Understanding the Makeup of the Russell 2000

The Russell 2000 index serves as a widely recognized benchmark for the performance of small-cap stocks in the United States. It is designed to represent approximately the bottom 2,000 companies in the Russell 3000E index, which in turn represents about 98% of the investable U.S. equity market. Therefore, the Russell 2000 provides a broad measure of the U.S. small-cap segment. The criteria for inclusion in the Russell 2000 center primarily on market capitalization and liquidity. Stocks must have a relatively small market capitalization to qualify, reflecting their status as small-cap companies. Furthermore, they must demonstrate sufficient trading volume and liquidity to ensure that the index remains tradable and representative.

The index is reconstituted annually to ensure that it continues to accurately reflect the small-cap market. This reconstitution process involves re-ranking companies based on their market capitalization and liquidity, which may result in companies being added to or removed from the index. The Russell 2000 offers investors exposure to a diverse range of small-cap companies across various sectors of the U.S. economy. This diversification can be beneficial, as small-cap stocks may exhibit different growth characteristics and sensitivities to economic conditions compared to larger-cap stocks. Keeping track of the list of stocks in the russell 2000 index is important if you want to understand small cap market movements.

The significance of the Russell 2000 lies in its role as a performance benchmark and as an underlying index for various investment products, such as index funds and exchange-traded funds (ETFs). Many investors use these products to gain exposure to the small-cap market or to track the performance of small-cap stocks relative to other market segments. The annual reconstitution of the list of stocks in the russell 2000 index can create opportunities and challenges for investors, as stocks being added to the index may experience increased demand, while those being removed may face selling pressure. Consequently, understanding the index’s makeup and reconstitution process is essential for investors seeking to navigate the small-cap equity market effectively. Reviewing the list of stocks in the russell 2000 index periodically is a sound investment strategy.

How to Find Companies Included in the Index

Obtaining a current and accurate list of stocks in the russell 2000 index requires consulting reliable sources. Several avenues exist for accessing this information, each with its own advantages and disadvantages. Investors seeking a comprehensive list of stocks in the russell 2000 index can choose the method that best suits their needs.

FTSE Russell, the index provider, is the official source for the list of stocks in the russell 2000 index. They offer data subscriptions that provide detailed information on index constituents, including real-time updates and historical data. This is often the most accurate but also the most expensive option. Financial websites, such as those operated by major brokerage firms and financial news outlets, often provide lists of stocks in the russell 2000 index. These lists are generally updated regularly, offering a convenient way to track the index’s composition. However, the frequency and accuracy of updates can vary across different platforms. Data providers like Bloomberg, Refinitiv, and FactSet offer comprehensive financial data services, including access to index constituents and related analytics. These services provide a wealth of information but come at a premium cost. Choosing the right source depends on the user’s budget, data requirements, and technical expertise.

When evaluating different sources for a list of stocks in the russell 2000 index, consider factors such as cost, ease of access, and update frequency. Official sources like FTSE Russell offer the highest level of accuracy but may require a paid subscription. Financial websites provide a more accessible and often free option, but the data may not be as comprehensive or up-to-date. Data providers offer a balance of accuracy and features, but their services can be expensive. The best approach is to compare the available options and select the one that aligns with your specific investment needs. Monitoring the index’s composition regularly is crucial for investors seeking to stay informed about the small-cap market and make well-informed decisions, ensuring access to an updated list of stocks in the russell 2000 index.

Top Sectors Represented in the Small-Cap Index

The Russell 2000’s performance is significantly influenced by the composition and weighting of its constituent sectors. Analyzing these sector allocations provides valuable insights into the index’s overall behavior and potential investment opportunities. The weightings of the sectors can shift over time, driven by market dynamics and economic trends. Understanding these shifts is crucial for investors seeking to align their portfolios with the small-cap market.

Technology, healthcare, financials, consumer discretionary, and industrials are frequently among the most heavily weighted sectors in the Russell 2000. The dominance of technology and healthcare reflects the innovative and growth-oriented nature of many small-cap companies. The presence of financials indicates the importance of regional banks and smaller financial institutions in the small-cap market. Consumer discretionary and industrials represent the broader economic activity within the United States. The specific weightings of these sectors, and others, contribute significantly to the overall risk and return profile of the index. Sector composition is important to consider to analyze the list of stocks in the russell 2000 index.

