Accessing Reliable Historical DJIA Data: A Foundation for Informed Decisions

Analyzing historical Dow Jones Industrial Average (DJIA) data is crucial for investment strategies, insightful research, and understanding market trends. Access to reliable, comprehensive data is paramount. Yahoo Finance offers a readily available source for yahoo finance djia historical data. However, limitations exist. Data gaps and potential inaccuracies can compromise the integrity of any analysis performed using this free resource alone. Therefore, exploring alternative data sources is essential for a complete and accurate picture of DJIA performance. The following sections will delve into using Yahoo Finance effectively, recognizing its limitations, and examining more robust alternatives for obtaining historical DJIA data. Understanding these nuances is critical for making informed investment choices.

The importance of accurate yahoo finance djia historical data cannot be overstated. Investors rely on historical data to inform their trading decisions, to test investment strategies, and to better understand market behavior. Incomplete or inaccurate data can lead to flawed conclusions and potentially costly mistakes. This necessitates a thorough approach to data acquisition and validation. For instance, identifying trends and patterns requires a complete dataset free of inaccuracies. Relying solely on a single source, such as Yahoo Finance, introduces inherent risks. The next section will demonstrate a step-by-step guide to extract data from Yahoo Finance, highlighting its functionality and emphasizing the need for corroboration from other credible sources for accurate analysis of yahoo finance djia historical data.

Many investors begin their journey into historical DJIA analysis with Yahoo Finance, recognizing its ease of access and user-friendly interface. However, it’s vital to understand the inherent limitations of free data sources. While Yahoo Finance provides a starting point, the data may not be entirely comprehensive or perfectly accurate. Missing data points, inaccuracies, and inconsistencies can significantly affect the validity of any conclusions drawn from the analysis. A comprehensive approach demands the use of multiple sources to verify data integrity and to gain a more complete perspective on long-term DJIA performance. This multi-source approach minimizes risk and enhances the reliability of any investment decisions based on the historical data. The subsequent sections will explore methods for verifying data integrity and identifying high-quality alternative sources for yahoo finance djia historical data.

Navigating Yahoo Finance for DJIA Information

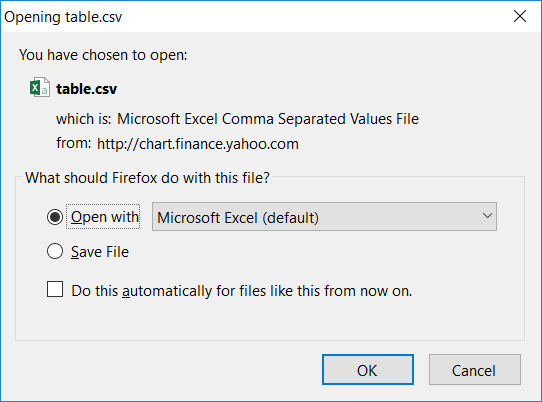

To access yahoo finance DJIA historical data, begin by visiting the Yahoo Finance website. Use the search bar to locate the Dow Jones Industrial Average (DJIA) symbol, “^DJI”. Once located, click on the symbol to access the DJIA’s main page. This page provides a wealth of real-time information, but to retrieve historical data, look for a section typically labeled “Historical Data” or a similar designation. Clicking this will open a new section dedicated to historical price information. You’ll find options to specify a date range for your download. Yahoo Finance usually allows selection of a start and end date, enabling you to obtain yahoo finance DJIA historical data for a customized period. Remember to select a suitable format for downloading the data; CSV (Comma Separated Values) is a widely used and easily imported format. After specifying your date range and preferred file format, click the download button, and the data file will typically download automatically to your computer.

The downloaded data file will usually contain several columns representing different aspects of the DJIA’s performance on each day. These commonly include the date, the opening price, the highest price reached during the day, the lowest price reached, the closing price, and the trading volume. Understanding these columns is vital for interpreting the yahoo finance DJIA historical data effectively. The “Open” price represents the price at the market’s opening, “High” and “Low” show the daily price extremes, and “Close” shows the final price at the market’s close. “Volume” indicates the total number of shares traded during the day. This information forms the basis of many analyses; for example, high volume often accompanies significant price movements. Proper understanding of these fields is crucial for accurate analysis of the yahoo finance DJIA historical data.

