Navigating Your Path: How to Get Into Quantitative Finance

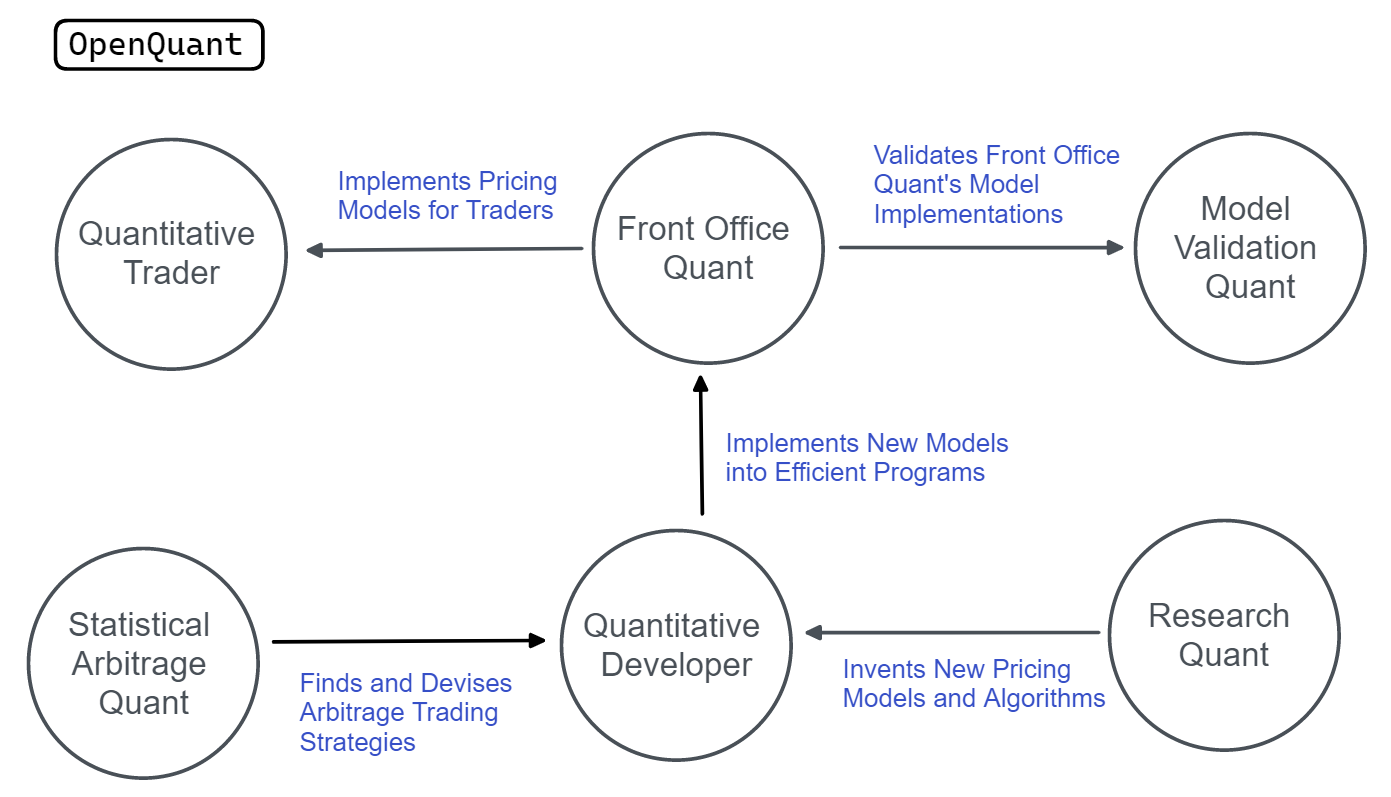

Quantitative finance, a field blending mathematical rigor with financial markets, has become increasingly vital in today’s complex economic landscape. It employs mathematical and statistical methods to analyze financial markets and solve problems related to investment management, risk management, and derivative pricing. The importance of quantitative finance stems from its ability to provide data-driven insights, optimize investment strategies, and manage risk more effectively than traditional methods. This analytical approach is essential for navigating the intricacies of modern finance. The roles within quantitative finance are diverse, ranging from quant traders who develop and execute automated trading strategies, to quant researchers who build and analyze financial models, and model validators who assess the accuracy and reliability of these models. For individuals wondering how to get into quantitative finance, it is imperative to understand the breadth of opportunities available. But how to get into quantitative finance if you don’t have a related degree? Well, it is still possible.

