Understanding the Concept of Tax Shields

In the world of finance, companies are constantly seeking ways to minimize their tax liability and maximize their value. One effective strategy for achieving this goal is through the use of tax shields. A tax shield refers to a reduction in a company’s tax liability, resulting from the deduction of certain expenses or the utilization of tax credits. By understanding the concept of tax shields, businesses can unlock significant savings and increase their overall value.

There are several types of tax shields that companies can utilize, including debt and depreciation. Debt, for instance, can provide a tax shield through the deduction of interest expenses. Similarly, depreciation allows companies to deduct the cost of assets over their useful life, reducing their taxable income. By leveraging these tax shields, companies can reduce their tax burden and increase their cash flow.

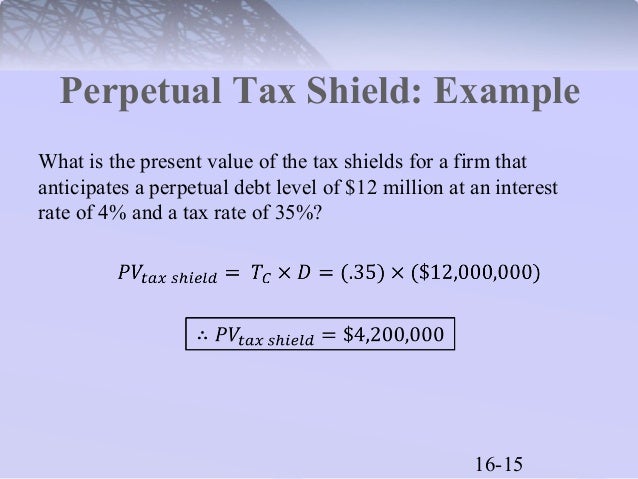

For example, consider a company with a significant amount of debt on its balance sheet. By deducting the interest expenses associated with this debt, the company can reduce its taxable income and lower its tax liability. This, in turn, can increase the company’s value by reducing its tax burden and increasing its cash flow. Similarly, a company that invests in assets with a long useful life, such as property or equipment, can utilize depreciation to reduce its taxable income and increase its tax shield. Understanding the present value of the tax shield is crucial in making informed financial decisions, as it allows companies to estimate the future benefits of these tax savings.

How to Calculate the Present Value of a Tax Shield

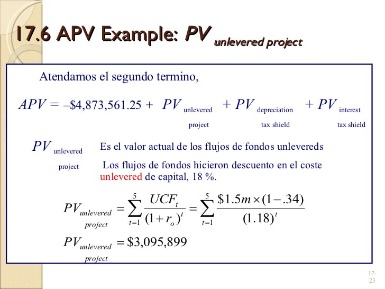

Calculating the present value of a tax shield is a crucial step in understanding the potential benefits of tax savings. The present value of a tax shield represents the current value of future tax savings, allowing companies to make informed financial decisions. To calculate the present value of a tax shield, companies can use the following formula:

Present Value of Tax Shield = (Tax Rate x Cash Flows) / (1 + Discount Rate)^Number of Years

This formula takes into account three key components: the tax rate, cash flows, and discount rate. The tax rate represents the percentage of tax savings, while cash flows refer to the expected annual savings from the tax shield. The discount rate, on the other hand, reflects the company’s cost of capital or the opportunity cost of investing in the tax shield.

To illustrate this calculation, consider a company with a debt of $1 million, an interest rate of 5%, and a tax rate of 25%. Assuming a discount rate of 10% and a 5-year period, the present value of the tax shield would be:

Present Value of Tax Shield = (25% x $50,000) / (1 + 10%)^5 = $184,415

This calculation demonstrates how the present value of a tax shield can be estimated using the formula. By understanding the present value of a tax shield, companies can make informed decisions about investing in tax-saving strategies and optimize their financial performance.

The Importance of Discount Rates in Tax Shield Calculations

In calculating the present value of a tax shield, the discount rate plays a crucial role in determining the current value of future tax savings. The discount rate represents the company’s cost of capital or the opportunity cost of investing in the tax shield. A higher discount rate implies a higher opportunity cost, which reduces the present value of the tax shield. Conversely, a lower discount rate increases the present value of the tax shield.

Choosing an appropriate discount rate is essential in tax shield calculations. A common approach is to use the company’s weighted average cost of capital (WACC), which reflects the cost of debt and equity financing. Alternatively, companies can use a risk-free rate, such as the yield on government bonds, plus a risk premium to account for the uncertainty of future cash flows.

