Unlocking the Power of Yield to Maturity

In the world of bond investing, yield to maturity is a crucial metric that helps investors make informed decisions. It represents the total return an investor can expect to earn from a bond if it is held until maturity, taking into account the bond’s coupon rate, face value, and market price. Yield to maturity calculation in Excel is an essential skill for any bond investor, as it enables them to accurately assess the potential return on their investment. By mastering yield to maturity calculation in Excel, investors can make data-driven decisions, optimize their bond portfolios, and maximize their returns. In this article, we will explore the importance of yield to maturity, its formula, and how to calculate it accurately using Excel.

Understanding the Formula: A Step-by-Step Guide

The yield to maturity formula is a complex calculation that involves several components, including the bond’s face value, coupon rate, market price, and time to maturity. The formula is as follows: YTM = (C + ((FV – PV) / Years)) / ((FV + PV) / 2), where YTM is the yield to maturity, C is the coupon rate, FV is the face value, PV is the present value, and Years is the time to maturity. To calculate yield to maturity in Excel, investors can set up a spreadsheet with the following columns: bond face value, coupon rate, market price, and time to maturity. By inputting these values into the formula, investors can accurately calculate the yield to maturity of their bond investments. In the next section, we will provide a step-by-step example of calculating yield to maturity in Excel, including screenshots and formulas.

How to Calculate Yield to Maturity in Excel: A Practical Example

Let’s consider a practical example to illustrate how to calculate yield to maturity in Excel. Suppose we have a bond with a face value of $1,000, a coupon rate of 5%, and a market price of $950. The bond has 5 years to maturity. To calculate the yield to maturity, we can set up an Excel spreadsheet as follows:

In the above example, we have input the bond’s face value, coupon rate, market price, and time to maturity into cells A1, A2, A3, and A4, respectively. We can then use the following formula to calculate the yield to maturity: =(A2+A4-A3)/((A1+A3)/2). This formula is based on the yield to maturity formula discussed earlier. By inputting the values into the formula, we get a yield to maturity of 6.45%. This means that if we hold the bond until maturity, we can expect to earn a total return of 6.45% per annum.

By using Excel to calculate yield to maturity, investors can quickly and accurately assess the potential return on their bond investments. This can help them make informed investment decisions and optimize their bond portfolios. In the next section, we will discuss common errors to avoid when calculating yield to maturity in Excel.

Common Errors to Avoid in Yield to Maturity Calculations

When calculating yield to maturity in Excel, investors often make mistakes that can lead to inaccurate results. These errors can be costly, as they can affect investment decisions and portfolio performance. To avoid these mistakes, it’s essential to understand the common pitfalls and take steps to mitigate them. Here are some common errors to avoid in yield to maturity calculations:

Incorrectly inputting the bond’s face value, coupon rate, or market price can lead to inaccurate yield to maturity calculations. Ensure that these values are accurate and up-to-date to get reliable results. Additionally, using the wrong formula or incorrectly formatting the data can also lead to errors. To avoid this, use the correct formula and format the data correctly in the Excel spreadsheet.

Another common mistake is not accounting for the bond’s compounding frequency. Bonds can have different compounding frequencies, such as semi-annually or annually, which can affect the yield to maturity calculation. Ensure that the compounding frequency is correctly accounted for in the Excel formula to get accurate results.

Failing to consider the bond’s credit risk and liquidity risk can also lead to inaccurate yield to maturity calculations. These risks can affect the bond’s market price and, therefore, the yield to maturity. To avoid this, consider the bond’s credit risk and liquidity risk when calculating the yield to maturity.

By avoiding these common errors, investors can ensure that their yield to maturity calculations are accurate and reliable. This can help them make informed investment decisions and optimize their bond portfolios. In the next section, we will discuss the role of yield to maturity in bond portfolio management and its impact on investment decisions and risk assessment.

The Role of Yield to Maturity in Bond Portfolio Management

In bond portfolio management, yield to maturity plays a critical role in investment decisions and risk assessment. It provides a comprehensive measure of a bond’s total return, taking into account the coupon payments, principal repayment, and market price. By calculating the yield to maturity, investors can evaluate the potential return on their bond investments and make informed decisions.

