What is Level 2 Market Data and Why is it Valuable?

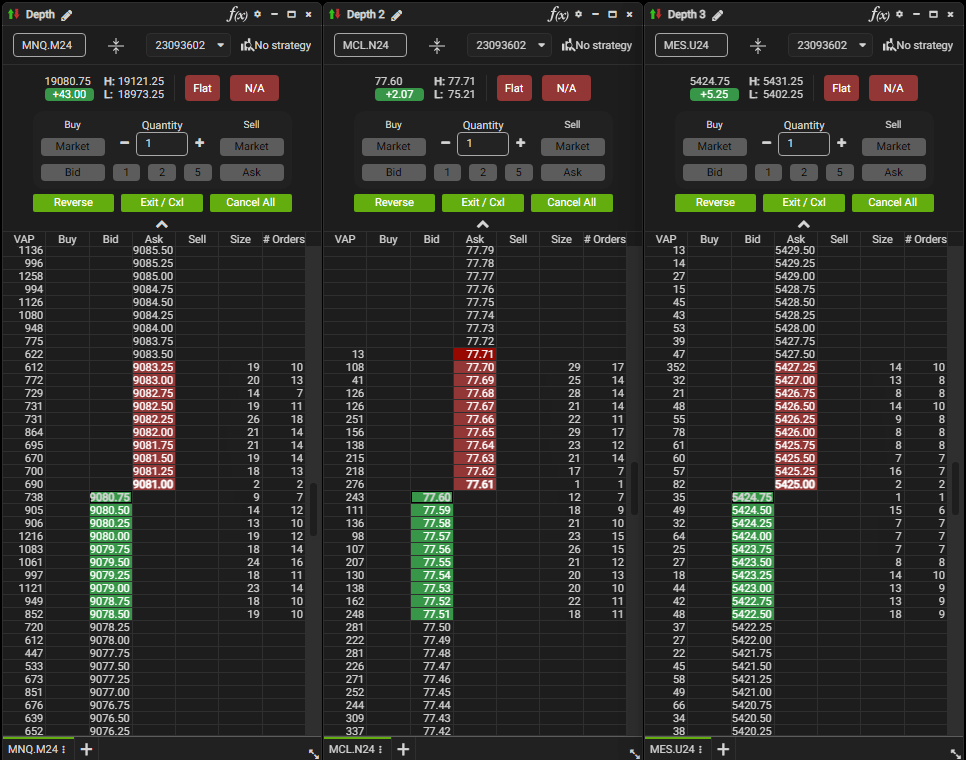

Level 2 market data provides a detailed, real-time view of the order book for a specific security. Instead of just seeing the best bid and ask prices, Level 2 data shows all outstanding buy and sell orders at various price points. This granular view offers significant advantages to traders and investors. It allows for a much deeper understanding of market depth and liquidity, enabling more informed trading decisions. For example, traders can identify potential price breakouts or reversals by observing order book imbalances. They can also assess the strength of buying or selling pressure by analyzing the volume at each price level. Accessing this rich information typically involves subscribing to expensive data feeds from professional providers. This article focuses on how to gain access to valuable insights with free level 2 market data.

Understanding the order book is key to successful trading. With free level 2 market data, traders can gain an edge without the significant cost associated with premium services. The ability to see the entire order book, even with limitations, provides a considerable advantage over relying solely on basic price charts. Analyzing the order flow allows for anticipation of price movements, leading to more precise entry and exit points. This data can be particularly useful in identifying hidden liquidity or anticipating market reactions to significant news events. However, it is crucial to remember that even the best free level 2 market data sources come with certain limitations, which will be discussed in the following sections. The value of free level 2 market data lies in its ability to empower traders with actionable intelligence, even if that intelligence is not perfectly complete or instantaneous.

