Understanding the Role of Market Makers in Shaping the Spread

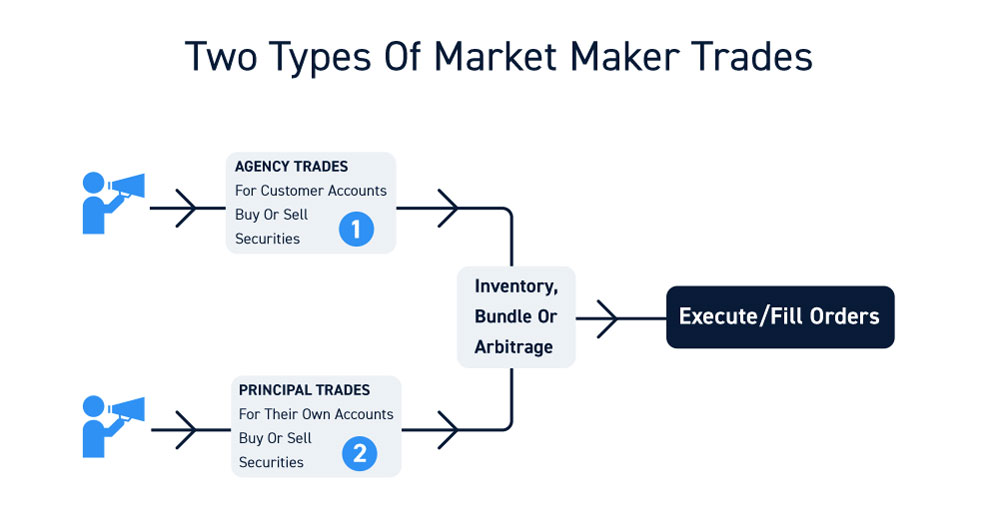

Market makers play a vital role in maintaining market liquidity, and their actions have a significant impact on the bid-ask spread. By quoting both buy and sell prices for a security, market makers facilitate trading and contribute to the formation of the bid-ask spread. The bid-ask spread exists because of the market makers’ ability to provide liquidity to the market, which is essential for facilitating trades. In return, market makers profit from the spread by buying at the bid price and selling at the ask price. This profit motive affects market prices, as market makers adjust their quotes to reflect their expected profits. For instance, in times of high volatility, market makers may widen the spread to compensate for the increased risk, leading to higher prices for buyers and lower prices for sellers. The bid-ask spread exists because of the market makers’ ability to adapt to changing market conditions, ensuring that they can continue to provide liquidity and profit from their role. As a result, market makers are essential for maintaining a functional and efficient market.

The Impact of Supply and Demand on the Bid-Ask Spread

The forces of supply and demand play a crucial role in shaping the bid-ask spread. Changes in market conditions can cause the spread to widen or narrow, depending on the balance between buyers and sellers. When demand is high and supply is low, the bid-ask spread tends to widen, as buyers are willing to pay a premium to acquire the security. Conversely, when supply is high and demand is low, the spread narrows, as sellers are forced to lower their prices to attract buyers. For example, during a bull market, the bid-ask spread may narrow as investors clamor to buy securities, driving up prices. In contrast, during a bear market, the spread may widen as investors scramble to sell, driving down prices. The bid-ask spread exists because of the constant interplay between supply and demand, and market makers adjust their quotes accordingly to reflect these changes. Additionally, market shocks, such as economic downturns or geopolitical events, can also impact the bid-ask spread, leading to increased volatility and wider spreads. Understanding the impact of supply and demand on the bid-ask spread is essential for investors and traders seeking to navigate the market effectively.

How to Identify and Exploit Inefficiencies in the Bid-Ask Spread

Identifying and exploiting inefficiencies in the bid-ask spread can be a lucrative strategy for traders and investors. To do so, it’s essential to analyze market data and identify situations where the spread is wider than usual. This can occur during times of high volatility, low liquidity, or when there is a lack of market makers. By analyzing order flow, trading volume, and price movements, traders can identify opportunities to profit from the bid-ask spread. For example, if a trader notices a security with a wider-than-usual spread, they may be able to buy at the bid price and sell at the ask price, earning a profit from the difference. However, it’s crucial to manage risk when exploiting these opportunities, as market conditions can change rapidly. Implementing stop-loss orders, diversifying portfolios, and continuously monitoring market data can help mitigate potential losses. The bid-ask spread exists because of the constant presence of inefficiencies in the market, and by identifying and exploiting these inefficiencies, traders can gain an edge over their competitors. Additionally, traders can use technical analysis tools, such as charts and graphs, to identify patterns and trends in the bid-ask spread, allowing them to make more informed trading decisions.

