What is Money Supply and Why Does it Matter?

The money supply, comprising M2 and M1 money supply, is a critical component of a nation’s economy. It refers to the total amount of money circulating in the economy, encompassing various forms of currency, deposits, and other liquid assets. The money supply plays a vital role in shaping the overall health of an economy, influencing inflation, interest rates, and economic growth. A deep understanding of the money supply is essential for individuals, businesses, and policymakers to make informed decisions that promote economic stability and growth.

Breaking Down the Monetary Aggregates: M1, M2, and Beyond

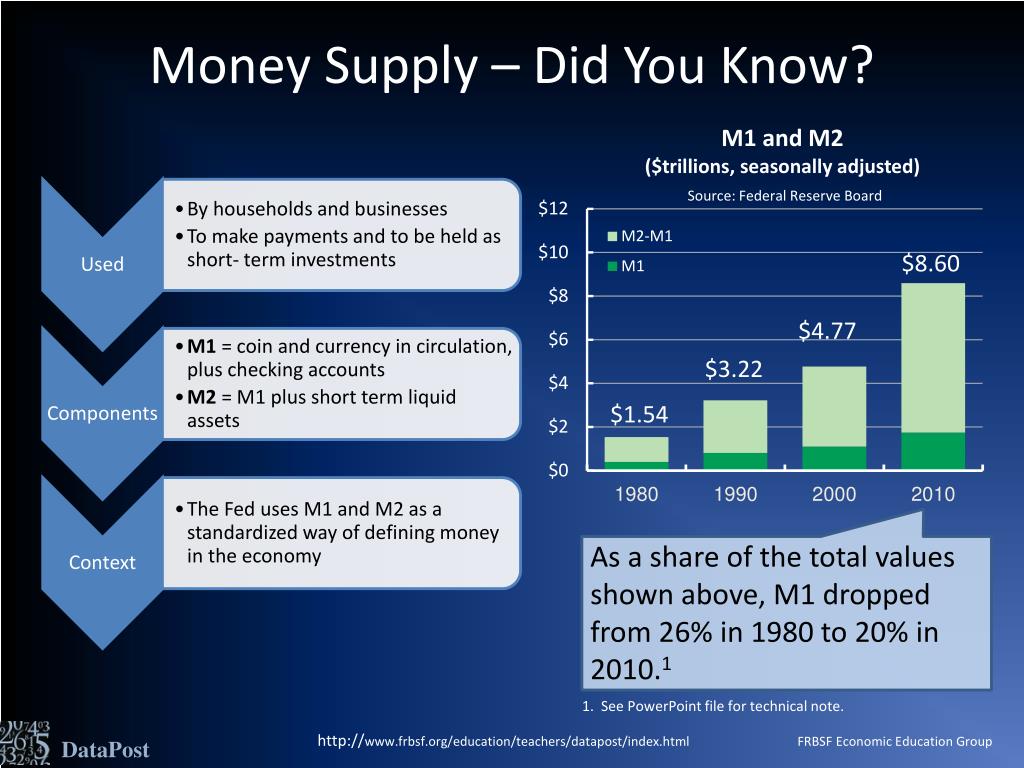

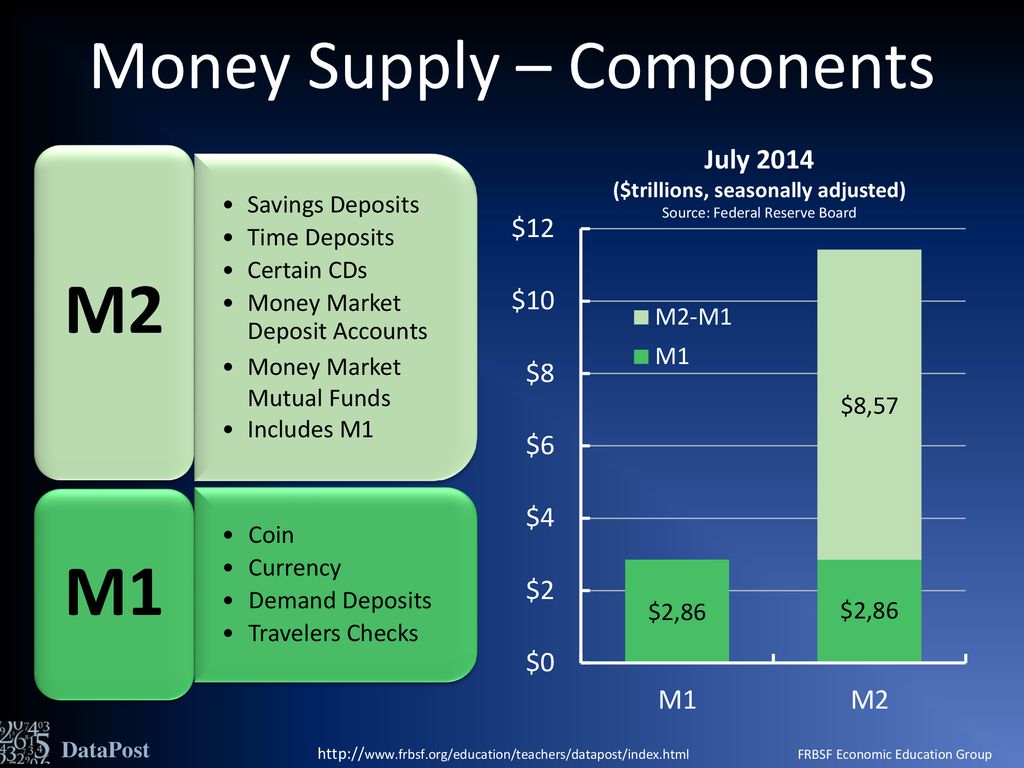

The monetary aggregates, including M1, M2, and M3, are essential components of the money supply. These aggregates are calculated by the Federal Reserve to measure the amount of money circulating in the economy. M1 money supply, also known as narrow money, consists of physical currency, checking accounts, and other checkable deposits. M2 money supply, or broad money, includes M1 plus savings deposits, money market funds, and other liquid assets. M3, the broadest measure, adds large time deposits and institutional money market funds to M2. Understanding the differences between M1 and M2 money supply is crucial, as they have distinct implications for the economy and financial markets.

How to Measure M1 Money Supply: A Closer Look

