What is Systematic Risk and Why Does it Matter?

Systematic risk, also known as market risk or undiversifiable risk, is a type of risk that affects the entire market or a large segment of it. It is a critical concept in finance and investing, as it can have a significant impact on investment portfolios. Systematic risk arises from factors that affect the overall market, such as economic downturns, changes in interest rates, and geopolitical events. It is essential to measure systematic risk accurately, as it can help investors make informed decisions and manage their portfolios more effectively. The question of whether beta measures systematic risk is a crucial one, as beta is a widely used metric in finance. By understanding systematic risk and its measurement, investors can better navigate the complexities of the market and achieve their investment goals. In fact, does beta measure systematic risk is a question that has been debated among finance professionals, and understanding the answer to this question can help investors make more informed decisions.

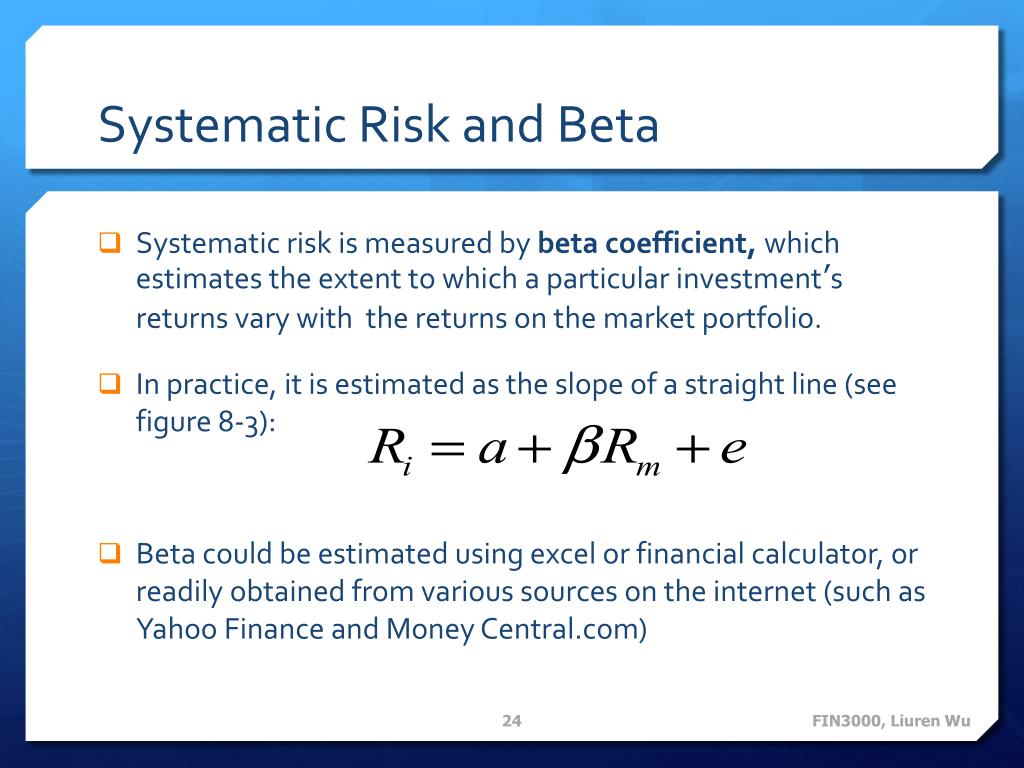

Understanding Beta: A Key Component of Systematic Risk

Beta is a widely used metric in finance that measures the systematic risk of an asset or a portfolio. It is calculated as the covariance of the asset’s returns with the market returns, divided by the variance of the market returns. A beta of 1 indicates that the asset moves in line with the market, while a beta greater than 1 indicates higher volatility and a beta less than 1 indicates lower volatility. For example, a stock with a beta of 1.2 is expected to increase by 12% if the market increases by 10%. Beta is a key component of systematic risk, as it helps investors understand the level of risk associated with a particular asset or portfolio. The question of does beta measure systematic risk is a crucial one, as it can help investors make informed decisions about their investments. By understanding beta, investors can better assess the risk-return tradeoff of their investments and make more informed decisions.

How to Identify Systematic Risk in Your Portfolio

Identifying systematic risk in a portfolio is crucial for investors who want to make informed decisions about their investments. One way to do this is by using beta as a metric. Beta provides a quantitative measure of systematic risk, allowing investors to assess the level of risk associated with a particular asset or portfolio. To identify systematic risk in a portfolio, investors can calculate the beta of each asset and then weigh them according to their portfolio allocation. This will give them an overall beta for the portfolio, which can help them understand the level of systematic risk they are exposed to. For example, a portfolio with a beta of 1.1 is expected to be more volatile than the market, while a portfolio with a beta of 0.9 is expected to be less volatile. In addition to using beta, investors can also use diversification to mitigate systematic risk. By spreading their investments across different asset classes and industries, investors can reduce their exposure to systematic risk and create a more stable portfolio. The question of does beta measure systematic risk is an important one, as it can help investors understand the role of beta in identifying systematic risk in their portfolios.

