What is the Cross-Section of Expected Stock Returns?

The cross-section of expected stock returns is a crucial concept in finance, referring to the relationship between the anticipated returns of a portfolio or a collection of stocks and various factors. These factors can include market capitalization, book-to-market ratio, profitability, and other essential elements that influence stock returns. Understanding the cross-section of expected stock returns is vital for investors, portfolio managers, and researchers seeking to optimize portfolio performance and develop well-informed investment strategies.

Identifying Determinants of Expected Stock Returns

A significant aspect of the cross-section of expected stock returns is the factors that influence these returns. Several factors have been identified as crucial determinants of stock returns, including the size effect, value effect, and profitability effect. These factors are essential for understanding the cross-section of expected stock returns and are integrated into prominent asset pricing models, such as the Fama-French three-factor model and the Carhart four-factor model.

The size effect highlights the relationship between market capitalization and expected stock returns. Generally, smaller firms have higher expected returns than larger firms. This effect is often attributed to the increased risk associated with smaller firms, as they are more susceptible to financial distress and have less liquid markets. Additionally, smaller firms may be under-researched and under-followed by investors, leading to potential mispricings and inefficiencies.

The value effect refers to the phenomenon that stocks with low valuation ratios, such as the book-to-market ratio, have higher expected returns than those with high valuation ratios. This effect is based on the idea that value stocks are often undervalued by the market, creating an opportunity for investors to earn higher returns. Value investing strategies, which focus on buying undervalued stocks and selling overvalued ones, have been popularized by well-known investors like Benjamin Graham and Warren Buffett.

Lastly, the profitability effect emphasizes the relationship between profitability and expected stock returns. Firms with higher profitability tend to have higher expected returns, and this effect is incorporated into modern asset pricing models. The profitability effect can be explained by the fact that profitable firms are more likely to generate sustainable cash flows, which can support higher stock valuations and returns over time.

The Fama-French three-factor model and the Carhart four-factor model are widely used frameworks to understand these factors and their impact on expected stock returns. These models help investors account for the size, value, and profitability effects when constructing portfolios and making investment decisions.

The Role of Market Capitalization in Expected Stock Returns

Market capitalization plays a significant role in the cross-section of expected stock returns. Generally, smaller firms have higher expected returns than larger firms, a phenomenon known as the size effect. This relationship can be attributed to various factors, including increased risk, under-research, and market inefficiencies.

Smaller firms often face greater risks than their larger counterparts due to their susceptibility to financial distress and less liquid markets. As a result, investors demand higher returns to compensate for the additional risk associated with smaller firms. Moreover, smaller firms may be under-researched and under-followed by investors, leading to potential mispricings and inefficiencies in the market. These inefficiencies can create opportunities for investors to earn higher returns by investing in undervalued small-cap stocks.

It is essential to note that the size effect is not a guarantee of higher returns for all small-cap stocks. Instead, it suggests that, on average, smaller firms have higher expected returns than larger firms. Investors should be cautious when implementing size-based strategies, as individual small-cap stocks can still underperform. Proper due diligence, risk management, and portfolio diversification are crucial to successfully capitalizing on the size effect.

When considering the cross-section of expected stock returns, investors should be aware of the size effect and its implications. By incorporating market capitalization as a factor in portfolio construction, investors can potentially enhance their returns and improve their overall risk-adjusted performance.

The Value Effect: Book-to-Market Ratio and Expected Stock Returns

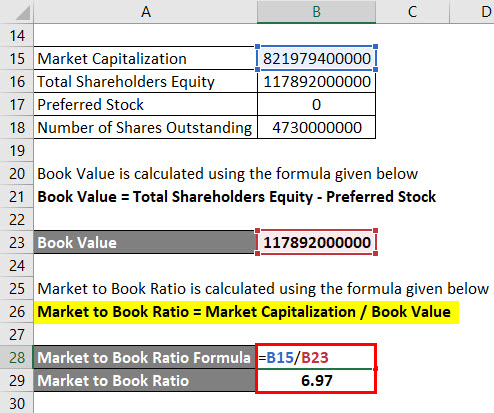

The value effect is a crucial concept in the cross-section of expected stock returns, suggesting that stocks with low valuation ratios, such as the book-to-market ratio, have higher expected returns than those with high valuation ratios. This effect has significant implications for value investing strategies, which focus on buying undervalued stocks and selling overvalued ones.

The book-to-market ratio, also known as the value ratio, is calculated by dividing a company’s book value (total assets minus total liabilities) by its market value (total outstanding shares multiplied by the current market price per share). A lower book-to-market ratio indicates that a stock is undervalued relative to its intrinsic value, making it an attractive investment opportunity for value investors.

