What is a Stock’s Risk Profile?

Investing in the stock market involves inherent risk. Risk and return are intrinsically linked; higher potential returns often come with higher risk. However, understanding the *type* of risk is crucial for making informed investment decisions. Volatility is a key aspect of a stock’s risk profile, representing the extent to which its price fluctuates. A stock’s beta is a measure of its volatility relative to the overall market. While beta is a critical concept, it’s important to note that risk encompasses more than just volatility. For instance, beta primarily measures systematic risk, which is market-wide risk affecting all stocks. A stock’s beta is a measure of its sensitivity to these market movements. This guide will delve into the meaning and uses of beta, clarifying its role in evaluating and managing investment risk. Understanding a stock’s beta is a measure of its sensitivity to market fluctuations.

A stock’s beta is a measure of its volatility in relation to the broader market. Investors frequently use beta to assess a stock’s risk and align their investments with their individual risk tolerance. A higher beta suggests greater volatility and risk, while a lower beta implies more stability. Investors with higher risk tolerance may gravitate towards stocks with higher betas, seeking potentially higher returns. Conversely, those with lower risk tolerance may favor lower-beta stocks for greater stability. Diversification, a fundamental principle of portfolio construction, aims to reduce overall portfolio risk by combining assets with differing risk characteristics. Careful selection of stocks with varying betas can play a significant role in an effective diversification strategy. A stock’s beta is a measure of its responsiveness to market changes.

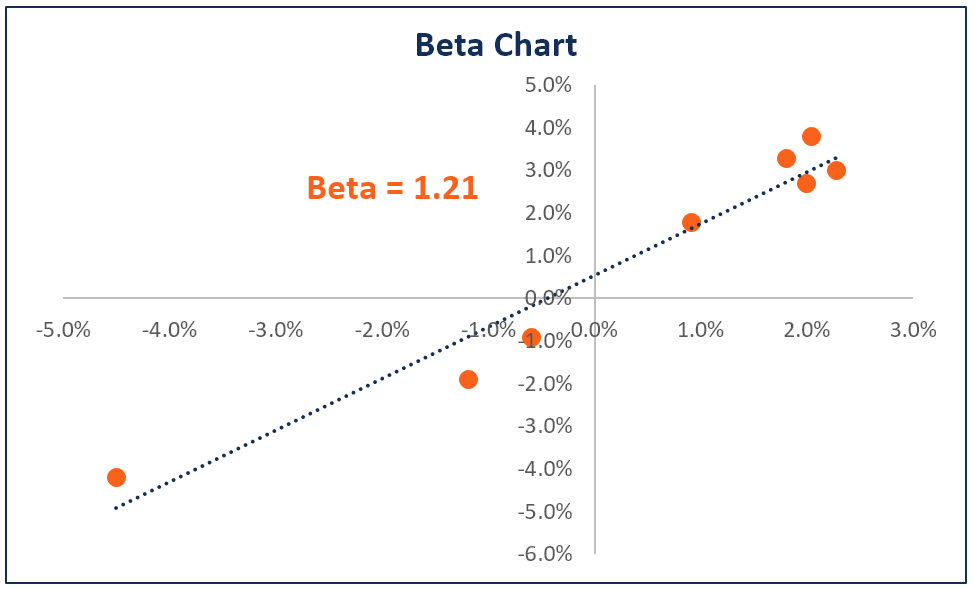

Beyond simply understanding what a stock’s beta is, investors need to appreciate its practical implications. A stock’s beta is a measure of its price fluctuations relative to a benchmark, like the S&P 500. A beta of 1 indicates the stock tends to move in line with the market. A beta greater than 1 suggests the stock is more volatile than the market; its price will likely fluctuate more dramatically. Conversely, a beta less than 1 implies less volatility than the market, meaning it’s potentially less susceptible to market swings. Therefore, understanding a stock’s beta is a measure of its potential for both gains and losses. It’s a critical tool for evaluating risk and building a well-diversified portfolio aligned with personal investment goals and risk appetite. A stock’s beta is a measure of its response to market movements.

The Significance of Beta in Investment Decisions

Understanding a stock’s risk profile is paramount for investors. Different investors possess varying risk tolerances. Some prefer conservative investments with lower potential returns, while others seek higher returns, even if it means accepting greater risk. A stock’s beta is a measure of its volatility relative to the overall market, providing a crucial metric for assessing risk. Investors can use this information to select investments aligning with their risk appetite. A stock’s beta is a measure of its sensitivity to market movements. A higher beta suggests greater price fluctuations, and therefore, greater risk. Conversely, a lower beta indicates less price fluctuation and lower risk. This understanding is vital for effective portfolio construction.

Beta plays a pivotal role in portfolio diversification. Diversification aims to reduce overall portfolio risk by investing in assets that don’t move in perfect unison. By combining stocks with different betas, investors can create a portfolio with a desired level of risk. For instance, an investor seeking a balanced portfolio might combine high-beta stocks with low-beta stocks to achieve a moderate level of risk. This strategy leverages the principle of diversification to manage risk effectively. A stock’s beta is a measure of its responsiveness to market changes. This allows investors to manage the risk within their portfolios strategically. Investors should always consider their risk tolerance before building their portfolio.

