Unlocking Small-Cap Insights: How to Extract a Comprehensive List of Russell 2000 Constituents

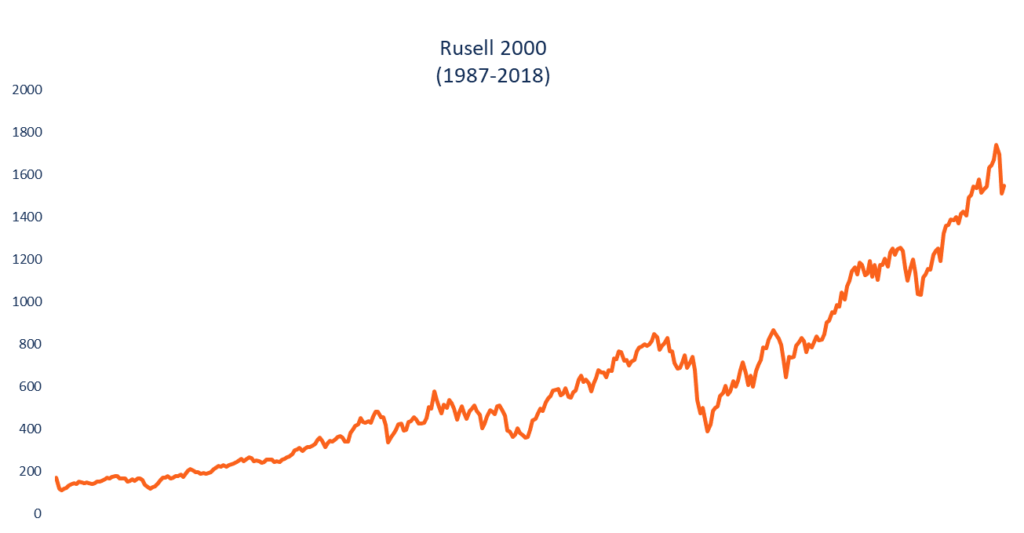

The Russell 2000 index serves as a vital benchmark reflecting the performance of small-cap U.S. stocks. It captures a segment of the market often overlooked, yet brimming with growth potential. Understanding the composition of the Russell 2000 is crucial for investors seeking exposure to this dynamic sector. This section introduces the process of obtaining a comprehensive russell 2000 companies list excel, offering a foundation for in-depth analysis. The Russell 2000 index is constructed through a rigorous methodology. Annually, the index undergoes a rebalancing process. This ensures accurate representation of the small-cap market. Knowing how the index is built helps in understanding the data’s significance.

The annual reconstitution involves adding and deleting companies based on their market capitalization and other eligibility criteria. This dynamic nature of the index necessitates regular updates to maintain an accurate russell 2000 companies list excel. Access to this data allows for informed investment decisions and a deeper understanding of the small-cap landscape. Investors can leverage this information to identify potential opportunities and manage risk effectively. A well-maintained russell 2000 companies list excel is an indispensable tool for anyone focused on small-cap investing. The index represents approximately 8% of the total market capitalization. It is part of the broader Russell 3000 index. Understanding its role within the larger market context is important.

Building a reliable russell 2000 companies list excel requires careful consideration of data sources and accuracy. The subsequent sections will guide you through navigating data providers. It will also highlight essential data points. Finally, it will discuss strategies for maintaining an up-to-date and informative database. This foundational knowledge empowers investors. It allows them to harness the power of small-cap data for enhanced investment outcomes. By understanding the index’s construction and accessing reliable data, investors can gain a competitive edge in the market.

Navigating Data Providers for Russell 2000 Information

Obtaining a reliable russell 2000 companies list excel requires careful consideration of available data sources. Several financial data providers offer comprehensive information on the Russell 2000 index and its constituents. Refinitiv, Bloomberg, and FactSet are prominent vendors known for their extensive financial databases. These platforms typically provide real-time data, historical information, and analytical tools. However, accessing these services usually involves subscription fees, which can be substantial, particularly for individual investors or smaller firms.

