Understanding the Concept of Return on Investment

Return on Investment (ROI) is a crucial metric for evaluating the profitability of investments. It measures the gain or loss generated on an investment relative to its cost. ROI is vital for decision-making in various fields, including finance, marketing, and project management. Understanding ROI helps assess the potential return of an investment and how it contributes to overall strategic planning. A higher ROI typically suggests a more profitable investment. This fundamental concept of ROI forms the foundation for understanding more complex metrics like Return on Invested Capital (ROIC). How do you calculate ROIC effectively?

ROI analysis is essential for comparing different investment options and identifying those with the most attractive potential returns. The significance of ROI extends beyond financial contexts. In marketing, ROI quantifies the effectiveness of advertising campaigns. In project management, it assesses the profitability of projects. Organizations can leverage this metric to determine which projects or initiatives generate the most value relative to their investment. Using ROI in conjunction with other metrics provides a comprehensive picture of the profitability of investments. Applying ROI to investments across various departments and functions of a company creates a valuable framework for evaluating overall profitability.

Ultimately, a solid understanding of ROI is essential for making sound strategic decisions. It allows businesses and individuals to compare various investment opportunities. Knowing how to calculate ROIC provides a more specific approach for analyzing investment profitability. Using this framework, businesses can evaluate the efficiency of capital allocation and make data-driven decisions about future investments.

Defining Return on Invested Capital (ROIC)

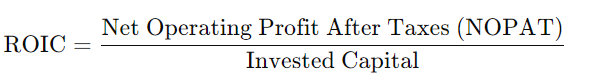

Return on Invested Capital (ROIC) is a crucial financial metric that assesses a company’s profitability by measuring the return generated on the capital it employs. Distinguishing it from general ROI, ROIC focuses specifically on the return a company produces using its invested capital. It evaluates the efficiency of a business or project in using the capital available. ROIC provides a vital lens through which to evaluate the financial performance and efficiency of a business. How do you calculate ROIC? It compares the net operating profits after tax (NOPAT) to the invested capital. Understanding how ROIC differs from other metrics like Return on Equity (ROE) is essential. ROE focuses on shareholder equity, while ROIC considers all invested capital, encompassing debt and equity. This broader perspective offers a more comprehensive view of a company’s profitability and financial health.

ROIC serves as a valuable tool for assessing a company’s ability to generate profits from its capital investments. A higher ROIC suggests more efficient capital allocation and greater profitability. It is a key performance indicator (KPI) in evaluating the profitability and efficiency of investments. An investment with a high ROIC implies the investment is likely to generate considerable returns. Companies frequently compare their ROIC to industry benchmarks or competitors to gauge their performance relative to the market. This comparison is often used to identify areas where a company could improve its capital allocation strategies. Understanding how ROIC works is essential in the assessment of long-term investment strategies. This comparison to similar companies assists in identifying areas of potential growth and efficiency improvements. A detailed understanding of the calculation is critical for strategic decision-making. How do you calculate ROIC? It’s the ratio of NOPAT to invested capital.

ROIC is a vital tool for evaluating investment strategies and assessing the financial health of a company. Understanding how to calculate ROIC is crucial for informed decision-making and strategic planning. The concept is applied in various contexts, such as capital budgeting and project selection. ROIC provides valuable insights into a company’s ability to generate returns from its investments, which is essential for long-term growth. How do you calculate ROIC? It helps determine the overall profitability of capital investments. Understanding the key components and how to interpret the results is essential. Companies can use ROIC to measure the performance of different investments. This allows informed decisions to be made concerning future investment strategies.

Key Components of the ROIC Formula

Calculating Return on Invested Capital (ROIC) involves two crucial components: Net Operating Profit After Tax (NOPAT) and Invested Capital. Understanding how do you calculate roic these elements is fundamental for accurate ROIC calculation. NOPAT represents the earnings a company generates from its operations after all taxes. Invested capital encompasses the total capital employed in a business, encompassing both debt and equity. Both variables are critical for deriving a precise ROIC figure. This analysis will clarify how to calculate ROIC and its significance.

