What Happens to a Put Option at Expiration?

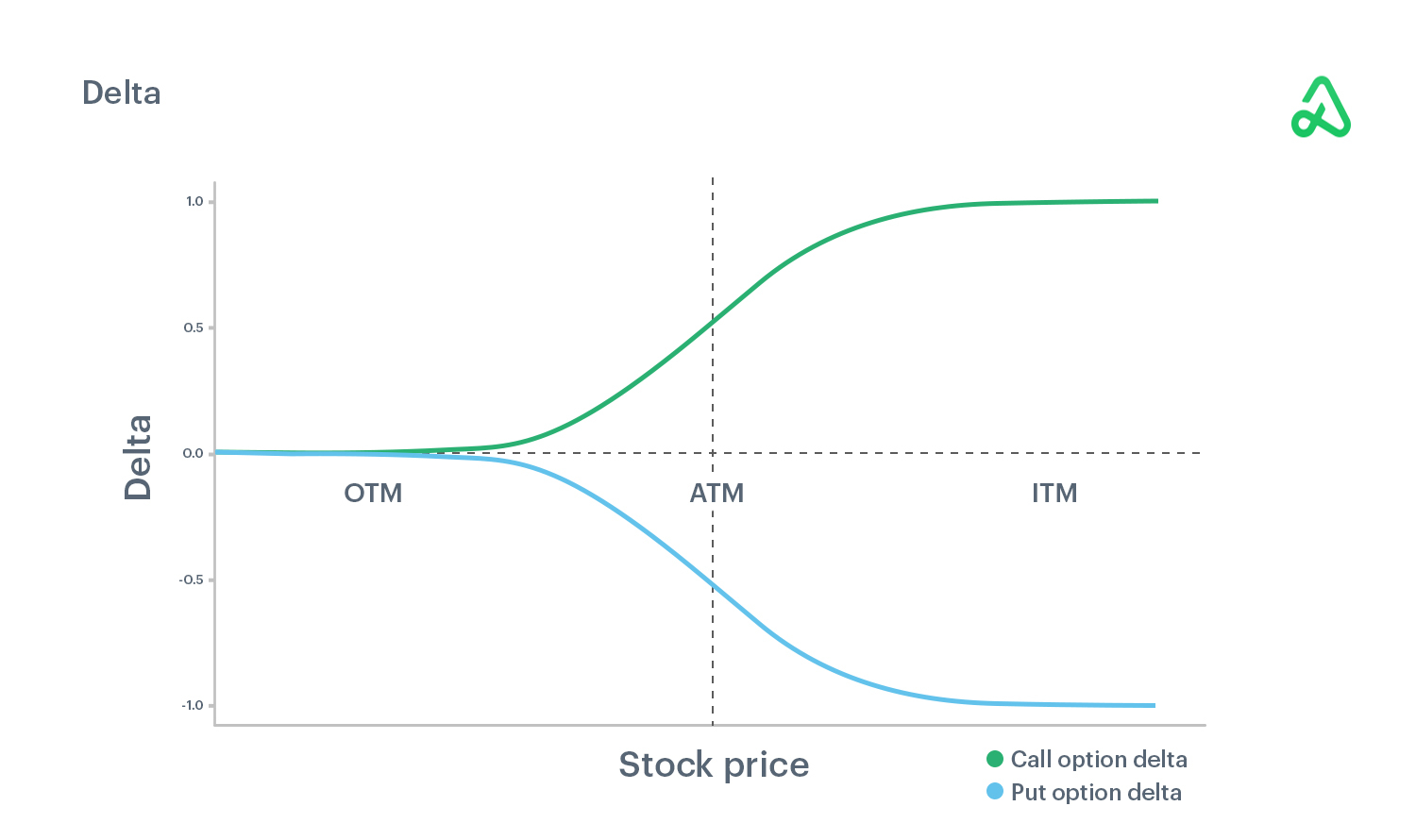

Options expiration is a critical event that significantly affects the value of a put option. It’s essential to understand what happens to a put option at expiration to make informed trading decisions. At expiration, a put option can have one of three outcomes: in the money, out of the money, or at the money. The value of a put option at expiry is determined by the underlying asset’s price in relation to the strike price.

If the underlying asset’s price is below the strike price, the put option is in the money, and its value is equal to the difference between the strike price and the underlying asset’s price. In this scenario, the option holder can exercise the option and sell the underlying asset at the higher strike price, resulting in a profit. On the other hand, if the underlying asset’s price is above the strike price, the put option is out of the money, and its value is zero. In this case, the option holder will not exercise the option, and it will expire worthless.