The Role of Information Asymmetry in the Bid-Ask Spread

Information asymmetry between buyers and sellers is a significant contributor to the bid-ask spread. When one party has access to more or better information than the other, it can create an imbalance in the market. Insiders, such as corporate executives or institutional investors, may possess information that is not publicly available, allowing them to make more informed trading decisions. This information asymmetry can lead to a wider bid-ask spread, as informed traders are willing to pay a premium to acquire securities or sell at a higher price. Additionally, informed traders may take advantage of this asymmetry by trading on their private information, further widening the spread. The bid-ask spread exists because of the constant presence of information asymmetry in the market, and understanding this concept is crucial for investors and traders seeking to navigate the market effectively. Furthermore, the rise of high-frequency trading and electronic communication networks has exacerbated information asymmetry, as these platforms provide faster access to market data and enable traders to react quickly to changing market conditions. As a result, traders must be aware of the potential for information asymmetry and take steps to mitigate its impact on their trading decisions.

Market Frictions and the Bid-Ask Spread: A Closer Look

Market frictions play a significant role in shaping the bid-ask spread, and understanding these frictions is crucial for investors and traders seeking to navigate the market effectively. One of the primary market frictions contributing to the bid-ask spread is transaction costs. These costs, including brokerage commissions, exchange fees, and other expenses, increase the cost of trading and widen the spread. Additionally, liquidity risks, such as the risk of not being able to buy or sell a security quickly enough, also contribute to the spread. Regulatory barriers, including restrictions on short selling or trading hours, can further widen the spread by limiting market participation. The bid-ask spread exists because of these market frictions, which create an imbalance between the prices at which buyers and sellers are willing to trade. By understanding these frictions, traders can better adapt to changing market conditions and make more informed trading decisions. For example, in times of high volatility, traders may need to adjust their trading strategies to account for increased transaction costs and liquidity risks. By doing so, they can minimize the impact of these frictions on their trading activities and maximize their profits. Furthermore, understanding market frictions can also help traders identify opportunities to profit from the bid-ask spread, such as by providing liquidity to the market or exploiting inefficiencies in the spread.

The Bid-Ask Spread as a Measure of Market Efficiency

The bid-ask spread is often viewed as a measure of market efficiency, with a narrower spread indicating a more efficient market. This is because a narrow spread suggests that buyers and sellers are in close agreement on the price of a security, reducing the need for intermediaries and increasing market liquidity. In an efficient market, prices reflect all available information, and the bid-ask spread is minimized. Conversely, a wide spread can indicate a less efficient market, where prices may not fully reflect available information and market participants may be more uncertain about the true value of a security. The bid-ask spread exists because of the constant presence of market inefficiencies, which create opportunities for traders to profit from the spread. By analyzing the bid-ask spread, investors and traders can gain insights into market efficiency and make more informed trading decisions. For example, a narrowing spread may indicate a market that is becoming more efficient, while a widening spread may signal a market that is becoming less efficient. Furthermore, understanding the relationship between the bid-ask spread and market efficiency can also help traders identify opportunities to profit from the spread, such as by providing liquidity to the market or exploiting inefficiencies in the spread.

The Impact of Technology on the Bid-Ask Spread

The advent of technology has significantly impacted the bid-ask spread, transforming the way markets operate and traders interact. The rise of high-frequency trading, for instance, has increased market liquidity and reduced the bid-ask spread. High-frequency traders use sophisticated algorithms to rapidly execute trades, providing liquidity to the market and narrowing the spread. Electronic communication networks (ECNs) have also played a crucial role in reducing the bid-ask spread. ECNs enable traders to directly interact with each other, bypassing traditional intermediaries and reducing transaction costs. This has led to a more efficient market, where prices reflect available information more accurately, and the bid-ask spread is minimized. Furthermore, the increased use of algorithms and automation has also reduced the role of human emotions in trading, leading to more rational decision-making and a narrower bid-ask spread. However, the increased reliance on technology also has its drawbacks. For instance, high-frequency trading can lead to flash crashes and market instability, while ECNs can create information asymmetry between traders with access to advanced technology and those without. The bid-ask spread exists because of the constant evolution of market structures and technologies, which create opportunities for traders to profit from the spread. By understanding the impact of technology on the bid-ask spread, traders can adapt to changing market conditions and make more informed trading decisions.

Navigating the Bid-Ask Spread in Different Market Conditions

Navigating the bid-ask spread in different market conditions is crucial for traders and investors to maximize their returns. In times of high volatility, the bid-ask spread tends to widen, making it more challenging to execute trades at favorable prices. In such scenarios, traders can adapt by increasing their liquidity provision, using limit orders, and focusing on longer-term trading strategies. On the other hand, in times of low liquidity, the bid-ask spread narrows, and traders can take advantage of this by using market orders and exploiting the reduced spread. The bid-ask spread exists because of the constant changes in market conditions, and understanding these dynamics is essential for traders to make informed decisions. Additionally, traders can use technical analysis and chart patterns to identify trends and adapt to changing market conditions. For instance, in a bull market, the bid-ask spread tends to narrow, and traders can use this to their advantage by buying at the bid price and selling at the ask price. In a bear market, the spread widens, and traders can use this to their advantage by selling at the bid price and buying at the ask price. By understanding how to navigate the bid-ask spread in different market conditions, traders can increase their chances of success and minimize their losses.

:max_bytes(150000):strip_icc()/bid-askspread-v4-dc6919600c5b4c5084b21e24fd3c7e5e.jpg)