Effective risk management relies heavily on understanding a stock’s beta. By carefully considering beta, investors can make informed decisions about asset allocation, reducing the impact of market downturns on their portfolios. Investors can use beta to measure the risk associated with individual stocks and construct portfolios that align with their overall investment goals. A stock’s beta is a measure of its systematic risk. This is critical because understanding systematic risk is fundamental to sound investment strategies. Successfully managing risk involves considering a stock’s beta is a measure of its sensitivity to market fluctuations, thus influencing the overall portfolio volatility.

How to Interpret a Stock’s Beta Value

A stock’s beta is a measure of its volatility relative to the overall market. It quantifies how much a stock’s price tends to move in comparison to a benchmark market index, such as the S&P 500. A beta of 1 indicates that the stock’s price will move in line with the market. If the market rises by 10%, a stock with a beta of 1 is expected to rise by approximately 10% as well. Conversely, a 10% market decline would likely lead to a similar 10% decrease in the stock’s price. A stock’s beta is a measure of its sensitivity to market fluctuations.

A beta greater than 1 signifies that the stock is more volatile than the market. For example, a stock with a beta of 1.5 will tend to move 1.5 times more than the market. A 10% market increase could result in a 15% rise in the stock’s price, while a 10% market drop might lead to a 15% fall. Conversely, a beta less than 1 suggests that the stock is less volatile than the market. A stock with a beta of 0.5, for instance, would typically move half as much as the market. A 10% market increase might only result in a 5% increase for this stock, and a 10% market decrease could translate to only a 5% decline. A stock’s beta is a measure of its response to market swings.

Understanding a stock’s beta is crucial for investment decisions. Investors with higher risk tolerance might favor stocks with betas greater than 1, seeking potentially higher returns. Conversely, investors prioritizing capital preservation might prefer stocks with betas less than 1, accepting potentially lower returns for reduced volatility. It’s vital to remember that a stock’s beta is a measure of its historical volatility and doesn’t guarantee future performance. Market conditions and company-specific events can significantly impact a stock’s price movements, regardless of its beta. A stock’s beta is a measure of its past price fluctuations relative to the market. It provides valuable insight but shouldn’t be the sole factor in investment choices.

Beta and Market Risk: Understanding Systematic Risk

A stock’s beta is a measure of its sensitivity to overall market movements. It quantifies systematic risk, also known as market risk. This is the risk inherent to the entire market, not specific to any one company. Factors like economic downturns, interest rate changes, or geopolitical events affect the entire market and thus impact a stock’s price, regardless of the company’s individual performance. A stock’s beta is a measure of its response to these market-wide fluctuations. A higher beta indicates greater sensitivity to market changes, and a lower beta shows less sensitivity. Understanding this distinction is crucial for investors. A stock’s beta is a measure of its systematic risk exposure.

Conversely, unsystematic risk (also called company-specific risk) stems from factors unique to a particular company. This could include news about a product recall, a change in management, or a lawsuit. Unsystematic risk is largely independent of market movements. Importantly, a stock’s beta is a measure of its systematic risk; it doesn’t capture unsystematic risk. Diversification is a key strategy to mitigate unsystematic risk. By investing in a variety of stocks across different sectors, investors can reduce the impact of company-specific events on their overall portfolio. However, diversification does not eliminate systematic risk, as that risk is inherent to the market itself. A stock’s beta is a measure of its sensitivity to market-wide fluctuations, not company-specific events.

Because beta only reflects systematic risk, investors shouldn’t rely on it as the sole indicator of a stock’s overall risk. While understanding a stock’s beta is essential, it’s crucial to consider other factors and risk measures for a holistic assessment. A stock’s beta is a measure of its volatility relative to the market. It provides valuable insights into how a stock is likely to behave during market upswings and downturns. But remember, a stock’s beta is a measure of its response to market-wide trends, not an absolute predictor of future price movements.

Factors That Influence a Stock’s Beta

A stock’s beta is a measure of its sensitivity to market movements. Several factors influence this crucial metric. Industry characteristics play a significant role. Cyclical industries, like consumer discretionary or technology, tend to exhibit higher betas than defensive sectors, such as utilities or consumer staples. This is because cyclical companies are more susceptible to economic fluctuations. A stock’s beta is a measure of its volatility relative to the market. Therefore, understanding industry trends is vital for assessing a stock’s beta.

A company’s financial leverage also impacts its beta. High levels of debt increase a firm’s financial risk. This heightened risk translates to greater price volatility, leading to a higher beta. Conversely, companies with lower debt burdens tend to have lower betas. A stock’s beta is a measure of its response to market changes; therefore, examining the debt-to-equity ratio offers insights into its potential volatility. The interplay between debt and equity affects how a company reacts to market swings, directly influencing its beta.

