Deciphering the Returns: Understanding the Three Factor Model

The fama french 3 factor model emerges as a pivotal extension to the Capital Asset Pricing Model (CAPM), seeking to provide a more accurate explanation of stock returns. While CAPM relies solely on market risk, the fama french 3 factor model expands the analysis by incorporating two additional factors: size and value. This enhancement addresses shortcomings in CAPM’s ability to fully explain observed return variations. The core purpose of the fama french 3 factor model is to offer investors and financial analysts a more comprehensive framework for understanding and predicting asset prices.

At its core, the fama french 3 factor model posits that stock returns are influenced not only by market risk, but also by the size of the company and its value. Market risk, represented by the overall market return, remains a crucial element. Size is captured by the Small Minus Big (SMB) factor, which reflects the historical outperformance of small-cap stocks relative to large-cap stocks. Value is represented by the High Minus Low (HML) factor, which captures the tendency for value stocks (those with high book-to-market ratios) to outperform growth stocks. The fama french 3 factor model suggests that by considering these three factors, one can better understand and potentially predict stock returns.

The introduction of the size and value factors in the fama french 3 factor model marked a significant advancement in asset pricing theory. CAPM often fails to explain why certain stocks consistently outperform or underperform the market. The fama french 3 factor model addresses this by recognizing that smaller companies and value-oriented companies may exhibit higher returns due to factors not captured by market risk alone. This fama french 3 factor model provides a more nuanced perspective on investment performance, enabling investors to make more informed decisions based on a broader range of factors influencing stock prices. The fama french 3 factor model remains a cornerstone of modern portfolio theory and investment analysis.

How to Evaluate Investment Performance Using the Fama-French Framework

Evaluating investment performance using the Fama-French three-factor model provides a more nuanced perspective than relying solely on the Capital Asset Pricing Model (CAPM). This approach acknowledges that factors beyond market risk influence stock returns. The core idea is to determine how sensitive a stock or portfolio is to each of the three factors: market risk, size (SMB), and value (HML). This is achieved by calculating factor loadings, which represent the coefficients in a multiple regression analysis. The Fama-French three factor model helps to measure investment performance.

To practically apply the fama french 3 factor model, begin by gathering the necessary data. Historical stock returns for the asset being evaluated are required, alongside the returns for the market, SMB, and HML factors. A readily accessible source for this data is the Kenneth R. French data library, available online. This library provides historical data for these factors, typically on a monthly or annual basis. Once the data is collected, a multiple regression analysis is performed, with the stock’s excess return (stock return minus risk-free rate) as the dependent variable and the market, SMB, and HML factors as independent variables. The coefficients resulting from this regression are the factor loadings.

These factor loadings reveal the investment’s sensitivity to each factor. A high loading on SMB suggests that the stock tends to perform well when small-cap stocks outperform large-cap stocks. Similarly, a high loading on HML indicates that the stock tends to perform well when value stocks outperform growth stocks. The expected return of the stock can then be calculated using the following formula: Expected Return = Risk-Free Rate + Beta * (Market Risk Premium) + SMB Loading * (SMB Premium) + HML Loading * (HML Premium). Here, Beta represents the market risk loading, and the premiums represent the historical average excess returns for each factor. By comparing the expected return calculated using the fama french 3 factor model with the actual return, investors can assess whether the investment has outperformed or underperformed relative to its factor exposures. This framework allows for a more informed understanding of investment performance and risk assessment.

Market Risk, Size, and Value: Breaking Down the Three Pillars

The fama french 3 factor model enhances the Capital Asset Pricing Model (CAPM) by incorporating size and value premiums. Each factor represents a distinct source of systematic risk and return. Understanding these factors is crucial for evaluating investment performance. Market Risk, the first factor, reflects the overall market’s volatility. It is often represented by the excess return of the market portfolio over the risk-free rate. A higher market risk premium typically indicates a greater expected return, compensating investors for the increased risk. This factor captures the undiversifiable risk inherent in all investments. The fama french 3 factor model uses market risk as a baseline for assessing other risk factors.

