Understanding the Net Present Value Concept

In the realm of project evaluation, the Net Present Value (NPV) is a crucial metric that helps decision-makers determine the viability of a project. NPV is the difference between the present value of expected cash inflows and outflows, discounted by a rate that reflects the time value of money. In essence, NPV provides a snapshot of a project’s potential profitability, allowing stakeholders to make informed decisions about whether to pursue or abandon a project. When evaluating a project, a positive NPV indicates that the project is expected to generate more value than it costs, while a negative NPV suggests that the project may not be worth pursuing. But what happens if the net present value of a project is zero? In this scenario, the project’s expected benefits and costs are equal, leaving decision-makers with a critical question: what does it imply, and how should they proceed?

When NPV Equals Zero: What Does it Imply?

When the net present value (NPV) of a project equals zero, it indicates that the project’s expected benefits and costs are equal. This break-even point is a critical threshold, as it suggests that the project is not expected to generate a profit or loss. In this scenario, the project’s feasibility and profitability are uncertain, and decision-makers must carefully consider the implications of a zero NPV. A zero NPV can be a result of various factors, including incorrect discount rate selection, inadequate cash flow forecasting, or ignoring non-financial factors. It is essential to identify the underlying causes of a zero NPV to make informed decisions about the project’s viability. If the net present value of a project is zero, it may be necessary to reassess the project’s objectives, scope, and timelines to determine whether it is worth pursuing.

How to Interpret a Zero NPV in Project Evaluation

When faced with a zero NPV, it is essential to consider the broader context of the project evaluation. A zero NPV does not necessarily mean that the project is not viable, but rather that the expected benefits and costs are equal. In this scenario, decision-makers must look beyond the NPV calculation and consider other factors that may impact the project’s success. These factors may include risk and uncertainty, strategic objectives, and non-financial benefits. For instance, a project with a zero NPV may still be pursued if it aligns with the organization’s strategic goals or provides intangible benefits, such as enhanced reputation or improved customer satisfaction. If the net present value of a project is zero, it is crucial to adopt a holistic approach to project evaluation, considering both financial and non-financial metrics to make informed decisions. By doing so, organizations can ensure that they are making the most informed decisions about which projects to pursue and how to allocate their resources effectively.

