Understanding the Federal Reserve’s Role

The Federal Reserve (the Fed) plays a crucial role in the US economy. Its primary mandate is to maintain price stability and maximum employment. To achieve these goals, the Fed utilizes various monetary policy tools, with interest rate adjustments being a key mechanism. Inflation, a general increase in prices, is a major concern. The Fed aims to keep inflation at a healthy level, typically around 2%. High inflation erodes purchasing power, while low inflation can signal economic weakness. Interest rates directly influence inflation. Raising interest rates generally cools down the economy, reducing inflationary pressures. Conversely, lowering rates can stimulate economic growth. The Fed’s recent actions demonstrate this dynamic. Over the past year, the Fed has implemented several interest rate increases to combat rising inflation. This illustrates the direct relationship between the Fed’s actions and the probability of fed rate increase to control inflation and maintain economic stability. The historical context provides insight into the Fed’s approach to managing economic fluctuations and its influence on the probability of fed rate increase. The frequency of these adjustments significantly influences expectations within the market. The probability of fed rate increase remains a key factor in investors’ decisions.

The interplay between inflation and employment is also critical. While lowering interest rates can boost employment, it can also lead to higher inflation. Conversely, raising rates to control inflation might temporarily slow job growth. The Fed must carefully balance these competing objectives. Finding the sweet spot, where inflation is low and stable, and employment is high, is a continuous challenge. The probability of fed rate increase is constantly evaluated, weighed against its potential impact on employment numbers. The Fed’s decision-making process requires careful consideration of various economic indicators and their impact on both inflation and employment. The probability of fed rate increase is, therefore, often a complex calculation considering the intricate relationship between these two key economic metrics. Accurate forecasts considering the probability of fed rate increase necessitates a comprehensive understanding of the historical context and the current economic climate.

Understanding the Fed’s historical actions is crucial for assessing the probability of fed rate increase in the future. Analyzing past rate adjustments, along with the economic conditions at the time, provides valuable insights into the Fed’s decision-making process. This historical analysis helps anticipate future moves by understanding the context behind the Fed’s past actions and the relative probability of fed rate increase based on those precedents. The probability of fed rate increase is rarely determined in isolation, and requires a deep understanding of historical context, including similar economic periods and how the Fed responded to those conditions.

Factors Influencing the Fed’s Decision

The Federal Reserve’s decision on interest rates hinges on a complex interplay of economic indicators. Inflation data, specifically the Consumer Price Index (CPI) and the Personal Consumption Expenditures index (PCE), provides crucial insight into price stability. High inflation significantly increases the probability of a fed rate increase, as the Fed aims to cool down an overheating economy. Conversely, low inflation might suggest a less urgent need for a rate hike. For example, persistently high CPI readings above the Fed’s target range would likely signal a greater probability of a fed rate increase.

Unemployment rates offer another key perspective. Low unemployment, indicating a strong labor market, can contribute to inflationary pressures. This, in turn, increases the probability of a fed rate increase. High unemployment, however, might suggest a need for expansionary monetary policy, making a rate hike less likely. The Fed carefully considers the balance between price stability and maximum employment. GDP growth provides insight into the overall health of the economy. Robust GDP growth, if accompanied by high inflation, could increase the probability of a fed rate increase. Conversely, weak GDP growth might dissuade the Fed from raising rates.

Beyond these core indicators, consumer confidence indices and market volatility also play a role. High consumer confidence can signal increased spending, potentially fueling inflation and thus increasing the probability of a fed rate increase. Significant market volatility, such as sharp stock market declines, could influence the Fed’s decision, potentially leading them to hold off on a rate hike to avoid exacerbating economic uncertainty. The Fed assesses the weight and interrelation of all these factors. This holistic approach allows them to gauge the probability of a fed rate increase with more accuracy. Understanding the relative importance of each indicator helps to anticipate the Fed’s next move. Analyzing past responses to similar economic conditions provides further context for assessing the probability of a fed rate increase in the present situation.

