Understanding the Bond Market: A Primer

The bond market is a complex and dynamic system that plays a crucial role in the global economy. At its core, the bond market allows individuals and institutions to lend money to borrowers, such as corporations and governments, in exchange for regular interest payments and the eventual return of their principal investment. Bonds are essentially debt securities that represent a loan made by an investor to a borrower.

There are various types of bonds, including government bonds, corporate bonds, municipal bonds, and high-yield bonds, each with its unique features and risks. Bond yields, which represent the total return on investment, are a critical component of the bond market. They are influenced by a variety of factors, including interest rates, credit ratings, and market conditions. For instance, when interest rates rise, bond yields also increase, making existing bonds with lower yields less attractive to investors. This, in turn, affects the bond’s selling price, as investors are willing to pay less for a bond with a lower yield.

Understanding the bond market is essential for investors and borrowers alike, as it provides a framework for evaluating the risks and opportunities associated with bond investments. By grasping the fundamental concepts of the bond market, investors can make informed decisions about their investments and borrowers can better navigate the complexities of the bond market. In the following sections, we will delve deeper into the concept of “all else constant” and its impact on bond pricing.

What Happens When All Else is Constant?

In the context of bond pricing, the concept of “all else constant” refers to a scenario where all factors that affect a bond’s price, except one, remain unchanged. This concept is crucial in understanding how changes in a single factor impact the bond’s selling price. When all else is constant, a bond will sell at a price that reflects its yield, which is influenced by the factors mentioned earlier, such as interest rates, credit ratings, and market conditions.

By holding all else constant, analysts and investors can isolate the impact of a specific factor on a bond’s price. For instance, if interest rates rise, and all else is constant, a bond’s selling price will decrease, as investors can earn a higher yield from newly issued bonds. This concept allows market participants to better understand the complex relationships between various factors and their impact on bond prices.

The concept of “all else constant” is particularly useful in evaluating the sensitivity of a bond’s price to changes in specific factors. By analyzing how a bond’s price responds to changes in interest rates, credit ratings, or market conditions, while holding all else constant, investors can make more informed investment decisions and manage their risk more effectively.

The Role of Interest Rates in Bond Pricing

Interest rates play a crucial role in determining a bond’s selling price. When interest rates rise, the yield on existing bonds with lower interest rates becomes less attractive to investors. As a result, the bond’s selling price decreases, and vice versa. This inverse relationship between interest rates and bond prices is a fundamental concept in bond pricing.

In the context of “all else constant,” changes in interest rates have a direct impact on a bond’s selling price. When all else is constant, a bond will sell at a price that reflects its yield, which is influenced by the prevailing interest rates. For instance, if interest rates rise from 2% to 3%, and all else is constant, a bond with a 2% yield will sell at a lower price, as investors can earn a higher yield from newly issued bonds.

The impact of interest rates on bond prices is further complicated by the concept of duration. Bonds with longer durations are more sensitive to changes in interest rates, resulting in greater price fluctuations. Therefore, when interest rates change, and all else is constant, bonds with longer durations will experience more significant price changes than those with shorter durations.

Understanding the relationship between interest rates and bond prices is essential for investors and borrowers alike. By grasping how changes in interest rates affect bond prices, market participants can make informed investment decisions and manage their risk more effectively.

How to Determine a Bond’s Selling Price

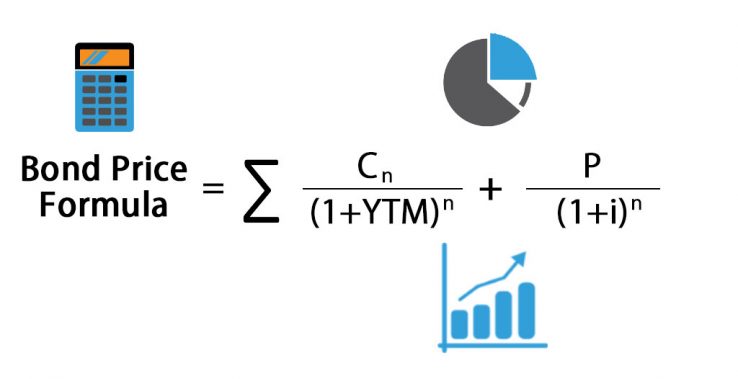

Determining a bond’s selling price involves considering various factors that affect its value. When all else is constant, a bond will sell at a price that reflects its yield, which is influenced by factors such as interest rates, credit ratings, and market conditions. To calculate a bond’s selling price, follow these steps:

Step 1: Determine the bond’s face value, coupon rate, and maturity date. These values are specified in the bond’s indenture and affect its yield.