Yahoo Finance provides additional features to refine your data search. You might find options to adjust the frequency of data points (daily, weekly, monthly). This allows for analysis tailored to different time horizons. Experiment with these options to obtain the best representation of yahoo finance DJIA historical data relevant to your specific analytical needs. Remember that while Yahoo Finance offers convenient access, always consider cross-referencing data with other sources for verification. Utilizing additional sources for cross-checking ensures a more complete and accurate understanding of the historical Dow Jones Industrial Average performance. This approach helps mitigate any potential data errors or inconsistencies inherent in any single data source, even a reputable one like Yahoo Finance. This thorough approach will lead to more reliable analyses built upon accurate yahoo finance DJIA historical data.

Understanding Data Limitations and Potential Issues with Yahoo Finance DJIA Historical Data

While Yahoo Finance offers readily accessible yahoo finance djia historical data, relying solely on this source presents potential limitations. Data inaccuracies can occur due to various factors, including reporting errors or delays from the underlying data providers. Missing data points, especially for older periods, are also common. These gaps can significantly impact the reliability of any analysis performed. Consequently, researchers should always critically evaluate the data’s completeness and accuracy. Understanding these potential issues is crucial for ensuring the robustness of any conclusions drawn from the analysis of yahoo finance djia historical data.

The importance of cross-referencing information from multiple sources cannot be overstated. Comparing data from Yahoo Finance with other reputable providers helps identify inconsistencies and potential errors. This process of verification enhances the validity and reliability of the historical data. Even seemingly minor discrepancies can compound over time, potentially leading to skewed analyses and incorrect interpretations. Therefore, a multi-source approach strengthens the foundation for informed decision-making based on yahoo finance djia historical data.

Furthermore, the free nature of Yahoo Finance’s data comes with inherent limitations. While the data is generally sufficient for introductory-level analysis or educational purposes, more rigorous research or high-frequency trading often necessitates the precision and completeness only premium data providers can offer. The need for critical evaluation extends to all data sources; even reputable sources like Yahoo Finance may contain errors or limitations. Always consider the potential for bias or inaccuracies when working with any financial data, including this freely available yahoo finance djia historical data. Robust analysis requires awareness of these limitations and the application of appropriate verification and validation methods.

How to Analyze Dow Jones Historical Data Effectively

Analyzing yahoo finance DJIA historical data effectively involves employing various techniques to extract meaningful insights. One fundamental approach is charting. Line charts provide a clear visual representation of price movements over time, allowing for easy identification of trends. Candlestick charts offer a richer picture, incorporating open, high, low, and closing prices for each period, revealing potential price patterns and reversals. These charts, easily created using spreadsheet software or dedicated charting platforms, are invaluable when analyzing yahoo finance DJIA historical data. Using data from yahoo finance, patterns can be visually identified and tracked over time.

Beyond visual representation, quantitative analysis enhances understanding. Moving averages, such as simple moving averages (SMA) or exponential moving averages (EMA), smooth out price fluctuations, highlighting underlying trends. The Relative Strength Index (RSI) measures momentum and can indicate overbought or oversold conditions, suggesting potential trend reversals. By calculating these indicators using the yahoo finance DJIA historical data, traders and analysts gain valuable signals about potential buy or sell opportunities. Combining chart analysis with indicator calculations provides a comprehensive analytical approach for interpreting yahoo finance DJIA historical data. The combination of visual and quantitative methods leads to more informed decisions. Effective data analysis relies on the accurate and complete dataset provided by reliable sources like Yahoo Finance, though additional sources may supplement the analysis.