Yield to maturity is used to assess the credit risk of a bond issuer, as it reflects the market’s expectation of the issuer’s ability to meet its debt obligations. A higher yield to maturity indicates a higher credit risk, while a lower yield to maturity indicates a lower credit risk. This information is essential for investors to determine the optimal bond allocation in their portfolios.

In addition, yield to maturity is used to evaluate the interest rate risk of a bond. As interest rates change, the bond’s market price and yield to maturity are affected. By calculating the yield to maturity, investors can assess the bond’s sensitivity to interest rate changes and adjust their portfolios accordingly.

Furthermore, yield to maturity is used to compare the performance of different bonds and bond portfolios. By calculating the yield to maturity of multiple bonds, investors can evaluate their relative performance and make informed decisions about which bonds to hold or sell.

In Excel, yield to maturity calculations can be performed quickly and accurately, allowing investors to make timely and informed investment decisions. By incorporating yield to maturity calculations into their bond portfolio management, investors can optimize their returns, manage risk, and achieve their investment objectives.

Using Excel Functions to Simplify Yield to Maturity Calculations

Calculating yield to maturity in Excel can be a complex and time-consuming process, especially for bonds with multiple cash flows. However, Excel provides several functions that can simplify yield to maturity calculations, making it easier and more efficient to analyze bond investments.

One such function is the XNPV function, which calculates the present value of a series of cash flows. By using the XNPV function, investors can quickly and accurately calculate the yield to maturity of a bond, taking into account the bond’s coupon payments, principal repayment, and market price.

Another useful function is the XIRR function, which calculates the internal rate of return of a series of cash flows. The XIRR function can be used to calculate the yield to maturity of a bond, as well as the bond’s total return, including the coupon payments and principal repayment.

By using these Excel functions, investors can simplify the yield to maturity calculation process, reducing the risk of errors and increasing the accuracy of their results. Additionally, these functions can be used to analyze multiple bonds and bond portfolios, making it easier to compare and contrast different investment opportunities.

For example, to calculate the yield to maturity using the XNPV function, investors can use the following formula: `=XNPV(rate, dates, cash flows)`, where `rate` is the discount rate, `dates` is the series of cash flow dates, and `cash flows` is the series of cash flows. Similarly, to calculate the yield to maturity using the XIRR function, investors can use the following formula: `=XIRR(cash flows, dates, [guess])`, where `cash flows` is the series of cash flows, `dates` is the series of cash flow dates, and `[guess]` is an optional argument that specifies the initial guess for the internal rate of return.

By incorporating these Excel functions into their yield to maturity calculations, investors can streamline their analysis and make more informed investment decisions. In the next section, we will discuss the differences between yield to maturity and current yield, and when to use each metric.

Yield to Maturity vs. Current Yield: What’s the Difference?

