Understanding the Concept of GMV in E-commerce

In the e-commerce industry, Gross Merchandise Value (GMV) is a vital metric that measures the total value of merchandise sold through a platform or marketplace. When understanding what is GMV in finance, it’s essential to recognize its significance in evaluating sales performance and revenue growth. GMV provides a comprehensive picture of a company’s operations, helping businesses identify areas of improvement, optimize their strategies, and make data-driven decisions to drive growth and profitability. By grasping the concept of GMV, e-commerce businesses can gain a competitive edge in the market, improve their financial health, and achieve long-term success.

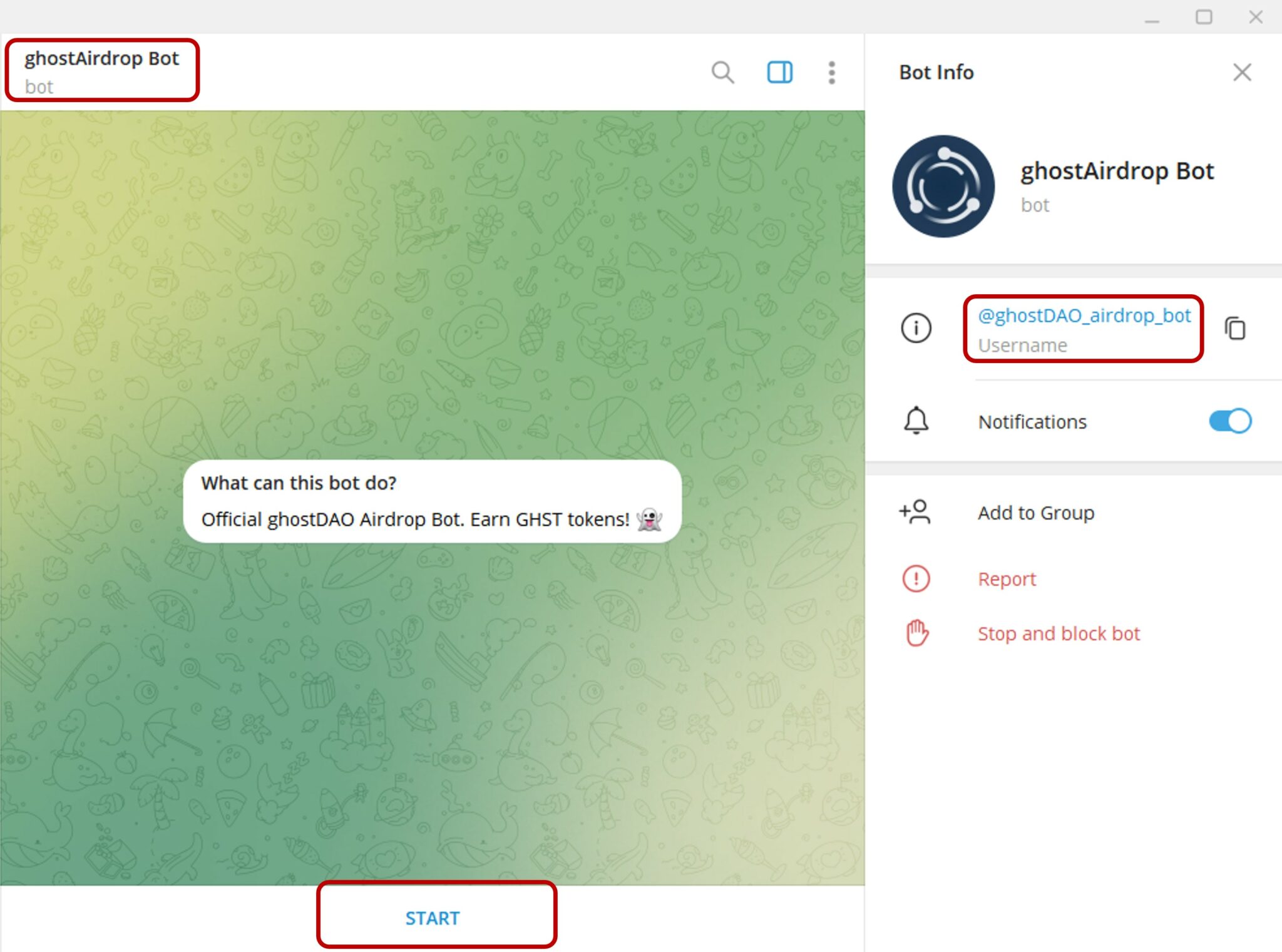

How to Calculate GMV: A Step-by-Step Guide

Calculating Gross Merchandise Value (GMV) is a crucial step in understanding the financial performance of an e-commerce business. To accurately determine GMV, it’s essential to follow a step-by-step approach. The GMV formula is: GMV = (Number of Items Sold x Average Price per Item) + (Number of Services Sold x Average Price per Service). This formula takes into account both physical products and services sold through the platform. For instance, if an e-commerce company sold 10,000 units of a product at $50 each and 500 services at $100 each, the GMV would be (10,000 x $50) + (500 x $100) = $500,000 + $50,000 = $550,000. By understanding how to calculate GMV, businesses can gain valuable insights into their sales performance, revenue growth, and overall financial health, ultimately helping them make informed decisions and drive growth.

The Difference Between GMV and Revenue: What You Need to Know

In the world of finance, particularly in e-commerce, two metrics are often used interchangeably: Gross Merchandise Value (GMV) and revenue. While they may seem similar, they have distinct differences that are crucial to understand. In this section, we will delve into the distinction between GMV and revenue, highlighting the key differences and why GMV is a more comprehensive metric for e-commerce businesses.

Revenue, also known as turnover, refers to the total amount of money earned by a business from its sales of goods or services during a specific period. It represents the top line of a company’s income statement and is a widely used metric to evaluate a company’s financial performance. On the other hand, GMV, also known as Gross Merchandise Volume, is the total value of merchandise sold through a particular platform or marketplace, including shipping and taxes. GMV is a more comprehensive metric as it takes into account the entire value of the transaction, whereas revenue only accounts for the company’s share of the sale.

