Decoding Bond Pricing: An Introduction

Understanding bond valuation is crucial for investors seeking to navigate the complexities of fixed-income markets. At its core, determining a bond’s worth involves calculating the present value of its anticipated future cash flows. These cash flows consist primarily of two components: periodic interest payments, often referred to as coupon distributions, and the ultimate return of the principal amount, also known as face amount or redemption value, at the bond’s maturity date. Therefore, the price of a bond is equivalent to the discounted value of these expected payments. This discounting process takes into account the time value of money, acknowledging that funds received today are worth more than the same funds received in the future, due to factors like inflation and potential investment opportunities.

The interest payments, typically made semi-annually, represent a steady stream of income for the bondholder. The face amount, on the other hand, signifies the sum the issuer promises to repay at the end of the bond’s term. To arrive at the current worth, each of these future cash flows must be discounted back to the present using an appropriate discount rate. This rate reflects the prevailing market interest rates for bonds with similar risk profiles and maturity dates. In essence, the price of a bond is equivalent to the total of the present values of all future coupon payments plus the present value of the face amount. Understanding this fundamental principle is essential for making informed investment decisions in the bond market.

Several factors influence the selection of an appropriate discount rate, including prevailing interest rates, the issuer’s creditworthiness, and the bond’s maturity date. Higher interest rates generally lead to a higher discount rate, resulting in a lower present worth for the bond. Conversely, lower interest rates translate to a lower discount rate and a higher present worth. The issuer’s credit rating also plays a vital role. Bonds issued by entities with lower credit ratings typically require higher discount rates to compensate investors for the increased risk of default. Consequently, the price of a bond is equivalent to the present value of its future cash flows, adjusted for these various risk factors. Accurately assessing these factors is paramount for both bond investors and issuers alike.

How to Calculate the Fair Value of a Bond

Determining the fair value of a bond involves calculating the present value of its anticipated cash flows. These cash flows consist of two components: the periodic coupon payments and the face value (or par value) received at maturity. The concept relies on discounting these future payments back to their present worth, considering the time value of money. This approach helps investors assess whether the price of a bond is equivalent to its intrinsic worth, guiding investment decisions.

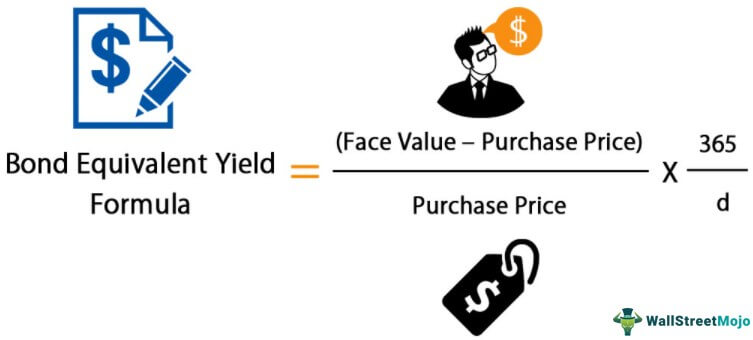

The formula for calculating the present value of a bond is: Present Value = (Coupon Payment / (1 + Discount Rate)^n) + (Face Value / (1 + Discount Rate)^n), where ‘n’ represents the number of periods. Let’s break this down. First, determine the coupon payment, which is the periodic interest payment the bondholder receives. The discount rate reflects the yield an investor requires to compensate for the bond’s risk. The ‘n’ signifies the number of periods until the coupon payment or face value is received. For example, consider a bond with a $1,000 face value, a 5% annual coupon rate (paid semi-annually), and a maturity of 3 years. If the appropriate discount rate is 6%, the calculation involves discounting each semi-annual coupon payment ($25) and the face value back to the present. The summation of these present values gives the fair value of the bond. The price of a bond is equivalent to the total present value of all future cash flows.

To further illustrate, imagine a scenario where market interest rates rise. Consequently, the discount rate used in the present value calculation also increases. This increase in the discount rate leads to a lower present value, meaning the fair value of the bond decreases. Conversely, if market interest rates fall, the discount rate decreases, resulting in a higher present value and a higher fair value for the bond. Understanding this calculation and the variables involved empowers investors to make informed decisions about bond investments. The price of a bond is equivalent to the discounted value of future cash flows, providing a benchmark for evaluating its investment potential.

