Understanding a Bond’s Full Cost: Beyond the Quoted Price

When delving into the world of bonds, it’s crucial to recognize that the price you see quoted is not the complete story. The sticker price, often referred to as the ‘clean price,’ represents only a portion of the total cost you’ll incur when purchasing a bond. A key component that often gets overlooked is accrued interest, which significantly affects the final transaction amount. Therefore, understanding what is the dirty price of a bond becomes fundamental for any investor. This concept extends beyond simple acquisition cost; it also influences the actual yield you receive. This is because a bond’s quoted price, on its own, does not account for the interest that has accumulated since the last payment date. The ultimate cost will be the clean price plus that accumulated interest. This understanding provides a more accurate picture of a bond’s real cost and total value.

The price displayed for a bond is typically what’s called the ‘clean price,’ and it’s separate from the accrued interest. Essentially, accrued interest represents the interest that has been earned on a bond since its last coupon payment date, but hasn’t yet been paid out. The buyer will pay the seller for this accrued interest, which means the total transaction cost is actually higher than the clean price. A good understanding of what is the dirty price of a bond is essential because it reveals this total cost, which is also known as the ‘full price.’ Ignoring this accrued interest can lead to significant miscalculations in evaluating the profitability of a bond investment. The true value of a bond, therefore, isn’t just in its quoted price; it’s in the combination of that price with the accrued interest.

The Significance of Accrued Interest in Bond Pricing

Accrued interest is a fundamental concept in bond pricing, representing the interest that has accumulated on a bond since its last coupon payment date. Bonds typically distribute interest payments periodically, often semi-annually, but also quarterly or annually. If a bond is bought or sold between these payment dates, the buyer compensates the seller for the portion of the next coupon payment that they earned while they owned the bond. This is crucial because the bond’s stated coupon rate is based on the bond’s par value and paid at set intervals. For example, consider a bond that pays interest every six months. If a buyer purchases the bond three months after the last coupon was paid, they will need to pay the seller the value of the three months of accrued interest, in addition to the bond’s market price. Understanding how accrued interest impacts the overall cost is essential for comprehending what is the dirty price of a bond. This mechanism ensures that both the seller and the buyer of the bond are compensated appropriately for the period they own the asset.

To further clarify, imagine a scenario where a bond with a coupon rate of 6% and a par value of $1,000 pays interest every six months, which equates to $30 every six months. If the bond is sold three months into this six-month period, the seller is entitled to the interest that has accrued during those three months, which would be $15. Consequently, the buyer pays the quoted market price of the bond plus this $15 in accrued interest. This practice avoids a scenario where the seller effectively misses out on earnings, and the buyer gets value for the upcoming coupon payment. This concept is core to understanding what is the dirty price of a bond. The accrued interest component ensures that the bond’s total cost accurately reflects the value associated with it at any given point in time.

What Does the ‘Dirty Price’ of a Bond Represent?

The ‘dirty price’ of a bond, also known as the ‘full price’, is a fundamental concept in fixed income investing that represents the total cost a buyer pays for a bond. Understanding what is the dirty price of a bond is crucial for accurately assessing the real cost of a bond transaction. It is not just the quoted market price that one sees on a trading platform. Instead, the dirty price includes both the ‘clean price’ (the price of the bond itself) and the accrued interest, which is the interest that has accumulated since the last coupon payment date. The clean price is often what is displayed on trading platforms and is used for quoting purposes, whereas the dirty price is the actual price exchanged in a transaction. This distinction is vital for those involved in trading bonds because the dirty price gives a complete picture of what changes hands, ensuring a transparent bond market.

The need for a ‘dirty price’ arises because bond coupon payments are typically made periodically, such as semi-annually. Therefore, between these payment dates, interest accrues on a daily basis. When a bond is sold before the next coupon payment date, the seller is entitled to receive the interest that has accumulated up to that point. What is the dirty price of a bond, therefore, includes this accrued interest, compensating the seller for the time they held the bond and didn’t receive a coupon payment. This concept ensures that neither the buyer nor the seller gains or loses unfairly due to the timing of the transaction within a coupon payment cycle. In essence, the dirty price reflects the true cost of acquiring a bond on any given date by incorporating the underlying accumulated interest.

In the bond market, the dirty price is the real cost the buyer faces and what the seller effectively receives. While the clean price might be used for comparison and quotation purposes, the dirty price reflects the actual financial exchange. Therefore, recognizing what is the dirty price of a bond is not merely an academic exercise, it’s essential for ensuring that both parties in a bond transaction have a clear understanding of the precise financial implications. This clear understanding of the bond’s total cost, especially including the accrued interest, is vital for determining yield and other critical metrics, and it allows investors to make informed decisions about the true value of their bond holdings. The dirty price is therefore the price of bond transactions.

