How to Determine Sharpe Ratio Using Spreadsheet Software

The Sharpe Ratio stands as a cornerstone metric in investment analysis, offering a clear view of risk-adjusted return. It quantifies how much excess return an investor receives for taking on additional risk. A higher Sharpe Ratio suggests better risk-adjusted performance. This makes it a valuable tool for both individual investors and professional portfolio managers when evaluating potential investments. The ability to calculate Sharpe Ratio in Excel provides a readily accessible and convenient way to assess investment performance. Spreadsheet software eliminates the need for complex programming or specialized financial software. This accessibility empowers users to quickly analyze and compare different investment options.

The power of the Sharpe Ratio lies in its simplicity and its ability to provide a standardized measure for comparing investments with varying levels of risk. Investors can use it to evaluate mutual funds, stocks, or even entire portfolios. By factoring in the risk-free rate, the Sharpe Ratio reflects the incremental reward earned above the return that could be achieved with a risk-free investment. Ultimately, learning to calculate Sharpe Ratio in Excel allows for informed decision-making and optimized portfolio construction. It enables a deeper understanding of the trade-off between risk and return, leading to better investment outcomes.

One of the significant advantages of using spreadsheet software to calculate Sharpe Ratio in Excel is the flexibility it offers. Users can easily modify inputs, experiment with different scenarios, and visualize the impact of various factors on the Sharpe Ratio. This hands-on approach fosters a greater understanding of the underlying principles and assumptions. Furthermore, spreadsheet calculations are transparent and auditable, allowing for greater confidence in the results. By leveraging the power of spreadsheets, investors can gain valuable insights into investment performance and make more informed decisions aligned with their risk tolerance and financial goals.

Understanding the Components Needed for Sharpe Ratio Calculation

To calculate Sharpe Ratio in Excel, one must first understand its components. The Sharpe Ratio is calculated using a straightforward formula: (Asset Return – Risk-Free Rate) / Standard Deviation of Asset Return. Each of these elements plays a crucial role in determining the risk-adjusted return of an investment.

The asset return represents the total return received from an investment over a specific period. This data can be sourced from historical stock prices, mutual fund performance reports, or other investment records. To calculate Sharpe Ratio in Excel accurately, ensure the asset return data is precise and covers a relevant timeframe. The risk-free rate is the rate of return on an investment with zero risk, often proxied by the return on U.S. Treasury bills. This rate is readily available from government websites and financial data providers. Matching the timeframe of the risk-free rate to that of the asset return is critical for accurate calculation. For instance, if asset returns are calculated annually, the annual risk-free rate should be used. The standard deviation measures the volatility or risk associated with the asset’s returns. It quantifies the dispersion of returns around the average return. Higher standard deviation indicates greater volatility and, consequently, higher risk. Spreadsheet software, like Excel, offers built-in functions to calculate Sharpe Ratio in Excel and the standard deviation, making the process more efficient.

The integrity of the data used to calculate Sharpe Ratio in Excel is paramount. Inaccurate or incomplete data will lead to a skewed Sharpe Ratio, potentially misleading investment decisions. Therefore, verifying the source and accuracy of historical prices, risk-free rates, and return calculations is an essential step in conducting a meaningful Sharpe Ratio analysis. Investors can then confidently calculate Sharpe Ratio in Excel by understanding these elements and gathering the necessary data to assess investment performance effectively.

Setting Up Your Spreadsheet for Sharpe Ratio Analysis

To effectively calculate sharpe ratio in excel, a well-organized spreadsheet is essential. Start by opening a new spreadsheet in Excel or your preferred spreadsheet software. The initial setup involves creating column headers that will house the necessary data for the Sharpe Ratio calculation. These columns should include “Date,” “Asset Price,” “Asset Return,” and “Risk-Free Rate.” The “Date” column will chronologically list the dates corresponding to the asset prices and risk-free rates. Format this column appropriately to display dates accurately. The “Asset Price” column will contain the historical prices of the asset you are analyzing. Ensure that the prices are entered accurately and consistently. The “Asset Return” column will be used to calculate the periodic returns based on the asset prices. The “Risk-Free Rate” column will hold the corresponding risk-free rates for each period.

Formatting the spreadsheet can greatly improve clarity and efficiency when you calculate sharpe ratio in excel. Consider using cell formatting options to differentiate the headers from the data. For example, you can apply a different background color or font style to the headers. For the data columns, choose a number format that is appropriate for the data type. For example, format the “Asset Price” column as currency and the “Asset Return” and “Risk-Free Rate” columns as percentages. To streamline data entry, utilize Excel’s auto-fill feature. This feature allows you to quickly populate dates or copy formulas down columns. For instance, if you have a series of consecutive dates, you can enter the first few dates and then use auto-fill to complete the sequence. Similarly, you can enter a formula in the first row of the “Asset Return” column and then use auto-fill to apply the formula to the remaining rows.

