Understanding the Concept of Short Bonds

In the world of finance, investors are constantly seeking ways to grow their wealth while minimizing risk. One often overlooked yet highly effective investment option is the short bond. But what is a short bond, and how can it benefit your investment portfolio? A short bond, also known as a short-term bond, is a type of debt security with a maturity period typically ranging from a few months to a few years. When you invest in a short bond, you essentially lend money to the issuer, such as a corporation or government entity, for a fixed period. In return, you receive regular interest payments and your principal investment back at maturity. Short bonds offer a unique combination of low risk, liquidity, and flexibility, making them an attractive option for investors seeking to diversify their portfolios.

How to Invest in Short Bonds for Maximum Returns

Investing in short bonds can be a lucrative way to grow your wealth, but it’s essential to do it right. Here’s a step-by-step guide to help you invest in short bonds and maximize your returns:

Step 1: Understand Your Investment Goals

Before investing in short bonds, define your investment goals and risk tolerance. Are you looking for regular income or capital preservation? Do you have a short-term or long-term investment horizon? Knowing your goals will help you choose the right short bond for your needs.

Step 2: Choose the Right Bond

Select a short bond that aligns with your investment goals and risk tolerance. Consider factors such as credit rating, interest rate, maturity period, and liquidity. You can invest in individual short bonds or opt for a short bond fund that diversifies your portfolio.

Step 3: Understand Interest Rates

Interest rates play a crucial role in short bond investments. Understand how interest rates are calculated and how they impact your returns. Keep an eye on market trends and adjust your investment strategy accordingly.

Step 4: Manage Risk

Short bonds are generally low-risk investments, but they’re not entirely risk-free. Be aware of credit risk, interest rate risk, and liquidity risk, and take steps to mitigate them. Diversify your portfolio and maintain a long-term perspective to minimize risk.

By following these steps, you can invest in short bonds with confidence and maximize your returns. Remember to stay informed, adapt to market changes, and adjust your strategy as needed to achieve your investment goals.

The Advantages of Short Bonds Over Traditional Investments

When it comes to investing, individuals and institutions alike are constantly seeking ways to maximize returns while minimizing risk. Short bonds offer a unique combination of benefits that set them apart from traditional investments, making them an attractive option for those looking to diversify their portfolios.

One of the primary advantages of short bonds is their liquidity. Unlike traditional investments such as stocks or mutual funds, short bonds offer a high degree of liquidity, allowing investors to quickly access their funds when needed. This makes them an ideal choice for investors with short-term financial goals or those who require easy access to their capital.

Another significant benefit of short bonds is their low risk profile. Short bonds are typically issued by high-credit-quality issuers, such as governments or large corporations, which reduces the risk of default. This makes them an attractive option for risk-averse investors or those seeking to reduce their overall portfolio risk.

In addition to their liquidity and low risk, short bonds also offer a high degree of flexibility. They can be tailored to meet specific investment goals and time horizons, making them an ideal choice for investors with unique needs or requirements. Furthermore, short bonds can be easily combined with other investments to create a diversified portfolio, reducing risk and increasing returns.

Compared to traditional investments such as CDs, short bonds offer higher returns without significantly increasing risk. They also provide a more stable source of income compared to stocks or mutual funds, making them an attractive option for income-seeking investors.

In conclusion, short bonds offer a unique combination of liquidity, low risk, and flexibility that sets them apart from traditional investments. By incorporating short bonds into their portfolios, investors can reduce risk, increase returns, and achieve their financial goals with confidence.

Short Bond vs. Long Bond: Key Differences and Considerations

When it comes to investing in bonds, one of the most critical decisions is choosing between short bonds and long bonds. While both types of bonds offer a relatively low-risk investment opportunity, they differ significantly in terms of maturity period, interest rates, and investment goals. Understanding these differences is crucial to making an informed investment decision.

One of the primary differences between short bonds and long bonds is their maturity period. Short bonds typically have a maturity period of less than five years, while long bonds can have a maturity period of 10, 20, or even 30 years. This difference in maturity period has a significant impact on the interest rates offered by each type of bond. Short bonds typically offer lower interest rates due to their shorter maturity period, while long bonds offer higher interest rates to compensate for the increased risk associated with longer-term investments.