Size, represented by the Small Minus Big (SMB) factor, captures the historical outperformance of small-capitalization companies relative to large-capitalization companies. SMB is constructed by sorting stocks based on market capitalization and creating a portfolio that goes long on small-cap stocks and short on large-cap stocks. The returns of this portfolio represent the size premium. The construction methodology involves annually ranking stocks by their market capitalization. Then, portfolios are formed based on these rankings. The SMB factor helps explain why smaller companies, which are often riskier and have higher growth potential, have historically delivered higher returns. The fama french 3 factor model recognizes that size is a significant determinant of stock returns.

Value, represented by the High Minus Low (HML) factor, captures the historical outperformance of value stocks relative to growth stocks. Value stocks are those with high book-to-market ratios, indicating they may be undervalued by the market. Growth stocks have low book-to-market ratios. HML is constructed by sorting stocks based on their book-to-market ratios and creating a portfolio that goes long on value stocks and short on growth stocks. The returns of this portfolio represent the value premium. The construction methodology involves annually ranking stocks by their book-to-market ratios. Portfolios are then formed based on these rankings. The HML factor accounts for the tendency of value stocks to outperform growth stocks over long periods. This may be because value stocks are often distressed or out of favor. This makes them riskier, demanding a higher return. The fama french 3 factor model demonstrates how value investing can generate alpha.

Analyzing the Strengths and Limitations of the FF Model

The Fama-French three-factor model offers a significant improvement over the Capital Asset Pricing Model (CAPM) in explaining stock returns. Its strength lies in its ability to capture common return patterns associated with size and value premiums. The model acknowledges that smaller companies and value stocks (those with high book-to-market ratios) tend to outperform the market in the long run, a phenomenon the CAPM often fails to explain. By incorporating these factors, the fama french 3 factor model provides a more nuanced and accurate picture of asset pricing.

However, the fama french 3 factor model is not without its limitations. While it explains a significant portion of the variation in stock returns, it doesn’t explain everything. Numerous other anomalies, such as momentum or quality effects, remain unexplained. Critics also point to the potential for data mining in the model’s development. The factors were identified by observing historical return patterns, raising concerns that they may not be persistent in the future. There are criticisms regarding its theoretical foundations. Unlike CAPM, which has a strong theoretical basis in risk aversion, the fama french 3 factor model is more empirical in nature. It identifies factors that have historically been associated with higher returns but doesn’t necessarily explain why these factors should be priced risks.

Another limitation stems from the evolving nature of financial markets. New factors may emerge, or the relationships between existing factors and returns may change over time. This necessitates ongoing research and refinement of factor models. Despite these criticisms, the fama french 3 factor model remains a valuable tool for investors and academics. It serves as a benchmark for evaluating investment performance and a foundation for more complex factor models. Understanding its strengths and limitations is crucial for its effective application in portfolio management and risk analysis. The fama french 3 factor model is a cornerstone in understanding asset pricing, despite the existence of return anamolies.