Data validation is another valuable Excel feature that can help ensure data accuracy when you calculate sharpe ratio in excel. You can use data validation to restrict the type of data that can be entered into a cell. For example, you can set up data validation to ensure that only numbers are entered into the “Asset Price” column. This can help prevent errors and ensure that your Sharpe Ratio calculation is based on accurate data. By taking the time to set up your spreadsheet carefully and utilizing Excel’s features effectively, you can create a robust and efficient tool for Sharpe Ratio analysis.

Calculating Asset Returns within the Spreadsheet

To accurately calculate the Sharpe Ratio in Excel, determining asset returns from historical prices is a fundamental step. The asset return represents the percentage change in the asset’s price over a specific period. This calculation forms the basis for understanding how well an investment has performed. The standard formula to calculate returns is: (Current Price – Previous Price) / Previous Price. This provides the return for a single period, such as a day, week, or month. To calculate sharpe ratio in excel, you first need a series of asset returns.

Implementing this formula in spreadsheet software is straightforward using cell references. Assuming the historical prices are listed in a column (e.g., column B), with dates in column A, the formula in cell C2 (representing the return for the second period) would be something like: =(B2-B1)/B1. This formula subtracts the previous period’s price (B1) from the current period’s price (B2), then divides the result by the previous period’s price (B1). After entering this formula in C2, you can use the auto-fill feature to quickly apply it to the rest of the column, calculating returns for all periods. Make sure the cells are formatted as percentages for easy interpretation. This allows you to calculate sharpe ratio in excel effectively.

Often, it’s necessary to convert daily returns into annualized returns for a more meaningful Sharpe Ratio calculation. This involves more than simply multiplying the daily return by 365 because it doesn’t account for the effects of compounding. A more accurate approach is to use the following formula: Annualized Return = (1 + Average Daily Return)^365 – 1. First, calculate the average daily return using the AVERAGE function in Excel. Then, apply the annualization formula. This annualized return provides a clearer picture of the asset’s performance over a year, which is crucial when you calculate sharpe ratio in excel. This conversion provides a standardized measure for comparing investments with different frequencies of return data and ensures a more accurate Sharpe Ratio.

Determining the Risk-Free Rate for Accurate Sharpe Ratio

To accurately calculate Sharpe Ratio in Excel, identifying and incorporating the appropriate risk-free rate is critical. The risk-free rate represents the return an investor can expect from an investment with zero risk. A common and widely accepted practice involves using the yield on U.S. Treasury bills as a proxy for the risk-free rate. These bills are backed by the U.S. government and are considered virtually default-free, making them a suitable benchmark.

Sources for obtaining both current and historical U.S. Treasury bill rates are readily available. The U.S. Department of the Treasury website is an authoritative source for this data. Financial websites like Bloomberg and Yahoo Finance also provide historical treasury bill rates. When selecting a risk-free rate, it’s important to choose a maturity that aligns with the investment horizon being analyzed. For instance, if evaluating monthly investment returns, a one-month Treasury bill rate would be most appropriate. To calculate Sharpe Ratio in Excel effectively, the risk-free rate needs to be expressed in the same time period as the asset returns.

Often, the risk-free rate is quoted as an annual percentage. If the asset returns are calculated on a daily or monthly basis, the annual risk-free rate must be adjusted accordingly. For example, to convert an annual risk-free rate to a daily rate, divide the annual rate by the number of trading days in a year (typically around 252). Similarly, to convert an annual rate to a monthly rate, divide by 12. This adjustment ensures consistency in the Sharpe Ratio calculation, leading to a more accurate reflection of risk-adjusted performance. By carefully selecting and adjusting the risk-free rate, you can enhance the precision of your efforts to calculate Sharpe Ratio in Excel.

Calculating Standard Deviation for Risk Assessment in Spreadsheet Software

Understanding the volatility of asset returns is crucial when assessing investment risk. Standard deviation serves as a statistical measure of this volatility, quantifying the dispersion of returns around their average. A higher standard deviation indicates greater volatility, implying a riskier investment. Spreadsheet software, such as Excel, offers built-in functions to easily calculate standard deviation, making it an invaluable tool for risk assessment. To effectively calculate sharpe ratio in excel, this step is essential.

To calculate the standard deviation within a spreadsheet, users can employ either the STDEV.S or STDEV.P function. The choice between these functions depends on whether the data represents a sample or the entire population of possible returns. STDEV.S calculates the sample standard deviation, which is appropriate when the data is a subset of a larger population. Conversely, STDEV.P calculates the population standard deviation, which is used when the data includes all possible returns. The syntax for both functions is straightforward: =STDEV.S(range of return values) or =STDEV.P(range of return values). Ensure the “range of return values” accurately reflects the cells containing the calculated asset returns. For those looking to calculate sharpe ratio in excel, selecting the right standard deviation function is a critical decision.

Once the appropriate standard deviation function is applied, the spreadsheet will display the calculated value. This value represents the volatility of the asset’s returns over the period analyzed. When interpreting this result, remember that a higher standard deviation signifies greater risk. Investors can use this information to compare the risk-adjusted returns of different investments, aiding in portfolio diversification and risk management strategies. Calculating the standard deviation accurately allows you to calculate sharpe ratio in excel effectively, which enhances your ability to make well-informed investment decisions. The ability to calculate sharpe ratio in excel is significantly enhanced through the correct determination of standard deviation.