The value effect is based on the idea that value stocks are often mispriced by the market, creating an opportunity for investors to earn higher returns. Numerous studies have documented the existence of the value effect, demonstrating that value stocks, on average, outperform growth stocks over the long term. This outperformance can be attributed to various factors, including mean reversion, risk premiums, and investor sentiment.

Value investing strategies, which explicitly target stocks with low valuation ratios, have been popularized by well-known investors like Benjamin Graham and Warren Buffett. These strategies typically involve selecting undervalued stocks based on fundamental analysis, such as evaluating a company’s financial statements, management team, and competitive position. By focusing on undervalued stocks, value investors aim to capitalize on the value effect and earn higher risk-adjusted returns over time.

When implementing value investing strategies, it is essential to consider the potential risks and limitations associated with the value effect. Value stocks can remain undervalued for extended periods, and there is no guarantee that they will eventually revert to their intrinsic value. Additionally, value stocks may underperform during certain market conditions, such as economic expansions or technology booms. To mitigate these risks, investors should practice proper due diligence, diversify their portfolios, and employ effective risk management techniques.

The Profitability Effect and Expected Stock Returns

The profitability effect is a significant factor in the cross-section of expected stock returns, highlighting the relationship between profitability and expected returns. Firms with higher profitability tend to have higher expected returns, and this effect is incorporated into modern asset pricing models.

Profitability is often measured using metrics such as return on equity (ROE), return on assets (ROA), or earnings before interest and taxes (EBIT) scaled by total assets (EBITDA). These measures provide insights into a company’s ability to generate profits relative to its size, assets, or equity. Higher profitability can indicate a firm’s competitive advantage, strong management, or efficient operations, making it an attractive investment opportunity.

The profitability effect is grounded in the idea that firms with higher profitability are less likely to face financial distress and have more stable cash flows. As a result, investors are willing to pay a premium for these firms, leading to higher expected returns. This effect is particularly relevant for value stocks, as firms with low valuation ratios and high profitability can offer significant upside potential.

Modern asset pricing models, such as the Fama-French five-factor model, explicitly incorporate the profitability effect alongside other factors like market risk, size, and value. By accounting for profitability, these models provide a more comprehensive framework for understanding the cross-section of expected stock returns and guiding investment decisions.

When implementing factor-based strategies, investors should consider the potential interactions between profitability and other factors, such as size and value. For example, smaller firms and value stocks may exhibit higher profitability on average, and understanding these relationships can help investors optimize their portfolios and manage risk.

It is essential to note that the profitability effect, like other factors, can vary over time and across markets. Investors should be mindful of these fluctuations and adjust their strategies accordingly. Regular portfolio rebalancing and risk management can help mitigate potential risks and ensure that factor-based strategies remain aligned with an investor’s long-term objectives.

How to Apply the Cross-Section of Expected Stock Returns in Portfolio Construction

The cross-section of expected stock returns offers valuable insights for portfolio construction, enabling investors to identify and weight various factors to optimize their investment strategies. By combining factors like size, value, and profitability, investors can create multi-factor portfolios that target specific investment objectives and risk profiles.

Identifying and Weighting Factors

The first step in applying the cross-section of expected stock returns in portfolio construction is identifying relevant factors and determining their weights. Factors can be identified using statistical techniques, such as factor analysis or principal component analysis, or by employing well-established factors like size, value, and profitability. Once factors are identified, investors should assign weights based on their investment objectives, risk tolerance, and the historical performance of each factor.

Combining Factors in a Multi-Factor Portfolio

After identifying and weighting factors, investors can combine them in a multi-factor portfolio. This process typically involves selecting stocks that exhibit strong factor characteristics, such as small market capitalization, low valuation ratios, or high profitability. By focusing on stocks with favorable factor exposures, investors can create portfolios that target specific risk-return profiles and enhance their overall expected returns.

Regular Portfolio Rebalancing and Risk Management

To maintain a multi-factor portfolio’s desired factor exposures and risk-return profile, investors should regularly rebalance their portfolios. Rebalancing involves periodically reviewing a portfolio’s factor exposures and adjusting allocations to ensure that they remain aligned with the investor’s objectives. Additionally, implementing effective risk management techniques can help mitigate potential risks and ensure that factor-based strategies remain effective over time.

When constructing a multi-factor portfolio, investors should consider the potential interactions between factors and how they may impact portfolio performance. For example, smaller firms and value stocks may exhibit higher profitability on average, and understanding these relationships can help investors optimize their portfolios and manage risk. Furthermore, factor performance can vary over time and across markets, making it essential to consider transaction costs and turnover when implementing factor-based strategies.

