What is Yield to Maturity and Why is it Important?

In the world of bond investing, understanding the concept of Yield to Maturity (YTM) is crucial for making informed investment decisions. YTM represents the total return an investor can expect to earn from a bond if they hold it until maturity, taking into account the coupon payments, face value, and market price. Essentially, it’s a way to calculate the bond’s internal rate of return, providing a comprehensive picture of its potential performance. By grasping the significance of YTM, investors can better evaluate the potential return on investment and make more informed decisions when comparing bonds. In fact, learning how to calculate YTM of bond is a vital skill for any bond investor, as it helps to identify the most profitable investment opportunities. In this article, we’ll delve into the intricacies of YTM, exploring how to calculate it and its importance in bond investing.

Understanding Bond Basics: Face Value, Coupon Rate, and Maturity Date

Before diving into the world of Yield to Maturity (YTM), it’s essential to understand the fundamental components of a bond. A bond’s face value, coupon rate, and maturity date are the building blocks of YTM calculations, and grasping their significance is crucial for accurate calculations. The face value, also known as the principal, is the amount borrowed by the issuer and repaid to the investor at maturity. The coupon rate, expressed as a percentage, represents the annual interest paid to the investor, usually semi-annually or annually. The maturity date marks the bond’s expiration, when the issuer repays the face value. These components interact to influence the bond’s market price, which, in turn, affects the YTM. Understanding how to calculate YTM of bond requires a solid grasp of these basics, as they form the foundation of YTM calculations.

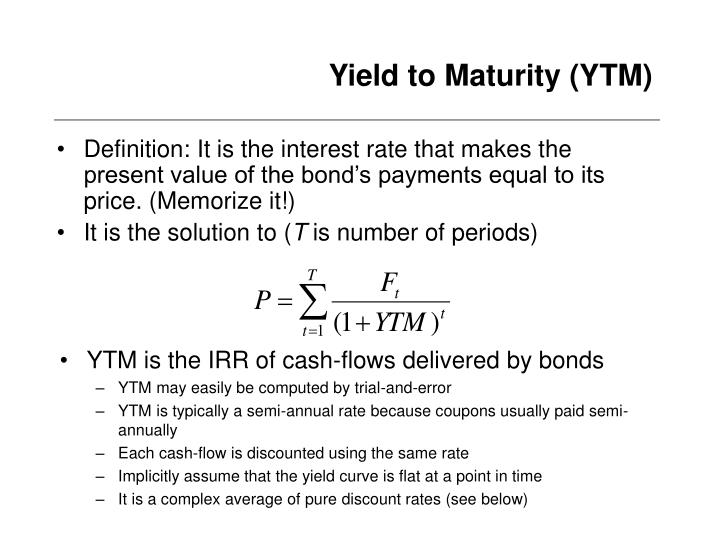

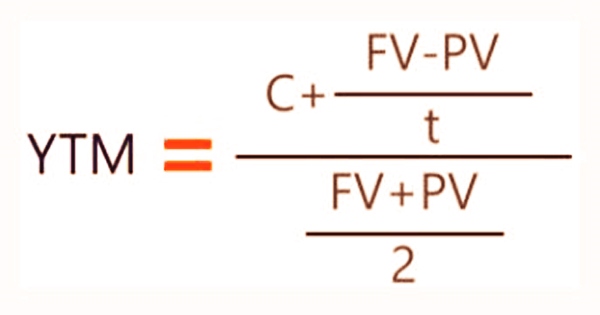

The Formula for Calculating Yield to Maturity

The formula for calculating Yield to Maturity (YTM) is a complex equation that takes into account the bond’s face value, coupon rate, market price, and time to maturity. The YTM formula is as follows:

YTM = (Coupon Payment + ((Face Value – Market Price) / Years to Maturity)) / ((Face Value + Market Price) / 2)

Breaking down each component of the formula, the coupon payment represents the annual interest paid to the investor, while the face value and market price are the bond’s principal amount and current market value, respectively. The years to maturity signify the remaining time until the bond expires. By understanding how to calculate YTM of bond using this formula, investors can gain a deeper insight into a bond’s potential return on investment. It’s essential to note that YTM is an annualized rate, expressed as a percentage, and it’s a critical metric for evaluating bond investments.

