What is a Discount Rate and Why Does it Matter?

In the realm of finance, a discount rate is a crucial element in evaluating investment opportunities and making informed financial decisions. It represents the rate at which future cash flows are discounted to their present value, enabling businesses and investors to assess the viability of a project or investment. Understanding how to find a discount rate is vital, as it directly impacts the calculation of net present value (NPV) and internal rate of return (IRR). A well-chosen discount rate can significantly influence investment returns and business profitability. In essence, it is a critical component in determining whether an investment will yield a positive return or result in a financial loss. By grasping the concept of discount rates and learning how to find them accurately, individuals can make more informed financial decisions and unlock savings.

Understanding the Types of Discount Rates

When it comes to understanding discount rates, it’s essential to recognize that there are different types, each with its own application and significance in various financial scenarios. The three primary types of discount rates are nominal, effective, and continuous discount rates. A nominal discount rate is the rate that is not adjusted for compounding, whereas an effective discount rate takes into account the compounding effect. A continuous discount rate, on the other hand, is used to calculate the present value of a continuous cash flow stream. Knowing how to find a discount rate and understanding the differences between these types is crucial for making informed financial decisions. For instance, in capital budgeting, a nominal discount rate may be used to evaluate a project’s feasibility, while an effective discount rate may be more suitable for calculating the present value of a bond’s cash flows. By grasping the nuances of each type, individuals can apply the appropriate discount rate to their specific financial situation, ultimately leading to more accurate calculations and better investment decisions.

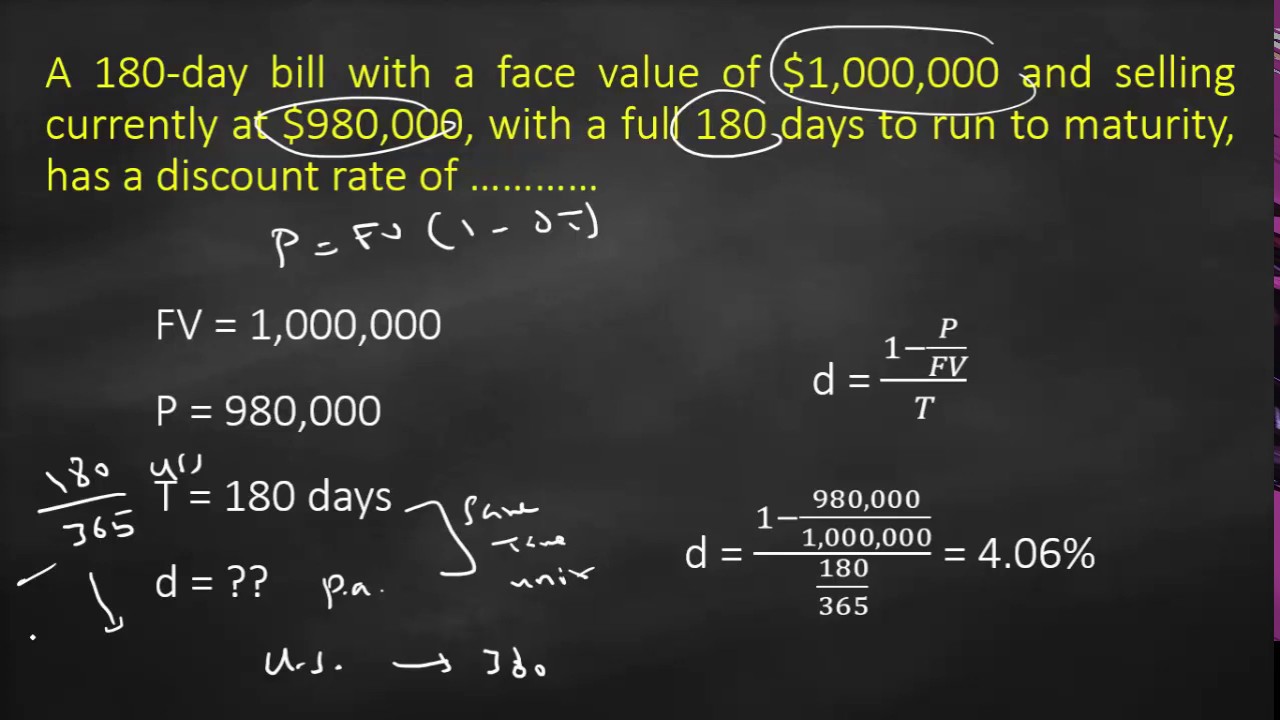

How to Calculate a Discount Rate: A Step-by-Step Guide

Calculating a discount rate is a crucial step in evaluating investment opportunities and making informed financial decisions. To accurately determine a discount rate, follow these steps:

Step 1: Determine the Cost of Capital – The cost of capital represents the minimum rate of return required by investors or lenders. This can be calculated using the weighted average cost of capital (WACC) formula.

Step 2: Identify the Risk-Free Rate – The risk-free rate is the return on a completely risk-free investment, such as a U.S. Treasury bond. This rate serves as a basis for calculating the discount rate.