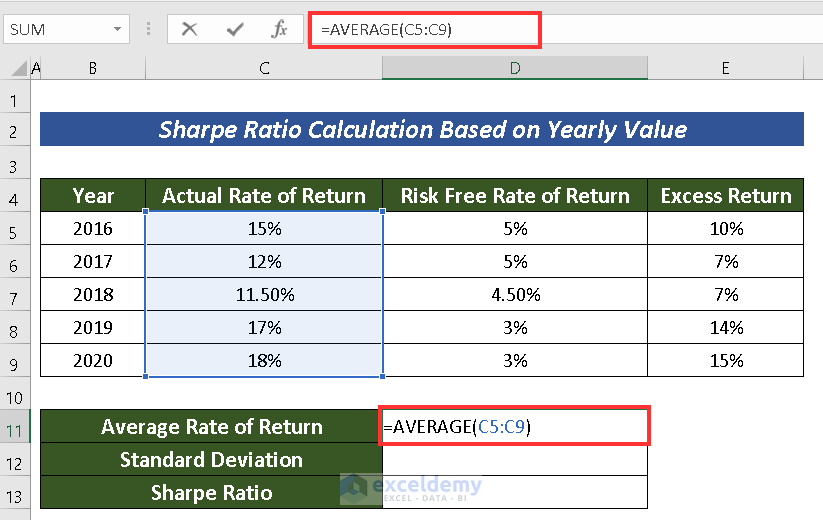

Putting It All Together: Sharpe Ratio Formula Implementation in Spreadsheet Software

Now that all the necessary components have been calculated, it’s time to combine them to calculate sharpe ratio in excel. The Sharpe Ratio is calculated using the following formula: (Asset Return – Risk-Free Rate) / Standard Deviation. In spreadsheet software like Excel, this formula can be directly implemented using cell references. Assuming that the annualized asset return is in cell B10, the annualized risk-free rate is in cell B11, and the standard deviation of asset returns is in cell B12, the formula in Excel would be: =(B10-B11)/B12. This formula subtracts the risk-free rate from the asset return and then divides the result by the standard deviation.

It is important to ensure clear and consistent cell referencing to avoid errors. Double-check that the cell references in the formula correspond to the correct data points in your spreadsheet. A common mistake is to accidentally reference the wrong cell, leading to an inaccurate Sharpe Ratio. When implementing the formula, pay close attention to the order of operations. Spreadsheet software will automatically follow the correct order, but it’s still good practice to be mindful. For instance, the subtraction should occur before the division. To calculate sharpe ratio in excel accurately, verify all data inputs before implementing the final formula.

Finally, format the resulting Sharpe Ratio value for easy readability. This might involve increasing the number of decimal places displayed or applying a percentage format if appropriate. A Sharpe Ratio of 0.56789 could be formatted to display as 0.57 or 56.79%, for instance. Consistent formatting makes it easier to compare Sharpe Ratios across different investments. By implementing the Sharpe Ratio formula in this way, you can easily calculate sharpe ratio in excel and gain valuable insights into the risk-adjusted performance of your investments. Remember to save your spreadsheet and periodically review the calculations as new data becomes available.

Interpreting Your Results: What Does Your Sharpe Ratio Tell You?

The calculated Sharpe Ratio provides valuable insights into an investment’s risk-adjusted return. To effectively interpret this ratio, it’s crucial to understand its scale and benchmarks. Generally, a Sharpe Ratio above 1.0 is considered acceptable, indicating that the investment’s return compensates adequately for its risk. A Sharpe Ratio of 2.0 or higher is viewed as very good, while a ratio of 3.0 or more is considered excellent. However, a Sharpe Ratio below 1.0 suggests that the investment’s return may not be worth the risk taken. When you calculate sharpe ratio in excel, consider these benchmarks as initial guidelines.

Comparing Sharpe Ratios across different investments offers a practical way to assess their relative performance. For instance, if Investment A has a Sharpe Ratio of 1.5 and Investment B has a Sharpe Ratio of 0.8, Investment A is generally considered more attractive on a risk-adjusted basis. It’s important to note that comparisons should be made within similar asset classes, as different asset classes inherently carry varying levels of risk. When you calculate sharpe ratio in excel, and perform these comparisons, it is a great way to make informed investment decisions.

Despite its usefulness, the Sharpe Ratio has limitations. It relies on historical data, which may not accurately predict future performance. The Sharpe Ratio also assumes that returns are normally distributed, which may not always be the case. Furthermore, it penalizes both upside and downside volatility equally, even though investors may be more concerned about downside risk. Therefore, the Sharpe Ratio should not be the sole factor in investment decisions. Other considerations, such as investment goals, time horizon, and risk tolerance, should also be carefully evaluated. To accurately calculate sharpe ratio in excel, one must also understand how to interpret the results. Understanding the context of an investment and looking at more than the Sharpe Ratio increases the likelihood of making smart investments.