What are Treasury Bills?

Treasury bills (T-Bills) are short-term debt securities issued by the U.S. Department of the Treasury. They represent a crucial part of the U.S. government’s debt management strategy. T-Bills are essentially IOUs, promising to repay a certain amount of money at a specified maturity date. Various maturities exist, ranging from a few weeks to several months. The 3-month T-Bill plays a particularly important role in the market, often serving as a benchmark for short-term borrowing rates across various sectors. Understanding the factors influencing interest on 3 month treasury bill rates is key to understanding the broader financial climate and its impact on the economy.

The 3-month Treasury bill is highly liquid and widely traded. Investors can easily buy and sell these instruments in the secondary market, making them a very important component in the overall financial landscape. Because of this liquidity, the market interest on 3 month treasury bill is a frequently observed and cited reference point in financial analysis. This benchmark rate influences rates on other short-term debt instruments, giving it considerable significance in the financial world. Investors and financial professionals closely watch interest on 3 month treasury bill fluctuations for clues about future economic conditions.

The differing maturities of T-Bills reflect the Treasury’s ability to manage its short-term borrowing needs. The 3-month T-Bill, in particular, provides a crucial benchmark for short-term borrowing rates. This makes it a key factor in assessing and predicting interest rates for various financial instruments. The price and interest on 3 month treasury bill are closely tied to wider economic conditions and market expectations, so keeping track of how they shift provides insights into potential future trends in the financial market.

Understanding Interest Rates

Interest rates are fundamental to the financial world, reflecting the cost of borrowing and the return on savings. Essentially, interest rates represent the price of money. They are influenced by the interplay of supply and demand in the financial marketplace. Higher interest rates often signal a tighter monetary policy, making borrowing more expensive. Conversely, lower rates typically encourage borrowing and spending, stimulating economic activity. The rate of interest on 3 month treasury bill is a significant indicator of this.

Interest rates on 3-month Treasury Bills, like other short-term interest rates, react to broader economic conditions. If the economy is growing strongly, demand for credit might rise, pushing interest rates upwards. Conversely, a slowdown or recession might cause rates to fall. The relationship between interest rates and economic growth is often complex and dynamic, and fluctuates constantly. Inflationary pressures can also influence the interest on 3 month treasury bill. These fluctuations in interest rates on 3 month treasury bill are a key indicator of market sentiment and economic outlook.

Market participants closely monitor interest rates on 3 month treasury bill as a significant economic indicator. Changes in these rates can affect borrowing costs for businesses and consumers, impacting their investment decisions and spending habits. Understanding how interest rates on 3 month treasury bill respond to economic fluctuations is crucial for investors, businesses, and policymakers. Interest rates on 3 month treasury bill are affected by numerous factors, including inflation expectations, the Federal Reserve’s monetary policy, economic growth, and global market conditions. A keen awareness of these factors can improve the understanding of interest rates on 3 month treasury bill.

Factors Influencing 3-Month Treasury Bill Interest Rates

Numerous economic factors influence the interest on 3-month treasury bill rates. Understanding these drivers is crucial for investors and economic analysts alike. Inflation expectations play a significant role. Anticipated inflation often leads to higher interest rates, as investors demand higher returns to compensate for the reduced purchasing power of their money. Conversely, low or stable inflation expectations tend to support lower interest on 3 month treasury bill rates. Changes in the Federal Reserve’s monetary policy are another key determinant. The Federal Reserve uses tools such as adjusting the federal funds rate to influence the broader economy. These policy changes can affect short-term borrowing costs, including interest on 3-month treasury bills.

Economic growth and overall market conditions also significantly impact interest on 3 month treasury bill rates. Strong economic growth often leads to increased demand for credit, putting upward pressure on interest rates. Conversely, slower or negative economic growth often results in lower borrowing needs, leading to potentially lower interest rates. Global economic conditions are also pertinent. Events in other countries can influence market sentiment and interest rate expectations. Global financial crises or uncertainty can cause fluctuations in the interest rates on 3-month treasury bills. The interconnected nature of global markets means that economic events in one region can have ripple effects on others, affecting the interest on 3 month treasury bill rates.