Understanding the concept of options expiration and its impact on the value of a put option is crucial for traders. It allows them to adjust their strategies, manage risk, and maximize profits. For instance, traders may choose to close their positions before expiration to avoid potential losses or adjust their strike prices to reflect changing market conditions. By grasping the concept of options expiration, traders can make informed decisions and improve their overall trading performance. This knowledge is essential in determining what is the value of a put option at expiry, which is critical in making profitable trades.

How to Calculate the Value of a Put Option at Expiry

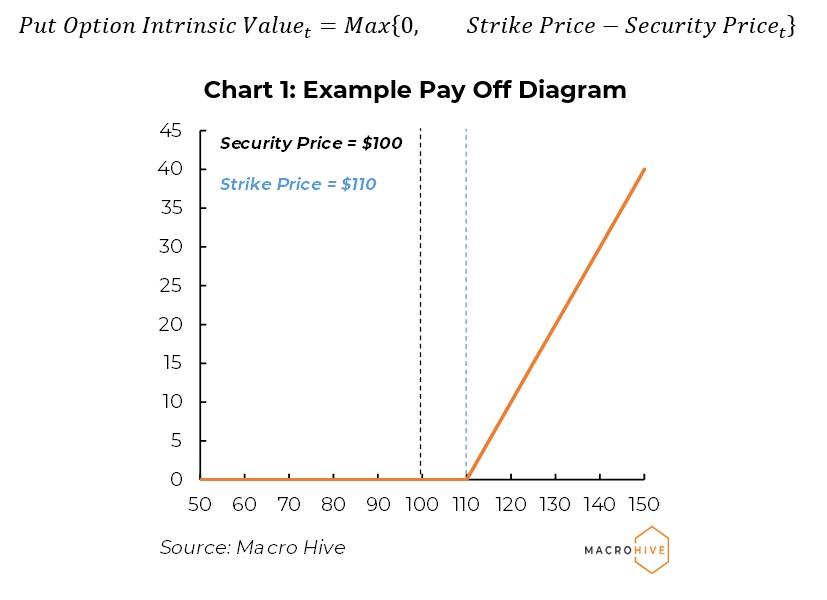

Calculating the value of a put option at expiry is crucial for traders to make informed decisions. The value of a put option at expiry is determined by the underlying asset’s price, strike price, and time to expiration. To calculate the value of a put option at expiry, follow these steps:

Step 1: Determine the underlying asset’s price at expiry. This is the current market price of the underlying asset.

Step 2: Identify the strike price of the put option. This is the predetermined price at which the option holder can sell the underlying asset.

Step 3: Calculate the intrinsic value of the put option. The intrinsic value is the difference between the strike price and the underlying asset’s price, if the option is in the money. If the option is out of the money, the intrinsic value is zero.

Step 4: Calculate the extrinsic value of the put option. The extrinsic value is the time value of the option, which is the value of the option’s potential to increase in value before expiry.

Step 5: Add the intrinsic and extrinsic values to determine the total value of the put option at expiry.

For example, let’s say the underlying asset’s price at expiry is $50, and the strike price of the put option is $55. If the option is in the money, the intrinsic value would be $5 ($55 – $50). The extrinsic value would be $2, assuming the option has some time value. Therefore, the total value of the put option at expiry would be $7 ($5 + $2).

Understanding how to calculate the value of a put option at expiry is essential for traders to determine what is the value of a put option at expiry and make profitable trades. By following these steps, traders can accurately calculate the value of a put option at expiry and adjust their trading strategies accordingly.

The Role of Intrinsic and Extrinsic Value in Put Options

Intrinsic and extrinsic value are two essential components that contribute to the overall value of a put option at expiry. Understanding the difference between these two values is crucial for traders to make informed decisions and maximize profits.

Intrinsic value refers to the value of a put option when it is in the money. It is the difference between the strike price and the underlying asset’s price. For example, if the strike price is $50 and the underlying asset’s price is $45, the intrinsic value of the put option is $5. This means that the option holder can exercise the option and sell the underlying asset at the higher strike price, resulting in a profit.

Extrinsic value, on the other hand, is the time value of the option. It is the value of the option’s potential to increase in value before expiry. Extrinsic value is influenced by factors such as volatility, time to expiration, and interest rates. The extrinsic value of a put option decreases as the option approaches expiry, as the option’s potential to increase in value decreases.

The intrinsic and extrinsic values of a put option are closely related. When a put option is in the money, its intrinsic value increases, and its extrinsic value decreases. Conversely, when a put option is out of the money, its intrinsic value is zero, and its extrinsic value is higher. Understanding the relationship between intrinsic and extrinsic value is essential to determine what is the value of a put option at expiry.