For instance, if an e-commerce platform sells a product for $100, and the platform takes a 10% commission, the revenue would be $10, whereas the GMV would be $100. This distinction is critical, as it affects how businesses evaluate their performance and make strategic decisions. GMV provides a more accurate picture of the overall market size and growth, allowing businesses to identify opportunities and challenges more effectively.

In finance, understanding the difference between GMV and revenue is essential for making informed decisions. By recognizing the distinct roles of these metrics, businesses can optimize their strategies, improve their financial performance, and gain a competitive edge in the market. As the e-commerce industry continues to evolve, the importance of GMV in finance will only continue to grow, making it essential for businesses to grasp this critical concept.

When it comes to what is GMV in finance, it is clear that GMV provides a more comprehensive view of a company’s sales performance and revenue growth. By using GMV, businesses can gain a deeper understanding of their market size, identify trends, and make data-driven decisions to drive growth and improvement. In the world of finance, GMV is an essential metric that should not be overlooked.

The Role of GMV in Financial Analysis and Decision-Making

In the realm of finance, Gross Merchandise Value (GMV) plays a vital role in evaluating business performance, identifying trends, and making informed decisions. As a key metric, GMV provides a comprehensive view of a company’s sales performance and revenue growth, enabling businesses to make data-driven decisions that drive growth and improvement.

One of the primary reasons GMV is essential in financial analysis is that it helps businesses understand their market size and growth potential. By analyzing GMV, companies can identify areas of strength and weakness, allowing them to adjust their strategies and optimize their operations. For instance, if a company notices a decline in GMV, it may indicate a need to revamp its marketing strategy or improve its product offerings.

GMV is also crucial in identifying trends and patterns in sales data. By analyzing GMV over time, businesses can identify seasonal fluctuations, changes in consumer behavior, and emerging trends. This information can be used to inform business strategy, such as adjusting inventory levels, pricing, and marketing campaigns to capitalize on emerging trends.

In addition, GMV is a critical metric in evaluating the performance of different business units or product lines. By comparing GMV across different segments, businesses can identify areas of high growth and profitability, allowing them to allocate resources more effectively. This information can also be used to identify opportunities for cost savings and process improvements.

