What is Depreciation in Accounting?

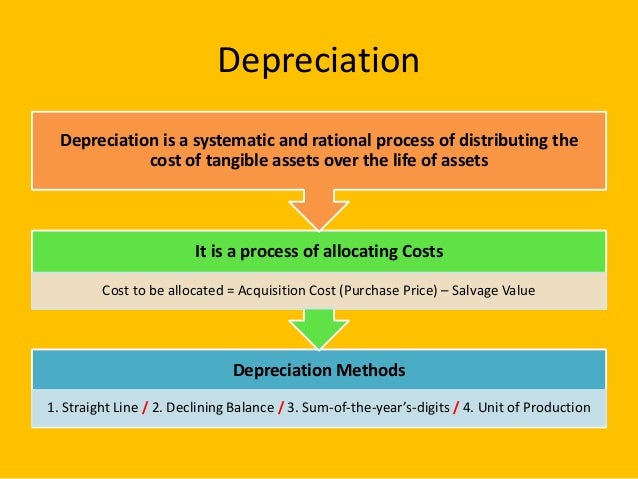

In the world of accounting, depreciation is a fundamental concept that plays a crucial role in allocating the cost of assets over their useful life. It’s a systematic process of allocating the cost of a tangible asset, such as property, plant, and equipment, over its expected lifespan. Depreciation is a non-cash expense, meaning it doesn’t involve an actual cash outflow, but rather an accounting entry to reflect the asset’s decreasing value over time. This concept is essential for businesses to accurately report their financial performance and make informed decisions about their asset management strategies. To clarify, depreciation is not the same as amortization, which is the process of allocating the cost of intangible assets, such as patents or copyrights, over their useful life. Understanding the difference between these two concepts is vital for businesses to accurately report their financial performance and make informed decisions about their asset management strategies.

How to Calculate Depreciation: A Step-by-Step Guide

Calculating depreciation is a crucial step in accurately reporting a company’s financial performance. There are three main methods of calculating depreciation: straight-line, declining balance, and units-of-production. The straight-line method is the most commonly used, where the asset’s cost is divided by its useful life to determine the annual depreciation expense. The declining balance method, on the other hand, involves multiplying the asset’s cost by a depreciation rate, which is typically higher in the early years of the asset’s life. The units-of-production method is used for assets that have a direct relationship between usage and depreciation, such as machinery. Choosing the right method depends on the type of asset, industry, and company’s financial goals. It’s essential to understand that depreciation is not a cash expense, but rather an accounting entry to reflect the asset’s decreasing value over time. This concept is often misunderstood, and it’s crucial to address the question, “is depreciation a cash expense?” to ensure accurate financial reporting.

The Cash Flow Conundrum: Is Depreciation a Cash Expense?

One of the most common misconceptions about depreciation is that it’s a cash expense. However, this couldn’t be further from the truth. Depreciation is a non-cash expense, meaning it doesn’t involve an actual cash outflow. Instead, it’s an accounting entry that reflects the decrease in value of an asset over time. So, is depreciation a cash expense? The answer is a resounding no. This distinction is crucial, as it affects how companies report their financial performance and make informed decisions about their asset management strategies. By understanding that depreciation is not a cash expense, businesses can avoid misconceptions about their cash flow and make more accurate financial projections. For instance, a company may report a significant depreciation expense on its income statement, but this doesn’t mean it’s actually paying out that amount in cash. This nuance is essential for businesses to grasp, as it can have a significant impact on their financial decision-making.