For instance, let’s say a put option has an intrinsic value of $5 and an extrinsic value of $2. The total value of the put option at expiry would be $7. If the underlying asset’s price increases, the intrinsic value of the option would decrease, and the extrinsic value would increase. Conversely, if the underlying asset’s price decreases, the intrinsic value of the option would increase, and the extrinsic value would decrease.

In conclusion, intrinsic and extrinsic value are essential components of a put option’s value at expiry. Understanding the difference between these two values and how they interact is crucial for traders to make informed decisions and maximize profits. By grasping the concept of intrinsic and extrinsic value, traders can determine what is the value of a put option at expiry and adjust their trading strategies accordingly.

Understanding the Impact of Volatility on Put Option Value

Volatility is a crucial factor that affects the value of a put option at expiry. It is a measure of the underlying asset’s price fluctuations, and it has a direct impact on the option’s premium. When volatility increases, the option’s premium also increases, making the option more valuable. Conversely, when volatility decreases, the option’s premium decreases, making the option less valuable.

The relationship between volatility and option premium is straightforward. When the underlying asset’s price is more volatile, the option’s potential to increase in value increases, making it more valuable. This is because the option holder has a higher probability of exercising the option and selling the underlying asset at the higher strike price. As a result, the option’s premium increases to reflect the higher potential for profit.

For example, let’s say a put option has a strike price of $50 and the underlying asset’s price is $45. If the volatility of the underlying asset increases, the option’s premium may increase from $5 to $7. This is because the option holder has a higher probability of exercising the option and selling the underlying asset at the higher strike price, resulting in a higher profit.

On the other hand, if the volatility of the underlying asset decreases, the option’s premium may decrease from $5 to $3. This is because the option holder has a lower probability of exercising the option and selling the underlying asset at the higher strike price, resulting in a lower profit.

Understanding the impact of volatility on put option value is essential for traders to make informed decisions. By grasping the relationship between volatility and option premium, traders can determine what is the value of a put option at expiry and adjust their trading strategies accordingly. This includes adjusting the strike price, expiration date, and trading volume to maximize profits in response to changes in volatility.

In conclusion, volatility plays a critical role in determining the value of a put option at expiry. By understanding how volatility affects the option’s premium, traders can make informed decisions and maximize profits. Whether the option expires in the money, out of the money, or at the money, understanding the impact of volatility is crucial to determining what is the value of a put option at expiry.

The Effect of Interest Rates on Put Option Value at Expiry

Interest rates play a significant role in determining the value of a put option at expiry. Changes in interest rates can affect the option’s value, making it essential for traders to understand the relationship between interest rates and put option value.

When interest rates increase, the value of a put option at expiry decreases. This is because higher interest rates make borrowing more expensive, reducing the demand for the underlying asset. As a result, the underlying asset’s price decreases, making the put option less valuable. Conversely, when interest rates decrease, the value of a put option at expiry increases. This is because lower interest rates make borrowing cheaper, increasing the demand for the underlying asset and driving up its price.

The impact of interest rates on put option value is more pronounced when the option is close to expiry. This is because the option’s time value is lower, making the option’s value more sensitive to changes in interest rates. For example, if a put option has a strike price of $50 and the underlying asset’s price is $45, an increase in interest rates may cause the option’s value to decrease from $5 to $3. This is because the higher interest rates reduce the demand for the underlying asset, making the put option less valuable.

On the other hand, a decrease in interest rates may cause the option’s value to increase from $5 to $7. This is because the lower interest rates increase the demand for the underlying asset, making the put option more valuable.

Understanding the impact of interest rates on put option value is crucial for traders to make informed decisions. By grasping the relationship between interest rates and option value, traders can determine what is the value of a put option at expiry and adjust their trading strategies accordingly. This includes adjusting the strike price, expiration date, and trading volume to maximize profits in response to changes in interest rates.

In conclusion, interest rates have a significant impact on the value of a put option at expiry. By understanding how changes in interest rates affect the option’s value, traders can make informed decisions and maximize profits. Whether the option expires in the money, out of the money, or at the money, understanding the effect of interest rates is essential to determining what is the value of a put option at expiry.

Real-World Examples of Put Option Value at Expiry

Understanding the concept of put option value at expiry is crucial for traders to make informed decisions. To illustrate this concept, let’s consider some real-world examples of put options and their values at expiry.

Example 1: In-the-Money Put Option

Suppose a trader buys a put option on XYZ stock with a strike price of $50 and an expiration date in one month. At expiry, the underlying stock price is $45. In this scenario, the put option is in the money, and its value at expiry is $5 ($50 – $45). The trader can exercise the option and sell the underlying stock at the higher strike price, earning a profit of $5 per share.

