Understanding the 13-Week T-Bill Rate: A Historical Perspective

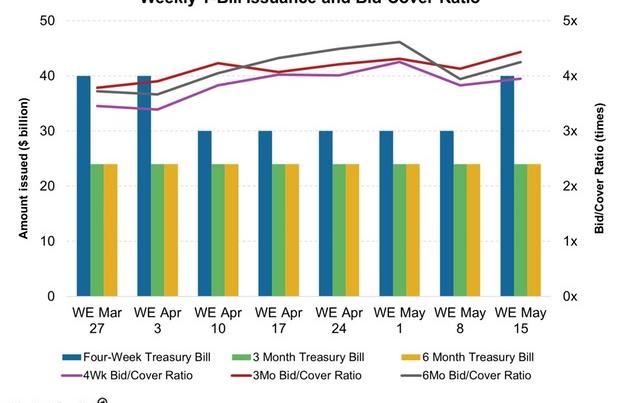

The 13-week T-bill rate is a vital component of the short-term Treasury yield curve, offering valuable insights into the financial market’s expectations of future interest rates and economic growth. With its history dating back to 1929, the 13-week T-bill rate has been a reliable indicator of market sentiment, reflecting the ever-changing landscape of economic indicators, monetary policy, and investor confidence. Understanding the historical trends of the 13-week T-bill rate is essential for investors seeking to make informed decisions about their portfolios. By analyzing the 13 week t bill rate history, investors can gain a deeper understanding of the complex relationships between economic indicators, monetary policy, and market sentiment, ultimately informing their investment strategies and mitigating potential risks.