The impact of different discount rates on the present value of a tax shield can be significant. For instance, if a company uses a discount rate of 10% instead of 8%, the present value of the tax shield may decrease by 20%. This highlights the importance of selecting a discount rate that accurately reflects the company’s cost of capital and risk profile.

To illustrate the effect of discount rates, consider a company with a tax shield of $100,000 per year for 5 years. Using a discount rate of 8%, the present value of the tax shield would be $379,419. However, if the discount rate is increased to 12%, the present value of the tax shield would decrease to $292,419. This example demonstrates how the discount rate can significantly impact the present value of a tax shield and, consequently, the company’s financial decisions.

In conclusion, the discount rate is a critical component in calculating the present value of a tax shield. By selecting an appropriate discount rate and understanding its impact on the present value of a tax shield, companies can make informed decisions about investing in tax-saving strategies and optimize their financial performance.

Applying Tax Shields to Real-World Scenarios

Tax shields have numerous applications in real-world financial decision-making, from capital budgeting to mergers and acquisitions. By understanding the present value of a tax shield, companies can make informed decisions that maximize tax savings and increase firm value.

In capital budgeting, tax shields can be used to evaluate the feasibility of projects. For instance, a company considering a new investment project can estimate the present value of the tax shield generated by the project’s depreciation and interest expenses. This can help determine whether the project is profitable and worthy of investment.

In mergers and acquisitions, tax shields can play a crucial role in determining the value of a target company. The acquiring company can estimate the present value of the tax shield generated by the target company’s debt and depreciation, which can increase the target company’s value and justify a higher acquisition price.

In financial planning, tax shields can be used to optimize a company’s capital structure. By estimating the present value of the tax shield generated by different debt levels, a company can determine the optimal debt-to-equity ratio that minimizes its tax liability and maximizes its value.

For example, consider a company evaluating two investment projects with different tax shield profiles. Project A generates a tax shield of $50,000 per year for 5 years, while Project B generates a tax shield of $75,000 per year for 3 years. By estimating the present value of each tax shield, the company can determine that Project B has a higher present value of the tax shield, despite its shorter duration. This can inform the company’s investment decision and maximize its tax savings.

In conclusion, tax shields have numerous applications in real-world financial decision-making. By understanding the present value of a tax shield, companies can make informed decisions that maximize tax savings and increase firm value.

The Relationship Between Tax Shields and Firm Value

The present value of a tax shield has a direct impact on a company’s firm value. By reducing a company’s tax liability, tax shields increase its profitability and cash flows, which in turn increase its value. This is because investors and financial analysts place a higher value on companies with lower tax liabilities, as they are able to retain more of their earnings and invest them in growth opportunities.

Research has shown that companies with higher tax shields tend to have higher firm values. This is because tax shields provide a competitive advantage, allowing companies to invest in growth opportunities that might not be available to companies with higher tax liabilities. Additionally, tax shields can increase a company’s financial flexibility, enabling it to take on more debt or invest in new projects.

For investors and financial analysts, understanding the present value of a tax shield is crucial in evaluating a company’s investment potential. By estimating the present value of a tax shield, investors can determine the impact of tax savings on a company’s cash flows and profitability, and adjust their valuation models accordingly. This can help investors make more informed investment decisions and avoid overpaying for companies with low tax shields.

Furthermore, the present value of a tax shield can also impact a company’s cost of capital. By reducing a company’s tax liability, tax shields can lower its cost of debt and equity, making it cheaper to raise capital. This can increase a company’s financial flexibility and enable it to pursue more investment opportunities.

In conclusion, the present value of a tax shield has a significant impact on a company’s firm value. By understanding the relationship between tax shields and firm value, companies can make informed decisions about investing in tax-saving strategies and maximize their value.

Common Mistakes to Avoid When Calculating Tax Shields

When calculating the present value of a tax shield, it’s essential to avoid common mistakes that can lead to inaccurate results. These mistakes can have significant implications for a company’s financial decision-making, as they can result in overestimation or underestimation of tax savings.

One common mistake is using an incorrect discount rate. The discount rate should reflect the company’s cost of capital, and using a rate that is too high or too low can significantly impact the present value of the tax shield. For example, if a company uses a discount rate of 10% instead of the correct rate of 8%, it may overestimate the present value of the tax shield and make suboptimal investment decisions.

