns to a one-year period, enabling a fair comparison between investments held for varying lengths of time. Imagine comparing a three-year bond to a five-year bond; the cumulative returns would inherently favor the longer-term bond. However, annualized returns level the playing field by expressing each bond’s return as if it were held for only one year. Another good example to show what is the difference between annualized and cumulative returns is real estate: you can have a cumulative return on one property, and compare the same metric, the cumulative return, with another property. However, if those properties were owned for different periods of time, comparing annualized returns is a better approach.

Consider an investor evaluating two investment options: Investment A, which yields a 50% cumulative return over five years, and Investment B, which yields a 20% cumulative return over two years. At first glance, Investment A appears superior. However, calculating the annualized returns reveals a different story. What is the difference between annualized and cumulative returns in this case? Investment A has an annualized return of approximately 8.45% per year, while Investment B boasts an annualized return of approximately 9.54% per year. This comparison highlights that, despite the lower overall return, Investment B performed better on a year-by-year basis, making it a potentially more attractive investment for investors focused on consistent yearly gains. Understanding what is the difference between annualized and cumulative returns and carefully considering the investment goals is crucial for making informed decisions.

The Importance of Context: Beyond the Numbers

Interpreting investment returns requires careful consideration of the surrounding circumstances. Cumulative and annualized returns offer valuable insights, but their true meaning emerges when viewed within the appropriate context. Understanding “what is the difference between annualized and cumulative returns” is crucial, but it is equally important to analyze the conditions that influenced those returns.

The time period plays a significant role in assessing investment performance. A high annualized return achieved during a bull market, characterized by sustained upward trends, may not be replicable under different market conditions. Conversely, seemingly low returns during a market downturn could still represent sound investment management. Therefore, it’s essential to consider the prevailing economic climate and market volatility when evaluating both cumulative and annualized figures. Furthermore, keep in mind “what is the difference between annualized and cumulative returns” in varying market scenarios.

Industry-specific trends and broader economic factors also impact investment outcomes. A technology stock might demonstrate impressive growth during a period of technological innovation, while a more conservative investment, like a bond, may offer stability during times of economic uncertainty. Evaluating returns in isolation can be misleading; a thorough analysis necessitates understanding the forces that shaped the investment landscape. Therefore, comparing returns across different asset classes should always be done cautiously, acknowledging that “what is the difference between annualized and cumulative returns” across them. A balanced perspective, combining quantitative data with qualitative analysis of market conditions, provides a more complete and insightful understanding of investment performance. This approach also highlights “what is the difference between annualized and cumulative returns” in providing a holistic investment evaluation.

Illustrative Examples: Putting Knowledge Into Practice

To further clarify what is the difference between annualized and cumulative returns, consider a few real-world investment scenarios. Imagine an investor purchases a stock for $100. After three years, the stock is sold for $160. The cumulative return is 60%, representing the overall profit. However, to understand the yearly growth rate, the annualized return is calculated. Using the formula, the annualized return is approximately 17%, reflecting the average yearly growth. This example shows what is the difference between annualized and cumulative returns, cumulative returns represent the total growth and annualized the yearly growth.

Let’s explore a bond investment. A bond is purchased for $1,000 and held for five years. It yields a total interest of $250 over that period. The cumulative return is 25%. The annualized return, however, is approximately 4.56%. Note what is the difference between annualized and cumulative returns; the total profit is less relevant than the yearly profitability if you want to compare with other investments with different timeframes. Real estate offers another perspective. A property is bought for $200,000. After two years, it’s sold for $240,000. The cumulative return is 20%. Factoring in costs and time, the annualized return is roughly 9.54%. In cases when investments lost value the same logic applies, for example, if the property was sold at $180,000, cumulative return would be -10% and annualized -5.13%.

These examples underscore what is the difference between annualized and cumulative returns, and highlights their practical applications. Cumulative returns reveal the actual profit or loss on an investment. Annualized returns provide a standardized rate for comparison. Understanding both metrics is vital for informed decision-making. For instance, a high cumulative return on a long-term investment might seem impressive. But a lower annualized return could indicate that other opportunities with shorter durations offered better yearly growth. By considering both what is the difference between annualized and cumulative returns, investors gain a more comprehensive view of investment performance, enabling them to make strategic choices aligned with their financial goals.

:max_bytes(150000):strip_icc()/Annualized-Total-Return-FINAL-69a0de5921b84ad88984ae90ff4e3733.jpg)