When evaluating data providers for your russell 2000 companies list excel, it’s crucial to weigh the costs against the benefits. Refinitiv and Bloomberg offer highly detailed datasets, including fundamental data, estimates, and news feeds, beneficial for in-depth analysis. FactSet is another strong contender, known for its robust research tools and global coverage. These platforms generally offer superior data quality and reliability compared to free alternatives. However, the cost can be a barrier for some users. Each provider has its strengths; therefore, assessing your specific data needs is essential before committing to a subscription.

Exploring free resources for compiling your russell 2000 companies list excel is also an option, although it comes with caveats. Websites offering basic stock information might provide a list of Russell 2000 companies. However, the accuracy and timeliness of this data can be questionable. Free sources often have limitations regarding data depth and may not include all the key data points necessary for comprehensive analysis. For instance, sector classifications or detailed financial ratios may be missing. Therefore, if you opt for free resources, be prepared to invest time in verifying and supplementing the data. Always cross-reference information with multiple sources to ensure accuracy. While free data can be a starting point, consider upgrading to a paid service for professional-grade analysis and a more reliable russell 2000 companies list excel.

Essential Data Points to Include in Your Small-Cap Analysis

When building your russell 2000 companies list excel, focusing on essential data points is crucial for effective analysis. A comprehensive list extends beyond just company names and ticker symbols. It incorporates elements that allow for deeper understanding and informed decision-making. This section outlines key data points to prioritize when compiling your russell 2000 companies list excel.

Ticker symbols and company names are, of course, the foundation of any russell 2000 companies list excel. However, sector classifications, based on the Global Industry Classification Standard (GICS), provide valuable context. GICS helps to categorize companies by their primary business activity. This allows you to analyze sector performance within the Russell 2000 and identify potential trends. Market capitalization is another critical data point. It reflects the overall size of the company. This figure is vital when assessing risk and comparing companies of different scales. Including market capitalization data enables filtering. You could focus specifically on micro-cap or larger small-cap stocks within the russell 2000 companies list excel.

Beyond basic information, incorporating key financial ratios enhances the analytical power of your russell 2000 companies list excel. The Price-to-Earnings (P/E) ratio indicates how much investors are willing to pay for each dollar of a company’s earnings. The Price-to-Book (P/B) ratio compares a company’s market value to its book value. These ratios, alongside others like Price-to-Sales (P/S), offer insights into valuation. They also allow for comparison across different companies and sectors. Dividend yield, representing the annual dividend payment relative to the stock price, is relevant for income-focused strategies. Furthermore, including data on debt levels and profitability margins allows for a more complete financial profile of each company within the russell 2000 companies list excel. By assembling this comprehensive dataset, you transform a simple list into a powerful tool for small-cap analysis.

Leveraging Spreadsheets for Organizing and Analyzing Russell 2000 Data

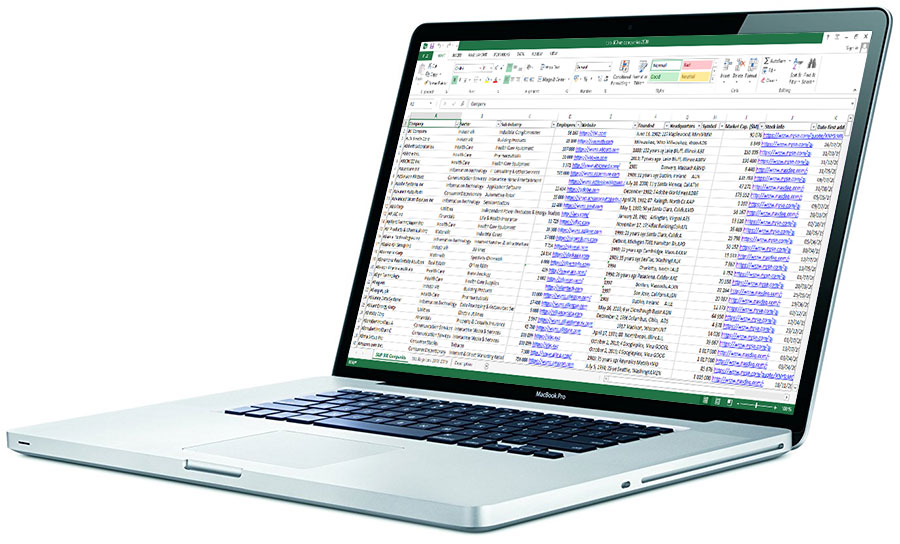

Spreadsheets, such as Microsoft Excel or Google Sheets, are indispensable tools for organizing and analyzing your russell 2000 companies list excel. Their intuitive interface and powerful functions allow for efficient data management and manipulation. Once you’ve gathered your russell 2000 companies list excel from a data provider, the next step is to import it into your chosen spreadsheet program.

