Defining Risk Transfer: A Crucial Aspect of Business Strategy

Risk transfer is a vital component of business strategy, enabling companies to manage uncertainty and mitigate potential losses. But what is transfer of risk, exactly? In essence, it involves shifting potential risks to another party, such as an insurance company, contractor, or supplier. This can be achieved through various means, including insurance policies, contracts, and other agreements. By transferring risk, businesses can reduce their exposure to potential losses, freeing up resources to focus on growth and innovation. There are various types of risks that can be transferred, including operational risks, financial risks, strategic risks, and compliance risks. Understanding the different types of risks and how to transfer them is crucial for businesses seeking to manage uncertainty and achieve long-term success.

How to Identify and Assess Risks in Your Business

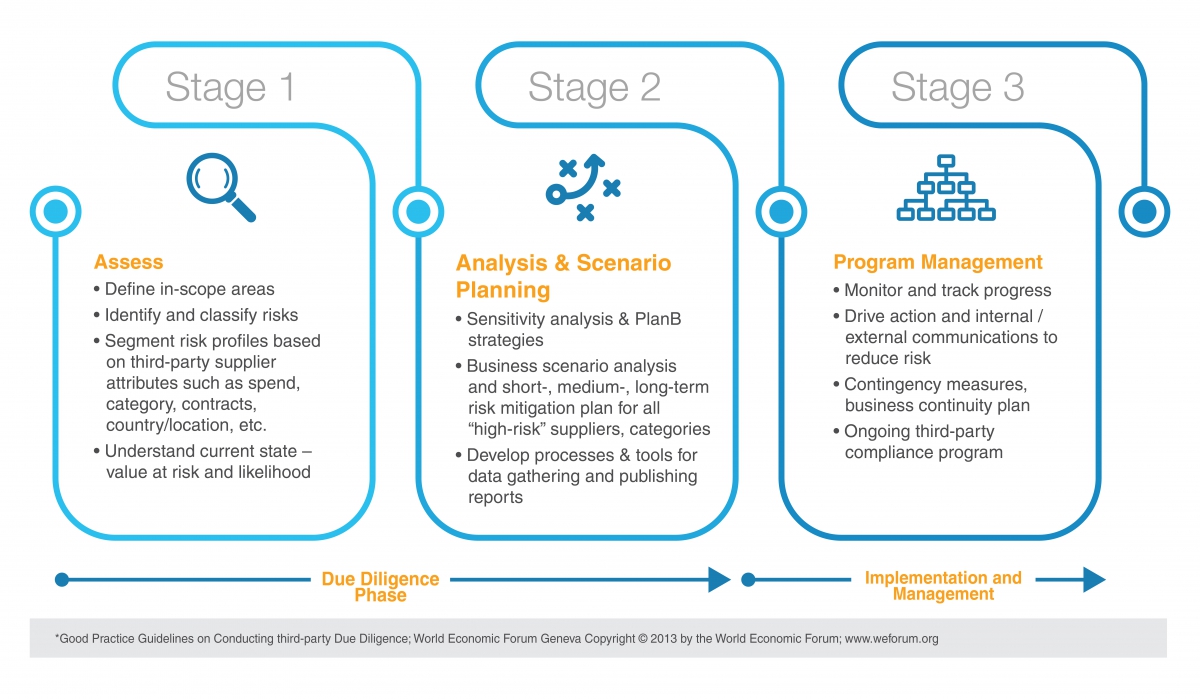

Identifying and assessing risks is a critical step in the risk transfer process. It enables businesses to understand the potential risks they face, prioritize them, and develop effective strategies to mitigate or transfer them. Failing to identify and assess risks can have severe consequences, including financial losses, reputational damage, and even business failure. So, how can businesses identify and assess risks effectively? One approach is to conduct a thorough risk assessment, which involves identifying potential risks, evaluating their likelihood and impact, and prioritizing them based on their severity. There are various tools and techniques that can be used to facilitate this process, including risk matrices, SWOT analysis, and scenario planning. By identifying and assessing risks proactively, businesses can develop effective risk transfer strategies and minimize their exposure to potential losses. This, in turn, can help to improve their overall resilience and competitiveness in the market.