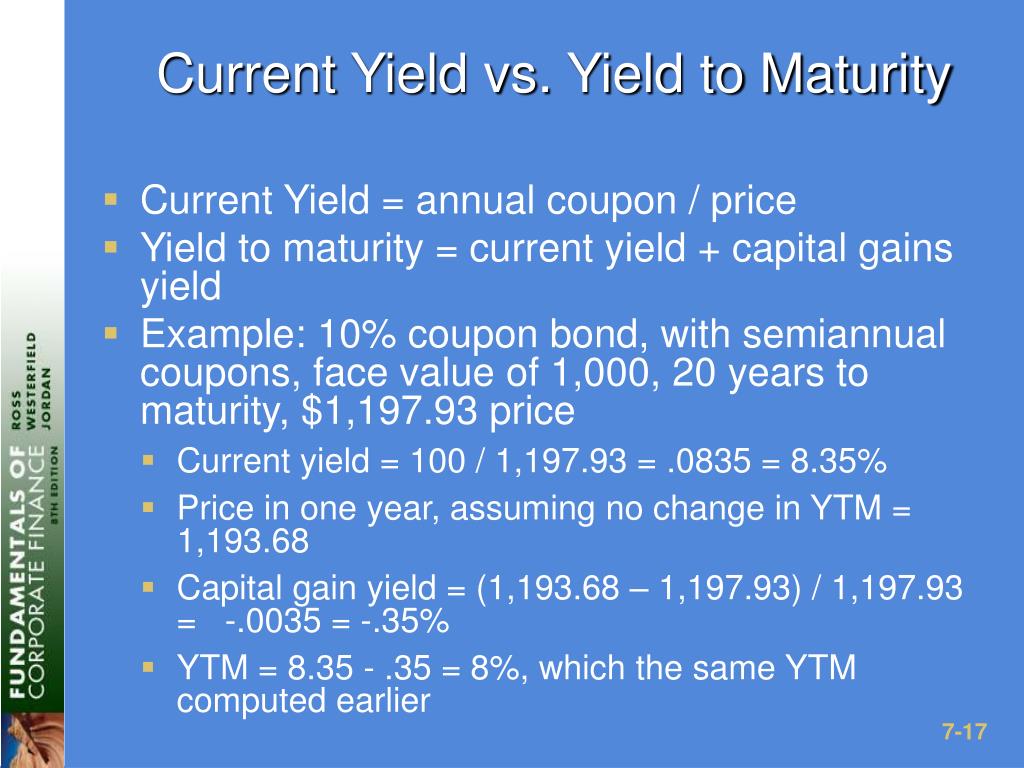

In bond investing, yield to maturity and current yield are two commonly used metrics to evaluate the performance of a bond. While both metrics provide insights into a bond’s return, they are calculated differently and serve distinct purposes. In this section, we will explore the differences between yield to maturity and current yield, and when to use each metric.

Yield to maturity, as discussed earlier, is the total return on a bond, taking into account the coupon payments, principal repayment, and market price. It provides a comprehensive measure of a bond’s performance, reflecting the bond’s credit risk, interest rate risk, and market conditions.

Current yield, on the other hand, is the bond’s annual coupon payment divided by its current market price. It represents the bond’s current income stream, without considering the principal repayment or market price changes. Current yield is a simpler metric, providing a snapshot of the bond’s current income generation.

The key differences between yield to maturity and current yield lie in their calculation and application. Yield to maturity is a more comprehensive metric, suitable for evaluating a bond’s total return and credit risk. Current yield, however, is a more straightforward metric, useful for evaluating a bond’s current income generation.

In Excel, investors can calculate both yield to maturity and current yield using various formulas and functions. For example, the yield to maturity can be calculated using the XNPV or XIRR functions, as discussed earlier. The current yield, on the other hand, can be calculated using a simple formula: `=coupon rate / current market price`.

When to use each metric depends on the investor’s goals and objectives. Yield to maturity is suitable for investors seeking to evaluate a bond’s total return and credit risk, while current yield is suitable for investors seeking to evaluate a bond’s current income generation. By understanding the differences between these two metrics, investors can make more informed investment decisions and optimize their bond portfolios.

In the next section, we will explore advanced techniques for calculating yield to maturity in Excel, including using macros and VBA scripts.

Advanced Yield to Maturity Calculations in Excel

For advanced users, Excel offers a range of techniques to streamline and automate yield to maturity calculations. In this section, we will explore the use of macros and VBA scripts to simplify and accelerate yield to maturity calculations.

Macros are a powerful tool in Excel that allow users to record and replay a series of actions. By creating a macro, investors can automate the yield to maturity calculation process, saving time and reducing errors. For example, a macro can be created to input the bond’s cash flows, coupon rate, and market price, and then calculate the yield to maturity using the XNPV or XIRR functions.

VBA scripts, on the other hand, offer a more advanced level of automation. By writing a VBA script, investors can create a custom function that calculates the yield to maturity, taking into account the bond’s specific characteristics and market conditions. VBA scripts can also be used to create interactive dashboards and reports, providing a more dynamic and user-friendly experience.

One example of an advanced yield to maturity calculation in Excel is the use of a Monte Carlo simulation. By creating a Monte Carlo simulation, investors can model different market scenarios and calculate the yield to maturity under each scenario. This can provide a more comprehensive understanding of the bond’s risk and return profile.

Another example is the use of a yield curve analysis. By creating a yield curve analysis, investors can calculate the yield to maturity of a bond based on the current market yield curve. This can provide a more accurate estimate of the bond’s yield to maturity, taking into account the current market conditions.

By leveraging these advanced techniques, investors can take their yield to maturity calculations to the next level, gaining a more sophisticated understanding of bond investments and making more informed investment decisions. Whether using macros, VBA scripts, or advanced analytics, Excel provides a powerful platform for yield to maturity calculations, empowering investors to make data-driven decisions with confidence.