In summary, the interaction of these various factors creates a dynamic environment where interest rates on 3-month treasury bills are not static. Analyzing these factors and understanding their interplay is crucial to predicting and interpreting market movements related to interest on 3 month treasury bills. Monitoring shifts in these key indicators helps investors and economists form informed opinions about future interest rate trends for 3 month treasury bills.

Accessing 3-Month Treasury Bill Interest Rate Data

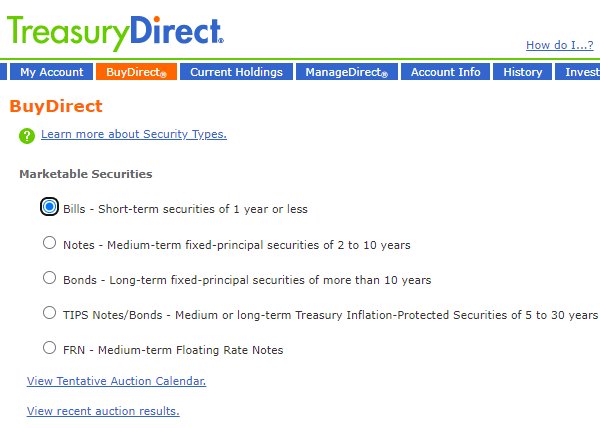

Staying informed about current interest rates on 3-month treasury bills is crucial for financial decisions. Reliable data sources are essential to interpret this critical economic indicator. Reputable financial websites and news outlets provide up-to-the-minute data. Many of these sources compile the interest on 3 month treasury bill. Government websites, specifically those of treasury departments, are also excellent sources. Websites like TreasuryDirect offer comprehensive information, including historical data and current rates. These platforms offer a clear and accessible view of the prevailing interest on 3 month treasury bill, enabling informed investment choices and economic analysis.

Scrutinize the information presented before making investment decisions. Accuracy and timeliness are paramount when evaluating interest on 3 month treasury bill. Comparing data across multiple reliable sources can increase confidence in the information. Be wary of unofficial or non-credible sources. Understanding the precise methodology and the time of data collection will give a more informed opinion about the interest rate on 3 month treasury bill and its effect on the economy.

Financial news outlets frequently report on treasury bill interest rates. News articles often contextualize the rates within broader economic trends and market conditions, which makes it easy to analyze the impact of the interest rate on 3 month treasury bill. Staying aware of these trends enhances one’s understanding of how the interest rates on 3 month treasury bill interact with the overall financial landscape. Combine these sources for a more complete picture, leading to more sound financial decisions.

How to Interpret 3-Month Treasury Bill Interest Rate Information

Analyzing interest on 3 month treasury bill rates requires understanding the implications of fluctuating numbers. Interest rate data reveals important insights into current and future economic conditions. A rising interest on 3 month treasury bill often signals an improving economy or heightened inflation expectations. Conversely, falling rates might indicate a slowing economy or a decreased inflationary pressure. Understanding these shifts is crucial for investors and economic analysts alike.

Examining the interest on 3 month treasury bill data helps to form educated opinions about the direction of the economy. Tracking the interest on 3 month treasury bill rates over time allows one to identify trends. For instance, sustained periods of rising rates can suggest increasing confidence in the economy. Conversely, a consistent decline in interest on 3 month treasury bill rates can hint at a potential economic slowdown. Careful observation of these indicators aids in comprehending the overall economic climate.

Investors should consider the context in which the 3-month Treasury bill interest rates are changing. Rapid shifts in interest on 3 month treasury bill rates can indicate significant changes in market sentiment or monetary policy. Understanding the relationship between the interest on 3 month treasury bill rates and broader economic indicators can help anticipate potential shifts and make informed investment decisions. The impact of these shifts can affect a multitude of sectors, ranging from individual investors to large corporations and government bodies. Tracking interest on 3 month treasury bill rates should be a key component of any investment strategy.

