Understanding the Discount Rate: A Crucial Concept

A discount rate is a critical tool in financial analysis, used to estimate the present value of future cash flows in various scenarios such as investment analysis, project evaluation, and financial planning. In essence, the discount rate represents the expected rate of return required to make an investment worthwhile. Calculating a discount rate accurately is essential for making informed financial decisions, as it allows decision-makers to compare different investment opportunities on an equal footing.

To calculate a discount rate, one must consider several factors, including the time horizon of the investment, the level of risk associated with the investment, and the specific risks related to the company or project in question. By accounting for these factors, decision-makers can arrive at a discount rate that accurately reflects the investment’s potential risks and rewards.

The Role of Time and Risk in Discount Rate Calculation

In the realm of financial analysis, the discount rate plays a pivotal role in estimating the present value of future cash flows. This crucial concept is employed in various scenarios, such as investment analysis, project evaluation, and financial planning. The discount rate serves as a tool to quantify the time value of money, accounting for the fact that a dollar today is worth more than a dollar in the future. Two essential factors influencing the discount rate are the length of the time horizon and the level of risk associated with the investment.

The time horizon, which refers to the duration of an investment or project, significantly impacts the discount rate. Generally, a longer time horizon necessitates a higher discount rate due to the increased uncertainty associated with future cash flows. This uncertainty arises from various sources, including fluctuations in market conditions, changes in technology, and shifts in consumer preferences. By accounting for these uncertainties, financial analysts can more accurately estimate the present value of future cash flows.

Risk, another critical factor in discount rate calculation, is inherent in any investment. The risk-adjusted discount rate concept acknowledges that the required return on an investment increases as the level of risk increases. This adjustment compensates investors for taking on additional risk, ensuring that they are adequately rewarded for their willingness to accept uncertainty. By incorporating risk into the discount rate, financial analysts can make more informed decisions about the viability and profitability of potential investments.

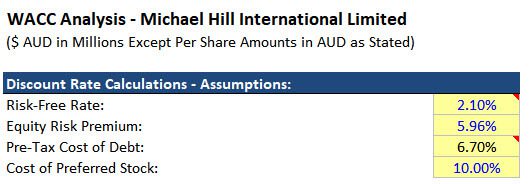

Calculating the risk-adjusted discount rate involves determining the risk-free rate and the risk premium. The risk-free rate represents the return on an investment with zero risk, typically based on the yield of long-term government bonds. The risk premium, on the other hand, reflects the additional return required to compensate for the risk associated with an investment. By combining the risk-free rate and the risk premium, financial analysts can arrive at a comprehensive discount rate that accurately reflects the time horizon and risk level of a given investment.

Identifying the Components of a Discount Rate

When learning how to calculate a discount rate, it is essential to understand the components that constitute this critical financial concept. The discount rate comprises three primary components: the risk-free rate, the risk premium, and the company-specific risk premium. Each component plays a distinct role in determining the overall discount rate, which ultimately influences the present value of future cash flows.

The Risk-Free Rate

The risk-free rate is the return on an investment with zero risk, typically based on the yield of long-term government bonds. This rate serves as the foundation for the discount rate, representing the minimum return an investor would expect to earn on a risk-free investment. In practice, there is no such thing as a completely risk-free investment, but government bonds are often considered the closest approximation due to the low default risk associated with these securities.

The Risk Premium

The risk premium is the additional return required to compensate for the risk associated with an investment. This premium reflects the difference between the expected return on a risky investment and the risk-free rate. By incorporating the risk premium into the discount rate, financial analysts can account for the additional uncertainty associated with an investment, ensuring that investors are adequately rewarded for taking on risk.

The Company-Specific Risk Premium

The company-specific risk premium is an additional risk component that accounts for factors unique to the company or industry in question. This premium reflects the specific risks associated with a company’s financial structure, business model, and industry conditions. By estimating the company-specific risk premium, financial analysts can create a more accurate and comprehensive discount rate that reflects the true risk profile of the investment.

Calculating the company-specific risk premium involves evaluating various factors, including financial leverage, business model, and industry conditions. Financial leverage, for example, can significantly impact a company’s risk profile, as highly leveraged firms are more susceptible to economic downturns and market volatility. Similarly, the business model and industry conditions can influence the company-specific risk premium, as some industries are inherently riskier than others due to factors such as regulatory environments, competition, and technological disruptions.