M1 money supply, a crucial component of the overall money supply, is calculated by the Federal Reserve to track the amount of liquid assets in the economy. The M1 money supply consists of physical currency, including coins and banknotes, as well as checking accounts and other checkable deposits. These deposits include negotiable order of withdrawal (NOW) accounts, automatic transfer service (ATS) accounts, and credit union share draft accounts. The Federal Reserve measures M1 money supply through its H.6 Money Stock Measures report, which provides a detailed breakdown of the components of M1. Understanding the components of M1 money supply is essential for grasping the intricacies of the monetary system and how it affects the economy. The M1 money supply plays a significant role in shaping interest rates, inflation, and economic growth, making it a critical metric for policymakers, businesses, and individuals alike.

The Role of M2 Money Supply in the Economy

M2 money supply plays a vital role in the economy, as it encompasses a broader range of liquid assets than M1. M2 includes savings deposits, money market funds, and other liquid assets, in addition to the components of M1. This broader definition of money supply is significant, as it affects the overall money supply in the economy and has a profound impact on savings, investments, and economic growth. The M2 money supply influences the availability of credit, interest rates, and inflation, making it a critical metric for policymakers, businesses, and individuals. For instance, an increase in M2 money supply can lead to increased borrowing and spending, which can stimulate economic growth. Conversely, a decrease in M2 money supply can lead to reduced borrowing and spending, which can slow down economic growth. Understanding the role of M2 money supply is essential for making informed decisions about investments, business strategies, and personal financial planning.