The allure of quantitative finance lies not only in its intellectual challenges but also in its potential for high rewards. However, breaking into this field requires careful planning and the acquisition of specific skills and knowledge. Understanding how to get into quantitative finance involves recognizing the necessary educational background, technical expertise, and practical experience. This article serves as a comprehensive guide for aspiring quants, providing actionable advice on education, skill development, resume building, and interview preparation. For those pondering how to get into quantitative finance, it’s a journey that demands dedication and a strategic approach.

The quantitative finance field is not static. It’s constantly evolving with new technologies and market dynamics. Therefore, a commitment to continuous learning and adaptation is essential for long-term success. So, how to get into quantitative finance and stay relevant? The answer lies in embracing lifelong learning. By staying informed about the latest research, tools, and trends, individuals can remain competitive and contribute to the advancement of the field. This guide aims to equip readers with the knowledge and resources necessary to embark on a successful career in quantitative finance and navigate the challenges and opportunities that lie ahead. Understanding how to get into quantitative finance is the first step towards a rewarding and impactful career.

Essential Educational Foundation for Quant Roles

A strong educational foundation is crucial for a successful career in quantitative finance. Aspiring quants typically hold degrees in mathematics, physics, statistics, computer science, or financial engineering. These disciplines provide the necessary mathematical and analytical skills. A solid understanding of stochastic calculus, probability theory, numerical methods, and optimization techniques is highly beneficial. Understanding how to get into quantitative finance often involves mastering these core concepts. The curriculum should emphasize rigorous problem-solving and analytical thinking.

While a strong academic background is usually preferred, alternative paths exist. Coding bootcamps and online certifications can offer focused training in programming and data analysis. These programs might provide a quicker route for individuals with some quantitative background. However, they often lack the breadth and depth of a formal degree. Bootcamps and certifications can supplement existing skills but may not offer the comprehensive knowledge needed for advanced quant roles. Successfully navigating how to get into quantitative finance often requires a combination of formal education and practical experience. Supplementing skills with self-learning is vital for long-term success in the field.

Specific coursework should include advanced mathematics courses. Probability and statistics form the basis of financial modeling. Linear algebra is essential for portfolio optimization. Numerical methods are critical for solving complex financial problems. Strong programming skills are necessary to implement models and analyze large datasets. The path to how to get into quantitative finance often involves a combination of strong theoretical and practical skills. Remember that continuous learning and adaptation are key to thriving in this dynamic field. Successful professionals consistently seek opportunities to expand their skillset and stay abreast of industry developments. Consider the value of a strong academic background, even if alternative routes exist.

Developing Critical Technical Skills for Quant Success

Success in quantitative finance demands a strong foundation in technical skills. Proficiency in programming languages like Python and C++ is essential. Python excels in data analysis and model building. Its versatile libraries simplify complex tasks. C++, known for its speed, is crucial for high-frequency trading systems. These systems require extremely fast execution. Mastering these languages opens doors to various roles in how to get into quantitative finance. Statistical software packages, such as R and MATLAB, are equally important. These tools facilitate statistical modeling and analysis. They are vital for extracting meaningful insights from vast datasets. This is a key component in how to get into quantitative finance successfully. Database management skills, particularly using SQL, are also necessary. Quants regularly interact with large databases. They need to efficiently query and manipulate data. Efficient data management is critical for building effective models and strategies.

Beyond core programming and statistical skills, version control using Git is paramount. Collaborative projects necessitate efficient version control. Git ensures smooth team collaboration and tracks code changes. This is important for maintaining code integrity and preventing errors. The ability to collaborate effectively is a significant aspect of how to get into quantitative finance. Furthermore, familiarity with cloud computing platforms like AWS or Google Cloud is increasingly valuable. These platforms provide scalable infrastructure for data processing and model deployment. This enhances the efficiency and scalability of various quantitative finance operations. Prospective quants should actively build and demonstrate these skills to increase their competitiveness in the field of how to get into quantitative finance.

To effectively utilize these tools, candidates need to understand their practical applications. Python’s pandas library simplifies data manipulation. Scikit-learn offers numerous machine learning algorithms. C++’s speed advantage allows for real-time processing in high-frequency trading. R’s statistical capabilities are invaluable for risk management and model validation. SQL efficiently retrieves relevant data from databases. This is essential for informed decision-making in the financial markets. These skills, coupled with a strong mathematical foundation, are essential components in understanding how to get into quantitative finance. By mastering these tools and techniques, aspiring quants can significantly improve their chances of success in this demanding yet rewarding field.

