Understanding the Federal Funds Rate

The Federal Funds Rate is the target rate the Federal Reserve (the Fed) sets for overnight lending between banks. It’s a crucial tool for influencing overall interest rates across the economy. When the Fed raises the Federal Funds Rate, borrowing becomes more expensive for businesses and consumers. Conversely, a lower rate makes borrowing cheaper, stimulating economic activity. The Federal Funds Rate has a profound impact on various aspects of the economy, from mortgage rates to business investment. Historically, significant changes in the Federal Funds Rate have often been responses to inflation or economic recessions. For example, the dramatic cuts during the 2008 financial crisis aimed to prevent a deeper economic downturn. Understanding the interplay between the Federal Funds Rate and other interest rates, such as the IOER rate, is critical for navigating the complexities of monetary policy and its effects on the financial markets. The relationship between IOER vs fed funds rate is a key factor in many investment decisions. This rate plays a significant role in the overall economy. Changes in this rate directly impact lending costs and broader financial conditions. The Federal Reserve uses this rate to influence monetary policy, aiming for stable prices and sustainable economic growth. A careful analysis of historical trends in the Federal Funds Rate provides valuable insights into the Fed’s approach to monetary policy and its impact on the economy. Analyzing the IOER vs fed funds rate helps to understand the overall interest rate environment.

The Federal Reserve’s actions regarding the Federal Funds Rate have far-reaching consequences. Businesses rely on these rates for planning investments and expansion. Consumer spending is also significantly influenced by changes to interest rates, including mortgage rates, loan terms, and credit card interest. Periods of low interest rates can stimulate economic growth by encouraging borrowing and spending. However, prolonged periods of low interest rates can also lead to inflation. The Fed carefully manages the Federal Funds Rate to balance these competing forces, aiming for a sustainable economic environment. Understanding the dynamics of the Federal Funds Rate and the IOER rate is therefore critical for understanding the broader economy and making informed financial decisions. The IOER vs fed funds rate dynamic is a key indicator of the overall health of the financial system.

Historically, the Federal Funds Rate has fluctuated significantly. During periods of economic expansion, the Fed often raises the rate to combat inflation. Conversely, during recessions, the Fed usually lowers the rate to stimulate economic activity. The relationship between IOER vs fed funds rate is constantly evolving, reflecting changes in the economic landscape. Analyzing past trends in the Federal Funds Rate allows for a better understanding of the Fed’s responses to various economic conditions, enabling better predictions of future movements. The impact of the Federal Funds Rate on borrowing costs is substantial and far-reaching. It influences decisions made by households, businesses, and financial institutions alike. Therefore, understanding the nuances of the Federal Funds Rate is crucial for effective financial planning and informed decision-making. The IOER vs fed funds rate interaction is a key element of understanding the Fed’s monetary policy tools.

Decoding the Interest on Reserve Balances (IOER) Rate

The Interest on Reserve Balances (IOER) rate represents the interest rate the Federal Reserve (Fed) pays commercial banks on their reserves held at the Fed. These reserves are the funds banks keep in their accounts at the central bank. Understanding the IOER rate is crucial when analyzing the broader financial landscape and its relationship to the federal funds rate. This rate directly impacts banks’ decisions regarding reserve holdings. A higher IOER rate incentivizes banks to keep more money in reserves, earning interest, rather than lending it out. Conversely, a lower IOER rate might encourage banks to lend more freely, increasing the money supply. The IOER rate, therefore, plays a significant role in the Fed’s monetary policy tools, working in tandem with the federal funds rate to influence overall interest rates. The interplay between IOER and the federal funds rate is a key factor in understanding overall monetary policy effectiveness. In the context of IOER vs fed funds rate, the IOER acts as a floor, influencing short-term rates and the availability of funds for lending.

Changes in the IOER rate have a ripple effect throughout the financial system. For example, if the Fed raises the IOER rate, banks find it more attractive to hold onto reserves. This reduces the amount of money available for lending, potentially leading to higher borrowing costs for businesses and consumers. The inverse is also true. A decrease in the IOER rate encourages banks to lend more readily. This increases the money supply, potentially lowering borrowing costs and stimulating economic activity. The IOER’s influence extends beyond simply affecting the amount of lending. It also impacts the overall cost of funds for banks, impacting their profitability and influencing their lending strategies. Understanding how the IOER and the federal funds rate interact is essential for comprehending monetary policy’s effects on the broader economy. For example, a higher IOER rate might make it more expensive for smaller banks to borrow funds, affecting their lending capabilities. This demonstrates the complex relationship between the IOER and the broader economy. The IOER vs fed funds rate comparison highlights the importance of considering both factors when assessing monetary policy implications.

