Introduction to Discounted Cash Flow Analysis in Excel

Discounted cash flow (DCF) analysis is a fundamental tool in finance. It determines the present value of future cash flows. This method is crucial for various financial decisions. These include investment appraisals, business planning, and mergers and acquisitions. A discounted cash flow in excel model offers significant advantages. Excel’s flexibility and accessibility make it ideal for complex calculations. The software handles the intricate mathematics involved in discounted cash flow analysis. Users can easily adapt spreadsheets to specific needs. This adaptability makes Excel a powerful tool for financial modeling. The discounted cash flow in excel approach provides a robust and transparent valuation method. This allows for a thorough understanding of the underlying assumptions and calculations.

Many professionals utilize discounted cash flow analysis. They rely on this method for making informed decisions. Understanding the present value of future cash flows is key. This understanding is vital across various sectors. Real estate, private equity, and corporate finance all benefit from DCF. The ability to project future cash flows is essential. This projection allows for a more informed view of investment potential. The discounted cash flow in excel process improves efficiency. It streamlines the valuation process, reducing time and effort. The accessibility of Excel makes DCF modeling achievable for a wider audience. This promotes better financial literacy and decision-making. This detailed approach allows for a more nuanced understanding of the value of an asset or business. It goes beyond simple market valuations, offering a deeper insight into future profitability.

Building a discounted cash flow in excel model requires careful planning. Accurate projections are critical for reliable valuations. The process involves several key steps. These include forecasting free cash flows, determining the discount rate, and calculating the terminal value. Each step plays a vital role in achieving an accurate final valuation. Understanding these components and their interdependencies is essential. This understanding ensures the model’s reliability and usefulness. Excel’s built-in functions simplify the process. These functions provide users with tools to manage calculations effectively. This software allows for efficient and accurate DCF modeling. The iterative nature of DCF analysis in Excel benefits users. It encourages careful review and adjustment of assumptions. This iterative process results in a more refined and accurate valuation.

Understanding the Fundamentals: Key Components of a DCF Model

A discounted cash flow (DCF) model in Excel relies on three core components: projecting free cash flows (FCF), determining the weighted average cost of capital (WACC), and calculating the terminal value. Free cash flow represents the cash a company generates after covering all operating expenses and capital expenditures. Accurately projecting FCF is crucial for a reliable discounted cash flow in excel analysis. The WACC, on the other hand, serves as the discount rate, reflecting the company’s cost of financing. It incorporates the cost of equity and the cost of debt, weighted by their respective proportions in the company’s capital structure. The terminal value estimates the present value of all cash flows beyond the explicit forecast period, a critical element in discounted cash flow in excel valuation.

The interdependency of these components is significant. Inaccurate FCF projections directly impact the final valuation. Similarly, an incorrect WACC leads to flawed discounting, affecting the present value calculation. The terminal value, often a substantial portion of the total valuation in a discounted cash flow in excel model, relies heavily on accurate FCF projections and a well-defined growth rate or exit multiple. Mastering each component is key to building a robust discounted cash flow in excel model. Understanding their interplay allows for a more comprehensive and reliable valuation. The discounted cash flow in excel method is sensitive to changes in any of these inputs.

Building a discounted cash flow in excel model requires a clear understanding of these fundamental building blocks. Each component influences the final valuation, highlighting the importance of accurate calculations and realistic assumptions. The discounted cash flow in excel process necessitates attention to detail throughout, from projecting free cash flows to calculating the terminal value. A thorough grasp of the underlying principles and the interrelationships between the components ensures the creation of a reliable and insightful discounted cash flow in excel valuation.

Projecting Free Cash Flows: A Step-by-Step Approach for Discounted Cash Flow in Excel

Forecasting free cash flows (FCF) is a crucial step in discounted cash flow (DCF) analysis. Accurate FCF projections are the foundation of a reliable valuation. Several methods exist for projecting FCFs, each with its strengths and weaknesses. One common approach uses historical financial statements as a starting point. Analysts can identify trends in revenue, expenses, and working capital. These trends inform future projections. This historical approach is best suited for mature, stable companies with a predictable pattern of cash flows. However, it may not be suitable for rapidly growing companies or those experiencing significant operational changes. Remember, the goal is to create realistic and well-supported projections to use in your discounted cash flow in excel model.

Alternatively, industry benchmarks can provide valuable insights for projecting FCFs, especially for companies lacking a long historical track record. By comparing a company’s key performance indicators (KPIs) to those of its competitors, analysts can identify reasonable growth rates and margins. This comparative approach is particularly useful when forecasting FCFs for new ventures or companies undergoing a transformation. However, relying solely on industry benchmarks may overlook company-specific factors. Therefore, combining benchmark data with internal company projections offers a more comprehensive and accurate forecasting approach in your discounted cash flow in excel model. Remember to meticulously document all assumptions and their rationale to ensure transparency and reproducibility.

