Tenor in Banking: A Significant Aspect of Financial Transactions

Tenor in banking is a fundamental concept that refers to the duration of a financial instrument or loan. Understanding tenor is crucial for financial institutions, investors, and borrowers alike, as it plays a significant role in financial transactions and agreements. The term “what is tenor in banking” is essential for anyone involved in the banking and financial sectors, as it directly impacts interest rates, risk management, liquidity, and regulatory compliance.

The Interplay Between Tenor and Interest Rates

A key aspect of understanding “what is tenor in banking” is recognizing its relationship with interest rates. Generally, longer tenors are associated with higher interest rates due to the increased risk for lenders. Over the duration of a loan or financial instrument, various factors can affect the lender’s financial position and the borrower’s creditworthiness. As a result, lenders demand a higher return on longer-term investments to compensate for the additional risk.

Interest rates for financial instruments with shorter tenors, on the other hand, tend to be lower due to the reduced risk for lenders. Shorter-term loans typically have more predictable cash flows and lower default risk, allowing lenders to offer lower interest rates. However, the trade-off for borrowers is that they may need to pay higher interest rates over time if they opt for multiple shorter-term loans instead of a single long-term loan.

Popular Financial Instruments and Their Tenors

When discussing “what is tenor in banking,” it is essential to explore the various financial instruments and loans that have different tenors. Tenors can range from days to several decades, depending on the financial instrument and the borrower’s needs. Here are some common financial instruments and their typical tenors:

- Bonds: Bonds are fixed-income securities that typically have maturities ranging from one to 30 years. Some bonds, such as Treasury bills, have shorter tenors, ranging from a few weeks to a year.

- Loans: Loans can have a wide range of tenors, from short-term working capital loans (less than a year) to long-term mortgages (up to 30 years). The tenor of a loan is often determined by the borrower’s creditworthiness, the purpose of the loan, and the lender’s risk appetite.

- Derivatives: Derivatives, such as futures and options, can have tenors ranging from days to several years. The tenor of a derivative is often based on the underlying asset’s tenor, such as a commodity, currency, or bond.

- Commercial Paper: Commercial paper is a short-term, unsecured debt instrument issued by corporations. It typically has maturities ranging from 1 to 270 days, with the majority of issuances having maturities of less than 90 days.

The diversity of tenor options available in the banking sector allows financial institutions to tailor their offerings to meet the unique needs of various borrowers, from individuals to large corporations. By understanding the tenor options associated with different financial instruments, borrowers and lenders can make more informed decisions regarding their financial strategies.

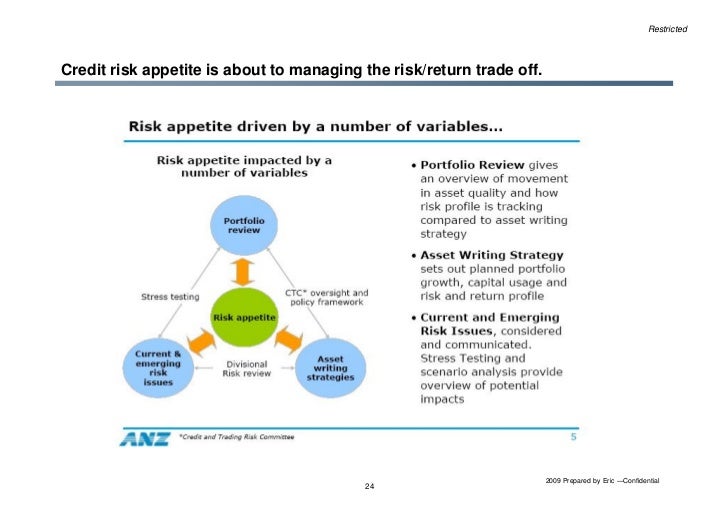

The Role of Tenor in Risk Management

Tenor plays a crucial role in risk management strategies within the banking sector. By effectively managing tenor, financial institutions can mitigate risk and optimize their return on investments. Two primary methods of risk mitigation are tenor diversification and optimal tenor allocation.

Tenor Diversification

Tenor diversification involves investing in financial instruments with varying tenors to reduce the overall risk exposure. By distributing investments across different tenors, banks can minimize the impact of interest rate fluctuations and market volatility on their portfolio. For instance, a bank may choose to invest in a mix of short-term commercial paper, medium-term corporate bonds, and long-term government bonds to create a balanced portfolio that can withstand market fluctuations.