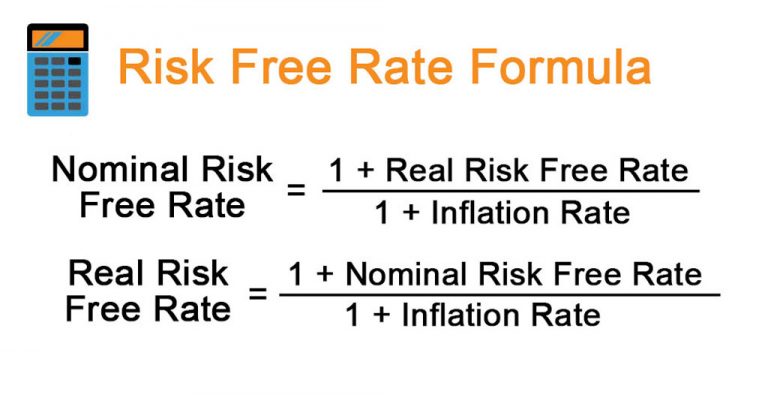

Calculating the Risk-Free Rate: A Key Component

The risk-free rate is a fundamental component of the discount rate, serving as the foundation for estimating the present value of future cash flows. In the context of how to calculate a discount rate, understanding the role of the risk-free rate and its determination is crucial.

The risk-free rate is typically based on the yield of long-term government bonds, as these securities are considered to have the lowest default risk. Government bonds issued by stable economies, such as the United States, Germany, or Japan, are often used as benchmarks for the risk-free rate due to their strong credit ratings and low likelihood of default. By using the yield of these bonds as the risk-free rate, financial analysts can establish a baseline return against which to compare the expected return on riskier investments.

Selecting an appropriate benchmark for the risk-free rate calculation is essential to ensure the accuracy and reliability of the discount rate. Generally, it is recommended to use the yield of long-term government bonds denominated in the same currency as the investment being analyzed. This approach ensures that currency risks are minimized and that the risk-free rate is directly comparable to the expected returns of the investment. Additionally, it is crucial to consider the time horizon of the investment when selecting the benchmark, as the yield of long-term bonds will generally provide a more accurate representation of the risk-free rate over extended periods.

Once the benchmark has been selected, calculating the risk-free rate is a straightforward process. For example, if using the yield of a 10-year U.S. Treasury bond as the benchmark, the risk-free rate would simply be the current yield-to-maturity of that bond. By regularly updating the risk-free rate to reflect changes in market conditions, financial analysts can maintain the accuracy and relevance of their discount rate calculations.

Estimating the Risk Premium: A Critical Step

When learning how to calculate a discount rate, understanding the risk premium and its estimation is vital. The risk premium reflects the additional return required to compensate for the risk associated with an investment. By accurately estimating the risk premium, financial analysts can create a more precise discount rate that accounts for the inherent uncertainty of an investment.

There are several methods for estimating the risk premium, each with its advantages and limitations. Three common approaches include using historical averages, implied premiums, and build-up methods.

Historical Averages

The historical average method involves calculating the average difference between the returns of a broad market index, such as the S&P 500, and the risk-free rate over a specific period. This historical average is then used as the risk premium in the discount rate calculation. While this method is straightforward and easy to implement, it may not accurately reflect current market conditions or future expectations, as historical averages may not always be indicative of future performance.

Implied Premiums

Implied premiums are derived from the prices of financial instruments, such as options or futures contracts, that incorporate expectations about future risk and returns. By analyzing these instruments’ prices, financial analysts can estimate the market’s implied risk premium, which can then be used in the discount rate calculation. This method provides a more forward-looking perspective on the risk premium but may be more complex and data-intensive than historical averages.

Build-Up Methods

Build-up methods involve adding various risk premia together to estimate the overall risk premium for an investment. For example, a build-up method might include a premium for market risk, a premium for industry risk, and a premium for company-specific risk. By breaking down the risk premium into its components, financial analysts can create a more nuanced and detailed estimate of the required return for an investment. However, build-up methods can be more subjective than other approaches, as the individual risk premia must be estimated based on expert judgment and historical data.

Regardless of the method chosen, accurately estimating the risk premium is a critical step in calculating the discount rate. By incorporating the risk premium, financial analysts can create a more comprehensive and accurate discount rate that reflects the true risk profile of an investment.

Accounting for Company-Specific Risks: A Comprehensive Approach

When learning how to calculate a discount rate, it is essential to consider company-specific risks, which can significantly impact an investment’s overall risk profile. By accounting for these risks, financial analysts can create a more accurate and comprehensive discount rate that reflects the unique characteristics of the company and its industry.

Company-specific risks can arise from various factors, including financial leverage, business model, and industry conditions. Each of these factors plays a distinct role in determining the company-specific risk premium, which is added to the risk premium to calculate the overall discount rate.

Financial Leverage

Financial leverage refers to the amount of debt a company uses to finance its operations and growth. Highly leveraged companies are more susceptible to economic downturns and market volatility, as they must meet their debt obligations regardless of their financial performance. To account for financial leverage in the discount rate calculation, financial analysts can add a premium that reflects the company’s debt-to-equity ratio and the prevailing interest rates.