Changes in sector weightings can occur due to various factors. For instance, a surge in technology stock valuations could increase the sector’s representation in the index. Conversely, economic downturns might negatively impact the consumer discretionary sector, reducing its weighting. These shifts in the sector weightings can have a ripple effect on the index’s performance. Investors interested in the list of stocks in the russell 2000 index should closely monitor these changes to anticipate potential market movements. Furthermore, the annual reconstitution of the Russell 2000 can lead to adjustments in sector allocations as companies are added or removed based on their market capitalization. This reconstitution process ensures that the index accurately reflects the evolving landscape of the U.S. small-cap market. Examining the list of stocks in the russell 2000 index and their respective sectors provides a comprehensive view of the small-cap universe. Understanding the impact of sector weightings on the Russell 2000 is vital for investors seeking to effectively allocate capital and manage risk within their portfolios, especially when analyzing the list of stocks in the russell 2000 index.

Key Characteristics of Firms Within the Index

The Russell 2000 index serves as a benchmark for small-cap U.S. equities. Companies within this index generally exhibit specific characteristics that distinguish them from their larger-cap counterparts. These characteristics influence investment strategies and potential returns. The typical revenue size of companies in the Russell 2000 is smaller compared to those in the S&P 500. This reflects their position in the growth cycle, often indicating higher growth potential but also increased risk. Investors seeking exposure to rapidly expanding businesses often find the list of stocks in the russell 2000 index appealing. These firms are frequently in the early to mid-stages of their development, poised for significant revenue and earnings growth.

Another key characteristic is higher volatility. Small-cap stocks, including the list of stocks in the russell 2000 index, tend to be more sensitive to market fluctuations and economic changes than larger, more established companies. This increased volatility stems from factors such as lower trading volumes, less analyst coverage, and greater susceptibility to specific industry or company-related news. While higher volatility presents potential for greater gains, it also carries a higher risk of losses. Growth potential is a significant draw for investors in the Russell 2000. Many small-cap companies are innovative and disruptive, operating in emerging industries or developing new technologies. This provides opportunities for substantial growth as these companies expand their market share and establish themselves as leaders in their respective fields. However, it’s crucial to acknowledge that not all small-cap companies will succeed, and the failure rate can be higher compared to larger, more stable businesses. The list of stocks in the russell 2000 index provides exposure to these companies.

The implications for investors are multifaceted. Investing in the Russell 2000 can offer diversification benefits, as small-cap stocks often have a lower correlation with large-cap stocks. This can help to reduce overall portfolio risk and enhance returns. However, investors must be prepared to accept higher volatility and conduct thorough research to identify companies with strong fundamentals and growth prospects. Furthermore, the annual reconstitution of the Russell 2000 can create opportunities and challenges for investors. As companies are added and removed from the index, their stock prices may experience significant fluctuations, potentially impacting investment returns. The list of stocks in the russell 2000 index can change during reconstitution. Understanding these characteristics is essential for investors seeking to navigate the small-cap market effectively and achieve their investment goals.

The Index’s Performance & Historical Trends

The historical performance of the Russell 2000 provides valuable insights into the dynamics of small-cap U.S. equities. When compared to major market indices like the S&P 500 and the Nasdaq Composite, the Russell 2000 often exhibits periods of both outperformance and underperformance. These fluctuations are influenced by various factors, including economic cycles, interest rate changes, and investor sentiment toward riskier assets. Examining the historical data reveals that small-cap stocks, as represented by the Russell 2000, can be more volatile than their large-cap counterparts. However, they also offer the potential for higher growth during periods of economic expansion. Investors seeking exposure to the U.S. small-cap market should carefully consider the historical performance trends of the Russell 2000 when making investment decisions. A list of stocks in the russell 2000 index shows a diverse range of companies that contribute to this volatility and growth potential.

Several key factors have shaped the Russell 2000’s performance over time. Economic cycles play a significant role, as small-cap companies are often more sensitive to changes in economic growth. During periods of strong economic expansion, small-cap stocks tend to outperform large-cap stocks, as they benefit from increased consumer spending and business investment. Conversely, during economic downturns, small-cap stocks may underperform as investors flock to safer, more established companies. Interest rate changes also have a notable impact. Lower interest rates can stimulate economic growth and boost the valuations of small-cap companies, while higher interest rates can have the opposite effect. Furthermore, changes in investor sentiment toward risk can influence the demand for small-cap stocks, driving their performance up or down. The list of stocks in the russell 2000 index is constantly being updated to reflect these economic realities.