How to Analyze the 13-Week T-Bill Rate History for Informed Investment Decisions

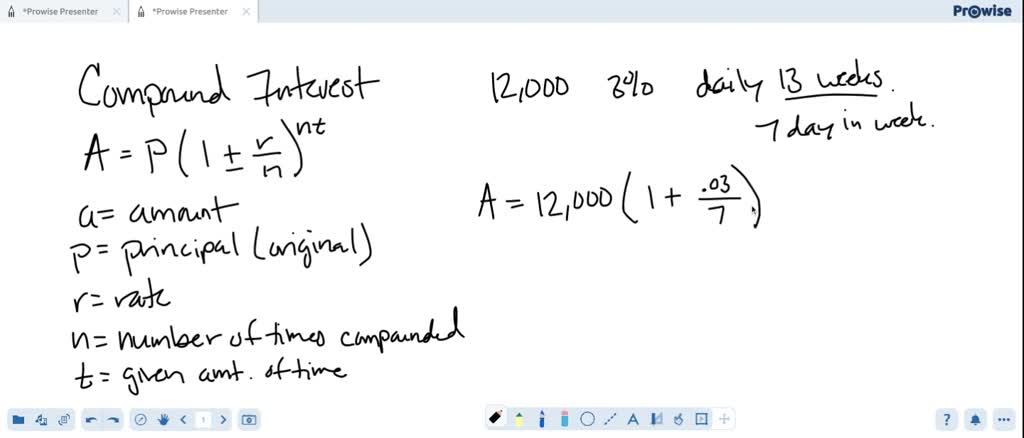

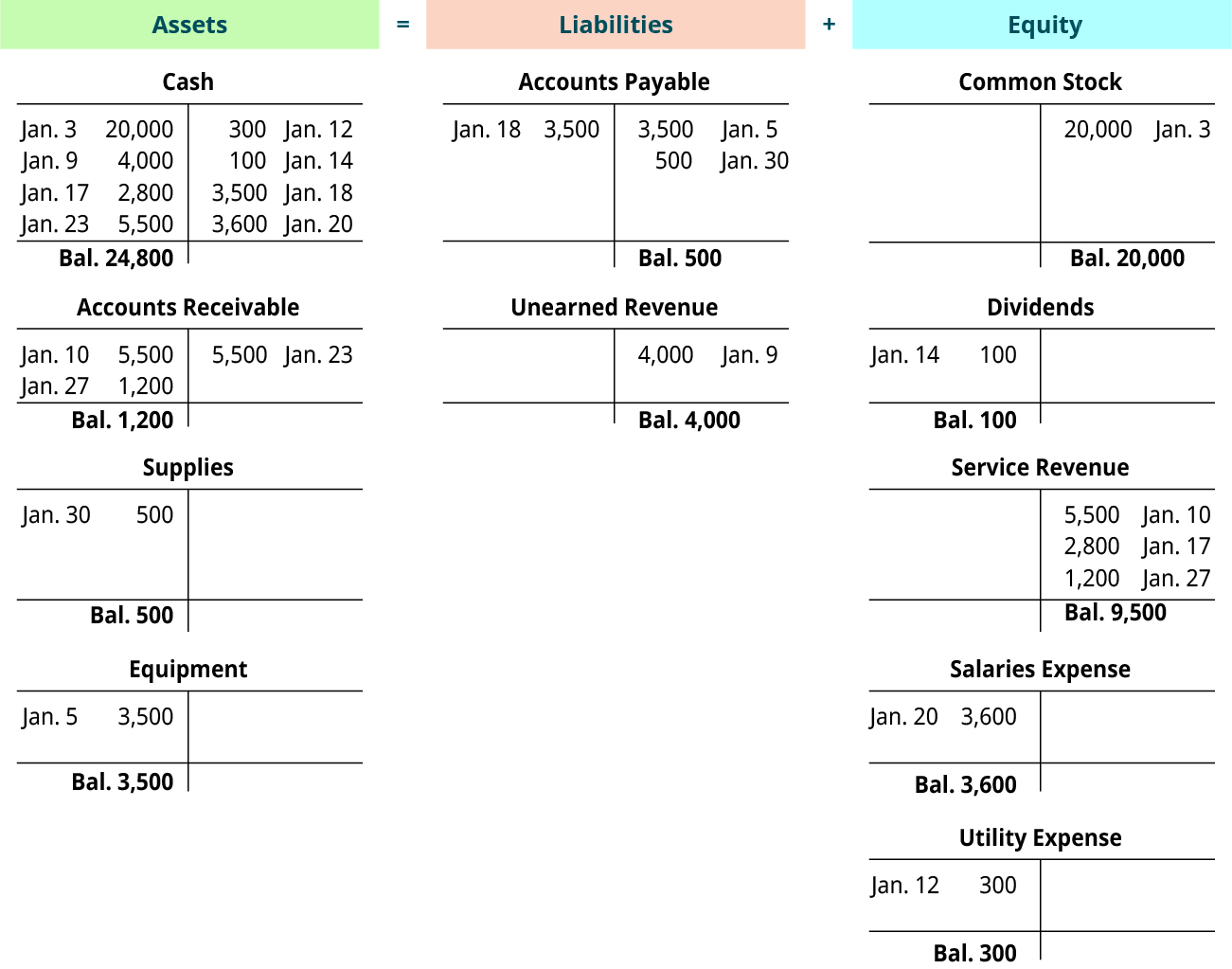

The 13-week T-bill rate is influenced by a complex array of factors, including economic indicators, monetary policy, and market sentiment. Understanding the interplay between these factors is crucial for investors seeking to make informed decisions about their portfolios. By analyzing the 13 week t bill rate history, investors can identify patterns and trends that can inform their investment strategies. For instance, examining the historical relationship between the 13-week T-bill rate and economic indicators such as GDP, inflation, and unemployment rates can provide valuable insights into the rate’s responsiveness to changes in the economy. Similarly, analyzing the impact of monetary policy decisions, such as interest rate changes and quantitative easing, on the 13-week T-bill rate can help investors anticipate future rate movements. Furthermore, understanding how market sentiment, including investor confidence and risk appetite, influences the 13-week T-bill rate can help investors navigate market volatility. By considering these factors and analyzing the 13 week t bill rate history, investors can develop a more nuanced understanding of the short-term Treasury yield curve and make more informed investment decisions.

A Brief History of the 13-Week T-Bill Rate: Trends and Patterns

The 13-week T-bill rate has a rich history, spanning over nine decades. Since its inception in 1929, the rate has experienced significant trends, patterns, and events that have shaped its trajectory over time. During the Great Depression, the 13-week T-bill rate plummeted to historic lows, reflecting the economic downturn. In the post-war period, the rate experienced a steady increase, driven by rising inflation and economic growth. The 1970s and 1980s saw a period of high inflation, which led to a surge in the 13-week T-bill rate. The 1990s and early 2000s were marked by a decline in the rate, driven by monetary policy easing and declining inflation. The 2008 financial crisis led to a sharp decline in the rate, as central banks implemented quantitative easing measures to stimulate the economy. Since then, the 13-week T-bill rate has experienced a slow and steady increase, reflecting the gradual recovery of the global economy. By analyzing the 13 week t bill rate history, investors can gain valuable insights into the complex relationships between economic indicators, monetary policy, and market sentiment, ultimately informing their investment decisions.

The Impact of Economic Indicators on the 13-Week T-Bill Rate

The 13-week T-bill rate is closely tied to various economic indicators, which have a profound impact on its trajectory. Gross Domestic Product (GDP) growth, inflation rates, and unemployment rates are some of the key indicators that influence the 13-week T-bill rate. When GDP growth is strong, the 13-week T-bill rate tends to rise, reflecting increased economic activity and higher borrowing costs. Conversely, during periods of slow economic growth, the rate tends to decline. Inflation also plays a significant role, as rising inflation expectations lead to higher interest rates and, subsequently, a higher 13-week T-bill rate. Unemployment rates also have an impact, with lower unemployment rates often leading to higher interest rates and a higher 13-week T-bill rate. By analyzing the historical relationship between these economic indicators and the 13-week T-bill rate, investors can gain valuable insights into the underlying drivers of the rate and make more informed investment decisions. For instance, understanding how changes in GDP growth or inflation rates have historically impacted the 13-week T-bill rate can help investors anticipate future rate movements and adjust their investment strategies accordingly. By examining the 13 week t bill rate history in the context of economic indicators, investors can develop a more nuanced understanding of the short-term Treasury yield curve and make more informed investment decisions.