Finally, macroeconomic factors significantly influence a stock’s beta. During economic expansions, many stocks tend to rise, leading to lower betas across the board. However, during recessions, the correlation between individual stock performance and overall market movements often strengthens, resulting in higher betas. Interest rate changes, inflation, and geopolitical events all contribute to shifts in market sentiment. These macro factors impact a stock’s beta is a measure of its response to market conditions. Therefore, keeping abreast of economic conditions is essential for comprehending a stock’s beta and its potential volatility. A stock’s beta is a measure of its price sensitivity to market changes. Understanding these factors helps investors better assess and manage investment risk.

Using Beta in Portfolio Construction

Investors utilize a stock’s beta is a measure of its volatility to construct diversified portfolios aligned with their risk tolerance. A conservative investor, for example, might favor a portfolio heavily weighted towards low-beta stocks, which exhibit less price fluctuation than the overall market. This strategy prioritizes capital preservation over potentially higher returns. Conversely, an aggressive investor comfortable with greater risk might allocate a larger portion of their portfolio to high-beta stocks, anticipating higher returns but accepting greater price volatility. A stock’s beta is a measure of its sensitivity to market movements. Understanding this allows for strategic portfolio building. Investors can adjust their portfolio’s overall risk profile using this data point.

Consider a portfolio aiming for moderate risk. This might involve a blend of stocks with varying betas. For instance, the portfolio could include a combination of low-beta stocks (like utility companies), medium-beta stocks (such as consumer staples), and some high-beta stocks (perhaps technology companies). The specific allocation will depend on the investor’s risk tolerance and financial goals. This approach seeks to balance potential gains with the management of risk. The overall portfolio beta is a weighted average of the individual stock betas. A stock’s beta is a measure of its responsiveness to market changes. Careful selection of stocks with differing betas allows for a customized risk profile.

Calculating the portfolio beta involves multiplying each stock’s beta by its weight in the portfolio (its proportion of the total portfolio value), then summing these products. This provides a single number representing the overall portfolio’s sensitivity to market fluctuations. This allows investors to adjust their asset allocation to achieve the desired risk level. By strategically combining stocks with different betas, investors can effectively manage their portfolio’s volatility and tailor it to their personal investment strategy. A stock’s beta is a measure of its potential for both gains and losses relative to the market. Sophisticated investors may use beta, along with other risk measures, to fine-tune their portfolio for optimal risk-adjusted returns.

Limitations of Using Beta

While a stock’s beta is a measure of its volatility relative to the market, relying solely on this metric for risk assessment presents several limitations. Beta is inherently backward-looking. It’s calculated using historical data, which may not accurately predict future price movements. A stock’s beta can change significantly over time due to various factors, making past performance a less reliable indicator of future volatility. Therefore, investors should not treat beta as a definitive predictor of future risk.

Moreover, a stock’s beta is a measure of its systematic risk—market risk that affects all stocks. It does not capture unsystematic risk, or company-specific risk, such as a sudden change in management or a product recall. These events can significantly impact a stock’s price, independent of market trends. A stock’s beta is a measure of its sensitivity to market movements, but it does not fully encompass the complexities of individual company risk profiles. Consequently, diversification is essential to mitigate unsystematic risk.

Furthermore, the accuracy of beta can be affected by market regime shifts. During periods of high market volatility or significant economic changes, the relationship between a stock’s price and the market benchmark can alter dramatically. A stock’s beta might be relatively stable during normal market conditions, but it may exhibit different behavior during market crises. A stock’s beta is a measure of its systematic risk, but its predictive power is diminished when market conditions change significantly. Investors should consider this limitation when using beta to construct portfolios or assess risk. Therefore, a comprehensive risk assessment requires more than just relying on a stock’s beta. Additional risk measures provide a more holistic understanding.

Beyond Beta: Other Risk Measures

While a stock’s beta is a measure of its volatility relative to the market, it’s not the only tool for assessing risk. Understanding a stock’s beta is essential, but a comprehensive risk assessment requires a more holistic approach. Standard deviation, for instance, measures the dispersion of a stock’s returns around its average. A higher standard deviation indicates greater volatility and, therefore, higher risk. This provides a different perspective than beta, which focuses solely on the relationship with the overall market. A stock could have a low beta but still exhibit high overall volatility as measured by standard deviation.

Another valuable metric is the Sharpe ratio. This ratio considers both the risk and return of an investment. It calculates the excess return per unit of risk, helping investors determine whether the potential return justifies the level of risk involved. A higher Sharpe ratio suggests better risk-adjusted returns. When considering a stock’s beta, remember that it only captures systematic risk, the risk inherent in the overall market. A stock’s beta is a measure of its sensitivity to market fluctuations. However, other factors contribute to a stock’s total risk, such as company-specific events or industry trends. These are examples of unsystematic risk, which beta doesn’t measure.

Therefore, investors should use beta in conjunction with other risk measures for a more complete picture. By combining beta with standard deviation and the Sharpe ratio, investors gain a more nuanced understanding of a stock’s risk profile. A stock’s beta is a measure of its systematic risk, but it’s crucial to remember the limitations of relying solely on this single metric. Analyzing a broader range of risk indicators allows for more informed investment decisions, better portfolio diversification, and a more accurate assessment of the overall risk-return profile of potential investments. Understanding a stock’s beta is a valuable starting point, but it’s only one piece of the puzzle in effective investment risk management.