Understanding the Basics: What Are Monthly Returns?

Monthly returns are a crucial concept in investment analysis, representing the change in an investment’s value over a month. These returns serve as a building block for calculating and comparing investment performance over various time periods. To better understand monthly returns, consider the following:

- Monthly returns can be positive or negative, reflecting gains or losses in an investment’s value.

- They are typically expressed as a percentage, making it easier to compare different investments and time frames.

- Monthly returns can be calculated for various investment vehicles, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs).

- Monitoring monthly returns helps investors assess their investment strategy’s effectiveness and make informed decisions about buying, selling, or holding investments.

- Compounding, or the process of reinvesting returns to generate additional earnings, can significantly impact monthly returns over time.

By understanding the basics of monthly returns, investors can begin to grasp the importance of annualizing these returns to evaluate and compare investment performance consistently.

The Importance of Annualizing Monthly Returns

Annualizing monthly returns is a critical step in investment analysis, allowing investors to compare performance across different time periods and investment types. By converting monthly returns into an annualized format, investors can:

- Standardize investment performance measurement: Annualized returns provide a consistent basis for evaluating investments, regardless of their time horizon.

- Assess long-term investment potential: By examining annualized returns, investors can better understand how an investment may perform over extended periods, helping them make informed decisions about their investment strategy.

- Compare different investment options: Annualized returns enable investors to compare various investment opportunities, such as stocks, bonds, and mutual funds, on a level playing field.

- Monitor portfolio performance: Regularly annualizing monthly returns helps investors track their portfolio’s progress and make adjustments as needed to maintain a well-diversified and balanced investment strategy.

- Identify trends and patterns: By analyzing annualized returns over time, investors can spot trends and patterns that may indicate changes in market conditions or investment strategies.

In essence, annualizing monthly returns is a powerful tool for investors seeking to make informed decisions and optimize their investment portfolios. By understanding the importance of annualized returns, investors can better navigate the complex world of investment analysis and achieve their financial goals.

How to Annualize Monthly Returns: A Step-by-Step Process

Annualizing monthly returns involves a straightforward process that can be broken down into three main steps. By following these steps, investors can accurately convert monthly returns into an annualized format:

