Defining Principal and Interest

Understanding what is the difference between interest and principal is fundamental to grasping how loans work. The principal is the original sum of money borrowed. It’s the base amount upon which interest accrues. Think of it as the foundation of the loan. For example, if someone borrows $1,000 to buy a new appliance, the $1,000 is the principal.

Interest, on the other hand, is the cost of borrowing that money. It’s the fee charged by the lender for allowing someone to use their funds. Interest is typically expressed as an annual percentage of the principal, known as the interest rate. So, what is the difference between interest and principal in this scenario? The principal is the $1,000 received, and the interest is the extra amount paid back to the lender on top of that $1,000.

To further illustrate what is the difference between interest and principal, imagine borrowing money from a friend. The amount borrowed is the principal. If the friend expects repayment of the original amount plus a small “thank you” for the favor, that “thank you” acts as the interest. In the world of formal loans, this interest is crucial for lenders to make a profit and cover their own costs. What is the difference between interest and principal can be also defined as the profit obtained from the principal amount in a loan.

How Interest is Calculated: Simple and Compound Interest

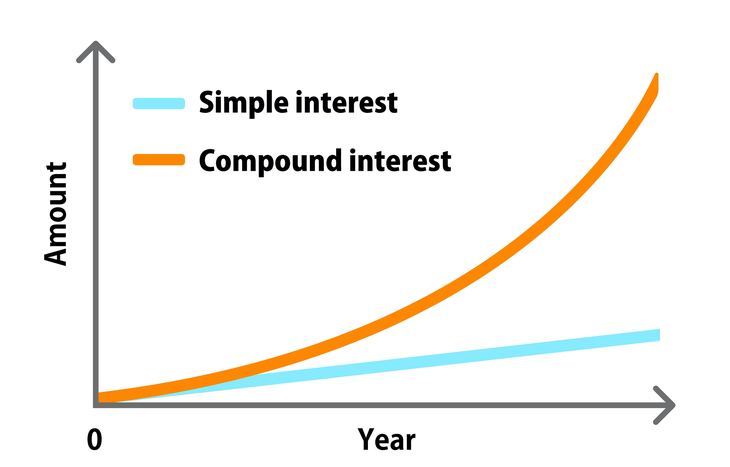

Interest is the cost of borrowing money, but what is the difference between interest and principal, and how is that interest actually calculated? There are two primary methods: simple interest and compound interest. Understanding the difference is crucial for managing finances effectively. Simple interest is calculated only on the principal amount. The formula for simple interest is: Interest = Principal x Rate x Time. For example, if you borrow $1,000 at a 5% simple interest rate for 3 years, the interest would be $1,000 x 0.05 x 3 = $150. Therefore, you would repay $1,150 in total.

Compound interest, on the other hand, is calculated on the principal amount and also on the accumulated interest of previous periods. This means you earn interest on your interest, leading to faster growth over time. The formula for compound interest is more complex: A = P (1 + r/n)^(nt), where A is the future value of the investment/loan, P is the principal amount, r is the annual interest rate, n is the number of times that interest is compounded per year, and t is the number of years. To illustrate, consider the same $1,000 loan at 5% interest for 3 years, compounded annually. Using the formula: A = $1,000 (1 + 0.05/1)^(1*3) = $1,157.63. The total interest paid is $157.63, slightly more than with simple interest. While the difference seems small in this example, the impact of compound interest becomes significantly more pronounced over longer periods and with larger principal amounts. This is what is the difference between interest and principal effect with time.

The frequency of compounding also affects the total interest paid. Interest can be compounded annually, semi-annually, quarterly, monthly, or even daily. The more frequently interest is compounded, the higher the total interest will be. For instance, a credit card with a high annual percentage rate (APR) that compounds interest daily can quickly accumulate debt if not managed carefully. When considering loans or investments, it’s essential to understand whether simple or compound interest is being used, as it can significantly impact the total cost or return. Being able to distinguish what is the difference between interest and principal and interest type will result in savings over time. In conclusion, while simple interest offers a straightforward calculation based solely on the principal, compound interest includes accumulated interest in subsequent calculations, leading to exponential growth or increased costs over time. Recognizing this difference is paramount for making informed financial decisions.

The Loan Amortization Schedule: How Payments are Allocated

Understanding what is the difference between interest and principal requires understanding the loan amortization schedule. An amortization schedule is a table detailing each periodic loan payment. It shows the amount allocated to the principal and the amount allocated to interest. With each payment, the proportion shifts. Initially, a larger portion goes toward interest, and a smaller portion pays down the principal. Over time, this gradually reverses. More of your payment goes toward principal, and less toward interest. This shift reflects the decreasing balance on which interest is calculated.