Consider a scenario where the IOER rate is increased significantly. Banks would likely prefer to keep their excess reserves at the Fed to earn the higher interest, rather than lend them at lower rates in the market. This reduces the supply of funds available for lending, pushing up short-term interest rates. This illustrates how the IOER rate acts as a floor for short-term interest rates. Conversely, if the IOER rate is lowered, banks might seek higher returns by lending their excess reserves, increasing the supply of funds and potentially decreasing short-term interest rates. This dynamic interaction between the IOER rate and the federal funds rate is a critical component of the Fed’s monetary policy toolkit, used to steer the economy towards desired goals such as price stability and full employment. The effectiveness of this tool, however, depends on a number of complex factors and is subject to ongoing analysis and refinement by economists and policymakers. The dynamic relationship between IOER and the federal funds rate is continuously monitored for optimal management of the monetary system.

The Interplay Between IOER and the Federal Funds Rate

The relationship between the Interest on Reserve Balances (IOER) rate and the Federal Funds Rate is a cornerstone of modern monetary policy. These two rates work in concert, allowing the Federal Reserve to effectively manage the money supply and influence economic activity. The Fed uses these rates to achieve its dual mandate: price stability and maximum employment. Understanding the dynamics of the iorb vs fed funds rate is crucial for grasping how the Fed steers the economy.

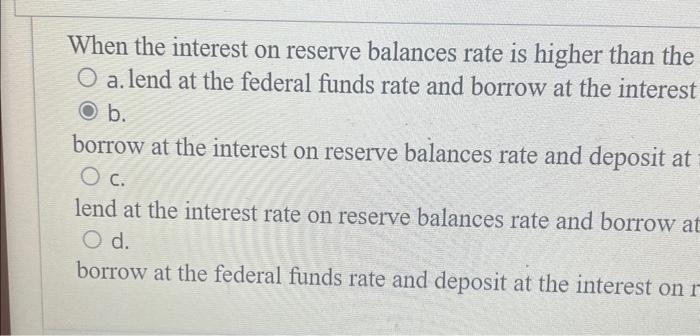

The IOER, which is the interest rate the Fed pays to banks on their reserve balances, acts as an important tool in maintaining the federal funds rate within the Fed’s target range. The federal funds rate represents the rate banks charge each other for the overnight lending of reserves. The iorb vs fed funds rate interaction comes into play as banks are unlikely to lend reserves at a rate significantly below what they can earn by simply holding those reserves at the Fed and collecting the IOER. Therefore, the IOER serves as a soft floor for the federal funds rate. When the Fed raises the IOER, it incentivizes banks to hold more reserves at the Fed, reducing the supply of reserves available for lending in the federal funds market. This, in turn, puts upward pressure on the federal funds rate, guiding it towards the desired target range. Conversely, lowering the IOER makes it less attractive for banks to keep reserves at the Fed, increasing the supply of lendable reserves and potentially pushing the federal funds rate downward. This constant interplay and awareness of the iorb vs fed funds rate enables the Fed to fine-tune monetary policy.

Changes in one rate often influence the other, creating a ripple effect throughout the financial system. For example, if the Fed wants to stimulate the economy, it might lower both the IOER and the target range for the federal funds rate. This encourages banks to lend more money, leading to lower borrowing costs for businesses and consumers. This ultimately spurs investment and spending. The opposite occurs when the Fed wants to curb inflation. Raising both rates makes borrowing more expensive, which helps to cool down economic activity. The effectiveness of this strategy hinges on the sensitivity of banks and other market participants to changes in the iorb vs fed funds rate and their ability to anticipate future policy actions by the Fed. By carefully managing these two key rates, the Fed aims to maintain a stable and healthy economy. The iorb vs fed funds rate interaction has become an essential tool for modern monetary policy, particularly since the 2008 financial crisis.

How the IOER Rate Affects Short-Term Interest Rates

The interest on reserve balances (IOER) rate plays a crucial role in influencing short-term interest rates across the financial system. Understanding the mechanics of this influence is key to grasping the intricacies of monetary policy. The IOER rate, in essence, acts as a floor for these short-term rates. This floor is established because banks have little incentive to lend funds at a rate lower than what they can earn by simply depositing those funds at the Federal Reserve and earning the IOER rate. This relationship is fundamental to understanding the dynamics of the iorb vs fed funds rate.

