Understanding Investment Risk: A Foundation

Investment risk often evokes images of potential losses. However, a more complete definition encompasses the uncertainty surrounding investment returns. Risk isn’t solely about losing money; it’s also about the unpredictable nature of profits. Variability in returns—how much they fluctuate—is a crucial aspect of assessing and managing this uncertainty. Understanding this variability is key to making sound investment decisions, and standard deviation measures which type of risk is inherent in these fluctuations. Investors need to grasp this concept to effectively evaluate potential opportunities and mitigate potential downsides. A key tool in this process is understanding how standard deviation measures which type of risk is present.

The level of uncertainty inherent in an investment significantly influences its risk profile. A highly volatile investment, with returns swinging wildly, presents a different risk profile than a stable investment with consistent, albeit possibly slower, growth. Analyzing the range and frequency of these return variations is vital. Standard deviation measures which type of risk is associated with these unpredictable shifts. It provides a quantifiable measure of the dispersion of returns around the average, allowing for a more objective assessment of investment volatility. This is especially important when comparing different investment opportunities.

By comprehending the variability of returns, investors can better align their investments with their individual risk tolerance. Some investors prioritize capital preservation and opt for lower-risk investments with less variability. Others may seek higher returns and accept the higher variability that often accompanies them. Regardless of investment goals, understanding how standard deviation measures which type of risk is paramount. This understanding enables informed choices, facilitating the construction of portfolios that align with individual financial objectives and risk appetites. Investors can use this knowledge to effectively manage their exposure to market fluctuations and achieve their financial targets.

Introducing Standard Deviation: Your Key to Volatility

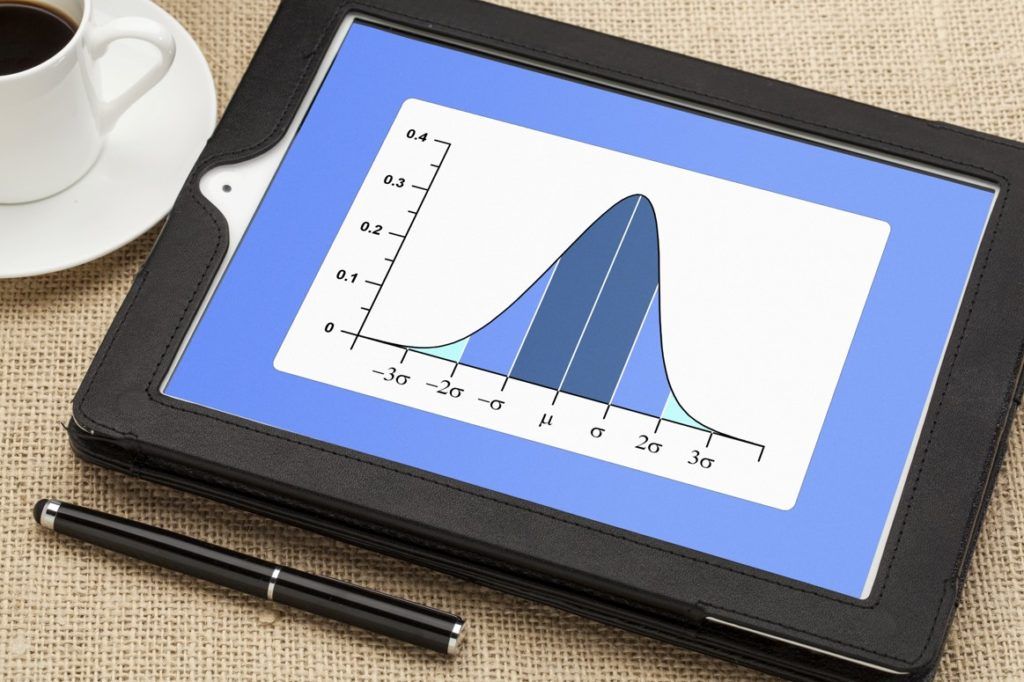

Standard deviation measures which type of risk? It measures the risk associated with the variability or volatility of an investment’s returns. In simpler terms, standard deviation quantifies how much the actual returns of an investment deviate from its average return. A higher standard deviation indicates greater volatility, meaning returns fluctuate more significantly around the average. Think of it like this: imagine two cities. City A has consistently mild temperatures throughout the year, while City B experiences extreme temperature swings, from scorching heat to freezing cold. City B’s temperatures show a much higher standard deviation than City A’s, reflecting greater variability. Standard deviation, therefore, provides a numerical measure of this variability.

Standard deviation measures which type of risk by calculating the square root of the variance. The variance itself represents the average of the squared differences from the mean. This mathematical process accounts for both positive and negative deviations from the average return, providing a comprehensive picture of the investment’s volatility. A small standard deviation suggests that the investment’s returns tend to cluster closely around the average, indicating lower volatility and thus lower risk. Conversely, a large standard deviation implies that returns are spread out over a wider range, signifying higher volatility and therefore higher risk. Understanding standard deviation helps investors assess the potential swings in their investment returns.