The Inverse Relationship Between Interest Rates and Bond Values

A foundational principle in fixed income investing is the inverse relationship between interest rates and bond values. When interest rates rise, the price of a bond is equivalent to, its market value tends to decrease, and conversely, when interest rates fall, the price of a bond is equivalent to, its value typically increases. This dynamic arises from the time value of money and how investors perceive alternative investment opportunities.

Imagine a bond paying a fixed coupon rate of 5%. If prevailing interest rates in the market suddenly climb to 7%, newly issued bonds will offer this higher, more attractive rate. Consequently, the existing 5% bond becomes less desirable because investors can now purchase new bonds yielding a greater return. To compensate for this lower coupon rate relative to the market, the price of the existing bond must fall. This price decrease makes the bond more attractive to potential buyers, effectively raising its yield to a level competitive with the new 7% bonds. The price of a bond is equivalent to, the present value of its future cash flows, so when discount rates (market interest rates) increase, the present value decreases.

Consider a contrasting scenario. Suppose interest rates decline to 3%. The original 5% bond now appears highly attractive, as it offers a higher return than currently available in the market. Investors are willing to pay a premium for this bond, driving its price upward. This price increase lowers the bond’s overall yield to align more closely with the new, lower market interest rates. This inverse relationship is crucial for understanding bond market dynamics. For example, if the Federal Reserve raises interest rates, bondholders should anticipate a potential decline in the value of their bond portfolios. Similarly, if economic indicators suggest a future decrease in interest rates, investors may consider purchasing bonds in anticipation of capital appreciation. Understanding that the price of a bond is equivalent to, the present value of its future cash flows, discounted at the prevailing market interest rate, is essential for making informed investment decisions.

Impact of Coupon Rate on Bond Valuation

The coupon rate of a bond significantly affects its price. The coupon rate represents the annual interest income that the bond issuer pays to the bondholder, expressed as a percentage of the face value. Understanding how the coupon rate interacts with prevailing market interest rates is crucial for grasping bond valuation. When assessing bonds, a key concept to remember is that the price of a bond is equivalent to the present value of its future cash flows.

Bonds can be classified into three categories based on the relationship between their coupon rate and the prevailing market interest rate. A premium bond has a coupon rate higher than the market interest rate. Because it offers a more attractive income stream, investors are willing to pay more than its face value. Conversely, a discount bond has a coupon rate lower than the market interest rate. Investors demand a lower price to compensate for the less attractive coupon payments. Finally, a par bond has a coupon rate equal to the market interest rate, and it trades at or near its face value. The price of a bond is equivalent to its par value in this scenario.