To illustrate, consider a scenario where the IOER rate is set at 5%. Banks with excess reserves would be unwilling to lend those reserves in the overnight market at a rate significantly below 5%. Why would they? They could simply deposit those reserves with the Fed and earn a guaranteed 5%. This creates a lower bound for the federal funds rate, the rate at which banks lend reserves to each other overnight. Competition among banks will still influence the actual fed funds rate, but it will likely hover around the iorb rate. This mechanism is how the Fed uses the IOER rate to guide short-term interest rates towards its desired target range. The interplay between the iorb vs fed funds rate is a cornerstone of modern monetary policy.

However, it’s important to note that the iorb vs fed funds rate relationship isn’t always perfectly aligned. Factors such as bank balance sheet management, regulatory requirements, and the presence of government-sponsored entities (GSEs) can create slight deviations. For example, institutions like GSEs might be willing to lend at rates slightly below the IOER because they don’t have access to IOER. Despite these nuances, the IOER rate remains a powerful tool for the Federal Reserve in managing short-term interest rates and implementing monetary policy. The Fed constantly monitors the iorb vs fed funds rate spread to ensure policy effectiveness, and adjustments to the IOER are often made to maintain the desired level of control over the fed funds rate.

How to Interpret the Relationship for Investment Decisions

Understanding the interplay between the interest on reserve balances (iorb) vs fed funds rate offers valuable insights for investors and businesses. Monitoring these rates can inform strategic decisions across various asset classes. The iorb vs fed funds rate impacts bond yields, lending rates, and overall investment strategies. When the Federal Reserve raises the iorb rate, it typically signals a tightening of monetary policy. This often leads to higher borrowing costs across the board. Conversely, a decrease in the iorb rate may indicate an easing of monetary policy, potentially lowering borrowing costs. Savvy investors closely watch these movements to anticipate shifts in market conditions. This knowledge allows them to adjust their portfolios accordingly. For example, an anticipated rate hike might prompt investors to reduce their exposure to long-duration bonds, which are more sensitive to interest rate increases. Understanding the dynamics of iorb vs fed funds rate is really useful.

Changes in the iorb vs fed funds rate significantly impact fixed-income investments. As the Fed increases these rates, bond yields tend to rise. This can reduce the value of existing bonds, especially those with longer maturities. Investors may consider shortening the duration of their bond portfolios or exploring floating-rate notes. These notes offer protection against rising interest rates. In the equity market, the impact is more nuanced. Higher rates can dampen economic growth by increasing borrowing costs for businesses. This might negatively affect corporate earnings and stock valuations. However, certain sectors, such as financials, may benefit from higher interest rates. Increased lending profitability can offset some of the negative effects. Recognizing these sector-specific dynamics is crucial for making informed investment decisions. The real estate market is also influenced by iorb vs fed funds rate.

Businesses can use the relationship between iorb vs fed funds rate to assess borrowing costs and make capital allocation decisions. A rising rate environment may make it more expensive to finance new projects or expand existing operations. Companies might postpone such investments or seek alternative funding sources. Conversely, lower rates can create more favorable borrowing conditions, encouraging investment and growth. Understanding how iorb vs fed funds rate impacts the cost of capital is essential for effective financial planning. Moreover, businesses can use these rates to forecast future economic conditions. Changes in monetary policy often precede broader economic shifts. By monitoring the iorb vs fed funds rate, businesses can proactively adjust their strategies to navigate changing market dynamics. This includes managing inventory levels, adjusting pricing strategies, and reevaluating investment plans. Staying informed about the iorb vs fed funds rate is paramount for sound financial management and strategic decision-making.

The Impact on Borrowing Costs for Businesses

Changes in the interest on reserve balances (iorb) vs fed funds rate significantly influence borrowing costs for businesses. The federal funds rate, as the target for overnight lending between banks, affects the prime rate. This rate is the basis for many business loans. When the Fed raises the federal funds rate, banks often increase their prime rate. This directly increases the cost of borrowing for businesses. Consequently, business investment decisions are impacted.

Higher borrowing costs can deter businesses from pursuing expansion plans. Companies may postpone new projects. They may reduce inventory levels. Capital expenditures may be delayed. These decisions reflect an attempt to mitigate the increased financial burden. The iorb vs fed funds rate relationship plays a crucial role here. The iorb rate influences the fed funds rate. When the Fed increases the iorb rate, it incentivizes banks to hold more reserves. This reduces the supply of lendable funds, putting upward pressure on the fed funds rate and, subsequently, business borrowing costs. Certain industries are more sensitive to these changes. For example, capital-intensive industries, such as manufacturing and real estate, are highly vulnerable to interest rate fluctuations. They rely heavily on borrowing to fund operations and projects.

