What is a Cryptocurrency Trading Bot? A Brief Overview

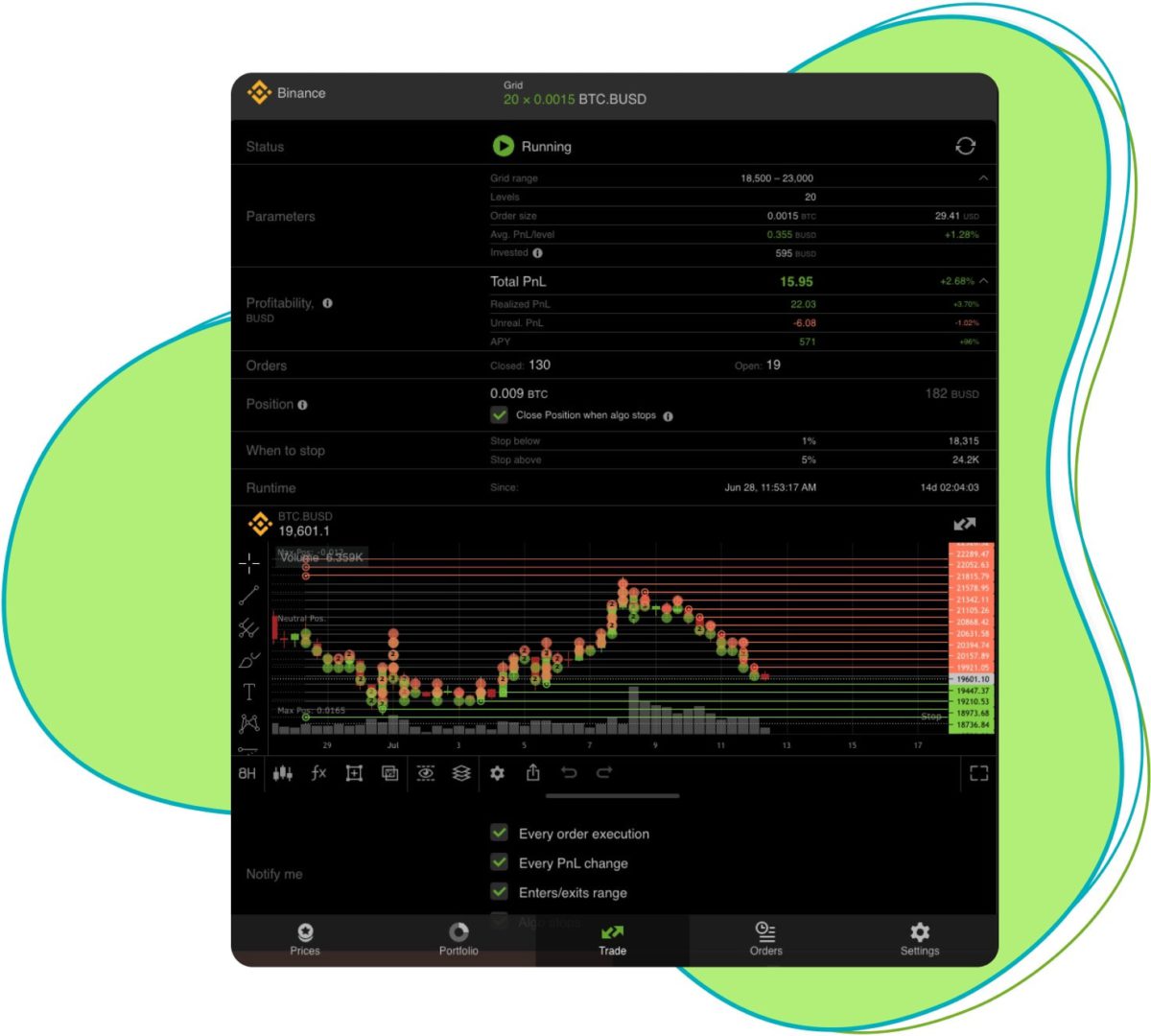

Cryptocurrency trading bots are computer programs designed to execute trades autonomously on digital currency exchanges like Binance. By leveraging predefined algorithms, these automated tools analyze market trends, assess risks, and capitalize on opportunities around the clock more efficiently than human traders. The primary objective of employing such bots revolves around maximizing profits while minimizing emotional biases and manual intervention.

Automated trading solutions have gained significant popularity due to their ability to process vast amounts of historical price data at unprecedented speeds. As a result, they enable investors to identify patterns unrecognizable through traditional analytic techniques. Moreover, incorporating well-designed code samples into your Binance trading bot strategy can lead to substantial financial gains provided you follow best practices and remain vigilant against emerging threats.