From Three to Five (and Beyond!): Exploring Extensions to the Factor Model

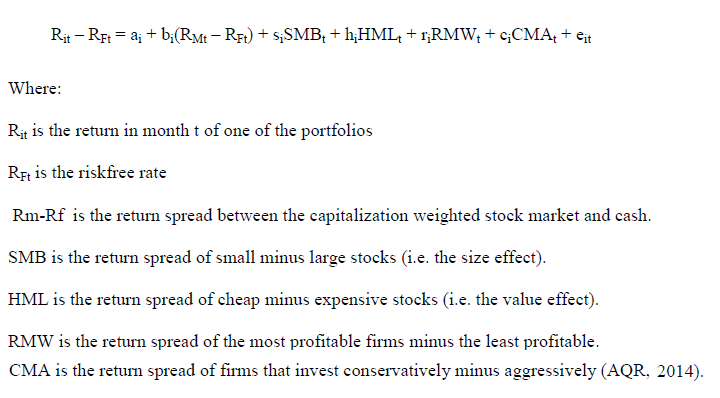

The fama french 3 factor model revolutionized asset pricing, yet researchers continue to refine and expand upon it. The initial model, with its market risk, size, and value factors, left some return anomalies unexplained. This led to the development of extensions, most notably the Fama-French five-factor model. This enhanced model incorporates two additional factors: profitability and investment. Profitability is measured as robust minus weak (RMW), reflecting the tendency of more profitable firms to generate higher returns. Investment is captured by conservative minus aggressive (CMA), acknowledging that companies investing conservatively tend to outperform those investing aggressively. The addition of these factors significantly improves the explanatory power of the fama french 3 factor model, capturing a wider range of return patterns across different stocks.

Beyond the five-factor model, numerous other multi-factor models have emerged. These models often incorporate factors such as momentum, quality, and low volatility. Momentum, the tendency of stocks that have performed well in the past to continue performing well in the near future, is a widely recognized anomaly. Quality factors aim to capture the characteristics of financially sound companies with stable earnings and strong balance sheets. Low volatility strategies exploit the empirical observation that stocks with lower volatility often generate risk-adjusted returns that are higher than predicted by the fama french 3 factor model or even the five-factor model. These expanded models seek to address the limitations of the original fama french 3 factor model and provide a more comprehensive framework for understanding and predicting asset returns. Researchers constantly explore new factors and combinations of factors, driven by the desire to identify and capture persistent sources of alpha.

The ongoing development of multi-factor models underscores the dynamic nature of financial research. While the fama french 3 factor model remains a cornerstone of asset pricing, it is not a static endpoint. The exploration of new factors reflects the evolving understanding of market behavior and the constant search for more accurate and robust models. Each new factor added to the fama french 3 factor model framework aims to explain previously unexplained variations in stock returns. The proliferation of factor models highlights the complexity of asset pricing and the ongoing quest to identify the fundamental drivers of investment performance. These extensions demonstrate the enduring influence of the fama french 3 factor model as a foundation for further research and innovation in the field of finance.

Comparing Factor Investing Approaches: FF Model vs. Other Methodologies

The Fama-French approach, specifically the Fama French 3 factor model, represents a cornerstone in factor investing. However, it is essential to understand how it differs from other methodologies. Smart beta strategies and fundamental indexing are two prominent alternatives. These approaches often aim to capture similar risk premiums, but they employ different construction techniques and factor definitions. The Fama French 3 factor model relies on market capitalization and book-to-market ratios to define size and value factors. In contrast, smart beta strategies may use alternative weighting schemes, such as equal weighting or volatility weighting, to construct portfolios. Fundamental indexing uses fundamental data, such as revenue or earnings, to weight stocks. These differences can lead to variations in portfolio composition and performance.

One key distinction lies in factor definitions. The Fama French 3 factor model defines value as High Minus Low (HML), comparing stocks with high book-to-market ratios to those with low ratios. Smart beta strategies might use different metrics to identify value stocks, such as dividend yield or price-to-earnings ratios. Similarly, the size factor (SMB) in the Fama French 3 factor model is based purely on market capitalization. Some smart beta strategies might incorporate other measures of size, like sales or number of employees. These variations in factor definitions can affect the correlation between factors and the overall portfolio risk profile. The Fama French 3 factor model provides a transparent and well-documented framework. But smart beta and fundamental indexing offer flexibility in customizing factor definitions to align with specific investment objectives.