Smaller businesses often feel the pinch more acutely than larger corporations. Larger companies typically have access to diverse funding sources. Smaller businesses may rely more on bank loans. An increase in the iorb vs fed funds rate, therefore, disproportionately affects their financial health. Consider a small construction company planning to purchase new equipment. An increase in interest rates could make the purchase unaffordable. This could halt their expansion plans. Similarly, a retail business relying on a line of credit might face higher interest payments. This could reduce profitability. The overall economic activity can be affected when businesses curb their investment and expansion. This slowdown can impact job creation. It can also impact overall economic growth. Understanding the interplay between the iorb vs fed funds rate is vital for businesses to navigate the financial landscape effectively.

Influence on Consumer Spending and Savings

Changes in the Interest on Reserve Balances (IORB) and the Fed Funds Rate wield considerable influence over consumer spending and savings patterns. These rates serve as key benchmarks that affect various consumer-related interest rates, shaping financial decisions across households. Understanding the dynamics of the “iorb vs fed funds rate” relationship is vital for consumers seeking to optimize their financial strategies.

Mortgage rates are directly influenced by the Fed Funds Rate. When the Fed Funds Rate increases, mortgage rates typically follow suit, making it more expensive for consumers to purchase homes. Conversely, a decrease in the Fed Funds Rate usually leads to lower mortgage rates, potentially stimulating housing demand. Credit card interest rates are also closely tied to these benchmark rates. Most credit cards have variable interest rates linked to the prime rate, which often mirrors movements in the Fed Funds Rate. As the Fed Funds Rate rises, credit card interest rates tend to increase, making borrowing more costly for consumers. Similarly, consumer loan rates for auto loans, personal loans, and other types of credit are affected. Higher rates can deter consumers from taking out loans, reducing spending on big-ticket items. The interplay of “iorb vs fed funds rate” directly shapes how consumers approach debt.

Changes in the IORB can also influence consumer behavior indirectly. A higher IORB can incentivize banks to hold more reserves at the Fed, potentially reducing the amount of money available for lending to consumers and businesses. This can lead to tighter credit conditions and higher borrowing costs. Conversely, a lower IORB can encourage banks to lend more, potentially increasing the availability of credit and lowering borrowing costs. These changes in interest rates can have significant consequences for economic growth and inflation. Higher rates can curb inflation by reducing consumer spending and investment, while lower rates can stimulate economic growth by encouraging borrowing and spending. The dynamic between the “iorb vs fed funds rate” is therefore a critical factor in shaping the overall economic landscape for consumers. The impact on savings is also noteworthy; higher rates might encourage more saving, while lower rates could disincentivize it. Understanding “iorb vs fed funds rate” helps anticipate these shifts.

Future Outlook and Potential Scenarios

The future direction of both the Interest on Reserve Balances (IORB) rate and the Federal Funds Rate is subject to a multitude of economic variables. These variables include inflation levels, employment figures, and overall economic growth. Predicting the precise path of these rates is difficult, but several plausible scenarios can be considered. One potential scenario involves persistent inflation, which could prompt the Federal Reserve to maintain or even increase both the IORB and the Federal Funds Rate to cool down the economy. This could lead to higher borrowing costs for businesses and consumers. Consequently, there would be a dampening effect on investment and spending.

Conversely, if economic growth slows significantly, or if inflation falls below the Fed’s target, a different scenario could unfold. The Fed might then choose to lower the Federal Funds Rate and potentially reduce the IORB rate to stimulate economic activity. Lowering the Federal Funds Rate directly influences the iorb vs fed funds rate relationship. This situation could lead to lower borrowing costs. It could also encourage investment and spending. Another possibility involves a period of relative stability, where the Fed maintains both rates at their current levels. They would be waiting for more conclusive data on the direction of the economy. This ‘wait and see’ approach would likely result in less volatility in financial markets, but it could also delay necessary adjustments to monetary policy. The iorb vs fed funds rate management is very important in those scenarios.

It’s also crucial to consider external factors, such as global economic conditions and geopolitical events. These external factors could influence the Fed’s decisions. A global recession, for instance, could prompt the Fed to lower interest rates. This would happen even if domestic economic conditions don’t warrant such a move. Staying informed about these potential scenarios and their implications can help businesses and investors prepare for a range of possible outcomes. The interplay between the iorb vs fed funds rate will continue to be a key tool for the Federal Reserve in managing the economy. Understanding this relationship is essential for navigating the complexities of the financial landscape.