By applying the cross-section of expected stock returns in portfolio construction, investors can create multi-factor portfolios that target specific investment objectives and risk profiles. Through careful factor identification, weighting, and combination, investors can enhance their expected returns and manage risk more effectively.

Challenges and Limitations of the Cross-Section of Expected Stock Returns

While the cross-section of expected stock returns offers valuable insights for investors, it is essential to acknowledge the challenges and limitations associated with using these factors for portfolio construction. Factors may interact with each other in complex ways, and factor performance can vary over time and across markets. By understanding these limitations, investors can implement factor-based strategies more effectively and manage potential risks.

Interactions Between Factors

Factors may interact with each other in ways that impact portfolio performance. For example, smaller firms often exhibit higher profitability and value characteristics, leading to potential interactions between the size, profitability, and value effects. Understanding these interactions can help investors optimize their portfolios and manage risk more effectively. However, it is essential to recognize that factor interactions can be complex and may not always be intuitive.

Variation in Factor Performance

Factor performance can vary significantly over time and across markets. For instance, the size effect has been less pronounced in developed markets compared to emerging markets, and the value effect has experienced periods of underperformance. Investors should be mindful of these variations when implementing factor-based strategies and consider adjusting their portfolios accordingly. Regularly monitoring factor performance and adjusting allocations can help investors maintain their desired risk-return profiles.

Transaction Costs and Turnover

Implementing factor-based strategies often involves high transaction costs and turnover, which can negatively impact portfolio performance. Frequent trading to capture factor premiums can lead to increased trading costs, taxes, and market impact costs. To mitigate these effects, investors should consider implementing factor-based strategies with lower turnover and focusing on factors with more persistent premiums. Additionally, employing cost-effective trading strategies and considering tax implications can help investors maximize their net returns.

Additional Considerations

When using the cross-section of expected stock returns for portfolio construction, investors should also consider other factors, such as liquidity, industry exposure, and regional concentration. Properly managing these factors can help investors build more robust and diversified portfolios. Furthermore, investors should be aware of the potential impact of macroeconomic conditions and market trends on factor performance and adjust their strategies accordingly.

By acknowledging the challenges and limitations of the cross-section of expected stock returns, investors can implement factor-based strategies more effectively and manage potential risks. Careful consideration of factor interactions, performance variations, transaction costs, and turnover can help investors build more robust and successful portfolios.

Future Research Directions in the Cross-Section of Expected Stock Returns

The cross-section of expected stock returns has been a subject of extensive research in finance, but several factors remain under-researched and warrant further investigation. Intangible assets, earnings quality, and environmental, social, and governance (ESG) factors are potential areas that could provide valuable insights for investors and portfolio construction. Additionally, considering investor behavior and sentiment can enhance our understanding of asset pricing models.

Intangible Assets

Intangible assets, such as patents, trademarks, and human capital, can significantly impact a firm’s value and expected returns. However, these assets are often not adequately captured in traditional financial statements, making it challenging to incorporate them into asset pricing models. Future research should focus on developing robust methods to measure and value intangible assets and their impact on expected stock returns.

Earnings Quality

Earnings quality, which refers to the reliability and sustainability of a firm’s earnings, is another area that has received limited attention in the cross-section of expected stock returns. High-quality earnings are often associated with firms that follow conservative accounting practices, have low accruals, and exhibit stable earnings growth. Investors should consider earnings quality when constructing portfolios, as firms with higher earnings quality may offer more stable returns and lower risk. Future research should explore the relationship between earnings quality and expected stock returns, as well as develop methods to measure and incorporate earnings quality into asset pricing models.

Environmental, Social, and Governance (ESG) Factors

Environmental, social, and governance (ESG) factors have gained increasing attention in recent years, as investors seek to align their investments with their values and beliefs. ESG factors can impact a firm’s risk profile, financial performance, and reputation, making them relevant for asset pricing models. Future research should focus on understanding the relationship between ESG factors and expected stock returns, as well as developing methods to measure and incorporate ESG factors into portfolio construction.

Investor Behavior and Sentiment

Investor behavior and sentiment can significantly impact asset prices and expected returns. Investors’ emotions, biases, and herding behavior can lead to mispricings and inefficiencies in the market, offering opportunities for investors to earn abnormal returns. Future research should explore the role of investor behavior and sentiment in asset pricing models and develop methods to measure and incorporate these factors into portfolio construction.

By considering intangible assets, earnings quality, ESG factors, and investor behavior and sentiment, future research can provide valuable insights for investors and enhance our understanding of the cross-section of expected stock returns. This, in turn, can lead to the development of more robust and effective portfolio construction strategies.