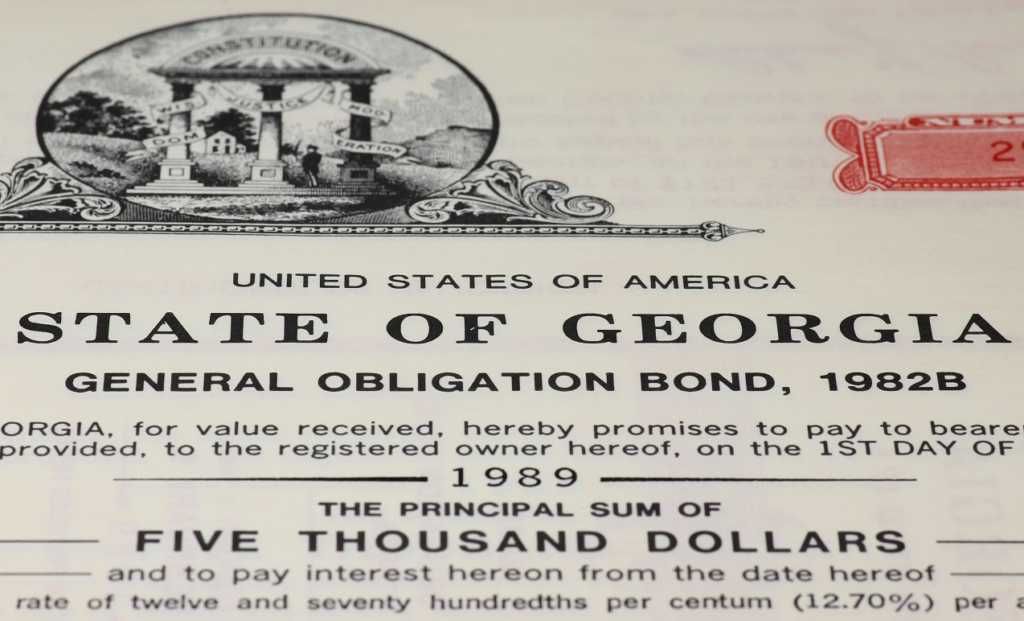

For example, consider a bond with a face value of $1,000 and a coupon rate of 5%. If the current market interest rate for similar bonds is 4%, this bond is a premium bond. Investors would likely pay more than $1,000 for it. Conversely, if the market interest rate is 6%, the bond is a discount bond. Investors would pay less than $1,000. If the market interest rate is exactly 5%, the bond is a par bond. Its price is equivalent to $1,000. The difference highlights the effect of the coupon rate on bond pricing. Therefore, the higher the coupon payments, the more attractive the bond is to investors. Keep in mind that the price of a bond is equivalent to the total discounted value of its future interest payments and principal repayment.

Maturity Date’s Role in Determining Bond Value

The maturity date, representing when the principal is repaid, significantly impacts a bond’s sensitivity to interest rate changes. Longer-maturity bonds generally exhibit greater price sensitivity compared to shorter-maturity bonds. This is because the price of a bond is equivalent to the present value of future cash flows, and these flows are discounted over a longer period. For example, imagine two bonds with the same coupon rate, but one matures in one year and the other in ten years. A change in interest rates will affect the present value of the ten-year bond’s cash flows much more drastically than the one-year bond.

To understand this sensitivity, the concept of ‘duration’ is helpful. Duration is a measure of a bond’s price sensitivity to changes in interest rates. While a precise calculation of duration involves a formula, it can be intuitively understood as the weighted average time until a bond’s cash flows are received. A higher duration signifies greater sensitivity to interest rate fluctuations. The price of a bond is equivalent to the present value of its cash flows, hence the longer the wait to receive them, the higher the impact from interest rates. Therefore, investors should carefully consider maturity when choosing bonds based on their risk tolerance and expectations for future interest rate movements.

Bonds are often categorized by their maturity terms. Short-term bonds typically mature in one to three years, mid-term bonds in four to ten years, and long-term bonds in over ten years. Short-term bonds are generally considered less risky because their prices are less volatile. Mid-term bonds offer a balance between risk and potential return. Long-term bonds offer the potential for higher returns but carry the greatest risk due to their sensitivity to interest rate movements. The price of a bond is equivalent to the discounted sum of its future cash flows, an important detail that helps determine the impact of duration. Understanding these maturity terms and their relationship to duration is crucial for making informed investment decisions. The price of a bond is equivalent to what a buyer is willing to pay based on these factors.

Creditworthiness and Its Effect on Bond Prices

Credit risk significantly impacts bond prices. Creditworthiness reflects an issuer’s ability to meet its debt obligations. Credit ratings, from agencies like Moody’s, S&P, and Fitch, assess this risk. Lower credit ratings signal higher risk, leading to increased yields and subsequently lower prices. The price of a bond is equivalent to the present value of future cash flows, and this present value is heavily influenced by the perceived risk of those cash flows not being paid.

Bonds are broadly categorized into investment-grade and high-yield (or junk) bonds. Investment-grade bonds are considered relatively safe. They have lower yields due to their lower risk. High-yield bonds carry a higher risk of default. To compensate for this increased risk, they offer higher yields. Therefore, the price of a bond is equivalent to what investors are willing to pay, considering the associated risk. A company with a strong credit rating will typically issue bonds at a higher price. This is because investors view them as a safer investment. Conversely, a company with a low credit rating must offer its bonds at a lower price to attract investors. This reflects the higher risk of default.

Changes in credit ratings can significantly affect bond prices. An upgrade in a company’s credit rating usually leads to an increase in its bond prices. This is because the perceived risk decreases. A downgrade has the opposite effect, causing bond prices to decline. For example, if a company is downgraded from investment grade to high yield, many institutional investors may be forced to sell their holdings. This increased selling pressure further drives down the price of the bond. The price of a bond is equivalent to the present value of its expected future cash flows, discounted at a rate that reflects the risk. As creditworthiness declines, the discount rate increases, resulting in a lower present value and therefore a lower price. Understanding credit risk and its impact on bond prices is essential for investors to make informed decisions.