Optimal Tenor Allocation

Optimal tenor allocation refers to determining the most suitable tenor for each investment based on the bank’s risk appetite, funding requirements, and market conditions. By allocating funds to the appropriate tenors, banks can maximize their risk-adjusted returns and meet their liquidity needs. For example, a bank may allocate a larger portion of its funds to shorter-term investments if it expects interest rates to rise in the near future, as this strategy can help protect the bank from potential losses due to falling bond prices.

In summary, understanding the role of tenor in risk management is essential for banks to maintain a stable and profitable portfolio. By implementing tenor diversification and optimal tenor allocation strategies, financial institutions can effectively manage risk, meet their liquidity needs, and achieve their financial objectives.

How Tenor Affects Liquidity in Banking

Tenor significantly impacts a bank’s liquidity position and its ability to meet short-term obligations. Liquidity refers to a bank’s ability to access sufficient funds to meet its immediate financial needs without incurring significant losses. A bank’s liquidity position can be influenced by various factors, including the tenor of its assets and liabilities.

Assets and Liabilities Maturity Structure

Banks must maintain a balance between the tenors of their assets and liabilities to ensure adequate liquidity. A mismatch between the two can lead to liquidity issues, particularly if a large portion of a bank’s assets consists of long-term loans and investments while its liabilities are primarily short-term deposits. In such cases, a bank may face difficulties in meeting its short-term obligations if a significant number of depositors decide to withdraw their funds simultaneously.

Managing Liquidity Risk

To manage liquidity risk, banks employ various strategies, including monitoring their liquidity position regularly, maintaining sufficient cash reserves, and establishing contingency funding plans. Additionally, banks can optimize their tenor structure by matching the tenors of their assets and liabilities, investing in highly liquid assets, and maintaining relationships with other financial institutions to access emergency funding if required.

In conclusion, tenor plays a critical role in determining a bank’s liquidity position. By effectively managing their tenor structure, banks can ensure that they have sufficient liquidity to meet their short-term obligations and maintain financial stability. Regular monitoring of tenor trends and adjusting strategies accordingly is essential for banks to ensure long-term profitability and stability.

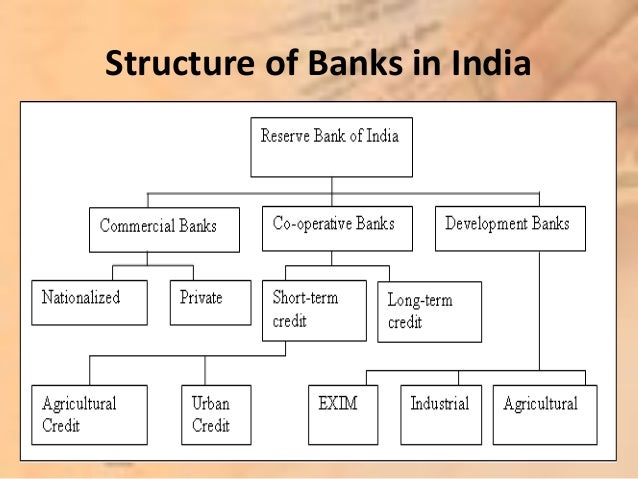

Navigating Regulatory Considerations in Tenor Selection

Banks must consider regulatory requirements and guidelines when determining the tenor of financial instruments and loans. Regulatory bodies, such as central banks and financial authorities, establish rules and guidelines to ensure financial stability, protect consumers, and prevent excessive risk-taking. Compliance with these regulations is essential for banks to maintain their operating licenses and avoid penalties.

Capital Adequacy Requirements

Capital adequacy requirements, such as Basel III, mandate that banks maintain sufficient capital reserves to cover potential losses from their lending activities. These regulations often consider the tenor of a bank’s assets and liabilities when calculating capital adequacy ratios. Banks with longer-tenor assets may be required to hold more capital to account for the increased risk associated with these instruments.

Liquidity Coverage Ratio

Liquidity coverage ratio (LCR) regulations require banks to maintain a minimum level of liquid assets to meet short-term obligations. Banks with a higher proportion of long-term assets, such as 30-year mortgages, may face challenges in meeting LCR requirements, as these assets may not be easily converted to cash within the required timeframe.