It is important to remember that standard deviation measures which type of risk— specifically, the risk of fluctuation around the average return. A higher standard deviation doesn’t inherently mean an investment is bad. It simply means the returns are less predictable. High volatility can lead to both substantial gains and significant losses. Therefore, an investment with a high standard deviation might be suitable for investors with a high risk tolerance who are seeking potentially higher returns, while a low standard deviation investment may be more appropriate for risk-averse investors seeking stability.

How Standard Deviation Quantifies Investment Risk

Standard deviation measures which type of risk? It measures the volatility of investment returns. A higher standard deviation indicates greater volatility, meaning returns fluctuate more dramatically around the average. Imagine two investments. One has a standard deviation of 5%, the other 15%. The investment with the 15% standard deviation experiences far more significant swings in its value. This doesn’t inherently mean it’s a *worse* investment; it simply signifies more uncertainty.

To visualize this, consider a simple chart plotting investment returns over time. An investment with a high standard deviation will show a wider scatter of data points around the average return line. Conversely, an investment with a low standard deviation will display data points clustered tightly around the average. Standard deviation measures which type of risk by quantifying this dispersion. A larger spread implies greater uncertainty about future returns. While a high standard deviation suggests greater potential for both significant gains and substantial losses, a lower standard deviation suggests more consistent, albeit potentially less spectacular, returns. This makes standard deviation a crucial metric for assessing risk.

Understanding standard deviation is key to managing risk effectively. Investors should consider their own risk tolerance when evaluating investments. Someone with a low risk tolerance might prefer investments with lower standard deviations, even if that means potentially lower returns. Conversely, those with a higher risk tolerance may accept a higher standard deviation in pursuit of potentially higher returns. Standard deviation measures which type of risk – specifically, the unpredictability of returns – and it’s a vital tool for aligning investment choices with individual risk profiles. Remember, standard deviation itself doesn’t determine the overall quality of an investment. Rather, it provides a crucial piece of information for a holistic risk assessment. By considering standard deviation alongside other factors, investors can make more informed and responsible decisions.

How to Interpret Standard Deviation in Investment Portfolios

Understanding how standard deviation measures which type of risk is crucial for portfolio management. Consider two hypothetical portfolios. Portfolio A boasts an annualized return of 10% with a standard deviation of 5%. Portfolio B also delivers a 10% annualized return, but its standard deviation is 15%. While both offer the same average return, their risk profiles differ significantly. Portfolio A exhibits less volatility; its returns cluster more closely around the average. Portfolio B, however, shows greater dispersion, meaning returns fluctuate more wildly from year to year. Investors with lower risk tolerance would likely prefer Portfolio A’s stability, despite the potential for slightly lower gains in some years. Standard deviation measures which type of risk—volatility—and this example clearly illustrates how this measure can help investors assess and compare investment options.

Standard deviation measures which type of risk is relevant across various investment horizons. For instance, analyzing a portfolio’s standard deviation over a five-year period offers a different perspective than a one-year analysis. Longer-term standard deviation calculations provide a broader view of risk, smoothing out short-term fluctuations. This long-term view is essential for investors with longer-term investment goals, such as retirement planning. They can use standard deviation to gauge the consistency of returns over time, helping them to manage risk effectively and make informed decisions aligned with their risk profiles and objectives. Understanding how standard deviation measures which type of risk is important for long-term investment strategy.

Interpreting standard deviation requires considering the context of the investment. A high standard deviation for a single stock is expected given the inherent volatility of individual equities. However, a high standard deviation for a well-diversified portfolio may indicate an issue with the portfolio’s construction or a need for rebalancing. The meaning of standard deviation also depends on the investor’s time horizon and risk tolerance. What might be considered high risk for one investor may be acceptable for another. Therefore, standard deviation isn’t a standalone metric but a valuable tool when used in conjunction with other risk measures and the investor’s overall financial goals. Standard deviation measures which type of risk, helping investors make informed decisions.

Standard Deviation and Different Asset Classes: A Comparative Look

Standard deviation measures which type of risk varies significantly across different asset classes. Stocks, known for their higher growth potential, typically exhibit a higher standard deviation than bonds. This reflects the greater volatility inherent in the stock market. Price fluctuations are more dramatic for stocks. A technology stock, for example, might have a very high standard deviation due to its sensitivity to market shifts and technological advancements. Conversely, bonds, considered more conservative investments, generally show lower standard deviation. Government bonds, in particular, often boast very low standard deviations, indicating their relative stability. This stability is because government bonds are generally considered to be low-risk investments.

Real estate investments occupy a middle ground. The standard deviation of real estate investments tends to be lower than that of stocks but higher than that of bonds. Property values fluctuate, but usually not as dramatically or rapidly as stock prices. Several factors influence this. Factors like location, market conditions, and economic trends all play a role. Standard deviation measures which type of risk in real estate is moderate. The inherent illiquidity of real estate also contributes to its somewhat lower volatility compared to stocks. However, the cost of buying and selling property can influence the overall return.