Building your discounted cash flow in excel model requires careful consideration of various factors influencing FCF. Capital expenditures (CAPEX) and changes in working capital (NWC) significantly impact a company’s cash flow. Forecasting CAPEX involves estimating investments in property, plant, and equipment (PP&E). This requires considering planned expansion, upgrades, and replacements. Similarly, projecting NWC changes involves forecasting variations in accounts receivable, accounts payable, and inventory. These projections should reflect expected sales growth and operational efficiency improvements. Excel’s functionalities simplify the incorporation of these elements. Formulas and data tables facilitate the calculation of FCF based on the projected revenue, expenses, CAPEX, and NWC changes. This structured approach enhances the clarity and accuracy of your discounted cash flow in excel model. Moreover, incorporating sensitivity analysis allows for evaluating the impact of varying assumptions on the final valuation. The goal is to produce robust and reliable projections that accurately reflect the underlying financial realities of the company.

Calculating the Weighted Average Cost of Capital (WACC)

The weighted average cost of capital (WACC) is a crucial component of discounted cash flow (DCF) analysis in Excel. It represents the average rate a company expects to pay to finance its assets. This rate is used to discount future cash flows back to their present value, providing a more accurate valuation. Calculating the WACC involves determining the cost of equity, the cost of debt, and the company’s capital structure (the proportion of debt and equity financing).

The cost of equity reflects the return investors require for investing in the company’s stock. The Capital Asset Pricing Model (CAPM) is a common method for estimating the cost of equity. The CAPM formula uses the risk-free rate, the market risk premium, and the company’s beta (a measure of systematic risk). The cost of debt represents the interest rate a company pays on its debt obligations. This can be found by examining the company’s financial statements or credit ratings. The capital structure is determined by dividing the market value of equity by the total market value of equity and debt. In Excel, these components can be easily calculated using simple formulas, making the process efficient and transparent. A precise WACC calculation is critical for achieving an accurate discounted cash flow in Excel valuation.

Once the cost of equity, cost of debt, and capital structure are determined, the WACC can be calculated using a weighted average formula. This formula considers the proportion of each financing source in the company’s capital structure. For example, if a company has 60% equity and 40% debt, the WACC would be a weighted average of the cost of equity and cost of debt, reflecting this proportion. Excel’s functionality simplifies these calculations, enabling users to create a dynamic WACC calculation that automatically updates when input values change. Accurate calculation of WACC within the discounted cash flow in Excel model is fundamental for a reliable valuation. Users should ensure the accuracy of all inputs to obtain a meaningful result. Understanding the nuances of WACC and its correct application within the discounted cash flow in Excel framework is essential for financial modeling accuracy.

Determining the Terminal Value: Methods and Considerations

The terminal value in a discounted cash flow in excel model represents the present value of all cash flows beyond the explicit forecast period. Accurately estimating this value is crucial for a reliable valuation. Two primary methods exist: the perpetuity growth method and the exit multiple method. The perpetuity growth method assumes a constant growth rate of free cash flows beyond the forecast horizon. This growth rate should reflect sustainable long-term growth, typically lower than the nominal GDP growth rate. The formula for calculating terminal value using this method is: Terminal Value = FCFn+1 / (WACC – g), where FCFn+1 is the free cash flow in the final year of the explicit forecast, WACC is the weighted average cost of capital, and g is the perpetual growth rate. This method is suitable when the business is expected to continue operations indefinitely with stable growth.

Alternatively, the exit multiple method values the company at the end of the forecast period based on a multiple of a relevant financial metric, such as EBITDA or revenue. This multiple is usually derived from comparable company transactions or market multiples. The terminal value is calculated by multiplying the chosen metric in the final forecast year by the chosen multiple. The exit multiple method is particularly useful when reliable long-term growth forecasts are unavailable or when a company is expected to be acquired or liquidated at the end of the forecast period. Selecting the appropriate method depends on the specific circumstances of the company and the availability of data. Sensitivity analysis should be conducted using both methods to assess the impact on the final discounted cash flow in excel valuation.

Regardless of the method chosen, careful consideration must be given to the assumptions underpinning the terminal value calculation. The chosen growth rate or exit multiple significantly impacts the overall valuation. Using conservative and well-supported assumptions is crucial for a robust discounted cash flow in excel model. A sensitivity analysis exploring a range of growth rates or exit multiples will provide insights into the valuation’s sensitivity to these key assumptions. This analysis helps assess the valuation’s robustness and informs decision-making by revealing the potential range of outcomes given different scenarios. By thoroughly addressing these aspects, analysts can strengthen the reliability and insights derived from their discounted cash flow in excel analysis.