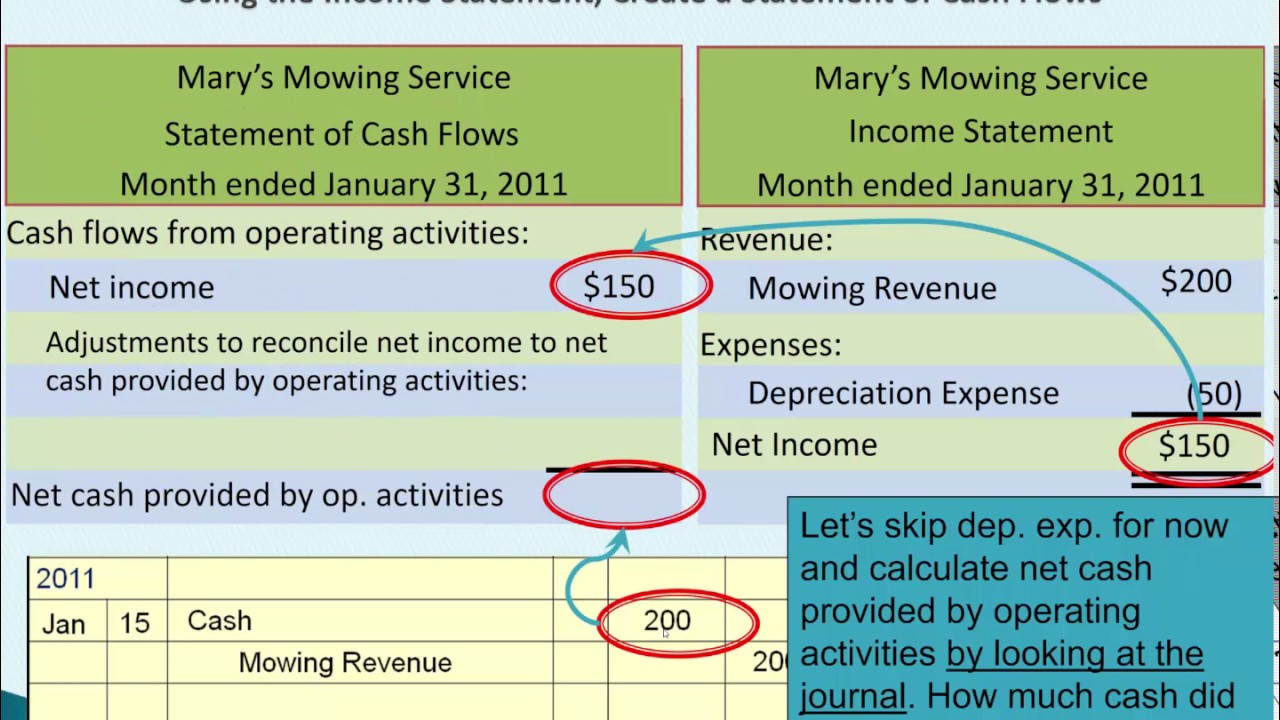

The Impact of Depreciation on Financial Statements

Depreciation has a significant impact on a company’s financial statements, affecting key metrics such as net income, cash flow, and asset values. On the income statement, depreciation is reported as an expense, reducing net income and ultimately affecting a company’s bottom line. However, it’s essential to remember that depreciation is not a cash expense, but rather an accounting entry to reflect the decrease in asset value over time. This distinction is crucial, as it affects how companies report their financial performance and make informed decisions about their asset management strategies. On the balance sheet, depreciation is reflected in the accumulated depreciation account, which represents the total amount of depreciation expense recorded over an asset’s useful life. The cash flow statement is also affected, as depreciation is added back to net income to calculate cash flow from operations. This is because depreciation is a non-cash item, and therefore, does not affect a company’s cash flow. Understanding how depreciation is reported on financial statements is vital for businesses to accurately assess their financial performance and make informed decisions about their asset management and cash flow strategies.

Depreciation vs. Cash Expenses: What’s the Difference?