Many traders benefit significantly from using free level 2 market data sources. By understanding the order book, they can make more informed decisions, potentially leading to improved trading performance. The ability to observe the dynamics of buying and selling pressure allows for better risk management. Traders can identify situations where the market may be vulnerable to price reversals or breakouts. This empowers them to time their trades more effectively. Remember, skillful interpretation of free level 2 market data, combined with sound risk management practices, can be a valuable tool for traders of all levels. While it won’t replace the speed and completeness of paid services, free level 2 market data offers a powerful way to enhance trading strategies without breaking the bank. The availability of free level 2 market data opens up a world of opportunities for those who can effectively leverage its power.

Understanding the Limitations of Free Level 2 Market Data

While the prospect of accessing free level 2 market data is appealing, it’s crucial to acknowledge inherent limitations. Free services often provide delayed data, meaning the information displayed might not reflect the current market reality. This delay can be significant, impacting the timeliness of trading decisions. The data may also be incomplete. Free level 2 market data sources might not offer the full depth of the order book, showing only a fraction of buy and sell orders. This limited view can hinder a trader’s ability to accurately gauge market sentiment and liquidity.

Furthermore, functionalities are often restricted. Paid services typically include advanced charting tools, customizable alerts, and historical data analysis features that are usually absent in free offerings. Users of free level 2 market data should anticipate fewer technical indicators and a less intuitive user interface. The reduced functionality can limit the sophistication of trading strategies. It’s important to remember that free level 2 market data is a trade-off: access in exchange for reduced quality and completeness. Realistic expectations are key to successful utilization.

Another significant constraint is the potential for data inaccuracies. While reputable sources strive for accuracy, free services may have less rigorous quality control than their paid counterparts. Errors or inconsistencies in the data can lead to flawed trading decisions. Finally, the availability of free level 2 market data may be limited to specific assets or exchanges. Traders should carefully check the scope of data coverage before relying on a particular free service. Understanding these limitations is paramount to effectively using free level 2 market data and mitigating potential risks.

How to Find Reputable Sources of Free Level 2 Market Data

Accessing free level 2 market data requires careful consideration. Many sources offer limited, often delayed, information. Trading platforms sometimes provide basic level 2 data as part of their free offerings. These often focus on a limited selection of popular assets, and updates may lag behind real-time feeds. However, for educational purposes or low-frequency trading, this free level 2 market data can prove useful. The quality and quantity of data vary significantly depending on the provider. Always review terms and conditions before using any platform to understand limitations. Some platforms will offer free access to a limited amount of data or for a trial period. After the trial period, there will be a subscription fee. Remember, even free sources require a cautious approach.

Several websites aggregate market data from various exchanges. These may present a snapshot of order book information, but accuracy and timeliness can be inconsistent. This aggregated free level 2 market data is not a substitute for professional-grade feeds. It can provide a general overview of market activity but should be used with an understanding of its limitations. It’s important to identify reputable aggregators with a history of accurate data presentation, although even with this there may be some delays. Always verify information from multiple sources before making trading decisions. Using free level 2 market data responsibly helps mitigate risk.

The availability of free level 2 market data also varies significantly by asset class. Free resources for stocks might be more common than for options or futures contracts. Forex trading often offers free charting with some basic market depth information. However, comprehensive free level 2 market data for more complex instruments is rare. Traders should adjust their expectations based on the asset class and the limitations of free data providers. Always prioritize data sources with clear transparency regarding their limitations and data accuracy. Understanding these limitations is crucial for effective use of free level 2 market data.

Analyzing Free Level 2 Market Data: Key Metrics and Interpretations

Understanding the components of free level 2 market data is crucial for effective use. The bid price represents the highest price a buyer is willing to pay for an asset. Conversely, the ask price is the lowest price a seller is willing to accept. The difference between these two prices is the spread, a key indicator of liquidity. A smaller spread suggests higher liquidity, meaning the asset is easier to buy or sell. Volume indicates the number of shares or contracts traded at each price level. High volume at a specific price level signifies strong buying or selling pressure at that point.