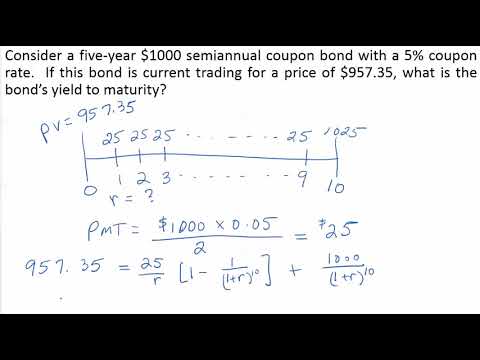

How to Calculate Yield to Maturity: A Step-by-Step Example

To illustrate the calculation of Yield to Maturity (YTM), let’s consider a practical example. Suppose we have a 10-year bond with a face value of $1,000, a coupon rate of 5%, and a current market price of $900. We want to calculate the YTM of this bond.

Step 1: Determine the bond’s coupon payment, which is the annual interest paid to the investor. In this case, the coupon payment is $50 (5% of $1,000).

Step 2: Calculate the bond’s yield to maturity using the formula: YTM = (Coupon Payment + ((Face Value – Market Price) / Years to Maturity)) / ((Face Value + Market Price) / 2)

Plugging in the values, we get: YTM = ($50 + (($1,000 – $900) / 10)) / (($1,000 + $900) / 2)

Step 3: Simplify the equation and solve for YTM. After calculating, we find that the YTM of this bond is approximately 6.45%.

This example demonstrates how to calculate YTM of bond, providing a clear understanding of the step-by-step process involved. By following these steps, investors can accurately determine the YTM of a bond and make informed investment decisions.

Factors Affecting Yield to Maturity: Understanding the Impact of Market Forces

Yield to Maturity (YTM) is not a fixed value, but rather a dynamic metric that can be influenced by various market forces. Understanding these factors is crucial for investors to accurately calculate YTM and make informed investment decisions. Some of the key market forces that can impact YTM include:

Changes in Interest Rates: Fluctuations in interest rates can significantly affect YTM. When interest rates rise, the YTM of existing bonds with lower coupon rates decreases, making them less attractive to investors. Conversely, when interest rates fall, the YTM of existing bonds with higher coupon rates increases, making them more appealing.

Credit Ratings: A bond’s credit rating can also impact its YTM. Bonds with higher credit ratings are considered safer investments, resulting in lower YTMs. Conversely, bonds with lower credit ratings are deemed riskier, leading to higher YTMs.

Market Sentiment: Investor sentiment and market conditions can also influence YTM. During times of economic uncertainty, investors may demand higher yields to compensate for the increased risk, resulting in higher YTMs. In contrast, during periods of economic stability, investors may be willing to accept lower yields, leading to lower YTMs.

Inflation Expectations: Inflation expectations can also impact YTM. When inflation expectations rise, investors may demand higher yields to keep pace with the expected increase in prices, resulting in higher YTMs.

By understanding how these market forces impact YTM, investors can better navigate the complexities of bond investing and make more informed decisions when calculating YTM of bond. This knowledge can help investors to identify opportunities and mitigate risks, ultimately leading to more effective investment strategies.

YTM vs. Current Yield: What’s the Difference?

When evaluating bond investments, investors often come across two important metrics: Yield to Maturity (YTM) and current yield. While both metrics provide insights into a bond’s potential return, they serve distinct purposes and should be considered separately. Understanding the difference between YTM and current yield is crucial for making informed investment decisions.

Current Yield: The current yield of a bond represents the annual interest payment as a percentage of the bond’s current market price. It is calculated by dividing the bond’s annual coupon payment by its current market price. The current yield provides a snapshot of the bond’s current income-generating potential, but it does not take into account the bond’s potential capital gains or losses.