Identifying market trends is crucial for effective analysis. Uptrends are characterized by consistently higher highs and higher lows, indicating bullish momentum. Downtrends show consistently lower highs and lower lows, indicating bearish sentiment. Consolidation periods are characterized by sideways price movement, often preceding a significant price break in either direction. Analyzing these trends within the context of broader economic conditions, using data from yahoo finance DJIA historical data, allows for a more nuanced interpretation of market behavior. Recognizing these patterns in yahoo finance DJIA historical data is fundamental to successful trading and investment strategies. By carefully observing these patterns and supplementing them with economic context, investors can make informed decisions based on the historical record. The use of yahoo finance DJIA historical data and appropriate analytical techniques is key to successful market participation.

Exploring Alternative Data Sources for the DJIA

While Yahoo Finance provides a convenient starting point for accessing yahoo finance djia historical data, its limitations regarding data accuracy and completeness necessitate exploring alternative sources. Reputable financial data providers like Refinitiv, Bloomberg, and FactSet offer significantly more comprehensive datasets. These platforms often include detailed historical information, going back many decades, with minimal data gaps. They also typically provide superior data quality, undergoing rigorous validation processes to ensure accuracy. However, a key consideration is the cost; access to these premium services usually involves substantial subscription fees, making them less accessible to individual investors compared to the free data available on Yahoo Finance. This cost often reflects the higher level of accuracy and the breadth of data provided. The choice depends on individual needs and budget; free sources like Yahoo Finance suffice for basic analysis, but professional-grade research demands the higher accuracy and detail of paid services. The decision involves weighing the cost against the value of more precise data.

The advantages of using premium data providers extend beyond sheer volume and accuracy. These platforms typically integrate data with powerful analytical tools. Users can easily generate customized reports, perform complex calculations, and conduct in-depth analyses within the platform itself. This integrated approach can significantly streamline the workflow compared to downloading data from Yahoo Finance and then manually processing it using spreadsheet software or programming languages. Consider the level of sophistication needed for your analysis. If you need simple charts and calculations, the free yahoo finance djia historical data might suffice. However, for intricate modeling or backtesting complex strategies, the enhanced analytical capabilities of paid services prove invaluable. The added cost translates to time saved and more robust analytical tools. Choosing the right data source depends heavily on the specific analytical needs.

In summary, accessing reliable yahoo finance djia historical data is crucial for informed investment decisions. Yahoo Finance provides a free starting point, useful for basic analyses, but its limitations prompt consideration of paid services. Refinitiv, Bloomberg, and FactSet offer superior data quality, completeness, and integrated analytical tools. The decision to use a free or paid service depends on individual needs, budget, and the complexity of your analysis. Understanding the strengths and weaknesses of each source ensures you obtain the best possible data for your investment strategies. Careful consideration of these factors leads to better-informed choices.

Advanced Techniques for Data Cleaning and Manipulation

Successfully analyzing yahoo finance DJIA historical data often requires cleaning and manipulating the downloaded dataset. Raw data frequently contains imperfections. These imperfections include missing values, outliers, and inconsistencies. Addressing these issues is crucial for accurate analysis. Spreadsheet software like Microsoft Excel or Google Sheets provides tools for basic data cleaning. These tools enable users to handle missing data through imputation techniques, such as replacing missing values with averages or interpolating data points. Outliers, data points significantly different from the rest, can be identified and either removed or adjusted. Inconsistencies in data formatting can also be corrected using these tools. For example, you might need to standardize date formats or correct errors in numerical values. Working with yahoo finance DJIA historical data effectively often necessitates attention to detail in this phase.

More advanced data cleaning and manipulation techniques leverage programming languages like Python. Python offers powerful libraries, such as Pandas and NumPy, that are specifically designed for data manipulation. These libraries allow for more sophisticated cleaning procedures. These procedures include handling large datasets efficiently and applying more complex imputation methods. Python also facilitates the creation of custom data cleaning functions. These functions can be tailored to specific issues found in the yahoo finance DJIA historical data. Python scripts can automate the cleaning process, making it repeatable and less prone to human error. This is especially beneficial when dealing with large volumes of yahoo finance DJIA historical data, or when performing frequent updates.