Order depth, a critical aspect of free level 2 market data, shows the total number of shares or contracts available at each bid and ask price. A deep order book, with many orders at various price levels, indicates greater market stability. Conversely, a shallow order book suggests higher volatility, as a smaller volume of orders could quickly impact the price. Traders using free level 2 market data should monitor changes in order depth to gauge the strength of buying or selling pressure. For example, a significant increase in volume at a particular bid price might signal an impending price increase. Similarly, a large sell order at the ask price could lead to a price decline. Analyzing these dynamics alongside price movements helps refine trading strategies.

Visualizing free level 2 market data effectively enhances its value. Many platforms present this data as a market depth chart, showing the bid and ask prices with their associated volumes. Some platforms also provide a time and sales display, showing each individual trade with its price and volume. By combining these visual representations with an understanding of order depth and volume, traders can gain valuable insights into market dynamics. This allows for informed decisions, enhancing the potential for successful trades. Remember, even with free level 2 market data, thorough analysis is paramount for effective trading strategies. Focusing on consistent monitoring and interpreting the interplay between price, volume, and order depth proves invaluable, particularly when used in conjunction with other analytical tools and techniques.

Integrating Free Level 2 Market Data into Your Trading Strategy

Incorporating free level 2 market data effectively requires a strategic approach. Traders can use this data to gain a better understanding of current market liquidity. By observing bid and ask sizes, one can identify potential support and resistance levels. This information is particularly valuable for day traders looking to capitalize on short-term price fluctuations. Analyzing order book depth provides insights into the strength of buying and selling pressure, aiding in decision-making. Remember, the limitations of free level 2 market data, such as delays, must be considered when making trading decisions.

Swing traders can also benefit from free level 2 market data, although its delayed nature might necessitate a slightly longer-term perspective. Observing consistent order imbalances can signal potential price movements over a longer timeframe. For instance, a persistent accumulation of buy orders at a specific price level might suggest an upcoming price increase. Combining this insight with other technical indicators strengthens the trading signal. However, always acknowledge the inherent limitations of free level 2 market data when forming trading strategies. Its use complements other forms of analysis, rather than replacing them entirely.

The key is to integrate free level 2 market data into a broader trading plan. Don’t rely solely on this data source. Combine it with your own technical and fundamental analysis. Use free level 2 market data to inform your entry and exit strategies. Identify potential opportunities within your pre-defined risk parameters. Understand the nuances of interpreting the data. This understanding will help in navigating the inherent limitations of free data. Remember, responsible risk management is crucial when using any data source, including free level 2 market data. Successful trading relies on a holistic approach, and free level 2 market data plays a supporting role.

Common Mistakes to Avoid When Using Free Level 2 Market Data

Relying solely on free level 2 market data can lead to inaccurate trading decisions. Delayed data, a common feature of free services, can significantly impact a trader’s ability to react quickly to market changes. This delay might cause missed opportunities or even losses. Traders should understand that the information presented is not real-time. Consequently, they should avoid making hasty trades based solely on this delayed information. They need to integrate the free level 2 market data with other forms of market analysis to avoid significant errors.

Misinterpreting order book information is another potential pitfall. Free services often provide incomplete or summarized data. A trader might mistakenly interpret a small increase in ask volume as significant selling pressure, when in reality, it’s an insignificant change in the overall market context. Furthermore, overlooking crucial macroeconomic factors or company-specific news can lead to flawed interpretations of the level 2 data. Remember that free level 2 market data offers only a piece of the puzzle. Successful trading requires a holistic approach, integrating multiple data points and fundamental analysis. It’s crucial to avoid over-reliance on any single data source, especially one with inherent limitations like free level 2 market data.

Another common error involves neglecting the limitations of the data source itself. Each provider of free level 2 market data has its own unique strengths and weaknesses. Some might excel in presenting data for specific asset classes, while others may offer more comprehensive, albeit still delayed, information. Understanding these limitations is crucial for accurate interpretation. Free level 2 market data should be treated as a supplementary tool, not the primary source for trading decisions. Its value lies in enhancing your understanding of market dynamics, not replacing other crucial steps in your trading process. Integrating free level 2 market data effectively requires awareness of its inherent limitations and a well-rounded trading strategy. Remember, responsible use of any market data, especially free level 2 market data, is critical for avoiding costly mistakes.