Monetary Policy and the 13-Week T-Bill Rate: A Delicate Balance

Monetary policy plays a crucial role in shaping the 13-week T-bill rate, with central banks using various tools to influence the rate and achieve their economic objectives. Interest rate changes, quantitative easing, and forward guidance are some of the key monetary policy instruments that impact the 13-week T-bill rate. When central banks raise interest rates, the 13-week T-bill rate tends to increase, reflecting higher borrowing costs and reduced liquidity. Conversely, during periods of monetary easing, the rate tends to decline. Quantitative easing, which involves the purchase of government securities, can also influence the 13-week T-bill rate by reducing yields and increasing liquidity. Forward guidance, which involves communicating future policy intentions, can also impact the rate by influencing market expectations. By analyzing the historical relationship between monetary policy and the 13-week T-bill rate, investors can gain valuable insights into the complex interactions between central banks, financial markets, and the economy. For instance, understanding how changes in interest rates or quantitative easing have historically impacted the 13-week T-bill rate can help investors anticipate future rate movements and adjust their investment strategies accordingly. By examining the 13 week t bill rate history in the context of monetary policy, investors can develop a more nuanced understanding of the short-term Treasury yield curve and make more informed investment decisions.

Market Sentiment and the 13-Week T-Bill Rate: A Reflection of Investor Confidence

Market sentiment plays a significant role in shaping the 13-week T-bill rate, as investor confidence, risk appetite, and market volatility all influence the rate. When investors are confident and risk-averse, they tend to seek safer assets, such as short-term Treasuries, which can drive up demand and push the 13-week T-bill rate lower. Conversely, during periods of high market volatility, investors may become more risk-averse, leading to increased demand for safe-haven assets and lower yields. By analyzing the historical relationship between market sentiment and the 13-week T-bill rate, investors can gain valuable insights into the complex interactions between investor psychology, market dynamics, and the short-term Treasury yield curve. For instance, understanding how changes in investor confidence or risk appetite have historically impacted the 13-week T-bill rate can help investors anticipate future rate movements and adjust their investment strategies accordingly. By examining the 13 week t bill rate history in the context of market sentiment, investors can develop a more nuanced understanding of the short-term Treasury market and make more informed investment decisions. Furthermore, investors can use the 13-week T-bill rate history to identify potential mispricings in the market, capitalize on market inefficiencies, and optimize their investment returns.

Using the 13-Week T-Bill Rate History to Inform Investment Strategies

By analyzing the 13 week t bill rate history, investors can gain valuable insights into the short-term Treasury market and make more informed investment decisions. One way to utilize the historical rate is to inform portfolio allocation decisions. For instance, during periods of rising interest rates, investors may want to adjust their portfolios to include more short-term Treasury securities, which tend to be less sensitive to interest rate changes. Conversely, during periods of falling interest rates, investors may want to shift their portfolios towards longer-term securities to take advantage of higher yields. The 13 week t bill rate history can also be used to inform risk management strategies. By analyzing the historical relationship between the 13-week T-bill rate and other market indicators, investors can identify potential risks and opportunities in the market and adjust their portfolios accordingly. Additionally, the 13 week t bill rate history can be used to optimize yield. By analyzing the historical patterns and trends in the 13-week T-bill rate, investors can identify opportunities to earn higher yields and adjust their investment strategies to maximize returns. For example, during periods of high market volatility, investors may want to focus on shorter-term Treasury securities, which tend to offer higher yields during such periods. By leveraging the insights provided by the 13 week t bill rate history, investors can develop more effective investment strategies and achieve their financial goals.

Conclusion: The Enduring Importance of the 13-Week T-Bill Rate History

In conclusion, understanding the 13 week t bill rate history is crucial for investors seeking to navigate the complexities of the short-term Treasury market. By analyzing the historical trends and patterns of the 13-week T-bill rate, investors can gain valuable insights into the factors that influence the rate, including economic indicators, monetary policy, and market sentiment. This knowledge can be used to inform investment strategies, including portfolio allocation, risk management, and yield optimization. As the 13 week t bill rate history continues to evolve, it remains an essential tool for investors seeking to make informed decisions in the financial market. By recognizing the significance of the 13 week t bill rate history, investors can stay ahead of the curve and achieve their financial goals in an ever-changing market landscape. Whether you’re a seasoned investor or just starting out, understanding the 13 week t bill rate history is essential for unlocking the secrets of short-term Treasury yields and achieving success in the financial market.

:max_bytes(150000):strip_icc()/dotdash_Final_Market_Sentiment_Nov_2020-01-0b3907c75fdd4e9e9d05c82851465244.jpg)