Interpreting Economic Data: A Guide for the Layperson

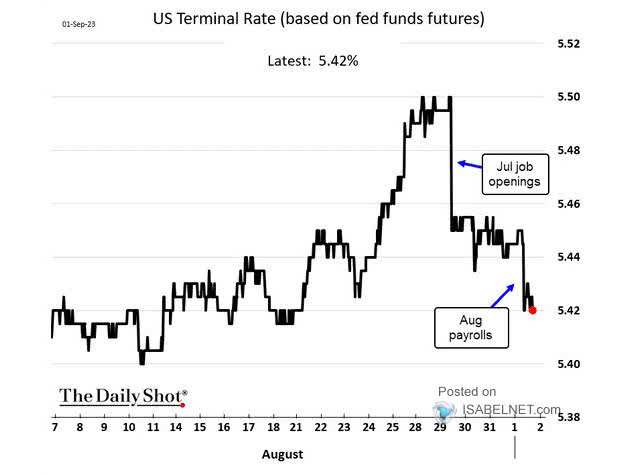

Understanding the factors influencing the probability of a fed rate increase requires familiarity with key economic terms. “Core inflation,” for example, measures inflation excluding volatile food and energy prices, providing a clearer picture of underlying price pressures. The Federal Funds Rate is the target rate that the Fed sets for overnight lending between banks. A higher rate generally makes borrowing more expensive, slowing economic growth and potentially reducing inflation. Quantitative easing (QE) is a monetary policy tool where the central bank injects liquidity into the money market by purchasing assets. It aims to lower long-term interest rates and increase borrowing. Visualizing these concepts is crucial. A simple chart illustrating the relationship between inflation and the federal funds rate over time can quickly demonstrate the Fed’s typical response to rising prices. Understanding these relationships is key to assessing the probability of a fed rate increase.

Another important indicator is the Consumer Price Index (CPI), which measures changes in the price of a basket of consumer goods and services. A rising CPI indicates inflation, potentially prompting the Fed to raise interest rates. Conversely, a falling CPI might suggest a need for lower interest rates to stimulate economic growth. Unemployment figures also significantly influence the Fed’s decision-making. Low unemployment typically suggests a strong economy, which may increase inflationary pressures. The Gross Domestic Product (GDP) growth rate reflects the overall health of the economy. Strong GDP growth can contribute to inflation, increasing the probability of a fed rate increase, while weak growth might lead to a more cautious approach. Charts comparing these indicators over time can aid in identifying trends and assessing the probability of a fed rate increase. Analyzing these economic indicators, alongside others like consumer confidence, is crucial for understanding the economic landscape.

Market volatility, measured through indices like the VIX (Volatility Index), can also indirectly influence the Fed’s decisions. High market volatility may indicate uncertainty, potentially prompting the Fed to act cautiously and delay a rate increase. Conversely, stable markets might suggest that the economy can withstand a rate hike. To effectively predict the probability of a fed rate increase, one must synthesize information from these various sources. Combining an understanding of core inflation, the federal funds rate, quantitative easing, CPI, unemployment, GDP, and market volatility with visual representations of these economic indicators will significantly improve one’s ability to anticipate the Fed’s next move. The probability of a fed rate increase is ultimately a complex calculation that requires a holistic approach, considering all the relevant economic data.

How to Predict the Likelihood of a Fed Rate Increase

Accurately predicting the probability of a fed rate increase requires a multi-faceted approach. Begin by regularly reviewing key economic indicators. Analyze inflation data, focusing on both headline and core inflation rates (CPI and PCE). Track unemployment figures, paying attention to the unemployment rate and labor force participation. Monitor GDP growth rates to assess the overall health of the economy. Consider consumer confidence indices, providing insight into consumer spending behavior. Finally, observe market volatility, including stock market indices and bond yields. Analyzing these indicators together provides a more holistic view. The interplay between these factors significantly impacts the probability of a fed rate increase.