How to Calculate the ‘Full Price’ of a Bond

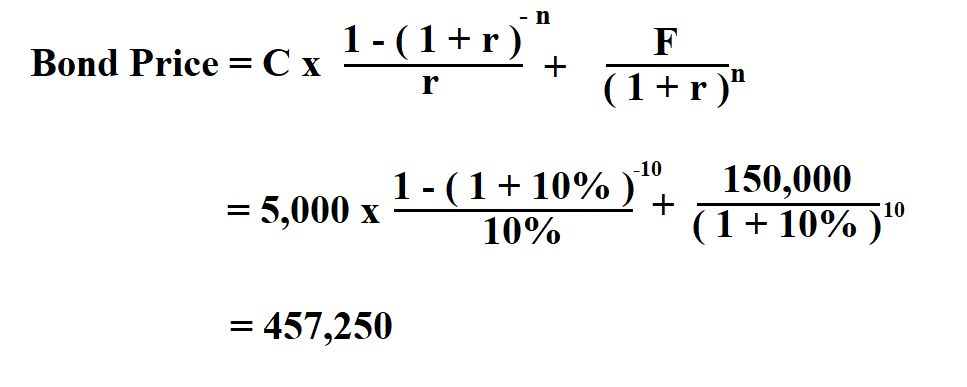

The dirty price of a bond, representing its total cost, is calculated by adding the accrued interest to the clean price. The formula is straightforward: Dirty Price = Clean Price + Accrued Interest. Let’s illustrate this with an example. Imagine a hypothetical government bond with a par value of $1,000 and a coupon rate of 5% per year, paid semi-annually. This means the bond pays $25 in interest every six months ($1,000 * 5% / 2). Now, suppose the last coupon payment was made on March 1st, and you are buying the bond on May 1st. This means two months’ worth of interest has accrued since the last payment, which you as the buyer, would need to compensate to the seller.

To calculate the accrued interest, we need to determine the fraction of the coupon period that has passed. In our example, two months out of six have passed since the last payment, which equals 2/6 or 1/3 of the semi-annual period. The accrued interest is then calculated as (1/3) * $25, which equals $8.33 approximately. Let’s say, further, that the quoted or clean price of the bond is $980. Therefore, to find the dirty price of a bond, we add the clean price to the accrued interest ($980 + $8.33). The total amount that the buyer pays to purchase this bond will be approximately $988.33. This $988.33 is what is known as the dirty price. Understanding this calculation is critical to grasp what is the dirty price of a bond and the full cost incurred during a bond transaction. This price reflects the full value of the bond, taking into account the coupon interest the seller has earned, and which the buyer must compensate at the time of purchase.

Why Understanding a Bond’s Comprehensive Price Matters

Understanding the ‘dirty price’ of a bond is not merely an academic exercise; it’s a crucial element for both buyers and sellers in bond transactions. The significance of knowing the total cost, which includes the accrued interest, directly impacts the actual yield and return on investment. Ignoring this component can lead to a misrepresentation of the true cost of acquisition and the profitability of a bond investment. For instance, if an investor focuses solely on the quoted, or ‘clean’ price, they may overlook the accrued interest owed to the seller, which is part of the what is the dirty price of a bond and it effectively reduces the overall yield upon purchase. This is because the investor is essentially paying for the interest that the seller has accumulated since the last coupon payment. Therefore, what is the dirty price of a bond is not just a theoretical concept, but a practical reality that affects every bond purchase.

Furthermore, the dirty price directly influences the overall yield for both sides of the transaction. For a buyer, if the transaction overlooks accrued interest, the actual cost is underestimated leading to inflated expected returns. The true cost includes not only the quoted price but also the interest accrued since the last payment date. What is the dirty price of a bond accurately represents the full price paid, ensuring that the yield is calculated correctly based on the total investment. Likewise, for the seller, the dirty price represents the actual proceeds received, including the accrued interest, accurately reflecting the value earned from holding the bond to that specific point in time. The seller receives the clean price, plus the interest they have earned since the last payment, which is a crucial component that a seller should consider in order to get the real value of their investment. Thus, the dirty price of a bond allows for a fair and clear transaction, avoiding ambiguity and miscalculations for both parties.

Consequently, neglecting to consider what is the dirty price of a bond in bond transactions can result in inaccurate financial assessments. It impacts how investors evaluate the true cost of purchasing the bond, as well as the effective return they are receiving. The distinction between the clean and dirty price is not an optional consideration; it is a fundamental necessity for precise financial reporting and investment analysis. Whether you are buying or selling, you need to be aware of what is the dirty price of a bond to make well-informed financial decisions. Therefore, a comprehensive understanding of the dirty price is essential for anyone involved in trading bonds to ensure clarity and financial accuracy.

How to Find a Bond’s ‘Full Cost’ in Financial Statements

Locating the ‘full cost’ or dirty price of a bond typically involves navigating through brokerage platforms and financial statements where bond transactions are recorded. Brokerage platforms, designed for individual investors, usually display the dirty price explicitly alongside the quoted price. This clarity allows investors to see the total outlay required for purchasing a bond, rather than just the clean price. The display often includes a breakdown of the clean price and the accrued interest component, ensuring that investors are fully informed about the nature of their cost. Understanding what is the dirty price of a bond means acknowledging this combined figure as the actual transaction amount. In financial statements, such as those prepared by institutional investors or companies, the presentation might differ slightly, but the core principle remains consistent. Accrued interest is often listed as a separate item, while the bond itself is valued at its clean price. However, the net impact on the balance sheet or income statement will reflect the total cost paid. For example, in the case of an investment in a debt security, the financial statement will show the acquisition cost of a bond, the original or the dirty price, at which the instrument was bought.

