Mastering the Markets: How to Choose the Right Automated Trading Approach

Algorithmic or automated day trading is revolutionizing how individuals approach the financial markets. It offers compelling advantages over traditional discretionary trading methods. One of the most significant benefits is the elimination of emotional decision-making. Fear and greed, common pitfalls for human traders, are removed from the equation. Automated strategies execute pre-defined rules, ensuring consistency and discipline. This leads to more rational and potentially profitable trading outcomes. Automated systems can react to market changes faster than a human ever could, and find the best algorithm for day trading for each situation.

Furthermore, automated strategies offer increased efficiency. A well-designed algorithm can monitor multiple markets simultaneously, identifying trading opportunities that a human trader might miss. The ability to execute trades rapidly and accurately is a distinct advantage, especially in fast-moving markets. Selecting the appropriate algorithm is vital. This choice hinges on factors like individual trading goals, risk tolerance, and prevailing market conditions. A trader seeking high-frequency, short-term gains will require a different algorithm than someone with a long-term investment horizon. Understanding your risk appetite is equally important; some algorithms are inherently more volatile than others. The best algorithm for day trading should align with your personal circumstances and objectives.

The market environment plays a crucial role in algorithm selection. Some algorithms perform optimally in trending markets, while others excel in range-bound or mean-reverting conditions. A comprehensive understanding of market dynamics is, therefore, essential for choosing the best algorithm for day trading. Different algorithms will be more suitable for stocks, forex, or cryptocurrency markets. The subsequent sections will delve into the mechanics of different algorithm types, providing insights into their strengths, weaknesses, and ideal applications. Understanding these nuances will empower you to make informed decisions and select the best algorithm for day trading that aligns with your specific needs and market outlook. The best algorithm for day trading can adapt to these ever-changing conditions to find an edge.

Decoding the Black Box: Exploring Popular Day Trading Algorithms

This section explores various algorithmic strategies employed in day trading, offering insights into their mechanics and applications. Identifying the best algorithm for day trading depends significantly on market conditions and individual trading styles. Algorithmic trading offers the possibility of removing emotional bias.

One prevalent approach is **Mean Reversion**. This strategy is based on the idea that prices tend to revert to their average value over time. A mean reversion algorithm identifies moments when a stock price deviates significantly from its mean and executes trades anticipating a return to that average. It proves most effective in range-bound markets where prices fluctuate within a defined channel. The potential drawbacks include whipsaws in trending markets, where the price continues to move in one direction, triggering losses. Therefore, understanding when to apply mean reversion is crucial for maximizing its profitability. Transaction costs and slippage can erode profits if trades are too frequent or the price changes quickly upon order execution. When it comes to the best algorithm for day trading, mean reversion can be a solid pick.

Another widely used strategy is **Trend Following**. Trend-following algorithms capitalize on the persistence of trends in the market. These algorithms identify the direction of a trend and initiate trades in that direction, aiming to capture profits as the trend continues. They are best suited for markets exhibiting strong and sustained trends. However, trend-following algorithms are vulnerable to trend reversals, where the price changes direction abruptly, leading to losses. Careful consideration of stop-loss orders is essential to mitigate this risk. Successfully implementing trend-following requires patience and the ability to withstand short-term fluctuations. Using the best algorithm for day trading like trend following, might need additional confirmation indicators to avoid false signals.

**Arbitrage** strategies exploit price discrepancies for the same asset across different markets or exchanges. An arbitrage algorithm identifies these price differences and simultaneously buys the asset in the cheaper market and sells it in the more expensive market, capturing the profit from the difference. Speed is paramount in arbitrage, as these opportunities are often short-lived. The complexities involve establishing connections to multiple exchanges and handling real-time data feeds. Furthermore, transaction costs and slippage can significantly impact the profitability of arbitrage strategies. High-frequency trading (HFT) systems are often employed for arbitrage due to their ability to execute trades with minimal latency. This reinforces the notion that the best algorithm for day trading is the one that aligns with your resources and infrastructure. The best algorithm for day trading needs to be fast with reliable connections.