Investment Strategies for 3-Month Treasury Bills

Investors seeking short-term investments often look to 3-month Treasury bills due to their safety and liquidity. These instruments are considered a low-risk investment, providing a predictable return on investment. Understanding the interest on 3 month treasury bill is crucial for navigating the potential rewards and risks associated with them. Compared to other short-term investments, Treasury bills offer a generally stable and secure return.

Several investment strategies exist for 3-month Treasury bills. One approach involves buying bills when the interest on 3 month treasury bill is attractive, holding them until maturity, and realizing a predictable return. This method is suitable for investors prioritizing consistent returns over high returns. Diversification is another strategy. Combining 3-month Treasury bills with other short-term investments can reduce risk and optimize returns. Evaluating yield to maturity is another key consideration to make informed decisions.

The risks associated with 3-month Treasury bills are relatively low. However, fluctuations in interest rates can impact the yield. Potential rewards include the security of the U.S. government backing and the predictable return at maturity. The safety of Treasury bills makes them appealing to investors seeking to maintain liquidity while preserving capital. Investors with short-term financial goals, like those looking to secure funds for immediate needs, often find Treasury bills a valuable asset. The liquidity of 3-month Treasury bills makes them an attractive option for investors needing quick access to funds.

Understanding the Role of 3-Month T-Bills in the Economy

Treasury bills, particularly the 3-month variety, play a crucial role in the overall economic landscape. Fluctuations in interest on 3 month treasury bill rates directly impact borrowing costs for businesses and consumers. Lower rates often stimulate economic activity as borrowing becomes cheaper, encouraging investment and spending. Conversely, higher rates tend to curb economic expansion by increasing the cost of borrowing.

Changes in interest on 3 month treasury bill rates influence various financial markets. For instance, if rates rise, investors might shift their portfolios to more profitable, albeit riskier, investments, which could lead to volatility in other sectors. The influence of these shifts on financial markets is a complex interplay of factors, including investor confidence and overall market sentiment. This effect also extends to other interest rates, with ripple effects potentially impacting everything from mortgage rates to corporate lending.

The interest on 3 month treasury bill serves as a crucial benchmark for short-term borrowing. Businesses and governments often use these rates as a reference point when setting their own borrowing terms. As a result, fluctuations in the interest on 3 month treasury bill rates can directly influence various sectors of the economy, impacting consumer and business decisions. This dynamic relationship highlights the significance of understanding the factors that drive changes in these rates. The influence extends beyond direct borrowing, impacting broader market sentiment and overall economic growth.

Important Considerations for Investors

Investors considering investments in 3-month treasury bills should carefully assess their individual financial situations and risk tolerance. Short-term liquidity needs are a key factor in considering these investments. Individuals seeking a safe, low-risk option often find 3-month treasury bills a compelling choice. The interest on 3 month treasury bill offers a predictable return, but potential returns are often modest.

The safety of principal is a significant draw for many investors. Treasury bills are backed by the full faith and credit of the U.S. government. This inherent security makes them an attractive option for those seeking a risk-averse investment strategy. Investors should be aware of the potential risks and rewards associated with interest on 3 month treasury bill investments, alongside other potential short-term investment avenues.

Several investor types could find interest on 3 month treasury bill attractive. Conservative investors, those seeking short-term, low-risk investments, and those prioritizing capital preservation might find 3-month treasury bills a suitable option. Individuals needing quick access to funds can benefit from the highly liquid nature of these instruments. Understanding the fluctuation of interest rates is paramount. Careful analysis of prevailing market conditions and economic forecasts is vital when making investment decisions.

:max_bytes(150000):strip_icc()/Treasury-yield-8782292e8ad64d4a9669cbc61f73b06a.jpg)