To further refine the assessment of the probability of a fed rate increase, consider the relationship between these indicators. For example, consistently high inflation coupled with strong employment figures might suggest a higher probability of a rate hike. Conversely, low inflation alongside weak economic growth might indicate a lower probability. Remember, the Fed’s decisions are complex, involving numerous considerations beyond these indicators. The probability of a fed rate increase is not a simple calculation but a nuanced interpretation of economic trends. Employing simple forecasting models, such as comparing current economic conditions to past periods of similar economic situations, can offer insights. This involves examining historical data on how the Fed responded to similar economic conditions and adjusting for current factors. Examining the probability of a fed rate increase this way gives additional perspective.

Accessing reliable economic data is crucial. Many reputable governmental and private organizations publish regular economic reports. These reports frequently include detailed analysis and forecasts. Understanding the nuances of these reports helps in evaluating the probability of a fed rate increase. Remember, economic forecasting is inherently uncertain. Therefore, focusing on a range of probabilities, rather than a single point prediction, is a more realistic approach. It is important to understand that even with careful analysis, predicting with certainty the probability of a fed rate increase remains challenging. The Fed’s actions are influenced by multiple factors, some unpredictable. Consistent monitoring and careful interpretation of economic data enhance the ability to estimate the likelihood of a future rate hike. This approach allows for a better informed perspective of the probability of a fed rate increase.

Market Reactions to Rate Hike Announcements

Federal Reserve rate hike announcements significantly impact various market sectors. The probability of a fed rate increase influences investor behavior and market volatility. Stock markets often experience short-term declines following a rate hike announcement. This is because higher interest rates increase borrowing costs for companies, potentially reducing profitability and investment. However, long-term effects can be more nuanced. Increased rates can signal a healthier economy, potentially boosting investor confidence over time. The probability of a fed rate increase is a key factor in assessing long-term market performance.

Bond markets generally react inversely to rate hikes. When interest rates rise, the value of existing bonds with lower interest rates falls. This is because investors can now earn higher returns on newly issued bonds. The magnitude of this effect depends on the size of the rate increase and the overall economic outlook. Understanding the probability of a fed rate increase is crucial for bond investors to manage their portfolios effectively. Real estate markets also feel the impact of rate hikes, although the effects are often less immediate than in stocks and bonds. Higher mortgage rates increase borrowing costs for homebuyers, potentially slowing down the market. However, the relationship is complex, influenced by other factors like supply, demand, and consumer confidence.

Past market reactions provide valuable insights into potential future responses. For instance, following previous rate hike announcements, the stock market initially experienced some volatility, but it generally recovered over time. Analyzing these past responses helps investors better understand the probability of a fed rate increase and its likely effects. This historical data, along with an understanding of current economic conditions and the Fed’s communication, assists in forming more informed investment strategies. The probability of a fed rate increase is therefore a critical component in risk assessment and portfolio management across diverse asset classes. Investors must carefully consider the short-term and long-term impacts on their investments when evaluating the potential for future rate increases.

Analyzing the Fed’s Communication and Statements

The Federal Open Market Committee (FOMC) plays a crucial role in setting interest rates. Their statements following meetings offer valuable insights into the probability of a fed rate increase. Analyzing the language used is key to understanding the Fed’s intentions. The committee uses carefully chosen words to signal their likely course of action. A hawkish tone suggests a greater probability of a rate hike. Conversely, a dovish tone indicates a lower probability of a fed rate increase. Paying close attention to the nuances of their communication is essential for gauging the market’s likely response.

Press releases and speeches by key officials, such as the Chair of the Federal Reserve, provide additional clues. These communications often contain forward-looking statements. These statements offer hints about the Fed’s assessment of economic conditions. The probability of a fed rate increase is often implicitly reflected in their assessment of inflation and unemployment. For example, emphasis on persistent inflation might suggest a higher probability of a rate hike. Conversely, concerns about weak economic growth could signal a lower probability. Careful analysis of these communications allows for a more informed assessment of the likelihood of future interest rate adjustments. Investors actively monitor these statements, seeking to understand the central bank’s policy intentions. This helps them to adjust their investment strategies accordingly, affecting market movements and asset pricing.