When it comes to understanding depreciation, one of the most critical distinctions to make is between depreciation expenses and cash expenses. While both are essential components of a company’s financial reporting, they serve different purposes and have distinct implications for a business’s financial health. Cash expenses, such as salaries, rent, and utilities, represent actual cash outflows that a company incurs in the course of its operations. These expenses are typically recorded on the income statement and directly affect a company’s cash flow. Depreciation, on the other hand, is a non-cash expense that represents the decrease in value of an asset over time. It’s an accounting entry that doesn’t involve an actual cash outflow, but rather a reduction in the asset’s value on the balance sheet. This fundamental difference is crucial, as it affects how companies report their financial performance and make informed decisions about their asset management and cash flow strategies. For instance, a company may report a significant depreciation expense on its income statement, but this doesn’t mean it’s actually paying out that amount in cash. By understanding the distinction between depreciation and cash expenses, businesses can avoid misconceptions about their financial performance and make more accurate projections about their future cash flow.

Real-World Examples of Depreciation in Action

Depreciation is not just a theoretical concept; it has practical applications in various industries. Let’s explore some real-world examples to illustrate how depreciation is used in different sectors. In the manufacturing industry, a company might purchase a machine for $100,000 that has a useful life of 10 years. Using the straight-line method, the company would depreciate the machine by $10,000 per year. This depreciation expense would be reported on the income statement, reducing net income, but not affecting cash flow. In the transportation industry, a trucking company might purchase a fleet of trucks for $500,000, with a useful life of 5 years. Using the declining balance method, the company would depreciate the trucks by 20% per year. This would result in a depreciation expense of $100,000 in the first year, $80,000 in the second year, and so on. In the real estate industry, a property owner might purchase a building for $1 million, with a useful life of 20 years. Using the units-of-production method, the owner would depreciate the building based on the number of units produced, such as the number of tenants or square footage rented. These examples demonstrate how depreciation is used in different industries to allocate the cost of assets over their useful life, providing a more accurate picture of a company’s financial performance. By understanding how depreciation is applied in real-world scenarios, businesses can better appreciate its importance in financial reporting and decision-making.

Common Misconceptions About Depreciation Expenses

Despite its importance in financial reporting, depreciation is often misunderstood, leading to misconceptions about its impact on a company’s financial performance. One common myth is that depreciation is a cash expense, which is not the case. Depreciation is a non-cash expense that represents the decrease in value of an asset over time, whereas cash expenses are actual outflows of cash. Another misconception is that depreciation directly affects a company’s cash flow, which is not true. Depreciation is a paper expense that doesn’t involve an actual cash outflow, so it doesn’t affect a company’s ability to pay its bills or invest in new opportunities. Additionally, some people believe that depreciation is directly related to an asset’s market value, which is not necessarily the case. Depreciation is based on the asset’s useful life, not its market value, and is used to allocate the cost of the asset over its useful life. By understanding these common misconceptions, businesses can avoid making inaccurate financial decisions and better appreciate the role of depreciation in financial reporting. For instance, a company might mistakenly believe that a high depreciation expense means it’s not generating enough cash, when in fact, the depreciation expense is simply a non-cash item that doesn’t affect its cash flow. By recognizing these misconceptions, businesses can make more informed decisions about their asset management and cash flow strategies.

Mastering Depreciation for Better Financial Decision-Making

Understanding depreciation is crucial for businesses to make informed financial decisions. By grasping the concept of depreciation, companies can optimize their asset management and cash flow strategies. It’s essential to recognize that depreciation is not a cash expense, but rather a non-cash item that affects a company’s financial statements. This understanding can help businesses avoid misconceptions about depreciation’s impact on cash flow and asset value. By accurately calculating depreciation, companies can allocate the cost of assets over their useful life, providing a more accurate picture of their financial performance. Furthermore, depreciation can help businesses identify opportunities to replace or upgrade assets, leading to improved operational efficiency and reduced costs. In today’s competitive business landscape, mastering depreciation is vital for companies to stay ahead of the curve. By recognizing the importance of depreciation, businesses can make better financial decisions, optimize their asset management, and ultimately drive growth and profitability. Remember, is depreciation a cash expense? No, it’s not. But understanding its role in financial reporting can have a significant impact on a company’s financial success.