Backtesting for Success: Validating Your Algorithmic Strategies

Backtesting plays a pivotal role in the development and refinement of any algorithmic trading strategy. It allows traders to assess the viability of a strategy using historical data before risking real capital. Understanding how to effectively backtest is crucial for determining if a “best algorithm for day trading” is truly promising. This process involves simulating trades on past market data to evaluate the potential performance of the algorithm under different conditions. The reliability of backtesting heavily depends on the quality and depth of the historical data used. High-resolution data, encompassing a significant period, provides a more accurate representation of potential performance. Remember to account for various market conditions that may have occurred during the backtesting period.

Effective backtesting requires specific metrics to evaluate an algorithm’s performance. Common metrics include the Sharpe ratio, which measures risk-adjusted return; maximum drawdown, indicating the largest peak-to-trough decline during the period; and win rate, representing the percentage of profitable trades. These metrics provide insights into the algorithm’s profitability, risk exposure, and consistency. One must avoid the pitfall of overfitting the data, where the algorithm is too closely tailored to the historical data and performs poorly in live trading. Overfitting leads to unrealistic expectations and ultimately, disappointment. Employ techniques like walk-forward analysis to validate the robustness of the “best algorithm for day trading”. This involves testing the algorithm on different segments of historical data to assess its ability to adapt to changing market dynamics.

While backtesting is invaluable, it is essential to recognize its limitations. Historical data is no guarantee of future performance. Market conditions evolve, and patterns that existed in the past may not persist. Regulatory changes, unexpected economic events, and shifts in investor sentiment can all impact the effectiveness of an algorithm. Transaction costs, slippage, and the availability of liquidity are real-world factors that backtesting simulations might not fully capture. To find the best algorithm for day trading, one must incorporate stress tests and sensitivity analyses into the backtesting process. These tests involve subjecting the algorithm to extreme market conditions and varying input parameters to assess its resilience. By acknowledging the limitations of backtesting and conducting thorough analyses, traders can develop more robust and reliable algorithmic trading strategies.

Platform Power: Selecting the Right Tools for Algorithmic Trading

Choosing the right trading platform is a critical step in successful algorithmic trading. The platform acts as the bridge between your trading algorithm and the market, so its capabilities directly impact your strategy’s performance. A robust platform is essential for executing the best algorithm for day trading.