NOPAT, a key part of how do you calculate roic, is essentially a company’s operating profit after considering the impact of income taxes. It isolates the profitability directly attributable to the core business operations. Crucially, NOPAT differs from gross profit. Gross profit represents revenue less the direct costs of producing goods or services. NOPAT, on the other hand, goes a step further, subtracting operating expenses and taxes. This nuance is essential when distinguishing between the different profitability measures.

Invested capital, a critical part of how do you calculate roic, is the total capital used by a business. This includes both debt and equity financing. Precisely accounting for both components is essential for calculating ROIC accurately. A thorough understanding of how to combine these components accurately is vital for a reliable ROIC calculation. An accurate calculation ensures a clear picture of the efficiency in which a company utilizes its capital. Errors in these calculations can lead to significant misinterpretations of a company’s performance.

Calculating NOPAT: A Step-by-Step Guide

To determine Net Operating Profit After Tax (NOPAT), several key financial figures are needed. Understanding how to calculate NOPAT is crucial for accurately assessing Return on Invested Capital (ROIC). This section outlines a step-by-step process for calculating NOPAT, including practical examples and common pitfalls to avoid. Knowing how to calculate ROIC is essential for making informed decisions.

The formula for calculating NOPAT is: NOPAT = EBIT × (1 – Tax Rate). EBIT, or Earnings Before Interest and Taxes, is a crucial component. It represents the profit a company earns before considering interest expenses and taxes. The tax rate is the percentage of earnings a company pays in taxes. A practical example illuminates the calculation. Assume a company has EBIT of $100,000 and a tax rate of 30%. NOPAT calculation is then as follows: NOPAT = $100,000 × (1 – 0.30) = $70,000. This calculation demonstrates how to determine NOPAT, a fundamental step in assessing ROIC.

Careful attention to detail is essential when calculating NOPAT. Errors in any of the input figures can significantly impact the accuracy of the final result. For instance, incorrect tax rate data or an inaccurate EBIT calculation will negatively influence the NOPAT. A thorough understanding of the formula’s components and meticulous review of the data sources are vital for precise NOPAT determination. This ensures reliable input data for the ROIC calculation. Careful review of the data’s accuracy is paramount in producing accurate ROIC estimations. Recognizing these nuances and pitfalls ensures the reliability and accuracy of the calculated NOPAT values, a vital factor for calculating ROIC. How do you calculate ROIC accurately? This process helps answer that question. Avoid common mistakes when computing NOPAT by verifying data sources and employing the formula correctly.

Calculating Invested Capital: A Step-by-Step Guide

Determining invested capital is a critical step in calculating Return on Invested Capital (ROIC). This calculation forms the denominator of the ROIC formula. Understanding how to accurately calculate invested capital is essential for a precise ROIC assessment. To ascertain invested capital, companies must incorporate debt and equity into the calculation. How do you calculate roic? The process involves several steps, each crucial for a reliable ROIC calculation.

First, determine the total value of debt. This includes short-term and long-term debt obligations. Precise figures are essential for this calculation. Next, ascertain the value of shareholders’ equity. This represents the ownership stake of investors. The balance sheet usually provides this information. Then, add the values of total debt and shareholders’ equity to arrive at the total invested capital. Employing these figures allows companies to establish a base for evaluating profitability. It’s crucial to understand that this calculation only includes capital actively employed in generating revenue.

For example, consider a company with $100,000 in total debt and $200,000 in shareholders’ equity. By summing these amounts ($100,000 + $200,000 = $300,000), the company determines the total invested capital. This figure is a vital component of the ROIC formula, enabling accurate evaluation of the return generated on invested capital. Consistency in employing this method ensures comparable results across various reporting periods.