How to Build a Discounted Cash Flow Model in Excel: A Practical Tutorial

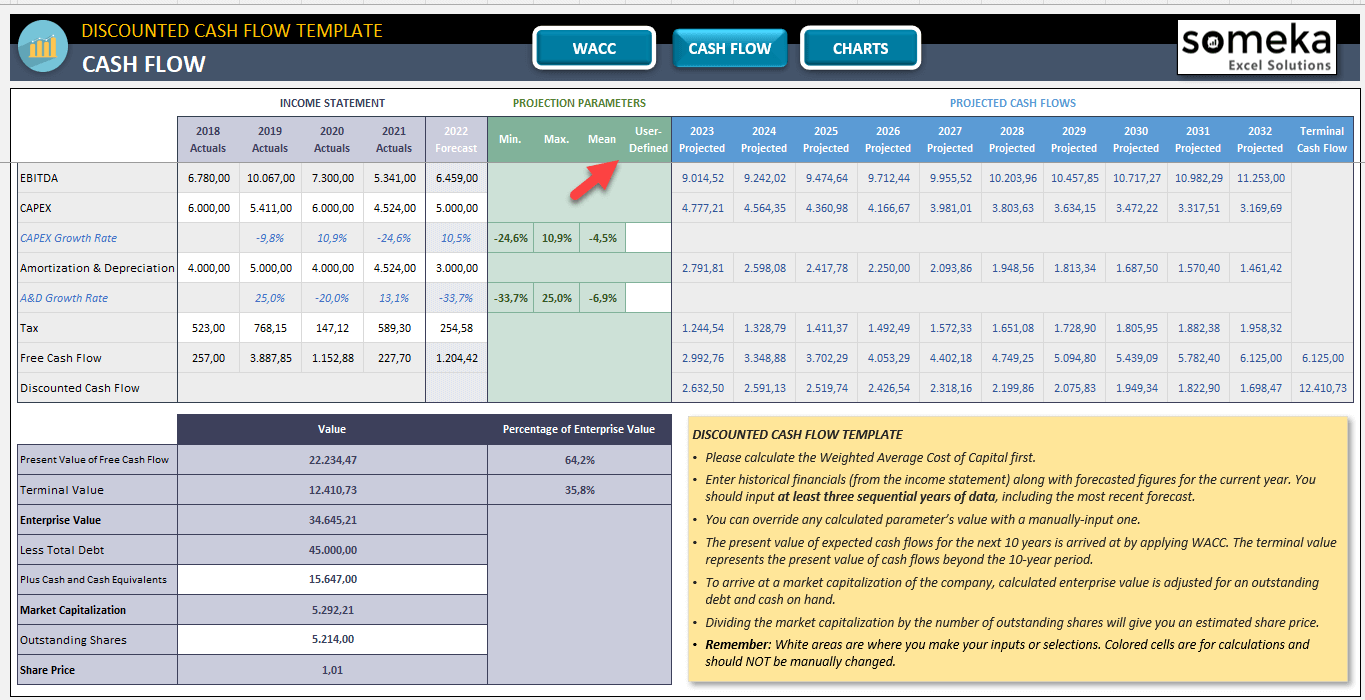

This section provides a step-by-step guide to building a discounted cash flow (DCF) model in Excel. Begin by creating a clear and organized spreadsheet. Separate sections will house projected free cash flows, the calculation of the weighted average cost of capital (WACC), and the terminal value. Use clear labels for each cell and section to ensure readability and understanding. Remember, a well-structured discounted cash flow in excel model is crucial for accuracy and ease of interpretation. This process will make the discounted cash flow in excel analysis significantly easier.

Next, input your projected free cash flows. This involves forecasting future cash flows for a specific period, typically 5-10 years. Utilize historical data, industry benchmarks, or company-specific projections to inform these forecasts. Account for factors like revenue growth, operating expenses, capital expenditures, and changes in working capital. The accuracy of these projections significantly impacts the final discounted cash flow in excel valuation. Once you have projected the free cash flows, you’ll need to calculate the WACC. This involves determining the cost of equity and the cost of debt, weighting them according to the company’s capital structure. Excel formulas, such as the CAPM model for the cost of equity, simplify this calculation. Using these steps, you build your discounted cash flow in excel model.