Comparing Free and Paid Level 2 Market Data Services

Understanding the differences between free and paid Level 2 market data services is crucial for informed decision-making. Free level 2 market data offers a valuable entry point for traders seeking to improve their market insights. However, limitations exist. These limitations primarily involve data delays, incomplete order book information, and restricted functionalities. Traders should carefully consider these constraints before relying solely on free sources for critical trading decisions. Paid services, conversely, provide real-time, comprehensive data feeds with minimal delays. This enhanced speed and accuracy are critical for high-frequency trading and for those needing the most up-to-the-minute market intelligence. The increased accuracy also reduces the risk of misinterpretations stemming from delayed or incomplete information, improving overall trading effectiveness. The comprehensive nature of paid services often includes features like advanced charting tools and analytical capabilities not found in free options. This makes them invaluable for sophisticated strategies.

The choice between free and paid Level 2 market data hinges on individual trading styles, risk tolerance, and budget. Day traders, for instance, heavily reliant on immediate market updates, might find the limitations of free level 2 market data unacceptable. Their need for speed and accuracy often justifies the cost of a paid service. Swing traders, however, might find the information provided by free sources sufficient, especially considering the additional expense of paid services. The key is to carefully weigh the benefits of real-time, complete data against the financial constraints of a paid subscription. This analysis allows traders to make informed decisions based on their specific needs and trading objectives. Many beginners will find free level 2 market data a helpful learning tool. However, as they become more experienced and their trading volume increases, they may find the benefits of a paid service outweigh the cost.

Ultimately, the decision rests on a cost-benefit analysis. Free level 2 market data offers a valuable learning opportunity and a viable option for low-volume traders. However, professional traders and those pursuing more sophisticated strategies may find the limitations of free services too restrictive. The advantages of speed, accuracy, and comprehensive features offered by paid services often outweigh the associated costs, particularly for those dependent on real-time market data for successful trading. Thus, understanding the nuances of both options is key to choosing the most appropriate solution for individual trading needs. The availability of both free and paid options ensures that traders of all levels and budgets can access the market data they need, although the extent of access and quality of data differ significantly.

Advanced Techniques and Strategies Using Free Level 2 Market Data

While free level 2 market data presents limitations, skilled traders can still extract valuable insights. Identifying potential breakouts involves observing significant shifts in order book imbalance. A sudden increase in buy orders at a specific price level, exceeding sell orders, might signal an imminent price increase. Conversely, a large concentration of sell orders could indicate a potential price drop. Remember to consider the context of this information; free level 2 market data’s inherent delays can impact the accuracy of this analysis. Using this data effectively requires careful observation and understanding of market dynamics. Always cross-reference with other indicators to confirm potential trading opportunities.

Another application of free level 2 market data lies in identifying market trends. By tracking the cumulative volume at various price points over time, traders can gauge the strength of support and resistance levels. Persistent high volume at a particular price suggests a strong support or resistance level. Conversely, low volume at these levels may indicate weakness. This type of analysis helps in identifying potential trend reversals or continuation patterns. However, remember that the delayed nature of free level 2 market data makes predicting precise turning points challenging. The data provides clues but should not be the sole basis for trading decisions. Supplement this analysis with other technical indicators for a more comprehensive view of the market. Accurate interpretation relies on combining the order book data with other data streams and analytical tools.

Furthermore, traders can use free level 2 market data to refine their order placement strategies. Observing order depth provides insight into potential liquidity at various price levels. Placing orders within areas of high liquidity reduces the risk of slippage. Conversely, identifying areas with low liquidity can provide opportunities for market manipulation. However, one should exercise caution. The delayed updates of free level 2 market data can lead to inaccurate assessments of liquidity. Therefore, rely on multiple sources and combine this data with your overall trading strategy. The delayed and limited nature of free level 2 market data should always inform your trading approach, leading to responsible use of this valuable but imperfect resource.