Expected performance also differs across methodologies. The Fama French 3 factor model has historically demonstrated a significant ability to explain stock returns. Smart beta strategies and fundamental indexing also seek to outperform market-cap weighted benchmarks. However, their performance can be more sensitive to specific market conditions and factor definitions. For example, a value-tilted smart beta strategy might perform well when value stocks are in favor but underperform during growth-led market rallies. The Fama French 3 factor model, while not immune to market cycles, provides a more standardized approach. Investors should carefully consider their investment goals and risk tolerance when choosing between the Fama French 3 factor model and other factor investing methodologies. Understanding the nuances of each approach is crucial for building a well-diversified and robust portfolio that aligns with their investment strategy. All seek to improve returns over traditional market capitalization weighted indices, but through different approaches than the fama french 3 factor model.

Real-World Applications: How Fund Managers Use the FF Model

Institutional investors and fund managers actively utilize the fama french 3 factor model for various purposes, showcasing its practical relevance in portfolio management. The model serves as a cornerstone in portfolio construction, guiding investment decisions based on factor exposures. Fund managers analyze the factor loadings of individual securities to build portfolios that strategically overweight specific factors, such as size or value, aiming to enhance returns. This approach allows for a more targeted investment strategy compared to traditional market capitalization-weighted approaches. The fama french 3 factor model assists in risk management by providing a framework for understanding and quantifying the sources of risk in a portfolio. By examining the factor exposures, managers can identify potential vulnerabilities and adjust the portfolio accordingly to mitigate unwanted risks. This is crucial for maintaining portfolio stability and achieving desired risk-adjusted returns.

Performance attribution is another key application of the fama french 3 factor model. Fund managers use the model to decompose portfolio returns and determine the contribution of each factor to the overall performance. This analysis helps to identify the drivers of success or underperformance and allows for adjustments to the investment strategy. Several publicly available funds explicitly state their adherence to factor-based investment strategies, often citing the fama french 3 factor model as a foundational element. These funds aim to capture the premiums associated with size and value factors. While specific brand names are avoided here, exchange-traded funds (ETFs) that track the Small Minus Big (SMB) and High Minus Low (HML) factors are readily available. These ETFs provide investors with a convenient way to gain exposure to these factors.

The widespread adoption of the fama french 3 factor model underscores its significance in the investment management industry. Its ability to explain stock returns beyond market risk has made it an indispensable tool for fund managers seeking to improve portfolio construction, manage risk effectively, and attribute performance accurately. The continued use and adaptation of the fama french 3 factor model demonstrate its lasting impact on investment practices. The fama french 3 factor model provides a robust framework for understanding asset pricing and informing investment decisions. The fama french 3 factor model helps fund managers make informed choices and achieve their investment objectives.

The Enduring Legacy: Why the FF Model Remains Relevant Today

The fama french 3 factor model stands as a cornerstone of modern finance, profoundly shaping our understanding of asset pricing. Introduced as a refinement to the Capital Asset Pricing Model (CAPM), the fama french 3 factor model offered a more nuanced explanation of stock returns. Its enduring contribution lies in its ability to capture systematic risk factors beyond market risk, specifically size and value, factors that have historically influenced investment performance. The fama french 3 factor model provided a framework that continues to be relevant.

The model’s significance extends beyond theoretical finance, influencing practical investment strategies employed by institutional investors and fund managers. The fama french 3 factor model serves as a benchmark for evaluating investment performance and constructing portfolios. It offers a lens through which to analyze risk exposures and potentially enhance returns. Its simplicity, relative to more complex models, allows for ease of implementation and interpretation, making it a widely used tool in the investment management industry. The fama french 3 factor model helped a lot of investors.

While the fama french 3 factor model has been expanded upon and challenged by newer multi-factor models, its foundational principles remain relevant. The introduction of factors like profitability and investment in the five-factor model demonstrates the ongoing evolution of factor-based investing, with the fama french 3 factor model as its starting point. The fama french 3 factor model’s legacy is not only as a standalone model but also as a catalyst for further research and innovation in the field of asset pricing. Its continued use as a benchmark and analytical tool solidifies its position as a vital component of financial theory and practice. The fama french 3 factor model is a strong base to keep learning.

:max_bytes(150000):strip_icc()/fama-4196653-b2f48bc85216461ab6f626e63818552c.jpg)