The investment goals of short bonds and long bonds also differ significantly. Short bonds are ideal for investors seeking short-term financial goals, such as saving for a down payment on a house or funding a child’s education. Long bonds, on the other hand, are better suited for investors with long-term financial goals, such as retirement or wealth accumulation.

Another key consideration when choosing between short bonds and long bonds is the level of risk associated with each. Short bonds are generally considered to be lower-risk investments due to their shorter maturity period and lower interest rates. Long bonds, while offering higher returns, carry a higher level of risk due to their longer maturity period and increased exposure to interest rate fluctuations.

In conclusion, short bonds and long bonds are two distinct types of investments that cater to different investment goals and risk tolerance. By understanding the key differences between these two types of bonds, investors can make informed decisions and choose the investment that best aligns with their financial objectives.

The Role of Short Bonds in a Diversified Investment Portfolio

When it comes to building a diversified investment portfolio, short bonds can play a crucial role in reducing risk and increasing returns. By incorporating short bonds into a portfolio, investors can benefit from their unique characteristics, such as liquidity, low risk, and flexibility. In this section, we will explore how short bonds can be used to diversify an investment portfolio and provide examples of how to incorporate them into a portfolio.

One of the primary benefits of short bonds is their ability to provide a stable source of income. By investing in short bonds, investors can generate regular interest payments, which can help to offset the volatility of other investments in their portfolio. Additionally, short bonds can provide a hedge against inflation, as their interest rates are often tied to inflation rates.

Another key advantage of short bonds is their low correlation with other asset classes. This means that short bonds tend to perform differently than stocks, mutual funds, and other investments, making them an ideal addition to a diversified portfolio. By incorporating short bonds into a portfolio, investors can reduce their overall risk and increase their potential returns.

So, how can investors incorporate short bonds into their portfolio? One approach is to allocate a portion of their portfolio to short bonds, such as 10% to 20%. This can help to reduce the overall risk of the portfolio and provide a stable source of income. Another approach is to use short bonds as a tactical allocation, investing in them during times of market volatility or uncertainty.

For example, an investor with a moderate risk tolerance may allocate 15% of their portfolio to short bonds, with the remaining 85% allocated to stocks, mutual funds, and other investments. This can help to reduce the overall risk of the portfolio and provide a stable source of income. Alternatively, an investor may use short bonds as a tactical allocation, investing in them during times of market volatility or uncertainty.

In conclusion, short bonds can play a crucial role in a diversified investment portfolio, providing a stable source of income, reducing risk, and increasing returns. By incorporating short bonds into a portfolio, investors can benefit from their unique characteristics and achieve their long-term financial goals.

Short Bond Risks and Considerations: What You Need to Know

While short bonds offer a relatively low-risk investment opportunity, they are not entirely risk-free. It’s essential for investors to understand the potential risks and considerations associated with short bonds to make informed investment decisions. In this section, we will discuss the key risks and considerations of short bonds and provide tips on how to mitigate them.

One of the primary risks associated with short bonds is credit risk. This refers to the risk that the issuer may default on their debt obligations, resulting in a loss of principal or interest. To mitigate credit risk, investors should carefully evaluate the creditworthiness of the issuer and consider investing in short bonds with high credit ratings.

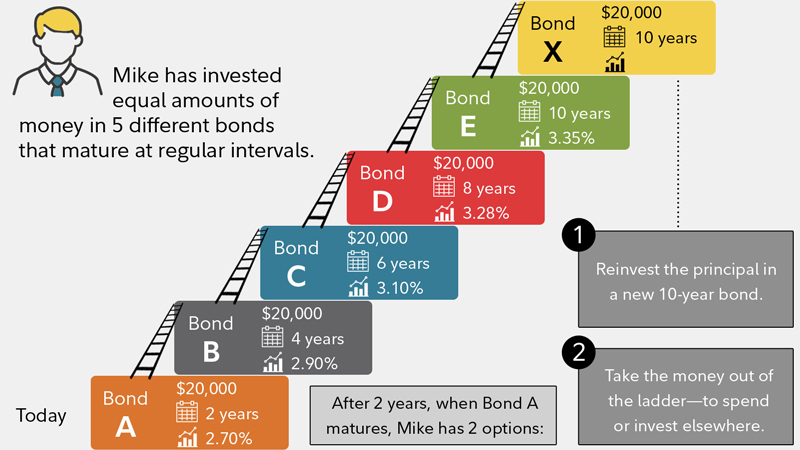

Another key risk is interest rate risk. When interest rates rise, the value of existing short bonds with lower interest rates decreases. This can result in a loss of principal if the bond is sold before maturity. To mitigate interest rate risk, investors can consider investing in short bonds with floating interest rates or ladder their investments to minimize exposure to interest rate fluctuations.