Data cleaning is a crucial first step. This involves removing any inconsistencies, correcting errors, and standardizing the format of your data. For example, ensure that all ticker symbols are in the same format and that numerical data is consistently formatted (e.g., using commas for thousands separators). Sorting is another essential function. You can sort your russell 2000 companies list excel by market capitalization, sector, or any other relevant data point. This allows you to quickly identify the largest companies in the index or to group companies by industry. Filtering lets you focus on specific subsets of the data. For instance, you can filter the list to show only companies in the technology sector or those with a market capitalization above a certain threshold. These operations are critical for preparing your russell 2000 companies list excel for deeper analysis.

Beyond basic cleaning, sorting, and filtering, spreadsheets offer a range of functions for more advanced analysis. You can calculate summary statistics such as the average market capitalization, the median P/E ratio, or the total weight of a particular sector within the index. Creating pivot tables is another powerful technique. Pivot tables allow you to quickly summarize and analyze large datasets. For example, you can use a pivot table to see the total market capitalization by sector or the number of companies in each sector. Furthermore, conditional formatting can be used to highlight data that meets specific criteria. For example, you could highlight companies with a P/E ratio above a certain level or those whose stock price has increased significantly over the past year. By mastering these spreadsheet techniques, you can unlock valuable insights from your russell 2000 companies list excel and make more informed investment decisions.

Transforming Raw Data into Actionable Intelligence

Once a russell 2000 companies list excel spreadsheet is populated, the true power lies in data manipulation to extract actionable insights. One valuable application is calculating sector weights within the index. By summing the market capitalization of companies within each GICS sector and dividing by the total market capitalization of the Russell 2000, one can determine the percentage allocation to each sector. This provides a clear understanding of the index’s composition and potential sector biases. Furthermore, it enables comparison against other benchmarks or the creation of sector-neutral portfolios. This is key for understanding the broader investment landscape.

The russell 2000 companies list excel can also be leveraged to identify potential investment opportunities based on specific, pre-defined criteria. For instance, an investor might be interested in companies with a Price-to-Earnings (P/E) ratio below a certain threshold, a minimum market capitalization, and positive revenue growth. By using spreadsheet filtering and sorting functions, it’s easy to narrow down the russell 2000 companies list excel to only those companies that meet these criteria. This process can be automated using spreadsheet formulas, allowing for quick identification of companies that fit specific investment strategies. Investors could also look at price-to-book ratios and other fundamental data points. This process streamlines investment analysis.

Creating custom rankings is another powerful way to utilize the russell 2000 companies list excel. Instead of relying solely on market capitalization-weighted rankings, companies can be ranked based on factors such as revenue growth, profitability, or analyst ratings. A composite score can be created by weighting different factors according to their importance in an investment strategy. This allows for a more nuanced and personalized approach to identifying attractive investment opportunities within the Russell 2000. The ability to manipulate and rank the russell 2000 companies list excel transforms raw data into actionable intelligence, empowering informed investment decisions. It goes beyond the obvious and enables strategic decision-making.

Avoiding Common Pitfalls When Working With Financial Data

Working with financial data, especially when compiling and analyzing a russell 2000 companies list excel, presents several potential pitfalls. Data errors can creep in from various sources, impacting the accuracy of your analysis. One common issue is transcription errors when manually entering data. Always double-check figures and ticker symbols against reputable sources. Data providers, while generally reliable, can sometimes have discrepancies. Cross-validate information from multiple sources to ensure consistency.