The amortization schedule offers clarity on what is the difference between interest and principal payments over the life of the loan. Consider a loan with a fixed monthly payment. The interest portion is calculated on the outstanding principal balance. As the principal decreases, the interest portion also decreases. Consequently, a larger part of each subsequent payment reduces the principal. The amortization schedule visually represents this transition, making it easier to track how your loan is being paid off. Seeing the schedule can aid in financial planning and understanding the true cost of borrowing.

To better understand what is the difference between interest and principal, imagine a $10,000 loan with a 5% interest rate, repaid over five years. In the early months, a significant portion of your payment covers the interest charges. As time goes on, more money goes directly towards reducing the $10,000 you initially borrowed. This reallocation is critical for borrowers. Online tools and spreadsheet programs create amortization schedules automatically. These schedules provide a clear picture of your loan repayment. They illustrate what is the difference between interest and principal payments each month and throughout the loan’s duration.

How to Determine Your Principal and Interest Payments

Understanding how to calculate the principal and interest portions of your loan payment is essential for effective financial planning. This section provides a step-by-step guide to help you decipher your loan statements and understand where your money is going. Calculating these amounts manually can be complex, but the formulas are readily available, and numerous online tools can simplify the process.

The most common way to calculate loan payments is using the following formula: M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]. Where: M = Monthly payment, P = Principal loan amount, i = Monthly interest rate (annual interest rate divided by 12), and n = Number of months for the loan term. This formula calculates the total monthly payment, which includes both principal and interest. To determine the interest portion of the first payment, multiply the principal loan amount (P) by the monthly interest rate (i). The remaining amount of the monthly payment (M) goes towards the principal. For subsequent payments, the interest portion decreases, and the principal portion increases. This reflects the amortization schedule of the loan, where early payments are heavily weighted towards interest. As time passes, the principal portion of each payment increases, accelerating the loan payoff. To accurately determine “what is the difference between interest and principal” for each payment period you should use an amortization schedule or an online calculator.

Online loan calculators are valuable tools. Input the loan amount, annual interest rate, and loan term to generate a detailed amortization schedule. The schedule breaks down each payment into its principal and interest components, showing how the allocation changes over the life of the loan. The ability to visualize how much goes towards each part, helps in understanding the dynamics of loan repayment. For instance, consider a $10,000 loan with a 5% annual interest rate over 5 years. The monthly payment would be approximately $188.71. In the first month, around $41.67 would go towards interest, and $147.04 towards principal. By the final month, the interest portion would be minimal, with the majority of the payment applied to the remaining principal. The understanding of “what is the difference between interest and principal” is key to managing your finances.

The Impact of Interest Rates on Loan Payments

Understanding what is the difference between interest and principal is crucial when considering a loan. Interest rates play a significant role in determining the overall cost of borrowing. A higher interest rate means you will pay more interest over the life of the loan. Conversely, a lower interest rate results in less interest paid. The interest rate directly impacts your monthly payments and the total amount you repay.

Changes in interest rates can dramatically affect affordability. For example, even a small increase in the interest rate on a mortgage can translate to hundreds of dollars more per month. Over the course of a 30-year mortgage, this can add up to tens of thousands of dollars in additional interest payments. Similarly, with shorter-term loans like auto loans, higher interest rates increase the monthly payment and the total cost. Therefore, it’s vital to shop around and compare interest rates from different lenders before committing to a loan. Understanding what is the difference between interest and principal will empower you to make informed decisions.

The length of the loan repayment period is also closely tied to the interest rate. With a fixed interest rate, a longer loan term typically means lower monthly payments, but significantly more interest paid over the loan’s life. Shorter loan terms result in higher monthly payments but less overall interest expense. Therefore, it’s a trade-off. As a borrower, evaluating your financial situation and goals to determine the optimal balance between monthly payment affordability and total interest paid is important. Before taking out a loan, always carefully consider the interest rate, loan term, and the total cost of borrowing. Comprehending what is the difference between interest and principal is key for responsible borrowing.

Understanding Early Loan Repayment: Its Impact on Principal and Interest

Making extra payments on a loan can significantly alter the balance between principal and interest. Understanding what is the difference between interest and principal in this scenario is crucial for effective debt management. The basic concept is that any amount paid above the scheduled payment is directly applied to the loan’s principal. This accelerates the repayment process and reduces the total interest paid over the loan’s lifetime.

When you make an early, extra payment, the impact on interest can be substantial. The faster the principal decreases, the less interest accrues in subsequent periods. This is because interest is calculated on the outstanding principal balance. Paying down the principal faster shrinks the base on which interest is calculated. For example, consider a $10,000 loan with a 5% interest rate and a 5-year term. By paying an extra $100 per month, you could potentially save hundreds of dollars in interest and shorten the loan term considerably. This strategy is especially effective early in the loan term, when a larger portion of each payment goes towards interest. Understanding what is the difference between interest and principal becomes key to lowering your overall debt burden. Many borrowers misunderstand this simple dynamic and miss out on potentially huge savings.