Liquidity risk is another consideration for short bond investors. This refers to the risk that the investor may not be able to sell their short bond before maturity at a favorable price. To mitigate liquidity risk, investors should consider investing in short bonds with a high level of liquidity, such as those issued by large corporations or governments.

In addition to these risks, investors should also consider the potential impact of inflation, market volatility, and regulatory changes on their short bond investments. By understanding these risks and considerations, investors can take steps to mitigate them and maximize their returns.

For example, investors can diversify their short bond portfolio by investing in bonds with different maturities, credit ratings, and issuers. This can help to reduce the overall risk of the portfolio and increase returns. Additionally, investors can consider working with a financial advisor or investment manager to develop a customized short bond investment strategy that meets their individual needs and goals.

In conclusion, while short bonds offer a relatively low-risk investment opportunity, they are not entirely risk-free. By understanding the potential risks and considerations associated with short bonds, investors can take steps to mitigate them and maximize their returns.

Real-World Examples of Short Bond Success Stories

Short bonds have been a successful investment choice for many individuals and institutions. In this section, we will explore some real-world examples of short bond success stories, highlighting the benefits and returns achieved by investors, and how they can be replicated.

One example is a large corporation that invested in short bonds as part of its cash management strategy. By investing in short bonds with maturities ranging from 3 months to 1 year, the corporation was able to earn a higher return on its cash reserves than it would have from traditional bank deposits. Over a 12-month period, the corporation earned a total return of 2.5%, significantly higher than the 0.5% return it would have earned from a traditional bank deposit.

Another example is a individual investor who used short bonds to diversify their investment portfolio. By investing in a mix of short bonds with different maturities and credit ratings, the investor was able to reduce the overall risk of their portfolio and increase their returns. Over a 5-year period, the investor earned an average annual return of 4.2%, significantly higher than the 2.5% return they would have earned from a traditional CD.

A third example is a pension fund that invested in short bonds as part of its fixed income strategy. By investing in short bonds with high credit ratings and maturities ranging from 1 to 5 years, the pension fund was able to earn a stable and predictable return on its investments. Over a 10-year period, the pension fund earned an average annual return of 5.5%, significantly higher than the 3.5% return it would have earned from a traditional bond fund.

These examples demonstrate the potential benefits of short bonds as an investment choice. By understanding how short bonds work and how to invest in them effectively, investors can achieve their financial goals and earn a higher return on their investments. Whether you are an individual investor, a corporation, or an institution, short bonds can be a valuable addition to your investment portfolio.

Conclusion: Why Short Bonds Are a Smart Investment Choice

In conclusion, short bonds offer a unique combination of benefits that make them an attractive investment choice for individuals and institutions alike. By understanding what is a short bond and how they work, investors can take advantage of their liquidity, low risk, and flexibility to achieve their financial goals.

Whether you are looking to diversify your investment portfolio, manage cash flow, or generate returns, short bonds can provide a smart and effective solution. With their short maturity periods and low credit risk, short bonds offer a stable and predictable return on investment, making them an ideal choice for risk-averse investors.

In addition, short bonds can be easily incorporated into a diversified investment portfolio, providing a hedge against market volatility and reducing overall risk. By investing in a mix of short bonds with different maturities and credit ratings, investors can create a customized investment strategy that meets their individual needs and goals.

While short bonds do come with some risks and considerations, such as credit risk, interest rate risk, and liquidity risk, these can be mitigated by careful planning and research. By understanding the potential risks and benefits of short bonds, investors can make informed investment decisions and achieve their financial objectives.

In today’s fast-paced and ever-changing investment landscape, short bonds offer a reliable and stable investment option that can help investors navigate uncertainty and achieve their goals. Whether you are a seasoned investor or just starting out, short bonds are definitely worth considering as a smart investment choice.

:max_bytes(150000):strip_icc()/conservativeportfolio-tardi-d19760c073f44c5b94bf060071963751.jpg)