Why Use Code Samples? Advantages and Applications

Incorporating code samples into your Binance trading bot arsenal offers numerous benefits, particularly for those seeking an expedited yet cost-effective solution. Some key advantages include:

- Reduced Development Time: Utilizing pre-built components enables developers to construct robust trading systems swiftly, allowing them to focus on refining strategy logic instead of foundational architecture.

- Lower Costs: Leveraging code samples significantly cuts down on labor expenses associated with crafting bespoke software from scratch. Furthermore, open-source libraries often come free of charge, further reducing overhead costs.

- Accessibility: Many code sample providers cater to varying skill levels, ensuring that beginners can still harness powerful automation capabilities despite limited programming expertise.

Beyond saving time and money, code samples serve diverse purposes across multiple trading scenarios. For instance, they facilitate rapid prototyping during early stages of project conception, aid in troubleshooting complex issues, and help keep abreast of evolving industry standards. More importantly, integrating quality code samples can elevate overall performance, thereby enhancing profitability prospects for your Binance trading bot endeavors.

When selecting code samples, prioritize options characterized by strong credibility, active community support, and extensive customization features. Reputable sources typically undergo rigorous vetting procedures, ensuring that each component meets stringent quality criteria before release. Meanwhile, thriving communities foster collaborative learning environments where users exchange ideas, report bugs, and suggest enhancements – all instrumental towards honing your bot’s competitive edge. Lastly, adaptable code samples grant greater flexibility in aligning functionalities with specific strategic goals, thus empowering you to distinguish your offerings amidst saturated markets.

Popular Code Sample Sources for Building Profitable Binance Trading Bots

To fully leverage the power of , it’s crucial to rely on trustworthy repositories showcasing top-notch implementations. Here are some popular choices known for their credibility, community support, and customizable offerings:

- GitHub: As one of the largest online hubs for version control and collaboration, GitHub hosts countless projects centered around crypto trading bots. Users benefit from extensive documentation, vibrant Q&A sections, and ample opportunities to learn from experienced programmers.

- Binance Developer Community: Directly affiliated with the platform itself, this resource provides official APIs, SDKs, and tutorials designed specifically for Binance traders. Access detailed guides covering everything from basic order placements to advanced margin trading techniques.

- CryptoTrader: An established name among algorithmic traders, CryptoTrader boasts cloud-based solutions compatible with major exchanges, including Binance. Its visual scripting interface simplifies bot creation even for coding novices, making it a great starting point for experimentation.

Each source brings unique strengths to the table, so carefully assess which option(s) suit your needs best. Factors such as ease-of-use, available feature sets, and compatibility with external tools should factor heavily into your decision-making process. Ultimately, combining insights gleaned from multiple sources will yield more well-rounded results than relying solely on any single repository.

Implementing Code Samples into Your Current Binance Trading Bot

To seamlessly integrate downloaded code samples into your active Binance trading bot, follow these straightforward steps designed for both novice and experienced developers alike.

- Choose Compatible Code Snippets: Select well-matched code examples suited to complement your existing project’s objectives and design structure. Consider factors such as programming language, library dependencies, and functional requirements.

- Isolate Testing Environment: Set up separate testing areas disconnected from live systems to safely experiment with imported code samples. Leveraging virtual environments, isolated containers, or unique devices ensures minimal disturbance to ongoing activities.

- Individually Validate New Elements: Independently assess each added code sample before combining it with your core solution. Early detection and correction of discrepancies prevent unnecessary complications.

- Incrementally Integrate: Gradually blend validated components into your principal framework, meticulously observing interactions throughout the process. Sequential incorporation simplifies problem identification.

- Document Every Change: Record all modifications along with justifications, fostering clear understanding and traceability. Thorough documentation supports efficient troubleshooting and continuous optimization efforts.

- Test Overall System Functionality: After consolidation, rigorously examine complete functionality encompassing diverse scenarios. Confirm proper operation amidst variable market circumstances, assorted crypto assets, and dynamic price fluctuations.

- Monitor Post-Deployment Activity: Persistently supervise updated trading bot behavior post-implementation. Remain attentive towards emerging issues, consistently calibrating code samples responsive to evolving market influences.

By judiciously applying these recommended procedures, effectively insert externally sourced code samples into flourishing Binance trading bots. Capitalizing on shared insights significantly condenses preliminary setup phases relative to entirely self-developed alternatives.