Practical Experience: Securing Internships and Projects

Gaining practical experience is a crucial step in learning how to get into quantitative finance. Academic knowledge is essential, but hands-on experience differentiates candidates and showcases their abilities to apply theoretical concepts to real-world scenarios. Internships, personal projects, and participation in competitions are valuable avenues for acquiring this practical experience.

Internships within quantitative trading firms, hedge funds, or financial institutions provide invaluable exposure to the daily realities of quantitative finance roles. These opportunities allow individuals to work alongside experienced professionals, contribute to ongoing projects, and gain insights into the industry’s dynamics. Websites like LinkedIn, Glassdoor, and company career pages are useful resources for finding internships. When pursuing these internships, tailor your resume and cover letter to highlight relevant skills and experience, demonstrating a clear understanding of how to get into quantitative finance and showcasing your passion for the field.

Personal projects are another excellent way to demonstrate your capabilities and enhance your understanding of quantitative finance. Developing a trading strategy, analyzing market data, or creating a pricing model are projects that allow you to apply your knowledge and showcase your problem-solving abilities. Contributing to open-source projects related to quantitative finance is another great way to gain experience, collaborate with other enthusiasts, and build a portfolio of work. Competitions, such as those offered by Quantopian or Kaggle, provide a platform to test your skills against others and gain recognition for your abilities. These experiences offer a practical understanding of how to get into quantitative finance, solidifying your knowledge and enhancing your resume. When documenting these projects, consider hosting code on platforms like GitHub for recruiters to assess your coding skills. Completing such projects highlights a proactive approach to understanding how to get into quantitative finance, improving prospects of finding relevant employment.

The Significance of Mastering Mathematical Concepts

A deep understanding of mathematics is the bedrock of quantitative finance. Aspiring quants must develop a strong foundation in several key areas. Linear algebra is crucial for portfolio optimization and risk management. Calculus, including differential and integral calculus, is essential for understanding derivatives pricing and stochastic models. How to get into quantitative finance requires a solid grasp of these core mathematical principles. A strong grasp of these concepts provides a significant advantage.

Probability theory and statistics are indispensable for analyzing financial data and building statistical models. This includes understanding probability distributions, hypothesis testing, and regression analysis. Stochastic processes, such as Brownian motion and Poisson processes, are vital for modeling asset prices and interest rates. Time series analysis is used to forecast future values based on historical data. How to get into quantitative finance involves mastering time series techniques like ARIMA and GARCH models to predict market trends. For example, the Black-Scholes model for option pricing relies heavily on stochastic calculus. The formula is:

\( C = S_0 N(d_1) – Ke^{-rT} N(d_2) \), where \( d_1 = \frac{\ln(S_0/K) + (r + \sigma^2/2)T}{\sigma\sqrt{T}} \) and \( d_2 = d_1 – \sigma\sqrt{T} \).

Here, \( C \) is the option price, \( S_0 \) is the initial stock price, \( K \) is the strike price, \( r \) is the risk-free interest rate, \( T \) is the time to maturity, \( \sigma \) is the volatility, and \( N(x) \) is the cumulative standard normal distribution function. This equation exemplifies the practical application of stochastic calculus in finance. How to get into quantitative finance also means understanding and being able to apply similar complex models.

Furthermore, concepts like Fourier analysis and differential equations are valuable for advanced modeling and analysis. Numerical methods are essential for implementing these mathematical models on computers. How to get into quantitative finance demands proficiency in applying these mathematical tools to solve real-world financial problems. These problems include pricing derivatives, managing risk, and developing trading strategies. Continuous practice and application of these mathematical concepts are crucial for success in the quantitative finance field. How to get into quantitative finance is a journey that requires continuous learning and adaptation.

Building a Powerful Resume and Network

Crafting a compelling resume is crucial for demonstrating your suitability for quantitative finance roles. To learn how to get into quantitative finance, your resume should immediately highlight relevant skills and experience. Emphasize quantitative abilities, programming proficiency, and any practical experience gained through internships or projects. Quantify achievements whenever possible by using metrics to showcase the impact of your work. For example, instead of saying “Developed a trading strategy,” state “Developed a trading strategy that generated a 15% return over a six-month period.” Include details of specific coursework undertaken, particularly those related to stochastic calculus, probability theory, and numerical methods.