Analyzing the historical trends of the Russell 2000 requires a comprehensive understanding of the macroeconomic environment and the specific characteristics of the companies included in the index. A list of stocks in the russell 2000 index reveals a wide array of sectors, each with its own unique growth drivers and challenges. For instance, technology companies in the Russell 2000 may be more sensitive to changes in innovation and consumer preferences, while healthcare companies may be more influenced by regulatory changes and demographic trends. Investors should also consider the impact of market events, such as geopolitical instability or major technological breakthroughs, on the performance of the Russell 2000. By carefully examining these factors, investors can gain a deeper appreciation for the historical performance of the index and make more informed investment decisions. A thorough analysis of the list of stocks in the russell 2000 index is crucial for understanding its overall performance.

Investment Strategies Utilizing the Russell 2000

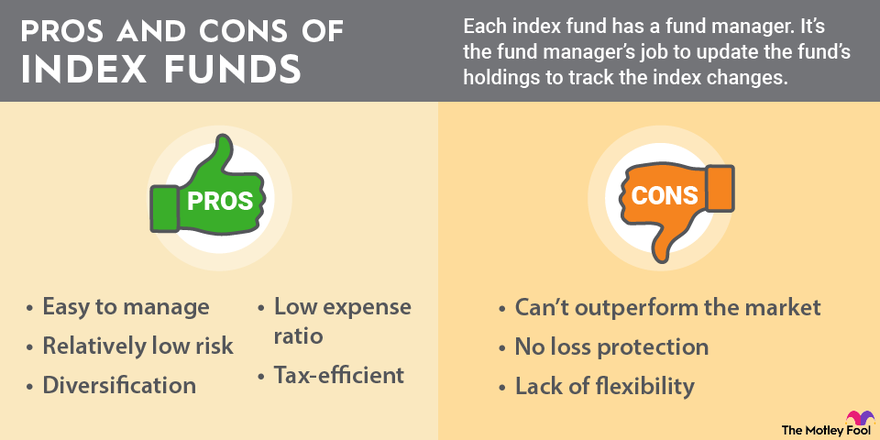

Various investment strategies cater to those seeking exposure to the Russell 2000 index. A popular approach involves investing in index funds or Exchange Traded Funds (ETFs) specifically designed to track the Russell 2000. These passively managed funds aim to replicate the index’s performance by holding a portfolio mirroring its composition. Investing in these funds provides diversification across a broad spectrum of small-cap companies, offering a convenient way to participate in the small-cap market segment. Investors can easily find a comprehensive list of stocks in the russell 2000 index represented within these funds, simplifying their investment decisions. The expense ratios and tracking error are important considerations when choosing an index fund or ETF.

Actively managed funds represent another avenue for investing in the Russell 2000. These funds employ professional portfolio managers who actively select stocks with the goal of outperforming the index. While actively managed funds offer the potential for higher returns, they also come with higher fees and the risk of underperformance. The success of these funds hinges on the manager’s stock-picking abilities and investment strategy. Analyzing the fund’s historical performance, investment style, and management team is crucial before investing. A complete list of stocks in the russell 2000 index may or may not be fully reflected in actively managed funds.

Each investment strategy carries its own set of risks and rewards. Index funds and ETFs provide a cost-effective way to gain broad exposure to the small-cap market, but their performance will mirror the index, limiting the potential for outsized gains. Actively managed funds offer the possibility of exceeding the index’s returns, but their higher fees can erode profits, and there’s no guarantee of success. Investors must carefully weigh their risk tolerance, investment goals, and time horizon when choosing an investment strategy. The ability to access a comprehensive list of stocks in the russell 2000 index, alongside thorough research, is crucial for making informed investment decisions. Diversification, a cornerstone of sound investing, is facilitated by the broad representation offered by the Russell 2000, but investors should still conduct due diligence on individual holdings, particularly within actively managed funds.