Putting It All Together: Calculating ROIC

To calculate Return on Invested Capital (ROIC), combine the results of the NOPAT and Invested Capital calculations. The formula is ROIC = (NOPAT / Invested Capital) * 100. This calculation provides a percentage representing the return generated for each dollar of invested capital. For example, a ROIC of 15% indicates that for every dollar invested, the company generates $0.15 in profit after taxes. How do you calculate ROIC? Understanding this formula is critical.

Consider a company with a NOPAT of $500,000 and Invested Capital of $3,500,000. Plugging these values into the formula, the calculation is (500,000 / 3,500,000) * 100 = 14.29%. This result signifies the company’s efficiency in generating profits from its investments. Different industries and company sizes will yield varying ROIC results, reflecting their unique profitability dynamics. Analyzing these factors is a fundamental aspect in evaluating a company’s financial performance. Various industries have different benchmarks and standards for evaluating the profitability of a company’s investments.

Analyzing ROIC across different business segments or projects within a company provides valuable insights. Comparing ROIC to industry benchmarks allows for a more informed assessment of a company’s performance relative to its competitors. This process helps identify areas for improvement and potential strategic adjustments. High ROIC often indicates strong performance in utilizing capital, and understanding how do you calculate roic plays a crucial role in this analysis. Lower ROIC might signal the need for adjustments in strategies or investment choices. A clear understanding of the company’s current capital allocation and its expected return is important in assessing the long-term success of these strategies.

Interpreting the ROIC Result: What Does It Mean?

The calculated ROIC value provides crucial insights into a company’s or project’s profitability and efficiency. A high ROIC generally indicates strong performance, suggesting the investment of capital is producing substantial returns. Conversely, a low ROIC might signal inefficiencies in capital allocation or deployment. Evaluating ROIC against industry benchmarks and competitor data offers a comparative perspective. For instance, if a company’s ROIC is significantly lower than industry averages, it may warrant an investigation into operational or strategic adjustments.

Interpreting ROIC also involves understanding the context of the investment. A high ROIC in a high-growth sector might be expected, while a lower ROIC in a mature market might be considered acceptable. The relationship between ROIC and expected profitability is a crucial connection. Comparing ROIC to the cost of capital is important for decision-making. A higher ROIC relative to the cost of capital suggests a more profitable investment. Managers can analyze ROIC in conjunction with other financial metrics to develop a comprehensive understanding of their business’s performance. By examining how do you calculate roic and analyzing how changes in ROIC relate to overall business strategies, firms can make strategic adjustments to optimize return on invested capital.

Ultimately, interpreting ROIC involves a nuanced analysis encompassing industry comparisons, sector benchmarks, and the overall economic context. A careful evaluation of how do you calculate roic leads to a deeper comprehension of investment profitability and the potential for strategic adjustments. Understanding the limitations of the data used in calculating ROIC is paramount, as potential inaccuracies can influence the interpretation of the final result. This crucial aspect of analysis ensures a realistic evaluation of investment profitability.

Using ROIC in Decision-Making: Strategies for Growth

ROIC plays a crucial role in capital budgeting and project selection. Companies can assess the profitability of different investment options using ROIC. This analysis helps determine which investments are likely to generate the highest returns in relation to the capital invested. A higher ROIC indicates a more profitable investment compared to one with a lower ROIC. Thorough analysis is crucial for identifying those investment opportunities that provide optimal returns.

ROIC can significantly inform strategic planning for long-term growth. By understanding how various investments affect ROIC, companies can make data-driven decisions. Companies can identify areas where capital allocation can maximize returns and optimize profitability. This data-driven approach is critical for companies looking to expand, acquire, or diversify their operations. This approach allows for calculated risk management and facilitates a more efficient use of capital.

Strategic decisions often hinge on how do you calculate roic and interpret the results. By comparing ROIC across different potential ventures or product lines, companies can identify investment opportunities with greater potential for profit. A detailed analysis of each opportunity can also reveal the specific elements of each project that contribute to its overall ROIC. This understanding facilitates focused efforts in areas with the highest potential for return on investment. ROIC also allows for comparisons across industry benchmarks and competitor data to evaluate a company’s overall financial strength.