Understanding these variations is crucial for diversification. A well-diversified portfolio might include a mix of asset classes. This aims to balance risk and reward. By strategically allocating investments across asset classes with varying standard deviations, investors can potentially mitigate overall portfolio volatility. This allows for potentially better risk-adjusted returns. Standard deviation measures which type of risk is present in each component. This information is crucial for informed decision-making. Investors must carefully consider their individual risk tolerance when constructing their portfolios.

Standard Deviation vs. Other Risk Measures

Standard deviation measures which type of risk, specifically volatility, but it’s not the only metric investors use. Beta, for example, measures a security’s volatility relative to the overall market. A beta of 1 indicates the security’s price will move with the market. A beta greater than 1 suggests higher volatility than the market, while a beta less than 1 implies lower volatility. The Sharpe ratio considers both risk and return, calculating risk-adjusted return. It helps determine if excess returns compensate for the additional risk. Standard deviation, while focusing solely on price fluctuations, provides a straightforward measure of risk that’s easily understood and widely applicable.

While standard deviation measures which type of risk effectively for many situations, it has limitations. It assumes a normal distribution of returns. In reality, investment returns often deviate from a normal distribution, particularly during market crashes or periods of extreme volatility. Standard deviation also doesn’t capture all aspects of risk. For instance, it doesn’t account for the possibility of extreme events (black swan events) that have a low probability but significant impact. Despite these limitations, standard deviation remains a valuable tool because it provides a simple, readily available measure of price volatility. Its ease of calculation and interpretation make it a staple in risk assessment for many investors.

Ultimately, a comprehensive risk assessment relies on multiple measures. Investors shouldn’t rely solely on standard deviation. Combining standard deviation with other measures, such as beta and the Sharpe ratio, provides a more holistic view of risk. This multifaceted approach, considering both the volatility of returns and their relationship to market movements and risk-adjusted returns, allows for a more nuanced and informed investment strategy. Understanding the strengths and limitations of standard deviation measures which type of risk is crucial for effective investment decision-making.

Using Standard Deviation to Make Informed Investment Decisions

Investors can leverage standard deviation to make more informed investment choices. Understanding standard deviation measures which type of risk – specifically, the volatility of returns – is crucial. A higher standard deviation signifies greater price fluctuations. This means potential for higher returns but also for larger losses. Investors with a high risk tolerance might favor investments with higher standard deviations, while those with low risk tolerance should prefer investments exhibiting lower standard deviations. Standard deviation provides a quantifiable measure to help align investment strategies with individual risk profiles.

Risk tolerance plays a vital role in determining suitable investment strategies. Investors should assess their personal risk tolerance before making any investment decisions. Those with a higher tolerance may feel comfortable with investments exhibiting higher standard deviations, accepting greater volatility for the potential of higher returns. Conversely, conservative investors should prioritize investments with lower standard deviations, even if it means potentially lower returns. By understanding how standard deviation measures which type of risk, investors can make choices that align with their comfort levels and financial goals. Remember, a diversified portfolio, carefully constructed to lower the overall standard deviation, is often a key element of a sound investment strategy.

Practical application of standard deviation involves comparing the standard deviations of different investments. For example, an investor could compare the standard deviation of a technology stock fund to that of a government bond fund. The technology fund would likely have a much higher standard deviation, reflecting its higher volatility. This information, combined with individual risk tolerance, guides the allocation of investment funds. Investors should regularly monitor the standard deviation of their portfolio. Changes in standard deviation may signal the need to rebalance the portfolio to maintain the desired level of risk. Successfully using standard deviation to manage investment risk involves consistently reviewing and adjusting the portfolio based on changing market conditions and personal circumstances. Standard deviation measures which type of risk is crucial to effective portfolio management.

Standard Deviation: A Practical Tool for Risk Assessment

In conclusion, understanding standard deviation is crucial for navigating the complexities of the investment world. Standard deviation measures which type of risk – specifically, the volatility of investment returns. Investors should utilize this metric to assess the uncertainty inherent in different assets and portfolios. A higher standard deviation indicates greater volatility, meaning returns fluctuate more significantly. Conversely, a lower standard deviation suggests more stable returns, although it doesn’t necessarily imply higher returns.

This understanding empowers investors to make more informed decisions. By carefully considering standard deviation alongside their risk tolerance, individuals can construct portfolios that align with their financial goals and comfort levels. Diversification plays a vital role in managing risk; spreading investments across various asset classes can help reduce the overall standard deviation of a portfolio, thus mitigating potential losses. Standard deviation measures which type of risk, and this awareness is key.

Ultimately, standard deviation serves as a powerful tool for measuring and understanding investment risk. It helps investors assess the potential fluctuations in their returns, aiding in the creation of well-diversified portfolios and fostering more confident investment choices. Regular monitoring of standard deviation, and how it changes across the investment lifecycle, should be part of a proactive investment strategy. This consistent vigilance ensures that portfolios continue to align with individual risk tolerance and financial goals. The effective use of standard deviation—which measures which type of risk is critical—supports informed, strategic investment decisions.