Business Model

A company’s business model can also impact its risk profile. For example, companies with recurring revenue streams, such as subscription-based services, may be considered less risky than those with one-time or project-based revenue. To account for the business model in the discount rate calculation, financial analysts can add a premium that reflects the stability and predictability of the company’s revenue streams.

Industry Conditions

Industry conditions, such as regulatory environments, competition, and technological disruptions, can significantly affect a company’s risk profile. For instance, companies operating in highly regulated industries, such as healthcare or finance, may face greater risks than those in less regulated sectors. To account for industry conditions in the discount rate calculation, financial analysts can add a premium that reflects the specific risks associated with the company’s industry.

By considering these factors and estimating the company-specific risk premium, financial analysts can create a more accurate and comprehensive discount rate that reflects the unique risks and characteristics of the company being analyzed. This approach ensures that the discount rate is better suited to the specific investment being evaluated, leading to more informed and reliable financial decisions.

Applying the Discount Rate: Real-World Scenarios

Understanding how to calculate a discount rate is crucial, but applying it in real-world scenarios is equally important. Two common applications of the discount rate are net present value (NPV) and internal rate of return (IRR) calculations. These methods help financial analysts evaluate investment opportunities and make informed decisions based on the analysis.

Net Present Value (NPV)

Net present value (NPV) is a financial metric that estimates the total value of an investment’s future cash flows, discounted back to their present value using the discount rate. To calculate NPV, financial analysts sum the present values of all expected future cash flows and subtract the initial investment cost. A positive NPV indicates that an investment is expected to generate more value than its cost, while a negative NPV suggests the opposite.

Internal Rate of Return (IRR)

Internal rate of return (IRR) is a discount rate that makes the net present value (NPV) of an investment’s cash flows equal to zero. IRR is a percentage that represents the annual rate of return an investment is expected to generate. Financial analysts can use IRR to compare different investment opportunities and select the one with the highest return. However, IRR has limitations, particularly when comparing investments with different cash flow patterns or when evaluating mutually exclusive projects.

When interpreting the results of NPV and IRR calculations, financial analysts should consider the following factors:

- The discount rate: A higher discount rate will result in a lower present value for future cash flows, making it more difficult for an investment to generate a positive NPV or achieve a high IRR.

- The time horizon: Longer time horizons will result in more significant discounting of future cash flows, which can impact the NPV and IRR of an investment.

- The risk profile: Investments with higher risk levels should have higher discount rates, which will lower their NPV and IRR compared to less risky investments.

By understanding how to apply the discount rate in real-world scenarios, financial analysts can make more informed investment decisions and effectively evaluate the viability of various projects and opportunities.

Staying Updated: Best Practices for Long-Term Success

Calculating a discount rate is a critical skill for financial analysts, but staying current on market conditions and financial trends is equally important. Regularly updating the discount rate ensures accurate and reliable financial analysis in the long term. This section will discuss best practices for updating the discount rate and emphasize the importance of staying informed about market conditions.

Monitoring Market Conditions

Financial analysts should closely monitor market conditions, such as interest rates, inflation, and economic growth, to ensure their discount rate remains relevant and up-to-date. For example, when interest rates rise, the risk-free rate component of the discount rate should also increase, leading to higher discount rates for future cash flows. By staying informed about market conditions, financial analysts can make more accurate discount rate adjustments and maintain the reliability of their financial analyses.

Regularly Reviewing and Updating the Discount Rate

To ensure accurate financial analysis, financial analysts should regularly review and update the discount rate. This process involves reassessing the risk-free rate, estimating the risk premium, and accounting for company-specific risks. By updating the discount rate, financial analysts can account for changes in market conditions, investment risks, and company performance, leading to more accurate present value estimates and informed investment decisions.

Utilizing Multiple Estimation Methods

Using various methods to estimate the risk premium and company-specific risk premium can help financial analysts create a more robust and reliable discount rate. For example, estimating the risk premium using historical averages, implied premiums, and build-up methods can provide a more comprehensive view of the required return for an investment. Similarly, considering multiple factors when determining the company-specific risk premium, such as financial leverage, business model, and industry conditions, can lead to a more accurate discount rate calculation.

Communicating Discount Rate Changes

When updating the discount rate, financial analysts should clearly communicate the reasons for the changes and their impact on financial analyses. Transparent communication ensures that stakeholders understand the basis for the discount rate and the potential implications for investment decisions. By effectively communicating discount rate changes, financial analysts can build trust and confidence in their analyses and promote informed decision-making.

In conclusion, mastering the art of discount rate calculation involves not only understanding the concept and its components but also staying informed about market conditions and regularly updating the discount rate. By employing best practices for updating the discount rate, financial analysts can ensure accurate and reliable financial analysis, leading to better investment decisions and long-term success.