The Role of Insurance in Risk Transfer

Insurance plays a vital role in risk transfer, enabling businesses to transfer specific risks to an insurance company in exchange for a premium. This can provide financial protection against unexpected events, such as natural disasters, accidents, or lawsuits. There are various types of insurance policies that can be used to transfer risk, including liability insurance, property insurance, and business interruption insurance. For example, a company may purchase liability insurance to protect against lawsuits arising from product defects or negligence. In the event of a lawsuit, the insurance company would cover the costs of legal defense and any damages awarded. Similarly, a business may purchase property insurance to protect against damage to its physical assets, such as buildings or equipment. By transferring risk through insurance, businesses can reduce their financial exposure and improve their overall resilience. Understanding what is transfer of risk and how insurance can be used to mitigate specific risks is crucial for businesses seeking to manage uncertainty and achieve long-term success.

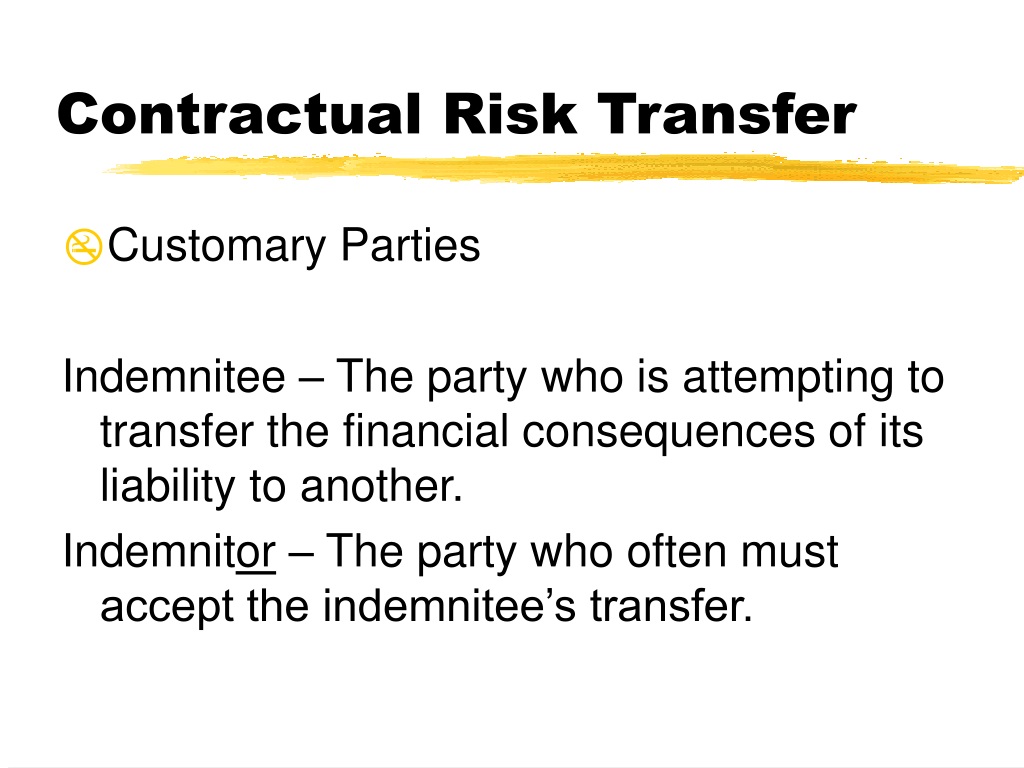

Contractual Risk Transfer: Understanding the Fine Print

Contractual risk transfer is another crucial aspect of risk management, enabling businesses to transfer risk to other parties through contractual agreements. This can include transferring risk to suppliers, contractors, or partners, and is often used in conjunction with insurance to provide comprehensive risk protection. A well-drafted contract can help to allocate risk between parties, ensuring that each party is aware of their responsibilities and liabilities. However, contractual risk transfer requires careful negotiation and drafting to ensure that the terms of the contract are clear and effective. Key elements of a risk transfer contract include indemnification provisions, liability limitations, and warranties, which can help to allocate risk and protect against potential losses. Understanding what is transfer of risk and how to negotiate effective contractual risk transfer agreements is essential for businesses seeking to manage uncertainty and achieve long-term success. By transferring risk through contracts, businesses can reduce their financial exposure, improve their risk management capabilities, and enhance their overall competitiveness.