Step 2: Calculate the bond’s yield to maturity (YTM), which takes into account the bond’s coupon rate, face value, and maturity date. The YTM represents the bond’s total return, including interest payments and capital gains.

Step 3: Consider the prevailing interest rates and their impact on the bond’s yield. When interest rates rise, the bond’s yield increases, and its selling price decreases, and vice versa.

Step 4: Evaluate the bond’s credit rating, which affects its yield and selling price. Bonds with higher credit ratings typically offer lower yields and sell at higher prices, while those with lower credit ratings offer higher yields and sell at lower prices.

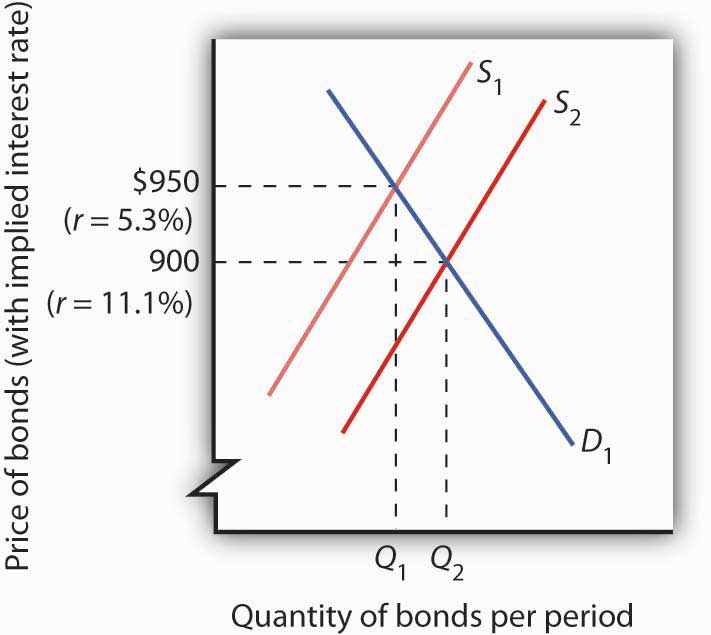

Step 5: Assess market conditions, such as supply and demand, which can influence the bond’s selling price. When demand is high, and supply is low, the bond’s selling price increases, and vice versa.

By following these steps and considering the factors that affect a bond’s value, investors and borrowers can determine a bond’s selling price and make informed investment decisions. Remember, when all else is constant, a bond will sell at a price that reflects its yield, making it essential to understand the complex relationships between these factors.

The Impact of Credit Ratings on Bond Prices

Credit ratings play a crucial role in determining a bond’s selling price. When all else is constant, a bond’s credit rating can significantly impact its yield and, subsequently, its selling price. Credit ratings, issued by rating agencies such as Moody’s and Standard & Poor’s, reflect a bond issuer’s creditworthiness and ability to repay debt.

A bond with a high credit rating, such as AAA or AA, is considered to be of high quality and carries a lower risk of default. As a result, investors are willing to accept a lower yield, and the bond sells at a higher price. Conversely, a bond with a low credit rating, such as BB or B, is considered to be of lower quality and carries a higher risk of default. Investors demand a higher yield to compensate for the increased risk, and the bond sells at a lower price.

The impact of credit ratings on bond prices is closely related to the concept of “all else constant.” When all else is constant, a bond’s credit rating becomes a key factor in determining its selling price. For instance, if two bonds have the same face value, coupon rate, and maturity date, but one has a higher credit rating, it will sell at a higher price, all else constant. This is because investors are willing to pay a premium for the higher-rated bond, given its lower default risk.

In addition, changes in credit ratings can also affect bond prices. If a bond’s credit rating is upgraded or downgraded, its selling price will adjust accordingly. When all else is constant, a bond’s selling price will increase if its credit rating is upgraded, and decrease if it is downgraded.