What Drives Changes in M1 and M2 Money Supply?

Changes in M1 and M2 money supply are influenced by a combination of factors, including monetary policy decisions, economic indicators, and financial market trends. The Federal Reserve, the central bank of the United States, plays a significant role in shaping the money supply through its monetary policy decisions. For instance, when the Federal Reserve lowers interest rates, it can increase the M2 money supply by encouraging borrowing and spending. On the other hand, when it raises interest rates, it can decrease the M2 money supply by reducing borrowing and spending. Economic indicators, such as GDP growth, inflation, and unemployment rates, also affect the money supply. For example, a growing economy with low unemployment rates may lead to an increase in M1 and M2 money supply, as businesses and individuals borrow and spend more. Financial market trends, including stock market performance and bond yields, can also influence the money supply. Understanding the factors that drive changes in M1 and M2 money supply is crucial for policymakers, businesses, and individuals to make informed decisions about investments, business strategies, and personal financial planning.

The Relationship Between M1, M2, and Inflation

The relationship between M1 and M2 money supply and inflation rates is a crucial aspect of understanding the monetary system. Changes in M1 and M2 money supply can have a significant impact on inflation rates, and vice versa. When the M2 money supply increases, it can lead to an increase in aggregate demand, which can drive up prices and inflation. Conversely, a decrease in M2 money supply can lead to a decrease in aggregate demand, which can reduce prices and inflation. The Federal Reserve, in its efforts to control inflation, closely monitors the M1 and M2 money supply to ensure that it is in line with its inflation targets. For instance, if the M2 money supply is growing rapidly, the Federal Reserve may increase interest rates to reduce borrowing and spending, thereby curbing inflation. On the other hand, if the M2 money supply is growing slowly, the Federal Reserve may decrease interest rates to stimulate borrowing and spending, thereby boosting economic growth. Understanding the relationship between M1, M2, and inflation is essential for policymakers, businesses, and individuals to make informed decisions about investments, business strategies, and personal financial planning.

Practical Applications of M1 and M2 Money Supply

Understanding M1 and M2 money supply is crucial for making informed decisions in various aspects of life, including investments, business strategies, and personal financial planning. For instance, investors can use M2 money supply data to gauge the overall health of the economy and make informed investment decisions. A growing M2 money supply can indicate a strong economy, making it an attractive time to invest in stocks or real estate. On the other hand, a declining M2 money supply can signal a slowing economy, making it a good time to diversify investments or reduce risk. Businesses can also use M1 and M2 money supply data to inform their business strategies, such as adjusting production levels or pricing strategies based on changes in the money supply. Additionally, individuals can use M1 and M2 money supply data to make informed decisions about their personal finances, such as whether to take out a loan or invest in a savings account. By understanding the dynamics of M1 and M2 money supply, individuals, businesses, and policymakers can make more informed decisions that can have a positive impact on their financial well-being and the overall economy.

Conclusion: The Importance of Monitoring M1 and M2 Money Supply

In conclusion, understanding M1 and M2 money supply is crucial for individuals, businesses, and policymakers to make informed decisions about investments, business strategies, and personal financial planning. The dynamics of M1 and M2 money supply have a significant impact on the overall economy, influencing inflation rates, interest rates, and economic growth. By monitoring M1 and M2 money supply, individuals and businesses can stay ahead of the curve, making informed decisions that can have a positive impact on their financial well-being. Furthermore, policymakers can use M1 and M2 money supply data to inform monetary policy decisions, promoting economic stability and growth. In today’s complex economic landscape, understanding M1 and M2 money supply is more important than ever. By grasping the concepts and dynamics of M1 and M2 money supply, individuals, businesses, and policymakers can navigate the economy with confidence, making informed decisions that drive growth and prosperity.

:max_bytes(150000):strip_icc()/money-supply-4192738-a002986b86714240b0c6b46453171588.jpg)