When it comes to what is GMV in finance, it is clear that GMV is a powerful tool in financial analysis and decision-making. By leveraging GMV, businesses can gain a deeper understanding of their sales performance, identify trends and opportunities, and make informed decisions that drive growth and improvement. As the e-commerce industry continues to evolve, the importance of GMV in finance will only continue to grow, making it essential for businesses to grasp this critical concept.

In conclusion, GMV is a vital metric in financial analysis, providing a comprehensive view of a company’s sales performance and revenue growth. By understanding the role of GMV in finance, businesses can make data-driven decisions, identify trends and opportunities, and drive growth and improvement.

GMV in Action: Real-World Examples of Successful E-commerce Businesses

While understanding the concept of Gross Merchandise Value (GMV) is essential, seeing it in action can provide valuable insights into its practical applications. In this section, we will explore real-world examples of successful e-commerce businesses that have leveraged GMV to drive growth and improve their financial performance.

One notable example is Amazon, the e-commerce giant that has mastered the art of GMV analysis. By tracking GMV, Amazon can identify trends and opportunities in its vast product catalog, allowing it to optimize its inventory, pricing, and marketing strategies. This data-driven approach has enabled Amazon to maintain its position as a market leader, with GMV growth rates consistently outpacing those of its competitors.

Another example is Etsy, a niche e-commerce platform specializing in handmade and vintage items. By analyzing GMV, Etsy can identify emerging trends and opportunities in its marketplace, allowing it to provide targeted support to its sellers and improve the overall shopping experience. This focus on GMV has enabled Etsy to drive growth and increase revenue, with GMV growth rates exceeding 20% in recent years.

In addition, companies like eBay and Rakuten have also leveraged GMV to drive growth and improve their financial performance. By tracking GMV, these companies can identify areas of strength and weakness, allowing them to adjust their strategies and optimize their operations. This data-driven approach has enabled these companies to maintain their competitive edge in the e-commerce market.

When it comes to what is GMV in finance, these real-world examples demonstrate the power of GMV in driving business growth and improvement. By leveraging GMV, e-commerce businesses can gain a deeper understanding of their sales performance, identify trends and opportunities, and make informed decisions that drive growth and improvement.

These examples also highlight the importance of GMV in finance, as it provides a comprehensive view of a company’s sales performance and revenue growth. By understanding GMV, businesses can make data-driven decisions, identify trends and opportunities, and drive growth and improvement. As the e-commerce industry continues to evolve, the importance of GMV in finance will only continue to grow, making it essential for businesses to grasp this critical concept.

Common Challenges and Limitations of GMV in Finance

While Gross Merchandise Value (GMV) is a powerful metric in finance, it is not without its challenges and limitations. In this section, we will explore some of the common issues that can impact the accuracy and reliability of GMV, as well as strategies for overcoming these challenges.

One of the most significant challenges of GMV is data accuracy. GMV is only as good as the data that goes into it, and inaccurate or incomplete data can lead to misleading results. This can be particularly problematic in e-commerce, where data is often scattered across multiple platforms and systems. To overcome this challenge, businesses must invest in robust data management systems and processes to ensure that their GMV data is accurate and reliable.

Another challenge of GMV is seasonality. Many e-commerce businesses experience fluctuations in sales due to seasonal factors, such as holidays or weather patterns. This can make it difficult to accurately track GMV over time, as sales may be artificially inflated or deflated due to seasonal factors. To overcome this challenge, businesses can use techniques such as seasonally adjusted GMV or year-over-year comparisons to smooth out seasonal fluctuations.

External factors can also impact GMV, such as changes in market trends or consumer behavior. For example, a sudden shift in consumer preferences can lead to a decline in GMV, even if a business is performing well. To overcome this challenge, businesses must stay attuned to market trends and consumer behavior, and be prepared to adapt their strategies as needed.

In addition, GMV can be impacted by factors such as returns and refunds, which can reduce the overall value of sales. To overcome this challenge, businesses can use techniques such as net GMV, which takes into account returns and refunds when calculating GMV.

When it comes to what is GMV in finance, understanding these common challenges and limitations is essential for businesses that want to get the most out of this powerful metric. By being aware of these challenges and taking steps to overcome them, businesses can ensure that their GMV data is accurate, reliable, and actionable.