The Limitations of Beta in Measuring Systematic Risk

While beta is a widely used metric for measuring systematic risk, it is not without its limitations. One of the main limitations of beta is its sensitivity to market conditions. Beta is calculated based on historical data, which may not accurately reflect current market conditions. This can lead to misestimation of systematic risk, particularly during times of market volatility. For example, a stock with a high beta during a bull market may not necessarily have the same level of systematic risk during a bear market. Additionally, beta only captures one aspect of systematic risk, namely the covariance with the market. It does not take into account other factors that can affect systematic risk, such as liquidity risk or credit risk. Furthermore, beta can be influenced by the specific market index used to calculate it, which can lead to inconsistent results. The question of does beta measure systematic risk is an important one, and understanding its limitations is crucial for investors who want to get an accurate picture of their portfolio’s risk profile. By recognizing the limitations of beta, investors can use it in conjunction with other metrics to get a more comprehensive understanding of systematic risk.

Alternative Measures of Systematic Risk: A Comparative Analysis

In addition to beta, there are other measures of systematic risk that investors can use to gain a more comprehensive understanding of their portfolio’s risk profile. Two such measures are value-at-risk (VaR) and expected shortfall (ES). VaR measures the potential loss of a portfolio over a specific time horizon with a given probability, while ES measures the expected loss of a portfolio in the worst α% of cases. Both VaR and ES provide a more nuanced view of systematic risk than beta, as they take into account the entire distribution of potential returns, rather than just the volatility of the market. However, they also have their own limitations, such as requiring large amounts of historical data and being sensitive to model assumptions. In contrast, beta is a simpler and more widely used measure of systematic risk, but it does not capture the tail risks that VaR and ES are designed to measure. The question of does beta measure systematic risk is an important one, and understanding the strengths and weaknesses of alternative measures can help investors choose the most appropriate metric for their needs. By using a combination of beta, VaR, and ES, investors can gain a more complete understanding of their portfolio’s systematic risk and make more informed investment decisions.

Real-World Applications of Beta in Portfolio Management

Beta plays a crucial role in portfolio management, as it helps investors assess the systematic risk of their investments and make informed decisions. One of the primary applications of beta is in risk assessment, where it is used to evaluate the potential volatility of a portfolio. By analyzing the beta of individual securities or asset classes, investors can identify areas of high risk and adjust their portfolios accordingly. Beta is also used in asset allocation, where it helps investors determine the optimal mix of assets to achieve their desired level of risk and return. For example, an investor with a high-risk tolerance may choose to allocate a larger portion of their portfolio to high-beta stocks, while an investor with a low-risk tolerance may opt for low-beta bonds. Additionally, beta is used in performance evaluation, where it helps investors assess the risk-adjusted returns of their portfolio. By comparing the beta of their portfolio to that of a benchmark, investors can determine whether their returns are commensurate with the level of risk they are taking. The question of does beta measure systematic risk is an important one, and understanding its real-world applications can help investors make more informed decisions. By incorporating beta into their portfolio management strategy, investors can better navigate the complexities of systematic risk and achieve their investment goals.

Common Misconceptions About Beta and Systematic Risk

Despite its widespread use, beta is often misunderstood, leading to misconceptions about its role in measuring systematic risk. One common misconception is that beta is a perfect measure of risk, capturing all aspects of systematic risk. However, as discussed earlier, beta has limitations, such as its sensitivity to market conditions and potential for misestimation. Another misconception is that beta is only relevant for individual stocks, when in fact, it can be applied to portfolios and even entire asset classes. Additionally, some investors believe that a low-beta portfolio is inherently safe, neglecting the fact that beta only measures systematic risk, not idiosyncratic risk. Furthermore, the question of does beta measure systematic risk is often oversimplified, as beta is just one component of systematic risk measurement. By understanding these misconceptions, investors can avoid common pitfalls and use beta more effectively in their portfolio management strategy. By recognizing the strengths and limitations of beta, investors can make more informed decisions and better navigate the complexities of systematic risk.

Conclusion: The Role of Beta in Measuring Systematic Risk

In conclusion, beta plays a crucial role in measuring systematic risk, but it is essential to understand its limitations and nuances. By recognizing the importance of systematic risk and its impact on investment portfolios, investors can better navigate the complexities of the market. The question of does beta measure systematic risk is a critical one, and understanding the answer is vital for making informed investment decisions. While beta is a valuable tool, it is not a perfect measure of risk, and alternative measures such as VaR and ES can provide a more comprehensive understanding of systematic risk. By incorporating beta into their portfolio management strategy, investors can make more informed decisions, mitigate risk, and ultimately achieve their investment goals. Ultimately, a deep understanding of beta and its role in measuring systematic risk is essential for investors seeking to optimize their portfolios and achieve long-term success.