Understanding the impact of credit ratings on bond prices is essential for investors and borrowers alike. By recognizing the relationship between credit ratings and bond prices, market participants can make informed investment decisions and manage their risk more effectively.

Market Conditions and Bond Pricing

Market conditions, such as supply and demand, play a significant role in determining a bond’s selling price. When all else is constant, changes in market conditions can impact bond prices, making it essential to understand their relationship.

In a market with high demand and limited supply, bond prices tend to increase, as investors are willing to pay a premium to acquire the bond. Conversely, in a market with low demand and high supply, bond prices tend to decrease, as investors are less willing to buy the bond. This is because the bond’s yield is influenced by market conditions, and when all else is constant, a bond will sell at a price that reflects its yield.

For instance, during a period of economic growth, investors may become more risk-averse, leading to increased demand for high-quality bonds. As a result, the prices of these bonds may increase, all else constant. On the other hand, during a period of economic downturn, investors may become more risk-tolerant, leading to decreased demand for high-quality bonds. As a result, the prices of these bonds may decrease, all else constant.

In addition, market conditions can also affect the yield curve, which in turn affects bond prices. When all else is constant, a bond’s selling price is influenced by its position on the yield curve. For example, a bond with a longer maturity date may be more sensitive to changes in market conditions, leading to greater price fluctuations.

Understanding the impact of market conditions on bond prices is crucial for investors and borrowers. By recognizing how changes in supply and demand affect bond prices, market participants can make informed investment decisions and manage their risk more effectively. When all else is constant, a bond will sell at a price that reflects its yield, making it essential to consider market conditions in bond pricing.

Real-World Examples of Bond Pricing in Action

To illustrate the concept of “all else constant” in bond pricing, let’s examine some real-world examples. In 2019, the US Treasury Department issued a 10-year bond with a coupon rate of 2.25%. At the time of issuance, the market interest rate was 2.5%. When all else is constant, a bond will sell at a price that reflects its yield. In this case, the bond’s selling price was lower than its face value, as investors demanded a higher yield to compensate for the lower coupon rate.

In another example, consider a corporate bond issued by a company with a high credit rating. The bond has a face value of $1,000, a coupon rate of 4%, and a maturity date of 5 years. When all else is constant, a bond will sell at a price that reflects its yield. If the market interest rate is 3.5%, the bond’s selling price will be higher than its face value, as investors are willing to pay a premium for the higher coupon rate.

In 2008, during the financial crisis, the US Federal Reserve lowered interest rates to stimulate economic growth. As a result, bond prices increased, as investors sought higher-yielding bonds. When all else is constant, a bond will sell at a price that reflects its yield. In this case, the decrease in interest rates led to an increase in bond prices, as investors were willing to accept lower yields.

These examples demonstrate how the concept of “all else constant” affects bond prices in real-world scenarios. By understanding how changes in interest rates, credit ratings, and market conditions impact bond prices, investors and borrowers can make informed decisions and manage their risk more effectively. When all else is constant, a bond will sell at a price that reflects its yield, making it essential to consider these factors in bond pricing.

Conclusion: Mastering Bond Pricing in a Constant World

In conclusion, understanding the concept of “all else constant” is crucial for mastering bond pricing. By recognizing how changes in interest rates, credit ratings, and market conditions affect bond prices, investors and borrowers can make informed decisions and manage their risk more effectively. When all else is constant, a bond will sell at a price that reflects its yield, making it essential to consider these factors in bond pricing.

Throughout this article, we have explored the basics of the bond market, the role of interest rates, credit ratings, and market conditions in bond pricing, and provided real-world examples of how the concept of “all else constant” affects bond prices. By applying these concepts, investors and borrowers can navigate the complex world of bond pricing with confidence.

Ultimately, mastering bond pricing requires a deep understanding of the interplay between various factors that affect bond prices. By recognizing the importance of “all else constant” in bond pricing, investors and borrowers can make informed decisions that drive success in the bond market. Whether you are a seasoned investor or a newcomer to the world of bonds, understanding the concept of “all else constant” is essential for achieving your financial goals.