Inconsistencies across sources are another challenge. Different providers may use slightly different methodologies for calculating financial ratios or classifying companies into sectors. Be aware of these differences and choose a consistent source for your primary data. Outdated information is a significant concern. The financial landscape is constantly evolving due to market fluctuations, mergers, acquisitions, and bankruptcies. Regularly update your russell 2000 companies list excel to reflect these changes. Using stale data can lead to flawed analysis and poor investment decisions.

Validating and verifying the accuracy of your russell 2000 companies list excel is crucial. Implement quality control measures to catch errors early. For instance, use spreadsheet formulas to check for outliers or inconsistencies in the data. Compare your list against the official Russell 2000 index to identify any missing or incorrectly classified companies. Pay close attention to data types. Ensure that numerical values are formatted correctly and that dates are accurate. By proactively addressing these potential pitfalls, you can significantly improve the reliability and usefulness of your russell 2000 companies list excel.

Strategies for Regular Updates and Maintaining Your Russell 2000 Database

Maintaining an accurate and current russell 2000 companies list excel database requires regular updates. The composition of the Russell 2000 index changes due to annual rebalancing, mergers, acquisitions, and bankruptcies. Neglecting these changes can lead to inaccurate analysis and flawed investment decisions. A proactive approach to updating your data is essential.

One method involves setting calendar reminders corresponding to the Russell 2000 rebalancing schedule. Typically, FTSE Russell announces preliminary reconstitution results in June, with changes taking effect at the end of the month. Monitoring these announcements allows you to anticipate changes to your russell 2000 companies list excel. Financial data providers often offer update services that flag changes in index membership, making it easier to identify additions and deletions. These services can be integrated into your spreadsheet workflow. Automating the data retrieval process can save time and reduce the risk of manual errors. Consider using scripting languages or spreadsheet add-ins to automatically pull updated data from reliable sources into your russell 2000 companies list excel. Regularly verifying your data against a trusted source is a best practice. This helps to catch any discrepancies or errors that may have occurred during the update process.

For those who prefer a more hands-on approach, manually comparing your existing russell 2000 companies list excel against the latest official list of constituents is an option. This can be a time-consuming process, but it allows for a thorough review of the data. Regardless of the method used, documenting the date of each update and the source of the information is crucial for maintaining data integrity. Implementing a version control system for your russell 2000 companies list excel can also be beneficial, allowing you to track changes over time and revert to previous versions if needed. By prioritizing regular updates and employing effective maintenance strategies, you can ensure that your Russell 2000 database remains a valuable resource for small-cap analysis.

Beyond Basic Data: Advanced Analysis Techniques for the Russell 2000

The foundation established by a well-organized russell 2000 companies list excel spreadsheet unlocks opportunities for sophisticated analysis. This moves beyond simple data aggregation into the realm of predictive modeling and strategic investment decisions. Several advanced techniques can extract further value from your russell 2000 companies list excel database.

One powerful approach is backtesting investment strategies. By simulating historical performance, you can evaluate the effectiveness of various investment rules applied to the russell 2000 companies list excel. For instance, explore how a momentum-based strategy, buying stocks with the highest recent returns, would have performed over different periods. This requires integrating historical price data with your russell 2000 companies list excel and employing spreadsheet functions or statistical software to calculate returns and risk metrics. Another valuable technique is correlation analysis, which examines the relationships between different stocks or sectors within the russell 2000 companies list excel. Identifying highly correlated assets can inform diversification strategies or highlight potential hedging opportunities. Furthermore, sector analysis, easily facilitated with your russell 2000 companies list excel, can reveal which areas of the small-cap market are outperforming or underperforming, potentially indicating future trends.

Deeper fundamental research on individual companies within the russell 2000 companies list excel is crucial. Screening the russell 2000 companies list excel based on financial ratios like Price-to-Earnings (P/E), Price-to-Book (P/B), or Debt-to-Equity (D/E) can pinpoint potentially undervalued or overvalued stocks. You can then delve into company-specific financials, news, and analyst reports to assess their growth prospects and risks. Integrating external data sources, such as economic indicators or industry-specific data, can also enhance your analysis. For example, analyzing how changes in interest rates affect companies in interest-rate-sensitive sectors within the russell 2000 companies list excel. Remember to validate the information from russell 2000 companies list excel across multiple sources to minimize errors and ensure accuracy, improving your data-driven decisions.