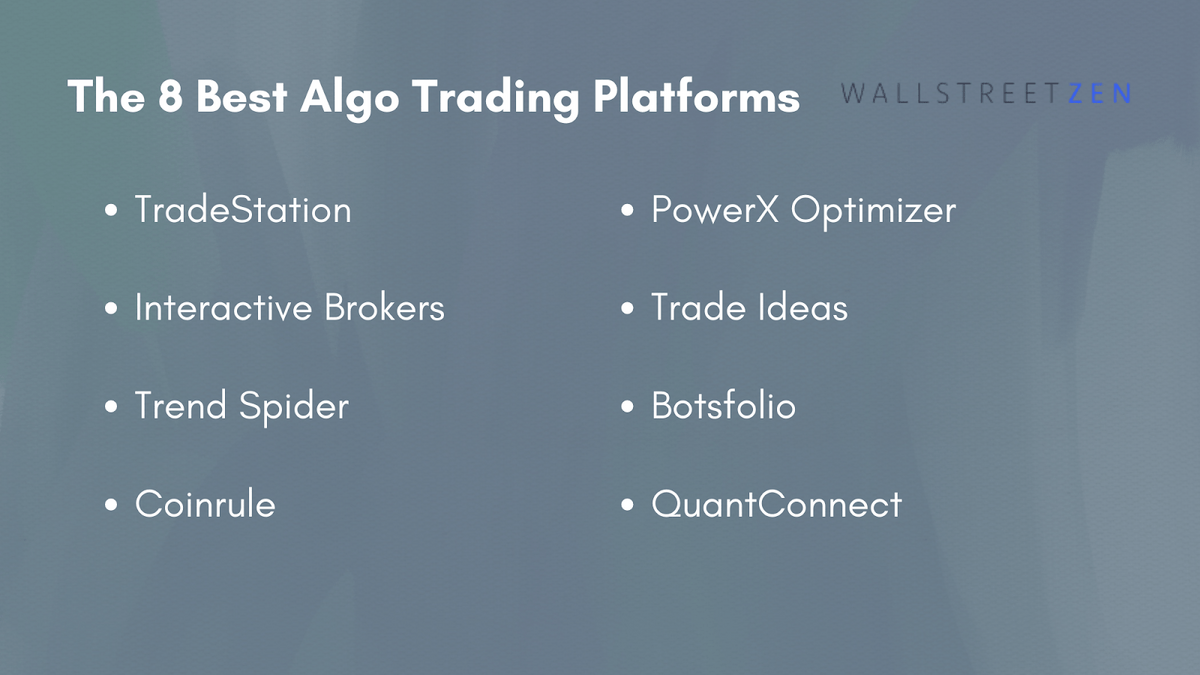

Several factors should be considered when selecting a platform. API (Application Programming Interface) availability is paramount. The API allows your algorithm to connect to the platform and automatically execute trades. A well-documented and reliable API is crucial for seamless integration. Backtesting capabilities are also vital. A good platform should allow you to test your algorithms on historical data to evaluate their performance before deploying them in live trading. Charting tools are important for visualizing market data and identifying potential trading opportunities. Order execution speed is another key consideration, especially for high-frequency strategies where milliseconds can make a significant difference. Commission fees can erode profits, so comparing fees across different platforms is advisable. Some popular platforms often utilized for algorithmic trading include MetaTrader, TradingView, and Interactive Brokers. Selecting a reliable and stable platform is essential to make the best algorithm for day trading possible.

Beyond the core functionalities, consider the platform’s ease of use and community support. A user-friendly interface can simplify the process of setting up and managing your algorithms. A strong community can provide valuable resources and support for troubleshooting issues. Ultimately, the best algorithm for day trading needs the solid foundation of a powerful and well-suited trading platform to truly shine. The stability of your selected platform is directly proportional to your potential success in the algorithmic trading landscape.

Risk Management Essentials: Protecting Your Capital in Algorithmic Trading

Risk management is vital for algorithmic trading. Protecting your capital requires strategic planning. A well-defined risk management approach is as crucial as selecting the best algorithm for day trading. It helps to mitigate potential losses. Ignoring risk management can lead to significant financial setbacks, even with the most sophisticated algorithms. Understanding and implementing risk control measures is paramount for long-term success.

Setting stop-loss orders is a fundamental risk management technique. A stop-loss order automatically exits a trade when the price reaches a predetermined level. This limits potential losses on any single trade. Position sizing is another essential element. It involves determining the appropriate amount of capital to allocate to each trade. Careful position sizing prevents overexposure to any single asset or trading strategy. Diversification also plays a key role. Spreading investments across different assets or markets reduces the impact of adverse movements in any one area. These techniques help create a resilient trading system, vital when seeking the best algorithm for day trading.

Unexpected market events present significant challenges. Algorithms must be designed to adapt to changing conditions. This might involve incorporating volatility measures or news sentiment analysis. It’s important to consider the psychological aspect of algorithmic trading. Even the best algorithm for day trading will generate losing trades. Maintaining discipline and avoiding emotional reactions is crucial. Stick to the predetermined risk management plan. Avoid the temptation to override the algorithm based on gut feelings. “Algorithm drift” can occur over time. Regular monitoring helps to identify and correct for this. Effective risk management combined with a robust algorithm and constant monitoring provides a strong foundation for profitable day trading.

The Human Element: Monitoring and Optimizing Your Algorithms

Even with the best algorithm for day trading, human oversight remains crucial. Automated strategies demand consistent monitoring to ensure optimal performance and adapt to evolving market dynamics. Regular review of an algorithm’s activity helps identify potential glitches, unexpected behaviors, or deviations from expected results. These observations are essential for proactive adjustments that maintain profitability.

Performance monitoring involves tracking key metrics like win rate, profit factor, drawdown, and trade frequency. Significant deviations from historical performance warrant immediate investigation. Perhaps market volatility has increased, requiring adjustments to risk parameters. Maybe a previously profitable pattern has become less reliable, necessitating modifications to the algorithm’s logic. The goal is to proactively identify and address issues before they significantly impact capital. Furthermore, the concept of “algorithm drift” highlights the gradual degradation of an algorithm’s performance over time due to changing market conditions. Detecting drift early allows for timely recalibration and prevents continued losses. Consistently seeking the best algorithm for day trading demands constant vigilance and adaptation.