To illustrate the savings, consider the following. Imagine you have a $20,000 loan at 6% interest, amortized over 10 years. If you consistently pay an extra $200 per month from the start, you’ll not only pay off the loan much sooner, but you’ll also save a substantial amount of money. This money otherwise would have been spent on interest. The precise savings depends on the loan terms, but the principle remains the same: paying down the principal early saves money. Grasping what is the difference between interest and principal empowers you to make financially sound decisions regarding loan repayment. So, explore options for increasing your loan payments to get debt-free faster.

Principal vs. Interest in Different Loan Types

Understanding what is the difference between interest and principal is crucial, and its application varies across different loan types. The core concepts remain the same: the principal is the original amount borrowed, and interest is the cost of borrowing. However, the specific ways these elements interact depend on the loan structure.

Mortgages, for example, are typically long-term loans secured by real estate. Early mortgage payments heavily favor interest, with a smaller portion allocated to the principal. As the loan matures, the balance shifts, and a larger share of each payment goes toward reducing the principal. This amortization structure means that borrowers pay more interest upfront. Understanding what is the difference between interest and principal in this context helps homeowners make informed decisions about refinancing or early repayment. With auto loans, the repayment term is generally shorter than a mortgage. The initial payments also include more interest than principal. As with mortgages, each subsequent payment allocates a larger portion to principal reduction. The shorter term means the impact of interest rate changes can be felt more acutely in monthly payments. Knowing what is the difference between interest and principal allows borrowers to evaluate loan offers and negotiate better terms.

Student loans often have unique features like deferment and forbearance options, which can temporarily postpone payments. During these periods, interest may continue to accrue, increasing the overall loan balance. What is the difference between interest and principal becomes particularly important in managing student loan debt, as understanding how interest accrues and capitalizes can significantly impact the total repayment amount. Moreover, student loans might have varying interest rates based on whether they are federal or private loans. Therefore, grasping what is the difference between interest and principal empowers borrowers to explore strategies like income-driven repayment plans or loan consolidation to manage their debt effectively. Each loan type presents distinct considerations regarding principal and interest. Recognizing these nuances ensures that borrowers can make well-informed choices, manage their debt responsibly, and minimize the overall cost of borrowing. When taking out a loan it’s very important to know what is the difference between interest and principal.

Avoiding Common Misconceptions About Principal and Interest

Many borrowers have misconceptions about loan payments. These misunderstandings can lead to poor financial decisions. Understanding what is the difference between interest and principal is crucial for effective loan management. Let’s address some common points of confusion in a question-and-answer format.

Q: Is all of my monthly payment going towards paying off the principal?

A: No, this is a very common misunderstanding. Your monthly payment is divided between interest and principal. In the early stages of the loan, a larger portion goes towards interest. Over time, the proportion shifts, and more of your payment goes towards the principal. Understanding what is the difference between interest and principal avoids surprises later.

Q: Does making extra payments only reduce the loan term, not the total interest paid?

A: This is incorrect. While extra payments do shorten the loan term, they also significantly reduce the total interest you pay. By paying down the principal faster, you accrue less interest over the life of the loan. What is the difference between interest and principal in this context? The difference is thousands of dollars saved. Making extra payments targets the principal amount. This drastically reduces the overall interest accrued. It’s a smart strategy to minimize your borrowing costs.

Q: Is simple interest always better than compound interest?

A: It depends on whether you are the borrower or the lender. From a borrower’s perspective, simple interest is generally preferable. With simple interest, you only pay interest on the principal amount. Compound interest, however, charges interest on the principal and any accumulated interest. This means you’re paying interest on interest. What is the difference between interest and principal is vital for making informed financial decisions. Understanding the difference can save you a significant amount of money. Always clarify whether loans, like a mortgage, use simple or compound interest.

Q: Does the interest rate remain constant throughout the life of the loan?

A: Not always. Some loans have fixed interest rates, while others have variable rates. Fixed rates stay the same. Variable rates can fluctuate based on market conditions. What is the difference between interest and principal, combined with understanding interest rate types, enables borrowers to choose the right loan. Variable rates can start low but increase significantly over time, affecting your monthly payments and the total interest paid.

Q: Can I deduct the full amount of my loan payments on my taxes?

A: Generally, you cannot deduct the full amount. However, you may be able to deduct the interest portion of certain loans, such as mortgages and student loans. Tax laws vary, so consult a tax professional. Knowing what is the difference between interest and principal helps you accurately calculate potential deductions. Keep detailed records of your loan payments and consult with a qualified tax advisor to maximize eligible deductions. Understanding these common misconceptions empowers you to make sound financial choices and manage your loans effectively.