Finally, calculate the terminal value, which represents the value of all cash flows beyond the explicit forecast period. You can employ either the perpetuity growth method or the exit multiple method. Select the most appropriate method based on the specific characteristics of the company and its industry. Once the terminal value is determined, discount all cash flows (including the terminal value) back to their present value using the calculated WACC. The sum of these present values represents the company’s estimated intrinsic value according to your discounted cash flow in excel model. This entire process of building a discounted cash flow in excel model should be thoroughly documented and easily understood by others. Clearly labeling each step and input will enhance the overall quality and usability of your discounted cash flow in excel model. Remember to regularly review and update your model to reflect changes in the company’s performance and market conditions. A well-maintained discounted cash flow in excel model is a valuable tool for financial analysis.

Sensitivity Analysis and Scenario Planning: Assessing Risk in Discounted Cash Flow in Excel

Sensitivity analysis is crucial for understanding how variations in key assumptions influence a discounted cash flow (DCF) model’s valuation. This process involves systematically changing one input variable at a time—such as the discount rate, revenue growth rate, or terminal growth rate—while holding other variables constant. Excel’s data tables make this straightforward. By observing the resulting changes in the final valuation, one can identify the most influential assumptions and assess the model’s vulnerability to estimation errors. This helps in making more informed investment decisions, especially when dealing with inherent uncertainties in future cash flows. A well-structured sensitivity analysis enhances the credibility and reliability of the discounted cash flow in excel model. The results should be presented visually, perhaps using charts to showcase the impact of different variables on the valuation.

Scenario planning complements sensitivity analysis by exploring multiple, integrated combinations of input variables. Instead of changing inputs individually, scenario planning creates different plausible scenarios (e.g., best-case, base-case, worst-case) representing various economic conditions or company performance levels. Each scenario uses a consistent set of assumptions across all input variables. This approach allows for a more holistic assessment of risk than sensitivity analysis alone. For example, a pessimistic scenario might incorporate lower revenue growth, higher discount rates, and reduced terminal values, reflecting a more challenging market environment. Excel’s “what-if” analysis tools, such as Goal Seek and Data Tables, are invaluable in quickly evaluating these different scenarios and their impact on the final discounted cash flow in excel valuation. This provides a comprehensive understanding of the potential range of outcomes and allows for better risk management.

By combining sensitivity analysis and scenario planning within a discounted cash flow in excel model, users gain a more robust understanding of the valuation’s sensitivity to underlying assumptions and uncertainties. This rigorous approach reduces reliance on a single-point estimate, instead presenting a range of possible values that reflect the inherent uncertainty in forecasting future cash flows. The discounted cash flow in excel model becomes a more powerful and reliable tool for financial decision-making when enhanced with these risk assessment techniques. The results from these analyses significantly aid in informing more reasoned and robust investment decisions, highlighting the critical role of these methods in financial modeling.

Interpreting Your Results and Making Informed Decisions

The final step in a discounted cash flow in excel analysis involves carefully interpreting the results and using them to make sound investment decisions. The calculated intrinsic value from your discounted cash flow in excel model represents the estimated present value of the company’s future cash flows. Compare this value to the current market price or acquisition cost. A value exceeding the market price suggests the asset might be undervalued, presenting a potentially attractive investment opportunity. Conversely, a value lower than the market price indicates a possible overvaluation, suggesting caution. Remember, the discounted cash flow in excel model provides a quantitative estimate. Qualitative factors, including management quality, competitive landscape, and industry trends, should also inform decision-making. A thorough analysis considers both quantitative and qualitative aspects.

Understanding the limitations of discounted cash flow in excel models is crucial for accurate interpretation. The accuracy of the valuation hinges on the reliability of the input assumptions, including growth rates, discount rates, and cash flow projections. Inaccurate or overly optimistic assumptions can significantly skew the results. Sensitivity analysis helps mitigate this risk by examining the impact of varying these assumptions. Scenario planning explores various potential outcomes by considering different sets of inputs. This process allows for a more robust and nuanced understanding of the valuation, and reduces the reliance on a single point estimate from the discounted cash flow in excel model. Using this method helps make better informed and less risky financial choices.

Presenting the findings from your discounted cash flow in excel analysis requires clarity and conciseness. Summarize the key assumptions, calculations, and results in a clear and understandable manner. Visual aids, such as charts and graphs, enhance the presentation and aid comprehension. Highlight the key drivers of the valuation and any potential areas of uncertainty. This clear and well-organized presentation allows stakeholders to readily grasp the implications of the analysis and participate effectively in decision-making processes regarding the discounted cash flow in excel valuation. This approach fosters transparency and builds confidence in the conclusions drawn.

https://www.youtube.com/watch?v=gLULdxrS-CU