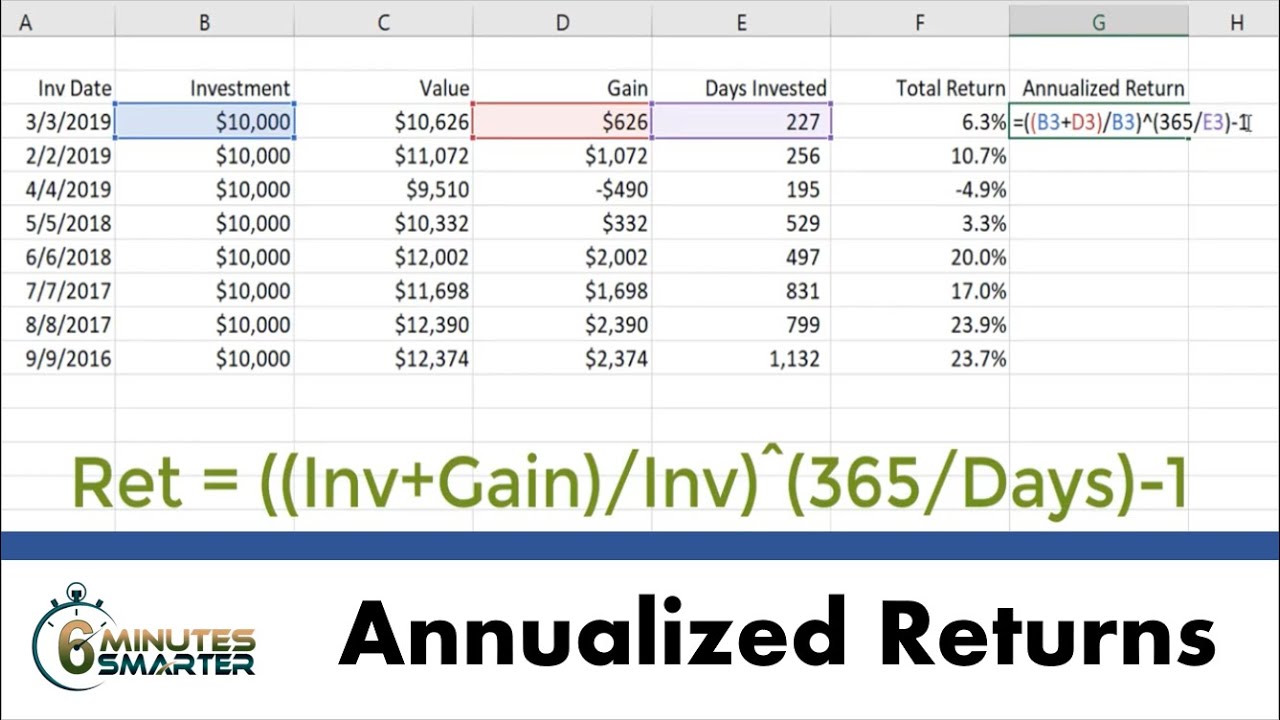

- Calculate the average monthly return: Begin by determining the average monthly return for the investment period in question. This can be done by adding up all the monthly returns and dividing by the total number of months. For example, if you have returns of 1%, 2%, -1%, and 3% for four consecutive months, your average monthly return would be (1% + 2% – 1% + 3%) / 4 = 1.25%.

- Determine the number of periods: Next, calculate the number of periods for annualization. In this case, since you are annualizing monthly returns, the number of periods would be 12 (months per year).