Analyzing the Annual Reconstitution of the Russell 2000

The Russell 2000 undergoes an annual reconstitution, a process that can significantly impact both the index and the individual companies within it. This reconstitution involves reassessing the market capitalization and ranking of eligible companies to ensure the index accurately reflects the small-cap market. During the annual reconstitution, stocks are added to the index as larger companies grow beyond the small-cap threshold, and companies are removed as their market capitalization declines. This dynamic process maintains the integrity of the Russell 2000 as a benchmark. The annual event is a significant undertaking by FTSE Russell, the index provider.

The reconstitution process can create both opportunities and risks for investors. Stocks being added to the index often experience increased demand as index funds and ETFs that track the Russell 2000 are required to purchase them. This increased demand can lead to a temporary price increase. Conversely, stocks being removed from the index may face selling pressure, potentially leading to a price decline. Savvy investors will monitor the list of stocks in the russell 2000 index, paying close attention to potential additions and deletions, seeking to capitalize on these price movements. Furthermore, the rebalancing can impact sector weightings within the index, as the inclusion or exclusion of companies from specific industries can shift the overall sector composition. Understanding the annual reconstitution process is crucial for investors seeking to effectively manage their exposure to the U.S. small-cap market. Analyzing the list of stocks in the russell 2000 index regularly can also help to understand the overall dynamics of the small cap market.

Price volatility can often occur around the reconstitution date, typically in June. This is due to the trading activity of index funds and other institutional investors adjusting their portfolios to match the updated index composition. Investors should be aware of this potential volatility and exercise caution during this period. The list of stocks in the russell 2000 index is published in advance, allowing market participants to prepare for the changes. However, the actual impact on individual stock prices can be difficult to predict. Investors should conduct their own due diligence and consult with a financial advisor before making any investment decisions based on the reconstitution. The annual reconstitution is an essential component of the Russell 2000’s role as a reliable barometer of U.S. small-cap equity performance, even though the list of stocks in the russell 2000 index changes every year, the goal to represent the small cap is always the same.

Factors That Influence Individual Stock Performance Within the Index

The performance of individual stocks within the Russell 2000, a key benchmark for small-cap U.S. equities, is subject to a multitude of influences. Understanding these factors is crucial for investors seeking to navigate the complexities of the small-cap market. Earnings reports are a primary driver. Strong earnings growth typically leads to increased investor confidence and higher stock prices. Conversely, disappointing earnings can trigger sell-offs. Industry trends play a significant role. Stocks in sectors experiencing tailwinds, such as technological innovation or increased consumer demand, often outperform. These sector-specific trends can significantly impact the performance of companies, whether or not they belong to the list of stocks in the russell 2000 index. Macroeconomic events exert broad influence. Factors like interest rate changes, inflation, and economic growth or recession can affect overall market sentiment and investor behavior. These events tend to impact the valuations and prospects of companies within the index.

Inclusion in or exclusion from the Russell 2000 during its annual reconstitution can significantly impact a stock’s performance. When a stock is added to the index, it often experiences a price increase due to increased demand from index funds and ETFs that are required to hold the list of stocks in the russell 2000 index. Conversely, exclusion can lead to selling pressure and a subsequent price decline. Investor sentiment is always relevant. Positive news or analyst upgrades can fuel buying activity, while negative news or downgrades can trigger selling. The overall market environment, whether bullish or bearish, also influences individual stock performance. Furthermore, company-specific events, such as mergers, acquisitions, or new product launches, can have a substantial impact on stock prices. Regulatory changes and government policies can also affect the business environment for companies within the index. The list of stocks in the russell 2000 index are particularly susceptible to news and government policies.

Liquidity, or the ease with which a stock can be bought or sold without significantly affecting its price, also plays a crucial role. Stocks with higher liquidity tend to be less volatile. Small-cap stocks, including those on the list of stocks in the russell 2000 index, generally have lower liquidity than large-cap stocks, which can amplify price swings. The level of institutional ownership can also influence stock performance. Higher institutional ownership can provide stability, while lower ownership can increase volatility. Finally, short interest, or the number of shares that have been sold short by investors betting on a price decline, can influence stock performance. High short interest can create a potential for a “short squeeze,” where a surge in buying forces short sellers to cover their positions, driving the stock price higher. Therefore, many different factors drive the performance of the list of stocks in the russell 2000 index, calling for constant diligence.