Networking plays a vital role in learning how to get into quantitative finance. Attending industry conferences and workshops provides opportunities to connect with professionals and learn about current trends. Joining online communities and forums focused on quantitative finance allows you to engage in discussions and build relationships with like-minded individuals. Actively reach out to alumni from your university who are working in the field. Informational interviews can provide valuable insights into the industry and potential career paths. Building a strong network can significantly increase your chances of finding job opportunities and gaining valuable mentorship.

Preparation is key to succeeding in quantitative finance interviews. Anticipate technical questions related to probability, statistics, calculus, and linear algebra. Common brainteasers are designed to assess your problem-solving abilities and logical thinking. Practice answering these questions aloud to demonstrate your thought process. Be prepared to discuss your previous projects in detail, explaining the methodology, challenges faced, and results achieved. Behavioral questions are designed to evaluate your teamwork skills, communication abilities, and ability to handle pressure. Use the STAR method (Situation, Task, Action, Result) to structure your answers and provide concrete examples. Mastering these aspects is critical to understand how to get into quantitative finance and securing a coveted position.

Understanding the Quantitative Finance Interview Process

The quantitative finance interview process is rigorous and multifaceted, designed to assess a candidate’s technical skills, problem-solving abilities, and understanding of financial markets. Understanding the different stages is crucial to know how to get into quantitative finance. Typically, the process involves several rounds, each focusing on different aspects of a candidate’s qualifications. These rounds often include technical interviews, brainteasers, and behavioral assessments. Technical interviews delve into the candidate’s knowledge of mathematics, statistics, programming, and finance. Brainteasers evaluate the candidate’s ability to think critically and solve complex problems under pressure. Behavioral interviews aim to assess the candidate’s personality, teamwork skills, and fit within the firm’s culture. Preparing for each type of interview requires a targeted approach.

Technical interviews often involve questions related to probability, stochastic calculus, linear algebra, and programming. Candidates may be asked to derive option pricing formulas, analyze time series data, or write code to implement a specific algorithm. To effectively prepare, practice solving problems from textbooks and online resources. For brainteasers, the key is to think out loud and demonstrate a structured approach to problem-solving. Even if the candidate does not arrive at the correct answer, the interviewer is often interested in their thought process. Behavioral questions usually focus on past experiences and how the candidate handled specific situations. Prepare examples that showcase problem-solving skills, teamwork, and leadership abilities to know how to get into quantitative finance. A strong understanding of these components is important to know how to get into quantitative finance.

Consider this example: “Estimate the number of piano tuners in Chicago.” A possible solution involves breaking down the problem into smaller, manageable parts. First, estimate the population of Chicago. Then, estimate the number of households. Next, estimate the percentage of households that own pianos. Finally, estimate how often pianos need tuning. By multiplying these estimates together, one can arrive at a reasonable answer. Another example, a coding question might involve writing a function to calculate the Black-Scholes option price. This requires knowledge of the formula and the ability to translate it into code. Practicing such problems and articulating the thought process clearly is vital. Therefore, thoroughly preparing for each interview type, with attention to technical skills, problem-solving strategies, and behavioral responses, will significantly increase one’s chances of success to know how to get into quantitative finance.

Continuous Learning and Staying Updated

The field of quantitative finance is dynamic. It requires continuous learning to remain competitive. To get into quantitative finance and excel, one must commit to lifelong education. This involves staying abreast of the latest research, technological advancements, and shifts in market trends.

Several resources facilitate ongoing learning. Academic journals offer cutting-edge research in financial modeling and econometrics. Industry publications provide insights into practical applications and emerging trends. Online courses and certifications offer structured learning opportunities in specialized areas. These areas include machine learning, algorithmic trading, and risk management. Attending industry conferences allows for networking and learning from experts. Staying updated with new regulations is also very important in how to get into quantitative finance.

Adaptability is paramount in quantitative finance. New challenges and technologies emerge constantly. Professionals must be prepared to learn new skills and adjust their approaches. This proactive approach ensures they remain effective and innovative. Reading research papers is crucial. It is important to analyze and implement recent technologies. The ability to learn and adapt contributes significantly to long-term success. This skill is invaluable in the fast-paced world of quantitative finance. How to get into quantitative finance often involves a lot of self-study.