Risk-Weighted Assets

Regulatory bodies often assign risk weights to various financial instruments based on their credit risk, market risk, and tenor. Banks must calculate their risk-weighted assets (RWAs) and maintain a minimum capital adequacy ratio relative to their RWAs. Longer-tenor instruments typically receive higher risk weights, increasing a bank’s RWAs and capital requirements.

In conclusion, navigating regulatory considerations is a critical aspect of tenor selection in banking. Compliance with banking regulations and guidelines ensures financial stability, consumer protection, and long-term profitability. By understanding the impact of tenor on capital adequacy, liquidity coverage ratios, and risk-weighted assets, banks can optimize their tenor strategies while maintaining regulatory compliance.

Strategies for Optimizing Tenor in Banking Operations

Banks can employ various strategies to optimize tenor in their operations, balancing risk, liquidity, and financial performance. These strategies include diversification, hedging, and dynamic tenor management. By implementing these approaches, banks can enhance their profitability and stability while providing value to their customers.

Diversification

Diversification involves investing in a wide range of financial instruments and loans with varying tenors. By spreading their investments across different tenors, banks can reduce their exposure to interest rate risk and liquidity risk. A well-diversified tenor portfolio can help ensure that a bank’s earnings remain stable, even in a volatile interest rate environment.

Hedging

Hedging is a risk management strategy that involves entering into financial instruments to offset potential losses from existing exposures. For example, a bank with a large portfolio of long-term fixed-rate loans can hedge its interest rate risk by entering into interest rate swaps or purchasing interest rate options. These instruments can help protect a bank’s earnings from adverse interest rate movements, ensuring a more predictable financial performance.

Dynamic Tenor Management

Dynamic tenor management involves actively adjusting a bank’s tenor portfolio in response to changes in market conditions, customer demand, and internal funding requirements. By continuously monitoring and adjusting their tenor strategies, banks can maintain a competitive edge, optimize their risk-adjusted returns, and enhance their financial performance.

In conclusion, optimizing tenor in banking operations is crucial for enhancing profitability, managing risk, and ensuring long-term stability. By implementing diversification, hedging, and dynamic tenor management strategies, banks can effectively manage their tenor portfolios, providing value to their customers and shareholders alike. Regular monitoring of tenor trends and adjusting strategies accordingly is essential for banks to maintain their competitive edge and thrive in the ever-evolving financial landscape.

Assessing Tenor’s Impact on Financial Performance

Tenor plays a significant role in shaping a bank’s financial performance, influencing its earnings, risk exposure, and liquidity. By monitoring tenor trends and adjusting strategies accordingly, banks can optimize their financial performance, ensuring long-term profitability and stability. This section discusses the importance of assessing tenor’s impact on financial performance and offers guidance on implementing effective tenor management strategies.

Earnings Stability

Managing tenor effectively can contribute to earnings stability by reducing a bank’s exposure to interest rate risk. Banks with well-diversified tenor portfolios can maintain relatively stable earnings, even in a volatile interest rate environment. By matching the tenors of their assets and liabilities, banks can minimize the impact of interest rate fluctuations on their net interest income.

Risk Management

Tenor management is a critical aspect of risk management in banking. Banks that effectively manage their tenor exposure can reduce their credit risk, market risk, and liquidity risk. By monitoring tenor trends and adjusting their strategies accordingly, banks can maintain a balanced risk profile, ensuring long-term stability and profitability.

Liquidity Considerations

Tenor can significantly impact a bank’s liquidity position. Banks with a high proportion of long-term assets may face challenges in meeting their short-term obligations, particularly if they experience a sudden withdrawal of deposits or a decline in market liquidity. By maintaining a diversified tenor portfolio, banks can ensure that they have sufficient liquidity to meet their short-term obligations and weather market fluctuations.

Monitoring Tenor Trends

To effectively assess tenor’s impact on financial performance, banks must monitor tenor trends and market conditions regularly. By tracking changes in interest rates, customer demand, and regulatory requirements, banks can adjust their tenor strategies to maintain a competitive edge and optimize their financial performance.

In conclusion, understanding the relationship between tenor and financial performance is crucial for banks seeking to ensure long-term profitability and stability. By implementing effective tenor management strategies, banks can reduce their risk exposure, enhance their earnings stability, and maintain adequate liquidity. Regular monitoring of tenor trends and adjusting strategies accordingly is essential for banks to thrive in the ever-evolving financial landscape.