Evaluating Performance: Metrics to Measure Success with Code Samples to Profit with Binance Trading Bot

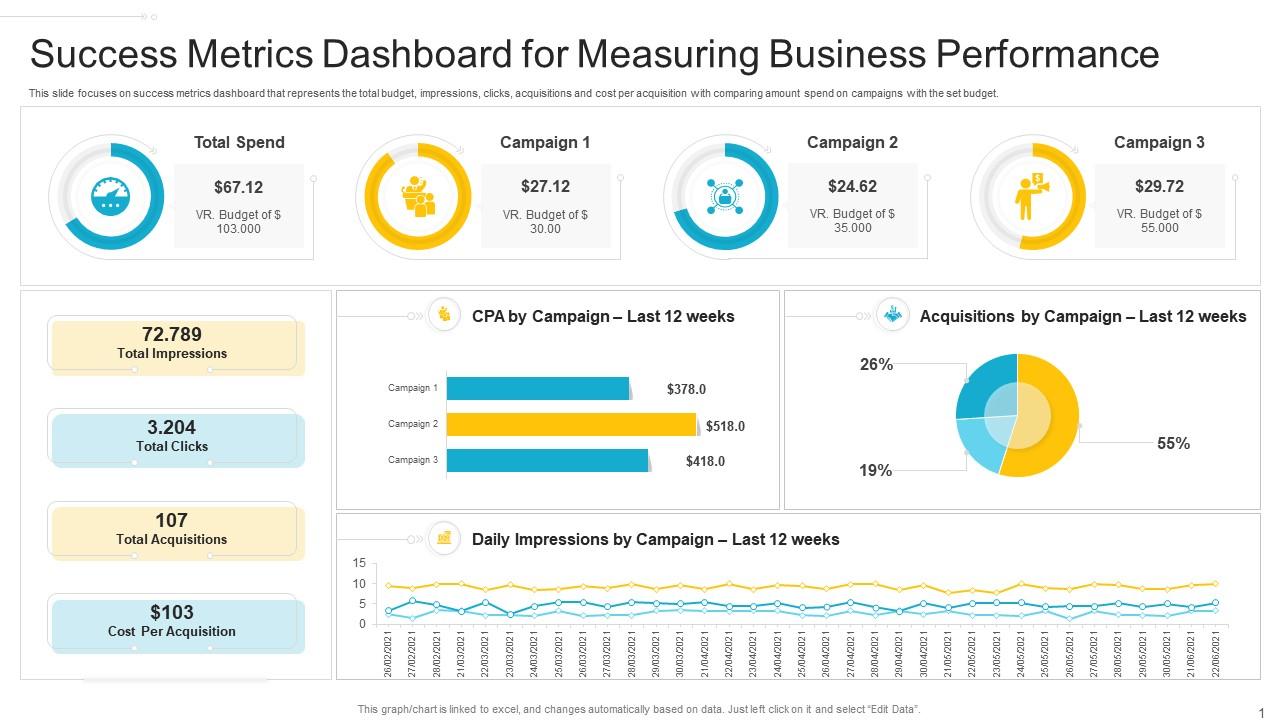

When implementing code samples to enhance your Binance trading bot’s profitability, it is crucial to measure its success effectively. Various quantitative measures, known as financial metrics, help assess the performance of your trading strategy. Here are some key performance indicators (KPIs) to monitor:

- Return on Investment (ROI): ROI calculates the net gain from an investment divided by its cost. It provides insight into the overall efficiency of your trading strategy. For example, if you invest $1,000 and earn $1,500, your ROI would be 50%. However, keep in mind that higher ROI does not always mean better performance, especially over shorter periods.

- Risk-Adjusted Returns: Risk-adjusted returns account for volatility and enable comparison of different investments’ performances consistently. Commonly used measurements include Sharpe ratio, Sortino ratio, and Modigliani ratio. By incorporating risk into your evaluation process, you obtain a more holistic view of your trading bot’s efficacy.

- Drawdown Rate: Drawdown rate refers to the maximum peak-to-trough decline during a specific period. Lower drawdown rates indicate less severe declines in capital, which translates to greater stability. Monitoring drawdown rates helps identify potential issues in your trading strategy and highlights areas requiring improvement.

By tracking these KPIs, you will have a clear understanding of whether your incorporated code samples contribute positively towards enhancing your Binance trading bot’s profitability. Remember that no single metric offers complete information; thus, evaluating multiple dimensions ensures a thorough assessment of your trading strategy’s performance.

Fine-Tuning Your Strategy: Adapting Code Samples for Enhanced Results with Code Samples to Profit with Binance Trading Bot

Once you successfully implement code samples into your Binance trading bot, fine-tuning becomes essential to maximize profits further. Fine-tuning involves modifying certain parameters according to personal preference and prevailing market conditions. Some elements worth considering include:

- Trade Frequency: Alter the number of daily or weekly trades executed by your bot. Increasing trade frequency might lead to higher transaction fees but potentially larger gains too. Balancing this parameter depends on your risk tolerance and desired outcomes.