Alternative Risk Transfer Mechanisms: Beyond Insurance

Beyond traditional insurance, there are alternative risk transfer mechanisms that businesses can use to manage uncertainty. One such approach is the use of captives, which are insurance companies owned and controlled by their policyholders. Captives can provide tailored risk management solutions, increased control over risk, and potential cost savings. Another alternative is risk retention groups, which are formed by businesses with similar risk profiles to share and manage risk collectively. Other non-traditional approaches include risk pooling, where multiple businesses pool their resources to manage risk, and finite risk insurance, which combines elements of insurance and financing to manage risk. Understanding what is transfer of risk and the various alternative risk transfer mechanisms available can help businesses develop a comprehensive risk management strategy. By exploring these alternative approaches, businesses can identify the most effective ways to transfer risk, reduce financial exposure, and achieve long-term success. However, it is essential to carefully evaluate the benefits and drawbacks of each approach, including the potential costs, regulatory requirements, and complexity of implementation.

Effective Risk Transfer Strategies for Businesses

Developing an effective risk transfer strategy is crucial for businesses seeking to manage uncertainty and achieve long-term success. A comprehensive risk transfer strategy involves prioritizing risks, allocating resources, and monitoring risk transfer effectiveness. To prioritize risks, businesses should identify and assess the likelihood and impact of potential risks, focusing on the most critical risks that could have a significant impact on operations. Allocating resources effectively involves assigning responsibility for risk management to specific teams or individuals, ensuring that they have the necessary skills and expertise to manage risk. Monitoring risk transfer effectiveness is also essential, involving regular review and assessment of risk transfer mechanisms to ensure they are operating as intended. By understanding what is transfer of risk and developing an effective risk transfer strategy, businesses can reduce financial exposure, improve risk management capabilities, and enhance competitiveness. Additionally, businesses should consider the following best practices: establishing clear risk management goals and objectives, identifying and mitigating potential risks, and continuously reviewing and updating risk transfer strategies to ensure they remain effective.

https://www.youtube.com/watch?v=KcCmCZoQVvE

Common Pitfalls to Avoid in Risk Transfer

When transferring risk, businesses must be aware of common pitfalls that can undermine the effectiveness of their risk management strategies. One common mistake is inadequate risk assessment, which can lead to unidentified risks and inadequate risk transfer mechanisms. Poor contract negotiation is another pitfall, as it can result in unfavorable terms and conditions that increase risk exposure. Failure to monitor risk transfer effectiveness is also a common mistake, as it can lead to ineffective risk transfer mechanisms and inadequate risk management. Additionally, businesses may fail to consider the total cost of risk transfer, including premiums, deductibles, and other expenses, which can impact the bottom line. Furthermore, businesses may not fully understand what is transfer of risk and how it works, leading to ineffective risk transfer strategies. By being aware of these common pitfalls, businesses can avoid costly mistakes and develop effective risk transfer strategies that reduce financial exposure and improve risk management capabilities. It is essential to conduct thorough risk assessments, negotiate contracts effectively, and continuously monitor risk transfer effectiveness to ensure successful risk management.

Best Practices for Long-Term Risk Management

Effective risk management is an ongoing process that requires continuous improvement and stakeholder engagement. To achieve long-term success, businesses must adopt best practices that prioritize risk management and mitigation. One key best practice is to conduct ongoing risk assessments, regularly reviewing and updating risk profiles to ensure that new risks are identified and addressed. Another best practice is to foster a culture of risk awareness, educating employees and stakeholders on the importance of risk management and encouraging open communication about potential risks. Continuous improvement is also essential, involving regular review and refinement of risk management strategies to ensure they remain effective. Additionally, businesses should prioritize stakeholder engagement, involving stakeholders in the risk management process and ensuring that their needs and concerns are addressed. By adopting these best practices, businesses can develop a robust risk management framework that supports long-term success and reduces financial exposure. Understanding what is transfer of risk and implementing effective risk transfer strategies is also crucial for long-term risk management. By prioritizing risk management and mitigation, businesses can reduce uncertainty and achieve long-term success.