Regardless of the chosen method—spreadsheet software or Python—a careful and systematic approach is essential. Thorough documentation of the cleaning steps is highly recommended. This documentation ensures reproducibility and allows for easy identification of any modifications made to the data. This meticulous approach is critical when using yahoo finance DJIA historical data for any quantitative analysis. Accurate and reliable data are fundamental to generating meaningful insights and drawing valid conclusions.

Putting the Data to Work: Practical Applications of Yahoo Finance DJIA Historical Data

Historical DJIA data, readily accessible through resources like Yahoo Finance, offers numerous practical applications for investors and analysts. Backtesting trading strategies, for instance, relies heavily on this data. By simulating past trades using historical price movements, investors can assess the performance of various strategies before committing real capital. This rigorous testing helps refine strategies and identify potential weaknesses. Analyzing yahoo finance DJIA historical data in this way allows for data-driven decisions, minimizing risk.

Furthermore, historical DJIA data plays a crucial role in creating sophisticated investment models. Quantitative analysts can use this data to identify patterns, correlations, and predict future market movements. These models incorporate factors beyond simple price movements, such as economic indicators and sentiment analysis. The ability to access extensive yahoo finance DJIA historical data is vital for building accurate and robust models. The insights gained from these models can inform portfolio allocation, risk management, and asset pricing strategies. Understanding market behavior during specific economic periods, like recessions or booms, is another key application. Analyzing DJIA performance during these periods, using data from Yahoo Finance or similar sources, allows investors to gauge the index’s resilience and inform risk management during similar situations in the future.

Beyond individual analysis, historical DJIA data facilitates comparative analyses with other indices. By comparing the DJIA’s performance against global indices or sector-specific indices, analysts can identify sector-specific trends or gauge the relative performance of different market segments. This comparative analysis also helps determine the impact of macroeconomic events on specific market sectors. The ability to access and analyze data from different sources, even if it begins with data sourced from yahoo finance DJIA historical data, is critical for this type of comparative study. Ultimately, effective analysis of yahoo finance DJIA historical data empowers informed investment decisions, supporting sound strategies built on a foundation of empirical evidence. The quality and reliability of the data source, like Yahoo Finance, plays a crucial role in the accuracy and dependability of any conclusions.

Safeguarding Your Data: Storage and Security

Properly storing and managing downloaded yahoo finance DJIA historical data is crucial. Data loss can severely impact research and analysis. Consider the volume and sensitivity of your data when choosing a storage solution. For smaller datasets, a well-organized folder structure on a personal computer might suffice. However, regular backups to an external hard drive or cloud storage are essential. This protects against hardware failure or accidental deletion. Cloud services offer various storage options, from free plans suitable for individuals to enterprise-level solutions for larger organizations working with extensive yahoo finance DJIA historical data. Always choose a reputable provider with robust security measures.

Data security is paramount when dealing with financial information. Unauthorized access to yahoo finance DJIA historical data could lead to misuse or even identity theft. Strong passwords, multi-factor authentication, and regularly updated antivirus software are basic security measures. Encrypting your data adds an extra layer of protection, making it unreadable even if accessed by unauthorized individuals. For sensitive data, consider employing encryption both during storage and transmission. Regularly reviewing security protocols helps maintain the integrity and confidentiality of your yahoo finance DJIA historical data. Remember to follow best practices for password management and avoid sharing your data with untrusted sources.

Version control systems, often used in software development, can also benefit users handling extensive yahoo finance DJIA historical data. These systems track changes made to the data over time, allowing for easy recovery of previous versions if needed. This is invaluable for preventing data corruption or accidental overwrites. Version control allows for collaboration if multiple individuals work with the same dataset. Careful data management practices, combined with appropriate security measures, ensures the long-term availability and protection of your valuable yahoo finance DJIA historical data, facilitating robust and reliable analysis for years to come.