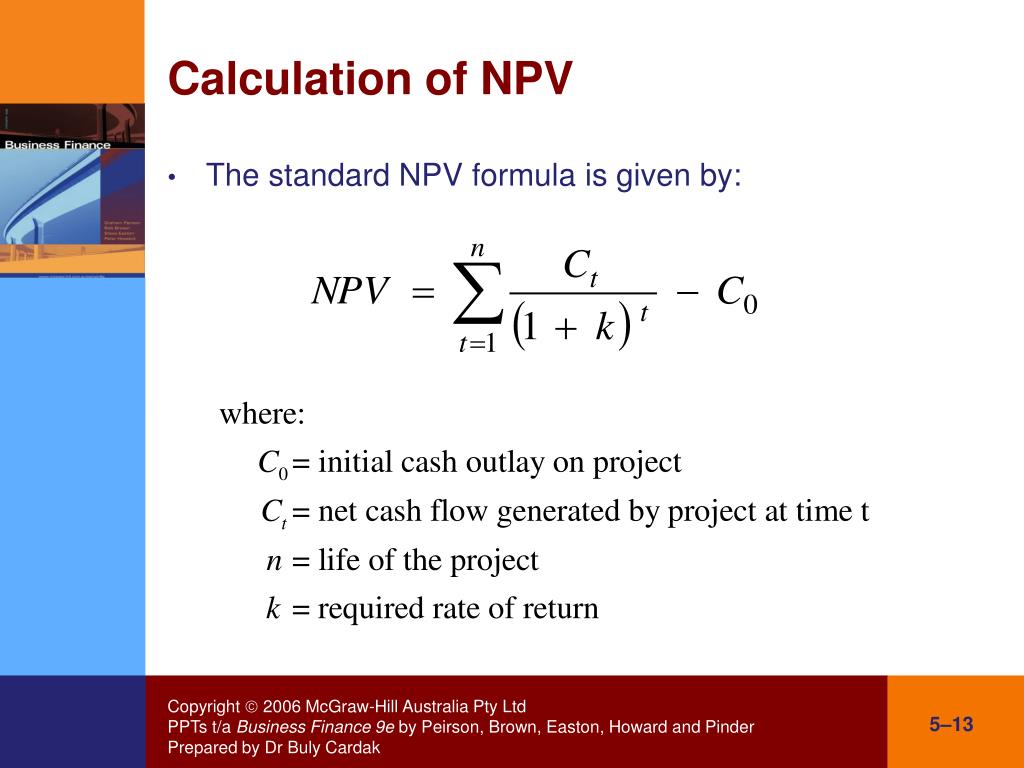

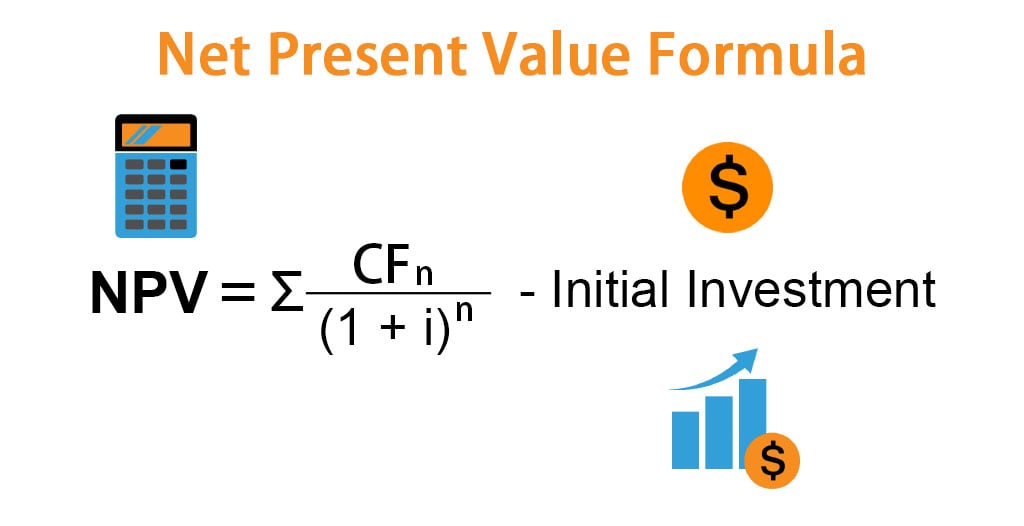

The Role of Discount Rate in NPV Calculation

The discount rate plays a crucial role in NPV calculation, as it determines the present value of future cash flows. A discount rate that is too high or too low can significantly impact the NPV outcome, including the scenario where NPV equals zero. For instance, a high discount rate may result in a zero NPV, indicating that the project’s benefits are not sufficient to justify the investment. On the other hand, a low discount rate may result in a positive NPV, suggesting that the project is viable. Therefore, it is essential to select a discount rate that accurately reflects the project’s risk profile and the organization’s cost of capital. If the net present value of a project is zero, it may be necessary to reassess the discount rate used in the calculation to ensure that it is reasonable and accurate. By doing so, organizations can increase the reliability of their NPV calculations and make more informed decisions about which projects to pursue.

Real-World Examples of Projects with Zero NPV

In reality, many projects may have a zero NPV, and it is essential to understand the implications of such a scenario. For instance, infrastructure projects, such as road construction or public transportation systems, may have a zero NPV due to the high upfront costs and uncertain future benefits. Similarly, research and development initiatives may have a zero NPV due to the high risks and uncertainties associated with such projects. In these cases, if the net present value of a project is zero, it is crucial to consider other factors, such as social benefits, environmental impact, and strategic objectives, to make informed decisions. By doing so, organizations can identify opportunities to create value and justify investments in projects that may not necessarily generate a positive NPV. Additionally, projects with a zero NPV may still be viable if they align with the organization’s long-term goals and objectives, or if they provide intangible benefits, such as enhanced reputation or improved customer satisfaction.

What to Do When NPV is Zero: A Framework for Decision-Making

When faced with a zero NPV, it is essential to have a framework for decision-making that goes beyond the NPV calculation. This framework should consider alternative evaluation methods, such as the internal rate of return (IRR) or payback period, to provide a more comprehensive understanding of the project’s viability. Additionally, sensitivity analysis can be used to test the robustness of the NPV calculation and identify key variables that may impact the project’s outcome. Scenario planning can also be employed to consider different scenarios and their potential impact on the project’s NPV. By considering these factors, organizations can make more informed decisions about whether to pursue a project, even if if the net present value of a project is zero. Furthermore, this framework can help organizations to identify opportunities to improve the project’s NPV, such as by reducing costs or increasing revenue, and to develop strategies to mitigate potential risks and uncertainties.

Common Pitfalls to Avoid in NPV Calculation

When calculating NPV, it is essential to avoid common pitfalls that can lead to inaccurate results and poor decision-making. One of the most critical pitfalls is incorrect discount rate selection, which can significantly impact the NPV calculation. If the discount rate is set too high or too low, it can lead to a misleading NPV, including a zero NPV. Another common pitfall is inadequate cash flow forecasting, which can result in inaccurate NPV calculations. Additionally, ignoring non-financial factors, such as strategic objectives, risk, and uncertainty, can lead to a narrow and incomplete understanding of the project’s viability. Furthermore, failing to consider alternative evaluation methods, such as sensitivity analysis and scenario planning, can limit the organization’s ability to make informed decisions. By avoiding these common pitfalls, organizations can ensure that their NPV calculations are accurate and reliable, and that they are making informed decisions about their projects, even if if the net present value of a project is zero.

Conclusion: The Significance of Zero NPV in Project Evaluation

In conclusion, a zero NPV is not necessarily a definitive indicator of a project’s viability. Rather, it is a signal to dig deeper and consider other factors that may impact the project’s success. By understanding the implications of a zero NPV, organizations can make more informed decisions about their projects and avoid costly mistakes. It is essential to recognize that NPV is just one tool in the project evaluation toolkit and that other methods, such as sensitivity analysis and scenario planning, can provide valuable insights. Furthermore, considering non-financial factors, such as strategic objectives and risk, can help organizations to develop a more comprehensive understanding of their projects. Ultimately, when if the net present value of a project is zero, it is crucial to adopt a nuanced and multifaceted approach to project evaluation, one that takes into account the complexities and uncertainties of the project environment.

:max_bytes(150000):strip_icc()/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-4cf181815e2741debb4174301e1b4b99.jpg)