Various platforms might display this information in slightly different formats, but the end goal is the same: to provide transparency regarding the bond’s complete cost. In brokerage statements, the transaction history will often show the dirty price as the final price paid. You might see it labeled as “total cost,” “all-in price,” or “transaction amount,” and the accompanying details should include both the clean price and the accrued interest. What is the dirty price of a bond, is a figure that professional traders and institutional investors use. This figure ensures consistency in valuation and accounting practices. When reviewing financial statements, one should look for entries that account for both the bond’s market value at the time of transaction and the corresponding accrued interest. This is because while the bond’s clean price might fluctuate based on market conditions, the accrued interest is a fixed component determined by the coupon rate and the time elapsed since the last payment. Therefore, identifying the dirty price in such records requires looking at the consolidated figures and not just the par value of the bonds.

Ultimately, whether you are an individual investor using a brokerage app or an analyst assessing a company’s balance sheet, recognizing where the dirty price of a bond is presented is crucial for accurate financial analysis. It provides a clear picture of the actual cost of acquiring a bond and is an essential step for understanding the effective yield or the true cost for the party involved in the transaction. Different types of platforms will present it differently, and it is up to the individual to understand the figures presented to ensure a correct representation of the real cost for the bond.

Common Pitfalls When Ignoring Accrued Interest

Ignoring accrued interest when engaging in bond transactions can lead to significant miscalculations and financial inaccuracies. The primary danger lies in an incomplete understanding of the true cost of a bond. For a buyer, focusing solely on the quoted or clean price means overlooking the accumulated interest owed to the seller. This oversight results in an underestimation of the total expenditure. Conversely, for a seller, neglecting accrued interest can lead to an under-realization of the total proceeds from the bond sale. This discrepancy in the calculation of what is the dirty price of a bond, can skew the perceived yield and make for uninformed financial decisions. For example, consider a scenario where a bond with a semi-annual coupon payment is purchased five months after its last payment date. The buyer, solely looking at the clean price, might believe they are getting a good deal. However, by ignoring the five months’ worth of accrued interest, they are effectively overpaying, potentially impacting their investment returns.

Furthermore, overlooking accrued interest can cause significant issues in financial planning and reporting. When investors only track the clean price, their financial statements and portfolio valuations become inaccurate, failing to reflect the complete picture of their bond holdings. This discrepancy can also impact calculations of overall portfolio yield. For instance, a portfolio containing multiple bonds bought at different times, each with its own unique accrued interest component, would present a distorted image of its true value and performance if these components are ignored. When you analyze the potential gains or losses from a bond investment, neglecting accrued interest could mislead you, making it seem more or less profitable than it actually is. In summary, a lack of understanding of what is the dirty price of a bond leads to flawed assessments of cost, return, and overall financial health, emphasizing the critical importance of including accrued interest in all bond transactions and valuations. A clear grasp of the full or dirty price of a bond is crucial for both buyers and sellers, as without it, investment decisions are made on incomplete information, which can have detrimental consequences.

Context_8: In summary, understanding what is the dirty price of a bond is essential for navigating bond transactions with clarity and precision. The ‘dirty price’, or full price, of a bond is not merely an optional consideration but a fundamental component of every bond purchase and sale. It reflects the total amount paid by the buyer, encompassing both the quoted (clean) price and the accrued interest since the last coupon payment. Ignoring this vital aspect can lead to inaccurate cost assessments and miscalculations of yield, affecting both the immediate expense for the buyer and the effective return for both parties. Grasping the significance of the dirty price ensures that all participants in a bond transaction operate with a complete and accurate understanding of the financial implications involved. It’s a fundamental concept to grasp to avoid any surprises or misinterpretations when investing in fixed-income assets. This is especially important because the clean price alone does not show the whole story.

The accurate calculation of the dirty price directly influences the effective yield received by the seller and the actual cost incurred by the buyer. For instance, a seller receives not just the clean price at the moment of the transaction, but also compensation for the interest earned over the period since the last payment date. Failing to account for this will lead to incorrect assumptions about the returns generated. Likewise, the buyer needs to consider what is the dirty price of a bond since that reflects the actual outlay, not just the quoted price, which influences the yield calculation on the purchase. This accurate view helps to assess the real value of the bond, ensuring more informed financial decisions. The difference between clean price and dirty price is the accrued interest and as such, a clear and honest overview is provided.

Therefore, recognizing the importance of the ‘dirty price’ is not an abstract financial exercise, but a critical element that safeguards transparency and accuracy in the bond market. It serves as a reminder that the total cost and effective return on a bond are determined not only by the quoted price but also by the interest that has accrued over time. Every transaction related to a bond must always include the understanding of what is the dirty price of a bond to reflect fair value exchange between seller and buyer. It’s not an optional element but an integral part of a transparent and fair transaction.