Another critical aspect is addressing potential biases within algorithms. These biases can stem from flawed assumptions in the initial design, skewed historical data used during backtesting, or unintended consequences of complex interactions between different components. Left unchecked, biases can lead to systematic errors and suboptimal trading decisions. Human oversight provides a vital check against these biases, offering a layer of critical assessment that purely automated systems often lack. Analyzing both winning and losing trades generated by the best algorithm for day trading is vital. The emotional aspect of trading doesn’t disappear with automation; it simply shifts. It’s important to approach algorithmic trading with a detached and analytical mindset, making adjustments based on data rather than fear or greed. By actively monitoring, optimizing, and guarding against biases, traders can maximize the potential of their algorithmic strategies and strive towards consistently achieving the best algorithm for day trading results.

Beyond the Basics: Advanced Techniques in Algorithmic Trading

As traders become more proficient in algorithmic strategies, exploring advanced techniques can significantly enhance their trading performance. These techniques often involve sophisticated mathematical models and computational power, pushing the boundaries of what’s achievable in automated trading. One such area is the application of machine learning, particularly neural networks, to predict price movements. These networks can be trained on vast datasets of historical price data, technical indicators, and even news sentiment to identify patterns that might be imperceptible to human traders. Implementing machine learning requires substantial expertise in data science and specialized software. Determining the best algorithm for day trading with machine learning requires careful consideration of data quality, feature selection, and model validation.

Another advanced technique involves natural language processing (NLP) to analyze news sentiment and its impact on market behavior. NLP algorithms can sift through news articles, social media posts, and financial reports to gauge public opinion about specific stocks or market sectors. This information can be used to trigger trades based on shifts in sentiment, potentially capitalizing on market reactions to news events. While promising, NLP-based strategies are complex to implement and require access to reliable news feeds and sophisticated sentiment analysis tools. Furthermore, the nuances of language and the potential for biased reporting must be carefully considered. The best algorithm for day trading may involve a hybrid approach, combining traditional technical analysis with NLP insights.

High-frequency trading (HFT) represents another frontier in algorithmic trading, characterized by extremely fast execution speeds and high turnover rates. HFT algorithms aim to exploit minuscule price discrepancies across different exchanges, often holding positions for only fractions of a second. This type of trading requires access to co-located servers, ultra-low-latency network connections, and highly optimized code. Due to the intense competition and regulatory scrutiny in the HFT space, it is generally accessible only to large institutions with significant resources. While HFT is beyond the reach of most individual traders, understanding its principles can provide valuable insights into market microstructure and order execution. Discovering the best algorithm for day trading ultimately depends on an individual’s resources, risk tolerance, and the specific market conditions being traded. These advanced techniques are constantly evolving, so continuous learning is essential for staying ahead.

The Road Ahead: Continuous Learning in the World of Algorithmic Trading

Algorithmic trading represents a dynamic and ever-changing landscape. Continuous learning is not merely an advantage, it is a necessity for sustained success. The pursuit of finding the best algorithm for day trading is an ongoing journey, requiring adaptability and a proactive approach to knowledge acquisition. Market dynamics shift, new technologies emerge, and regulatory landscapes evolve. Traders must commit to staying informed and adapting their strategies accordingly. Stagnation can lead to obsolescence in this competitive field. Diligence and consistent effort are required to stay ahead.

To remain competitive, traders should actively seek opportunities for professional development. This involves staying abreast of the latest research, attending industry conferences, and engaging with the algorithmic trading community. Consider exploring online courses, workshops, and webinars that delve into advanced trading techniques, machine learning applications, and risk management strategies. Networking with other traders and sharing insights can provide valuable perspectives and accelerate the learning process. Remember, the best algorithm for day trading today might not be the best tomorrow, highlighting the importance of continuous refinement and adaptation. Experimentation is key to improving and finding what suits you best.

Discipline and patience are crucial virtues in the realm of algorithmic trading. It is essential to resist the temptation to make impulsive decisions based on short-term market fluctuations. A well-defined trading plan, coupled with rigorous backtesting and risk management protocols, provides a solid foundation for long-term success. The search for the best algorithm for day trading also involves a commitment to ongoing education and self-improvement. This dedication to continuous learning, combined with a disciplined approach to trading, can significantly enhance the likelihood of achieving profitability in the dynamic world of automated trading. Remember that finding the best algorithm for day trading is highly personal, and depends on your goals.