Another mistake is inaccurate cash flow projections. Cash flows should be estimated based on realistic assumptions about the company’s future performance, and inaccurate projections can lead to incorrect calculations of the present value of the tax shield. For instance, if a company overestimates its future cash flows, it may underestimate the present value of the tax shield and miss out on valuable tax savings opportunities.

Failure to consider tax law changes is another common mistake. Tax laws and regulations are subject to change, and companies should consider the potential impact of these changes on their tax shields. For example, if a company fails to account for a potential increase in the tax rate, it may underestimate the present value of the tax shield and make suboptimal investment decisions.

Additionally, companies should avoid using simplistic assumptions about the tax shield, such as assuming a constant tax rate or ignoring the impact of depreciation on cash flows. These assumptions can lead to inaccurate calculations of the present value of the tax shield and poor financial decision-making.

By avoiding these common mistakes, companies can ensure that their calculations of the present value of the tax shield are accurate and reliable, and make informed decisions about investing in tax-saving strategies.

Advanced Topics in Tax Shield Analysis

In addition to the basic calculation of the present value of a tax shield, there are several advanced topics that can be explored to further refine the analysis. These topics include the use of Monte Carlo simulations, sensitivity analysis, and scenario planning.

Monte Carlo simulations involve running multiple iterations of the present value calculation using different assumptions about the discount rate, tax rate, and cash flows. This can help to estimate the uncertainty associated with the present value of the tax shield and provide a range of possible outcomes. For example, a company may use a Monte Carlo simulation to estimate the present value of a tax shield based on different scenarios for future cash flows.

Sensitivity analysis involves analyzing how changes in the input variables affect the present value of the tax shield. This can help to identify the most critical assumptions and variables that drive the calculation. For example, a company may use sensitivity analysis to determine how changes in the discount rate or tax rate affect the present value of the tax shield.

Scenario planning involves developing different scenarios for future cash flows and estimating the present value of the tax shield under each scenario. This can help to provide a more comprehensive understanding of the potential outcomes and risks associated with the tax shield. For example, a company may develop scenarios for different economic conditions, such as a recession or boom, and estimate the present value of the tax shield under each scenario.

By incorporating these advanced topics into the analysis, companies can gain a more nuanced understanding of the present value of the tax shield and make more informed decisions about investing in tax-saving strategies. Additionally, these advanced topics can help to identify potential risks and opportunities associated with the tax shield, allowing companies to develop more effective risk management strategies.

For instance, a company may use scenario planning to identify potential risks associated with changes in tax laws or regulations, and develop strategies to mitigate these risks. Alternatively, a company may use sensitivity analysis to identify opportunities to optimize the present value of the tax shield by adjusting the discount rate or tax rate.

By applying these advanced topics to the analysis of the present value of the tax shield, companies can unlock the full potential of tax savings and make more informed decisions about investing in tax-saving strategies.

Conclusion: Maximizing Tax Savings with Present Value Analysis

In conclusion, understanding the present value of a tax shield is a crucial concept in financial decision-making. By applying the concepts and techniques outlined in this guide, companies can unlock the full potential of tax savings and make more informed decisions about investing in tax-saving strategies.

The present value of a tax shield is a powerful tool that can help companies reduce their tax liability and increase their value. By calculating the present value of a tax shield, companies can estimate the future tax savings associated with a particular investment or strategy, and make more informed decisions about whether to pursue it.

Moreover, the present value of a tax shield can be applied to a wide range of real-world scenarios, from capital budgeting decisions to mergers and acquisitions. By incorporating tax shields into their financial analysis, companies can gain a more comprehensive understanding of the potential risks and opportunities associated with different investments and strategies.

However, it is essential to avoid common mistakes when calculating the present value of a tax shield, such as incorrect discount rates, inaccurate cash flow projections, and failure to consider tax law changes. By being aware of these potential pitfalls, companies can ensure that their calculations are accurate and reliable.

Finally, advanced topics in tax shield analysis, such as Monte Carlo simulations, sensitivity analysis, and scenario planning, can provide even more insights into the present value of a tax shield. By incorporating these advanced topics into their analysis, companies can gain a more nuanced understanding of the potential risks and opportunities associated with different investments and strategies.

In summary, the present value of a tax shield is a critical concept in financial decision-making, and companies that understand how to calculate and apply it can gain a significant competitive advantage. By following the guidelines outlined in this guide, companies can maximize their tax savings and make more informed decisions about investing in tax-saving strategies.