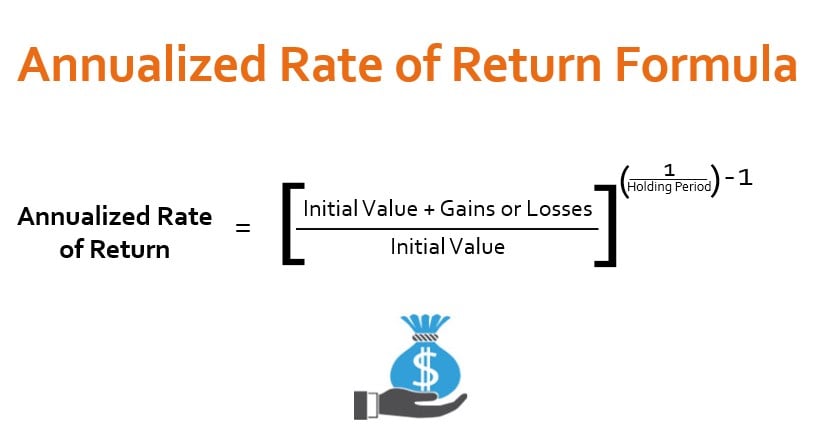

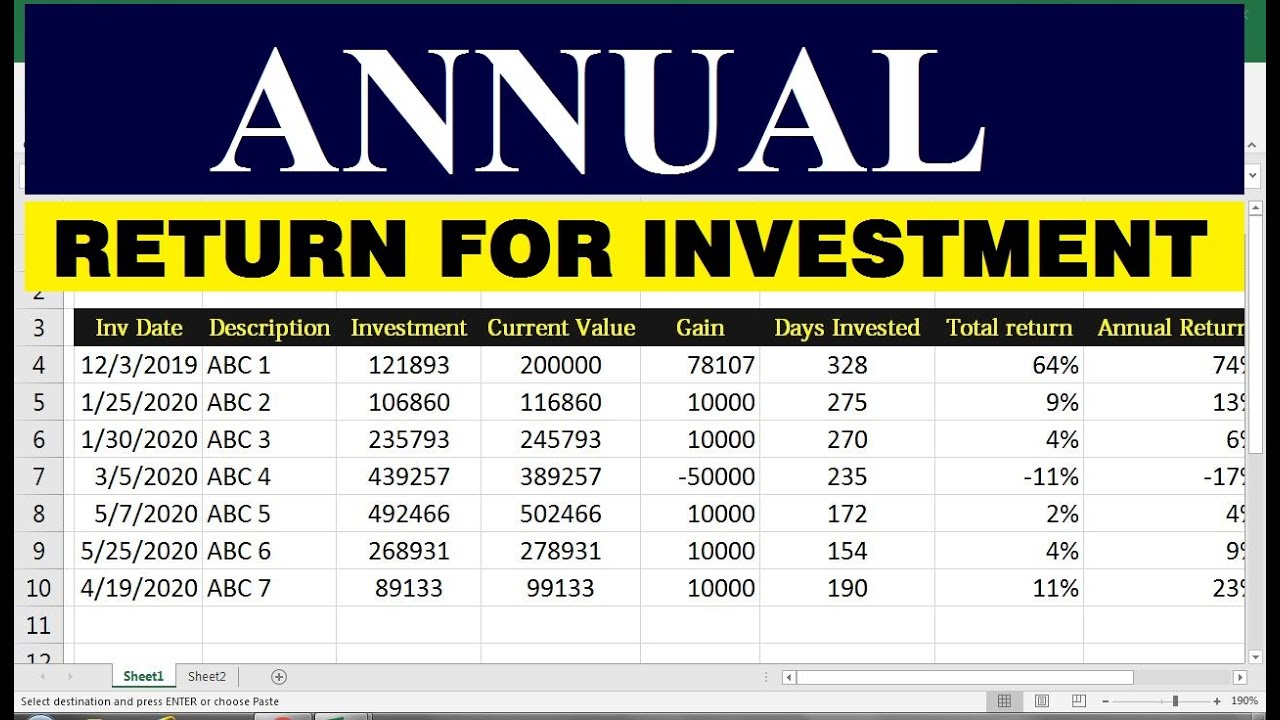

- Apply the formula for annualization: Finally, to annualize the monthly returns, raise the average monthly return to the power of the number of periods and multiply by 100. The formula for annualizing monthly returns is as follows: Annualized Return = (1 + Average Monthly Return) ^ Number of Periods – 1 Using the example above, the annualized return would be (1 + 1.25%) ^ 12 – 1 = 15.56%.

By following these steps, investors can accurately annualize monthly returns, providing a standardized measure for investment evaluation and comparison. Keep in mind that annualized returns should be used in conjunction with other investment metrics, such as risk-adjusted returns and volatility, to ensure a comprehensive investment analysis.

Common Mistakes to Avoid When Annualizing Monthly Returns

While annualizing monthly returns is a valuable tool for investment analysis, it is essential to avoid common mistakes that can lead to misleading or inaccurate results. Some of these mistakes include:

- Neglecting compounding effects: Failing to account for the compounding of monthly returns can result in underestimating the true annualized return. Compounding occurs when returns are reinvested, generating additional earnings. To avoid this mistake, ensure that you apply the correct formula for annualization, as outlined in the previous section.

- Using inappropriate formulas: Various formulas can be used to annualize monthly returns, and selecting the wrong one can lead to inaccurate results. For example, using a simple multiplication of the average monthly return by the number of periods is incorrect and will not account for compounding effects. Always use the formula Annualized Return = (1 + Average Monthly Return) ^ Number of Periods – 1 to ensure accurate annualized returns.

- Failing to adjust for volatility: Volatility, or the degree of fluctuation in returns, can significantly impact investment performance. When annualizing monthly returns, it is crucial to consider volatility to obtain a more accurate measure of investment performance. Risk-adjusted return metrics, such as the Sharpe ratio, can help account for volatility in annualized returns.

- Ignoring other investment factors: Annualized returns should not be considered in isolation when evaluating investment performance. Factors such as fees, taxes, and liquidity can significantly impact investment performance and should be taken into account alongside annualized returns.

By being aware of these common mistakes and taking steps to avoid them, investors can ensure that their annualized returns provide a reliable and accurate measure of investment performance.

Tools and Resources for Annualizing Monthly Returns

To simplify the process of annualizing monthly returns, investors can take advantage of various tools and resources. These resources can help ensure accurate calculations and save time, allowing for more effective investment analysis. Some recommended tools and resources for annualizing monthly returns include:

- Financial Calculators: Online financial calculators, such as those provided by investment websites and financial institutions, can help investors quickly and easily annualize monthly returns. These calculators typically require users to input monthly returns and the number of periods, automatically applying the correct formula for annualization.

- Investment Software: Specialized investment software, such as portfolio trackers and financial analysis tools, often include features for annualizing monthly returns. By integrating this functionality with other investment analysis tools, investors can streamline their workflow and obtain a more comprehensive view of their investment performance.