- Position Sizing: Manage risks associated with each trade through strategic position sizing. You can set fixed lot sizes or use dynamic approaches tied to available funds or portfolio size. Proper position sizing reduces exposure to significant losses due to extreme price movements.

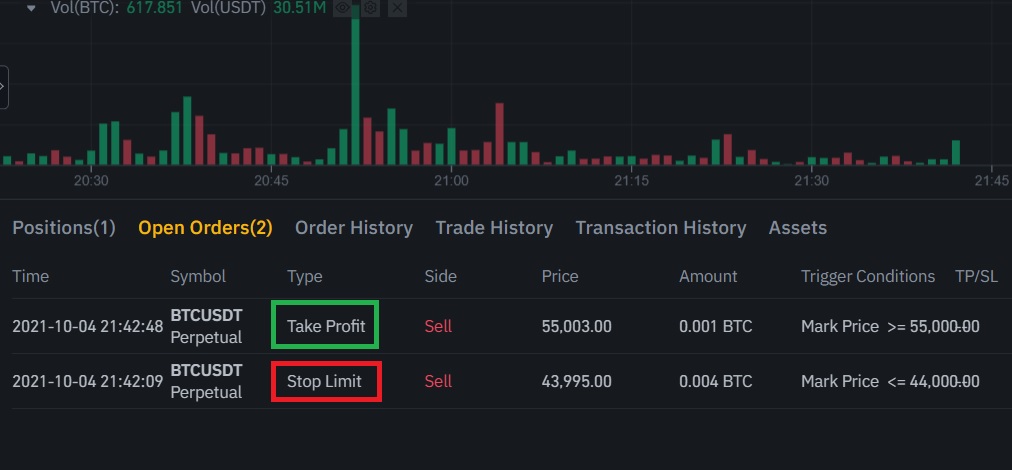

- Stop Losses & Take Profits: Set appropriate levels for automatic exit points—stop losses limit potential losses, whereas take profits lock in realized gains. Customizable stop loss and take profit settings allow you to balance risk against reward, ensuring optimal results under varying market scenarios.

Regularly analyzing your trading bot’s performance and making necessary tweaks keeps your strategy fresh and relevant amid changing market dynamics. Leveraging code samples enables quick adaptation, allowing you to respond swiftly to emerging opportunities or threats.

Staying Updated: Keeping Your Code Samples Relevant Amid Market Changes with Code Samples to Profit with Binance Trading Bot

In an ever-evolving landscape like cryptocurrency trading, staying updated about market trends and regulatory changes significantly impacts your success. Regularly monitoring industry news helps ensure your chosen code samples remain effective and compliant within the broader ecosystem. Here are some ways to keep yourself well-informed:

- Follow Reputable News Outlets: Stay subscribed to reliable crypto news websites, blogs, podcasts, or social media accounts covering major developments across exchanges, regulations, and technologies.

- Participate in Online Communities: Engage with fellow traders and developers via online forums, discussion boards, or chat groups dedicated to Binance trading bots and algorithmic trading techniques. Shared experiences help identify new insights and adaptive measures.

- Set Google Alerts: Monitor specific keywords related to your trading strategy or preferred assets. By setting up alerts, you receive timely notifications whenever there’s a notable update, helping you react promptly if required.

By incorporating these habits into your routine, you proactively address shifting variables affecting your Binance trading bot’s performance. Continuous improvement ensures sustained growth and resilience even during volatile periods.

Security Best Practices When Using Code Samples for Binance Trading Bots

When employing code samples for your Binance trading bot, it’s crucial to prioritize security alongside optimization efforts. Taking adequate precautions minimizes risks associated with unauthorized access, data breaches, and operational disruptions. Consider implementing the following best practices:

- Secure Storage of API Keys: Store sensitive information, such as Binance API keys, in encrypted form and limit exposure by restricting access only to necessary functions. Utilize environment variables or specialized vault services designed for storing secrets safely.

- Regular System Backups: Schedule periodic backups of your trading bot configuration, settings, and historical data. Storing multiple copies at geographically dispersed locations adds redundancy and facilitates quick recovery from unexpected failures or ransomware attacks.

- Maintaining Up-to-Date Software Versions: Periodically check for updates to programming languages, libraries, frameworks, and operating systems utilized by your Binance trading bot. Timely patch application reduces vulnerabilities exploited by cybercriminals targeting outdated components.

- Monitor Access Logs: Track all login attempts, successful or otherwise, along with other critical actions performed by your trading bot. Analyzing logs regularly enables early detection of suspicious activities, enabling swift countermeasures before significant damage occurs.

Adherence to these security principles fortifies your overall defense posture, ensuring longevity and trustworthiness for your code samples to profit with Binance trading bot endeavors. Remember, vigilance remains paramount in safeguarding valuable digital assets against evolving threats lurking in cyberspace.