Step 3: Estimate the Market Risk Premium – The market risk premium represents the additional return required by investors for taking on market risk. This can be estimated using historical market data.

Step 4: Calculate the Discount Rate – Using the cost of capital, risk-free rate, and market risk premium, calculate the discount rate using the capital asset pricing model (CAPM) formula: Discount Rate = Risk-Free Rate + (Market Risk Premium x Beta).

Example: Suppose the cost of capital is 10%, the risk-free rate is 2%, and the market risk premium is 5%. If the beta of the investment is 1.2, the discount rate would be: Discount Rate = 2% + (5% x 1.2) = 10%. By following these steps and using the correct formula, individuals can learn how to find a discount rate that accurately reflects the investment’s risk and potential return.

Remember, accurate calculations are crucial in determining a reliable discount rate. Be sure to consider all relevant factors and avoid common mistakes, such as ignoring inflation or using incorrect formulas, to ensure informed financial decisions.

Factors Affecting Discount Rates: What You Need to Know

When learning how to find a discount rate, it’s essential to understand the key factors that influence its value. These factors can significantly impact financial decisions, and ignoring them can lead to inaccurate calculations and poor investment choices. The following factors are crucial to consider:

Inflation: Inflation can erode the purchasing power of money over time, making it essential to adjust the discount rate accordingly. A higher inflation rate typically results in a higher discount rate.

Risk: The level of risk associated with an investment also affects the discount rate. Higher-risk investments require a higher return to compensate for the increased uncertainty, resulting in a higher discount rate.

Time Value of Money: The time value of money concept states that a dollar today is worth more than a dollar in the future. This means that the discount rate should be higher for longer-term investments to account for the decreased value of future cash flows.

Market Conditions: Market conditions, such as interest rates and economic growth, can also impact the discount rate. For example, in a low-interest-rate environment, the discount rate may be lower to reflect the reduced cost of borrowing.

Industry and Company-Specific Factors: Industry and company-specific factors, such as the company’s credit rating and industry growth prospects, can also influence the discount rate. These factors can affect the risk profile of the investment and, subsequently, the discount rate.

By understanding these factors and how they impact the discount rate, individuals can make more informed financial decisions and learn how to find a discount rate that accurately reflects the investment’s risk and potential return.

Where to Find Discount Rates: Top Resources and Tools

When learning how to find a discount rate, it’s essential to have access to reliable resources and tools. These can help individuals accurately calculate discount rates and make informed financial decisions. The following are top resources and tools for finding discount rates:

Financial Websites: Websites such as Investopedia, Yahoo Finance, and Bloomberg provide a wealth of information on discount rates, including tutorials, calculators, and expert opinions.

Discount Rate Calculators: Online calculators, such as those found on NerdWallet and Bankrate, allow users to input specific variables and calculate a discount rate quickly and easily.

Expert Opinions: Financial experts and analysts often provide insights and guidance on how to find a discount rate in various publications and online forums.

Central Banks and Government Agencies: Central banks and government agencies, such as the Federal Reserve and the U.S. Treasury Department, provide data and information on discount rates and their impact on the economy.

Financial Databases: Databases such as Quandl and Alpha Vantage offer access to historical discount rate data, allowing users to analyze trends and patterns.

By utilizing these resources and tools, individuals can gain a better understanding of how to find a discount rate and make more informed financial decisions. Remember, accurately calculating a discount rate is crucial for evaluating investment opportunities and achieving long-term financial success.

Real-World Applications of Discount Rates: Case Studies and Examples

Discount rates are not just theoretical concepts; they have real-world applications in various industries. Understanding how to find a discount rate is crucial for making informed financial decisions in fields such as finance, real estate, and entrepreneurship.

In finance, discount rates are used to evaluate investment opportunities, such as bonds and stocks. For example, a financial analyst may use a discount rate to determine the present value of a bond’s future cash flows and decide whether to invest in it.

In real estate, discount rates are used to calculate the net present value of a property. This helps investors determine whether a property is a good investment opportunity based on its expected cash flows and risk profile.

In entrepreneurship, discount rates are used to evaluate the feasibility of new projects and investments. By calculating the discount rate, entrepreneurs can determine whether a project is likely to generate sufficient returns to justify the investment.

Case Study: A company is considering investing in a new project that is expected to generate $100,000 in revenue per year for the next five years. The company’s cost of capital is 10%. Using a discount rate of 10%, the company can calculate the present value of the project’s cash flows and determine whether it is a viable investment opportunity.

By understanding how to find a discount rate and its applications in various industries, individuals can make more informed financial decisions and achieve their long-term goals. Whether in finance, real estate, or entrepreneurship, accurately calculating a discount rate is crucial for evaluating investment opportunities and achieving success.

Common Mistakes to Avoid When Finding a Discount Rate

When learning how to find a discount rate, it’s essential to avoid common mistakes that can lead to inaccurate calculations and poor financial decisions. By being aware of these mistakes, individuals can ensure they find the correct discount rate and make informed investment decisions.

Ignoring Inflation: One of the most common mistakes is ignoring the effects of inflation when calculating a discount rate. Failing to account for inflation can result in an inaccurate discount rate, leading to poor investment decisions.