- Professional Financial Advisors: Working with a professional financial advisor can provide investors with access to expert knowledge and resources for annualizing monthly returns. Financial advisors can help ensure accurate calculations, interpret the results, and provide guidance on how to apply annualized returns to investment decision-making.

By utilizing these tools and resources, investors can more effectively and accurately annualize monthly returns, ultimately leading to better-informed investment decisions and improved portfolio performance.

Applying Annualized Returns to Real-World Investment Scenarios

Annualized returns can be a valuable tool for investors when evaluating and comparing the performance of various investment options. Here are some examples of how to apply annualized returns to real-world investment scenarios:

- Comparing the performance of different mutual funds: When considering multiple mutual funds for investment, annualized returns can help investors compare their performance over different time periods. By annualizing monthly returns, investors can assess which funds have consistently outperformed the market or their peers, and make more informed investment decisions.

- Evaluating the risk-adjusted returns of a stock portfolio: In addition to absolute returns, investors should consider the risk associated with their investments. By calculating the risk-adjusted annualized returns, such as the Sharpe ratio, investors can better understand the trade-off between risk and reward in their portfolio. This information can help investors optimize their asset allocation and manage risk more effectively.

- Assessing the impact of inflation on investment performance: Inflation can erode the purchasing power of investors’ returns over time. By annualizing monthly returns and adjusting for inflation, investors can gain a more accurate understanding of their investment’s true performance and make necessary adjustments to their investment strategy to maintain their purchasing power.

By applying annualized returns to these real-world investment scenarios, investors can make more informed decisions, effectively manage their portfolios, and ultimately achieve their financial goals.

Limitations of Annualized Returns and Other Considerations

While annualized returns can be a valuable tool for investment analysis, it is essential to recognize their limitations and consider other factors when evaluating investment performance. Some of these limitations and considerations include:

- Fees: Investment fees, such as management expenses and trading costs, can significantly impact investment performance. When comparing annualized returns, investors should consider the impact of these fees on their investment returns and adjust their analysis accordingly.

- Taxes: Taxes can also affect investment performance, particularly for taxable accounts. Investors should consider the tax implications of their investments, such as capital gains taxes and dividend taxes, when evaluating annualized returns.

- Liquidity: The liquidity of an investment, or the ease with which it can be bought or sold, can impact investment performance. Investors should consider the liquidity of their investments when annualizing monthly returns, as less liquid investments may have higher risks and lower returns.

- Time periods: The length of the time period used for annualizing monthly returns can affect the results. Longer time periods may provide a more accurate representation of investment performance, while shorter time periods may be more susceptible to short-term market fluctuations.

- Volatility: Annualized returns do not account for volatility, or the degree of fluctuation in investment performance. Investors should consider using risk-adjusted return metrics, such as the Sharpe ratio, to account for volatility when evaluating investment performance.

By acknowledging the limitations of annualized returns and considering other factors, investors can make more informed investment decisions and effectively evaluate their investment performance.

Conclusion: The Value of Annualizing Monthly Returns in Investment Analysis

Understanding how to annualize monthly returns is a crucial skill for investors seeking to evaluate and compare the performance of their investments over different time periods. By annualizing monthly returns, investors can establish a standardized measure for investment evaluation, facilitating more informed decision-making and effective portfolio management.

To recap, investors should be aware of the steps involved in annualizing monthly returns, including calculating the average monthly return, determining the number of periods, and applying the appropriate formula for annualization. Additionally, investors should be mindful of common mistakes, such as neglecting compounding effects, using inappropriate formulas, and failing to adjust for volatility. Utilizing tools and resources like financial calculators, investment software, and professional financial advisors can further streamline the annualization process.

Applying annualized returns to real-world investment scenarios, such as comparing mutual funds, evaluating risk-adjusted returns, and assessing the impact of inflation, can provide valuable insights for investors. However, it is essential to recognize the limitations of annualized returns and consider other factors, such as fees, taxes, and liquidity, when evaluating investment performance.

In conclusion, annualizing monthly returns is an indispensable technique for investors seeking to make informed decisions and optimize their investment strategies. By mastering this skill and incorporating it into their investment analysis, investors can better understand their investment performance and work towards achieving their financial goals.