By addressing these challenges and limitations, businesses can unlock the full potential of GMV and use it to drive growth, improvement, and success in the competitive world of e-commerce.

Best Practices for GMV Reporting and Analysis

When it comes to what is GMV in finance, effective reporting and analysis are crucial for unlocking its full potential. In this section, we will explore best practices for GMV reporting and analysis, including tips on data visualization, benchmarking, and using GMV to inform business strategy.

Data visualization is a critical component of GMV reporting and analysis. By presenting GMV data in a clear and concise manner, businesses can quickly identify trends, opportunities, and areas for improvement. Some effective data visualization techniques for GMV include using charts and graphs to display sales performance, creating heat maps to identify high-performing products, and using scatter plots to analyze the relationship between GMV and other key metrics.

Benchmarking is another essential best practice for GMV reporting and analysis. By comparing GMV performance to industry benchmarks or internal targets, businesses can evaluate their performance and identify areas for improvement. This can be particularly useful for e-commerce businesses, which can use benchmarking to compare their GMV performance to that of competitors or industry averages.

Using GMV to inform business strategy is also a critical best practice. By analyzing GMV data, businesses can identify opportunities to optimize their product offerings, pricing, and marketing strategies. For example, a business may use GMV data to identify high-performing products and adjust its inventory accordingly, or to identify areas where pricing adjustments can improve revenue growth.

In addition, businesses should also consider using GMV to evaluate the performance of different sales channels, such as online marketplaces, social media, or physical stores. By analyzing GMV data by channel, businesses can identify areas where they can optimize their sales strategies and improve overall performance.

Finally, businesses should also consider using GMV to evaluate the performance of different product categories or segments. By analyzing GMV data by category or segment, businesses can identify areas where they can optimize their product offerings and improve overall performance.

By following these best practices for GMV reporting and analysis, businesses can unlock the full potential of this powerful metric and drive growth, improvement, and success in the competitive world of e-commerce.

By leveraging GMV in finance, businesses can gain a deeper understanding of their sales performance, identify trends and opportunities, and make informed decisions that drive growth and improvement. As the e-commerce industry continues to evolve, the importance of GMV in finance will only continue to grow, making it essential for businesses to grasp this critical concept.

The Future of GMV in Finance: Trends and Predictions

As the e-commerce industry continues to evolve, the role of Gross Merchandise Value (GMV) in finance is likely to become even more critical. In this section, we will explore the future of GMV in finance, including emerging trends, predictions, and how GMV will continue to play a critical role in e-commerce and financial analysis.

One of the key trends shaping the future of GMV in finance is the increasing importance of data analytics. As e-commerce businesses generate more data than ever before, the ability to analyze and interpret GMV data will become essential for driving growth and improvement. This will require businesses to invest in advanced data analytics tools and techniques, such as machine learning and artificial intelligence.

Another trend is the growing importance of omnichannel retailing. As consumers increasingly shop across multiple channels, including online marketplaces, social media, and physical stores, GMV will play a critical role in measuring sales performance and revenue growth across these channels. This will require businesses to develop more sophisticated GMV tracking and analysis systems that can handle complex data sets.

In addition, the future of GMV in finance will also be shaped by emerging technologies such as blockchain and the Internet of Things (IoT). These technologies have the potential to revolutionize the way e-commerce businesses operate, and GMV will play a critical role in measuring their impact on sales performance and revenue growth.

Looking ahead, it is clear that what is GMV in finance will continue to play a critical role in e-commerce and financial analysis. As the industry continues to evolve, GMV will remain a key metric for measuring sales performance, identifying trends, and making informed decisions. By understanding the future of GMV in finance, businesses can stay ahead of the curve and drive growth, improvement, and success in the competitive world of e-commerce.

As the importance of GMV in finance continues to grow, it is essential for businesses to stay up-to-date with the latest trends, predictions, and best practices. By doing so, they can unlock the full potential of GMV and drive growth, improvement, and success in the competitive world of e-commerce.

:max_bytes(150000):strip_icc()/gross-merchandise-value.asp-80aac267540b4692a5a0896020191678.jpg)