Understanding the Fed’s communication style is vital. The probability of a fed rate increase isn’t always explicitly stated. Instead, it’s often conveyed through subtle shifts in language and emphasis. For example, a shift from describing inflation as “transitory” to “persistent” might significantly alter the market’s perception of the probability of a fed rate increase. Similarly, discussions of potential risks to the economy can provide clues. These nuances are crucial for accurately interpreting the Fed’s stance. By studying past statements and comparing them to subsequent actions, investors can refine their ability to predict the probability of a fed rate increase. This allows them to proactively adjust their investment portfolios and manage risk more effectively.

The Impact of Global Economic Factors

Global economic events significantly influence the probability of a fed rate increase. Geopolitical instability, for example, can create uncertainty in financial markets. This uncertainty can lead to increased volatility and affect inflation expectations. A major war or significant political upheaval could push inflation higher, increasing the probability of the Fed raising interest rates to combat it. Conversely, periods of global economic stability can reduce inflationary pressures, lessening the need for a rate hike.

International trade disputes also play a crucial role. Tariffs and trade wars disrupt supply chains, impacting prices for goods and services. Increased prices due to trade friction contribute to inflationary pressures, potentially increasing the probability of a fed rate increase. The interconnected nature of the global economy means that events in one region can quickly impact others, making international developments a key factor in the Fed’s decision-making. The impact on the probability of a fed rate increase can be profound; for instance, a slowdown in a major trading partner’s economy might reduce demand for US goods, easing inflationary pressures and lowering the probability of a rate hike.

Global inflation is another critical factor. If inflation is rising globally, the pressure on the US to raise rates increases. The Fed must consider the relative inflation rates in the US versus other major economies. If global inflation is significantly higher than US inflation, this could reduce the probability of a fed rate increase, as the Fed might be concerned about competitiveness. Conversely, if global inflation is lower than US inflation, the Fed might be more inclined to raise rates to avoid widening the gap, thereby significantly impacting the probability of a fed rate increase. Analyzing these international factors alongside domestic indicators provides a more complete picture when assessing the likelihood of future rate adjustments.

Long-Term Implications of Interest Rate Changes

Interest rate increases implemented by the Federal Reserve have profound and lasting effects on various aspects of the economy. Higher interest rates typically curb inflation by making borrowing more expensive, thus reducing consumer spending and business investment. This can lead to slower economic growth in the short term. However, controlled inflation fosters a stable economic environment, benefiting long-term economic health and investor confidence. The probability of fed rate increase significantly impacts these outcomes.

For individuals, higher interest rates mean increased borrowing costs for mortgages, auto loans, and personal loans. Savings accounts and other interest-bearing instruments may offer higher returns. Businesses face higher costs for expansion and investment, potentially impacting hiring and job growth. The impact varies based on individual circumstances and the magnitude of the rate increase. A gradual increase might allow for adaptation, while a sharp rise can cause disruption. The probability of fed rate increase influences these individual financial decisions.

The long-term effects also depend on other economic factors and the Fed’s overall monetary policy strategy. Sustained higher interest rates can lead to a decrease in asset prices, particularly in sectors sensitive to interest rate changes like real estate and bonds. Conversely, a well-managed increase can help prevent runaway inflation, ensuring a more predictable and sustainable economic future. Understanding the probability of fed rate increase is crucial for businesses and individuals to make informed financial decisions and long-term plans. Continuous monitoring of economic indicators is paramount for navigating this complex landscape and assessing the likelihood of further rate adjustments. The ability to accurately predict the probability of fed rate increase provides a significant advantage in long-term financial planning.