Yield to Maturity (YTM): In contrast, YTM represents the total return an investor can expect to earn from a bond if it is held until maturity. YTM takes into account the bond’s coupon payments, face value, and market price, providing a more comprehensive picture of the bond’s potential return. YTM is a more accurate representation of a bond’s potential return, as it considers the bond’s entire life cycle.

Key Differences: The main difference between YTM and current yield lies in their scope. Current yield focuses on the bond’s current income-generating potential, while YTM considers the bond’s total return over its lifetime. When evaluating bond investments, it is essential to consider both metrics to gain a complete understanding of the bond’s potential return. By understanding the distinction between YTM and current yield, investors can make more informed decisions and optimize their bond portfolios.

Common Pitfalls to Avoid When Calculating Yield to Maturity

Calculating Yield to Maturity (YTM) can be a complex process, and even small mistakes can lead to inaccurate results. To ensure accurate calculations, it’s essential to avoid common pitfalls that investors often encounter. By being aware of these potential errors, investors can ensure that their YTM calculations are accurate and reliable.

Incorrectly Assuming a Constant Yield: One common mistake is assuming that the yield remains constant over the bond’s life. In reality, yields can fluctuate due to changes in interest rates, credit ratings, and market sentiment. To avoid this pitfall, investors should consider the potential impact of changing market conditions on the bond’s yield.

Failing to Account for Compounding: YTM calculations involve compounding, which can be tricky to implement correctly. Investors should ensure that they accurately account for compounding to avoid underestimating or overestimating the bond’s yield.

Using Inaccurate Market Prices: The market price of the bond is a critical input in YTM calculations. Investors should ensure that they use the most up-to-date and accurate market prices to avoid errors.

Ignoring the Bond’s Call Feature: Some bonds come with a call feature, which allows the issuer to redeem the bond at a specific price before maturity. Investors should consider the potential impact of the call feature on the bond’s yield to avoid underestimating its potential return.

Not Considering Taxes: Taxes can significantly impact the bond’s yield, and investors should consider the tax implications of their investment. Failing to account for taxes can lead to inaccurate YTM calculations.

By being aware of these common pitfalls, investors can ensure that their YTM calculations are accurate and reliable. By avoiding these errors, investors can make more informed investment decisions and optimize their bond portfolios. Remember, accurate YTM calculations are crucial for evaluating the potential return on investment, and understanding how to calculate YTM of bond is essential for making informed investment decisions.

Putting it all Together: How to Use Yield to Maturity in Your Investment Strategy

Now that you understand how to calculate YTM of bond and its significance in bond investing, it’s essential to incorporate it into a comprehensive investment strategy. By considering YTM, investors can make informed decisions and optimize their bond portfolios. Here are some practical tips on how to use YTM in your investment strategy:

Compare Bonds: YTM provides a standardized metric for comparing bonds with different coupon rates, face values, and maturity dates. By calculating the YTM of different bonds, investors can evaluate their potential returns and make informed decisions.

Evaluate Risk: YTM takes into account the bond’s credit rating, which reflects the issuer’s creditworthiness. By considering YTM, investors can evaluate the risk associated with a particular bond and adjust their investment strategy accordingly.

Monitor Market Conditions: YTM is sensitive to changes in interest rates, credit ratings, and market sentiment. By monitoring these market forces, investors can adjust their investment strategy to maximize returns and minimize losses.

Diversify Your Portfolio: YTM can help investors diversify their bond portfolios by identifying bonds with different yield profiles. By combining bonds with different YTM, investors can create a diversified portfolio that minimizes risk and maximizes returns.

Regularly Review and Adjust: As market conditions change, YTM can fluctuate. Regularly reviewing and adjusting your investment strategy based on YTM can help investors stay ahead of the curve and optimize their returns.

By incorporating YTM into a comprehensive investment strategy, investors can make informed decisions, optimize their bond portfolios, and achieve their investment goals. Remember, understanding how to calculate YTM of bond is crucial for evaluating the potential return on investment, and by following these practical tips, investors can unlock the full potential of YTM.

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-02-10d2adc981ea475eb2165a5ec13082ed.jpg)