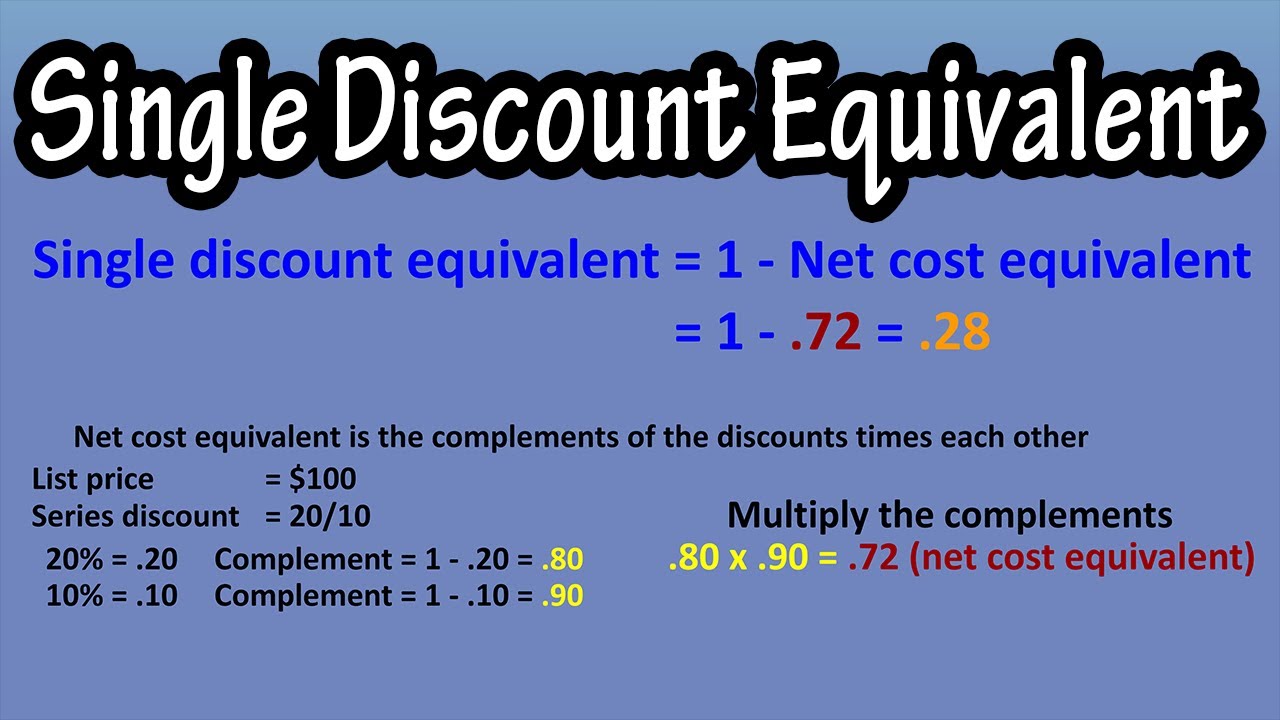

Using Incorrect Formulas: Another mistake is using the wrong formula to calculate a discount rate. There are different formulas for different types of discount rates, and using the wrong one can lead to incorrect results.

Not Considering Risk: Discount rates should take into account the level of risk associated with an investment. Failing to consider risk can result in an inaccurate discount rate, leading to poor investment decisions.

Not Accounting for Time Value of Money: The time value of money is a critical concept in finance, and failing to account for it when calculating a discount rate can lead to inaccurate results.

To avoid these mistakes, it’s essential to have a thorough understanding of how to find a discount rate and the factors that influence it. By following the steps outlined in this guide and avoiding common mistakes, individuals can ensure they find the correct discount rate and make informed financial decisions.

Remember, accurately calculating a discount rate is crucial for evaluating investment opportunities and achieving long-term financial success. By learning how to find a discount rate and avoiding common mistakes, individuals can make informed financial decisions and achieve their goals.

Conclusion: Mastering the Art of Finding Discount Rates

In conclusion, understanding how to find a discount rate is a crucial aspect of financial decision-making. By grasping the concept of discount rates, individuals can make informed investment decisions, evaluate business opportunities, and achieve long-term financial success.

Throughout this guide, we have explored the different types of discount rates, how to calculate them, and the factors that influence them. We have also discussed the importance of avoiding common mistakes when finding a discount rate and provided real-world examples of how discount rates are used in various industries.

By mastering the art of finding discount rates, individuals can unlock savings, optimize investment returns, and drive business growth. Whether in finance, real estate, or entrepreneurship, accurately calculating a discount rate is essential for making informed financial decisions.

Remember, learning how to find a discount rate is a valuable skill that can benefit individuals and businesses alike. By following the steps outlined in this guide and avoiding common mistakes, individuals can ensure they find the correct discount rate and achieve their financial goals.

In today’s fast-paced financial landscape, understanding how to find a discount rate is more important than ever. By staying informed and up-to-date on the latest concepts and techniques, individuals can stay ahead of the curve and achieve long-term financial success.