Inflation’s Influence on the Worth of Bonds

Inflation significantly erodes the real return of a bond. The nominal yield, the stated interest rate, doesn’t reflect the true purchasing power if inflation is high. Investors require higher yields to offset the anticipated decline in purchasing power caused by inflation. This compensation ensures that the real interest rate, the nominal yield minus inflation, remains attractive. When inflation expectations rise, the price of a bond is equivalent to fall to push yields higher, reflecting this increased risk.

The real interest rate represents the actual return an investor receives after accounting for inflation. For example, if a bond offers a 5% nominal yield and inflation is 3%, the real interest rate is only 2%. High inflation diminishes the value of future coupon payments and the principal repayment, making bonds less appealing. Consequently, the price of a bond is equivalent to adjust to reflect these inflationary pressures. Investors closely monitor inflation indicators, such as the Consumer Price Index (CPI), to gauge its potential impact on bond values. Central banks’ monetary policies, aimed at controlling inflation, also play a crucial role in shaping bond market dynamics. If a central bank is expected to raise interest rates to curb inflation, the price of a bond is equivalent to decrease in anticipation of higher yields.

Treasury Inflation-Protected Securities (TIPS) offer a safeguard against inflation. TIPS are designed to protect investors from the decline in purchasing power due to inflation. The principal of a TIPS bond is adjusted based on changes in the CPI. As inflation rises, the principal increases, and vice versa. This adjustment ensures that the investor’s return maintains its real value. In addition to the adjusted principal, TIPS also pay a fixed interest rate. Because the principal increases with inflation, the actual interest payment also increases, providing further inflation protection. Therefore, TIPS provide a hedge against inflation, making them attractive to investors concerned about the eroding effects of rising prices. As investors seek to maintain the real value of their investments, the price of a bond is equivalent to become more appealing during periods of high or rising inflation expectations, although this can vary based on overall market conditions and the specific features of the TIPS.

Market Sentiment and Bond Market Dynamics

Market sentiment plays a crucial role in shaping bond market dynamics. Even without fundamental shifts in interest rates or an issuer’s creditworthiness, investor psychology and economic events can significantly influence bond prices. The price of a bond is equivalent to its perceived value in the market, which can fluctuate based on collective investor feelings.

One manifestation of market sentiment is the “flight to quality.” In times of economic uncertainty or market turmoil, investors often seek the safety and security of government bonds, particularly U.S. Treasury bonds. This increased demand drives up the prices of these bonds, causing their yields to fall. Conversely, during periods of optimism and economic expansion, investors may shift their focus to riskier assets, such as corporate bonds or stocks. This shift in sentiment can lead to a decrease in demand for government bonds, resulting in lower prices and higher yields. Investor expectations regarding future economic growth, inflation, and monetary policy also contribute to bond market dynamics. If investors anticipate higher inflation, they may demand higher yields to compensate for the erosion of purchasing power. Similarly, expectations of interest rate hikes by the Federal Reserve can put downward pressure on bond prices, as investors anticipate the opportunity to purchase newly issued bonds with higher coupon rates. The price of a bond is equivalent to its present value, but that value can be swayed by prevailing market beliefs.

It’s important to distinguish between the ‘fair value’ of a bond and its ‘market price’. The fair value, calculated based on the present value of future cash flows, represents the intrinsic worth of the bond. However, the market price, determined by supply and demand, can deviate from the fair value due to market sentiment. For example, a bond may trade at a premium (above its fair value) during periods of high demand or optimism, or at a discount (below its fair value) during times of fear or uncertainty. Understanding the interplay between market sentiment and fundamental factors is essential for investors seeking to navigate the complexities of the bond market. The price of a bond is equivalent to what someone is willing to pay at a specific time, influenced by many factors including overall market psychology. The price of a bond is equivalent to its value, but the market’s mood can alter the value it seems to have.

:max_bytes(150000):strip_icc()/bond-final-f7932c780bc246cbad6c254febe2d0cd.png)