Example 2: Out-of-the-Money Put Option

Suppose a trader buys a put option on ABC stock with a strike price of $60 and an expiration date in two months. At expiry, the underlying stock price is $65. In this scenario, the put option is out of the money, and its value at expiry is $0. The trader cannot exercise the option, and the option expires worthless.

Example 3: At-the-Money Put Option

Suppose a trader buys a put option on DEF stock with a strike price of $70 and an expiration date in three months. At expiry, the underlying stock price is $70. In this scenario, the put option is at the money, and its value at expiry is $0. The trader cannot exercise the option, and the option expires worthless.

These examples illustrate how the value of a put option at expiry is determined by the underlying asset’s price, strike price, and time to expiration. By understanding these factors, traders can determine what is the value of a put option at expiry and make informed decisions to maximize profits.

In each of these examples, the trader’s understanding of the put option’s value at expiry is crucial in determining the best course of action. By grasping the concepts discussed in this article, traders can make informed decisions and maximize profits when trading put options at expiry.

Common Mistakes to Avoid When Trading Put Options at Expiry

When trading put options at expiry, it’s essential to avoid common mistakes that can lead to significant losses. By understanding these mistakes, traders can develop a more effective trading strategy and maximize profits.

Failing to Understand the Option’s Value

One of the most critical mistakes traders make is failing to understand the value of a put option at expiry. This includes not grasping the concept of intrinsic and extrinsic value, as well as the factors that influence the option’s value, such as the underlying asset’s price, strike price, and time to expiration. To avoid this mistake, traders must have a clear understanding of what is the value of a put option at expiry and how it is calculated.

Misjudging Market Conditions

Another common mistake is misjudging market conditions, such as volatility, interest rates, and market sentiment. Traders must stay up-to-date with market news and analysis to make informed decisions. Failing to do so can result in trading decisions that are not aligned with market conditions, leading to losses.

Lack of a Clear Trading Strategy

A clear trading strategy is essential when trading put options at expiry. Traders must define their goals, risk tolerance, and market expectations to develop a strategy that suits their needs. Without a clear strategy, traders may make impulsive decisions, leading to losses.

Not Adjusting to Changing Market Conditions

Market conditions can change rapidly, and traders must be able to adjust their strategy accordingly. Failing to do so can result in losses, as the trader’s strategy is no longer aligned with market conditions.

Overtrading

Overtrading is a common mistake that can lead to significant losses. Traders must avoid overtrading by setting clear goals and risk tolerance, as well as by developing a disciplined trading strategy.

By avoiding these common mistakes, traders can develop a more effective trading strategy and maximize profits when trading put options at expiry. It’s essential to have a clear understanding of what is the value of a put option at expiry and how it is calculated, as well as to stay up-to-date with market conditions and adjust trading strategies accordingly.

Maximizing Profits with Put Options at Expiry

To maximize profits with put options at expiry, traders must develop a clear understanding of what is the value of a put option at expiry and how it is calculated. This includes understanding the factors that influence the option’s value, such as the underlying asset’s price, strike price, and time to expiration.

Adjusting Trading Strategies Based on Market Conditions

Traders must be able to adjust their trading strategies based on market conditions, including changes in volatility, interest rates, and market sentiment. This includes adjusting the strike price, expiration date, and underlying asset to maximize profits.

Identifying High-Profit Opportunities

Traders must be able to identify high-profit opportunities by analyzing market conditions and option value. This includes identifying undervalued or overvalued options and adjusting trading strategies accordingly.

Managing Risk

Risk management is crucial when trading put options at expiry. Traders must set clear goals and risk tolerance, as well as develop a disciplined trading strategy to minimize losses.

Staying Up-to-Date with Market News and Analysis

Traders must stay up-to-date with market news and analysis to make informed decisions. This includes staying informed about changes in market conditions, economic indicators, and company performance.

By following these tips and strategies, traders can maximize profits with put options at expiry. It’s essential to have a clear understanding of what is the value of a put option at expiry and how it is calculated, as well as to stay up-to-date with market conditions and adjust trading strategies accordingly.

Additionally, traders can use various trading strategies, such as spreads, straddles, and iron condors, to maximize profits. These strategies involve combining different options to minimize risk and maximize profits.

Ultimately, maximizing profits with put options at expiry requires a deep understanding of options trading, market conditions, and risk management. By following these tips and strategies, traders can develop a successful trading strategy and achieve their financial goals.

:max_bytes(150000):strip_icc()/dotdash_v3_Understanding_the_Binomial_Option_Pricing_Model_Nov_2020-01-204c5d0f3c5d476a8537fc08f0ecdc55.jpg)