Unveiling the Essence of Working Capital

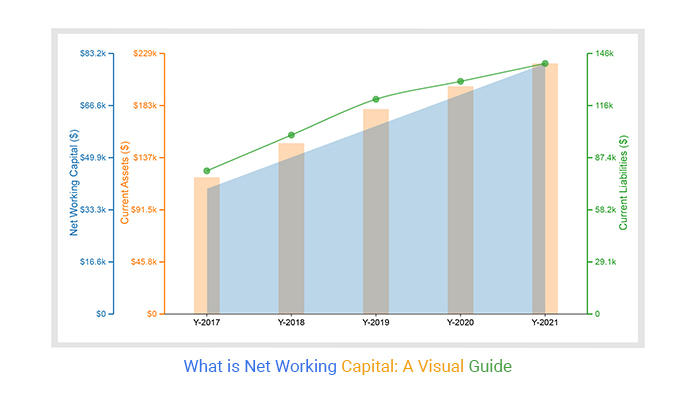

Working capital represents the lifeblood of a company, indicating its capacity to meet short-term obligations. It is fundamentally the difference between a company’s current assets and its current liabilities. Current assets are resources that can be converted into cash within a year, while current liabilities are obligations due within the same timeframe. Understanding the dynamics of working capital is crucial for assessing a business’s operational efficiency and overall financial health. Careful management of these elements is vital for sustained profitability and stability.

A healthy working capital position signifies that a company possesses sufficient liquid assets to cover its immediate debts. This ensures smooth day-to-day operations and the ability to seize growth opportunities. Conversely, insufficient working capital can lead to cash flow problems, hindering the company’s ability to pay its suppliers, employees, or other creditors on time. Therefore, businesses must diligently monitor and manage their working capital to maintain a stable financial footing. Changes in a company’s current assets and liabilities influence what is the change in net working capital. Effective management of working capital also includes understanding what is the change in net working capital, as it can affect the business’s ability to meet its financial obligations.

Several factors impact the ideal level of working capital for a business, including industry, business model, and growth stage. A startup company may require a higher level of working capital to fund its initial growth phase. A stable, mature company might operate efficiently with a leaner working capital position. Regularly evaluating what is the change in net working capital allows the business to adapt to fluctuating market conditions and maintain a healthy financial outlook. By strategically analyzing and optimizing their working capital, businesses can enhance profitability, improve financial stability, and position themselves for long-term success. Furthermore, understanding what is the change in net working capital over time helps the business identify and manage potential liquidity issues.

Delving into the Components: Current Assets and Liabilities

Understanding what is the change in net working capital requires a close look at its building blocks: current assets and current liabilities. Current assets are a company’s possessions that can be converted into cash within a year. These include cash itself, the most liquid asset, which is readily available for immediate use. Accounts receivable represent money owed to the company by its customers for goods or services already delivered. Effective management of accounts receivable is crucial for maintaining a healthy cash flow. Inventory consists of raw materials, work-in-progress, and finished goods that a company intends to sell. Efficient inventory management is essential to avoid tying up excessive capital and minimizing storage costs. These assets reflect the business’s capacity to meet its short-term obligations and fund its operations.

Current liabilities, conversely, represent a company’s short-term financial obligations due within a year. Accounts payable are amounts owed to suppliers for goods or services purchased on credit. Managing accounts payable strategically can improve cash flow. Short-term debt includes obligations like bank loans or lines of credit that must be repaid within a year. These liabilities reflect the business’s immediate obligations to external parties. Carefully balancing current assets and current liabilities is vital for maintaining adequate liquidity. Consider a retail business. Its current assets include cash in registers, outstanding payments from credit sales (accounts receivable), and products on shelves (inventory). Its current liabilities could include payments due to suppliers for merchandise (accounts payable) and the current portion of a bank loan. A clear grasp of these elements is key to determine what is the change in net working capital and its effects.

The interplay between current assets and current liabilities directly impacts a business’s daily operations. For example, delays in collecting accounts receivable can strain cash flow, making it difficult to pay suppliers on time. Similarly, an overstock of inventory can tie up capital that could be used for other investments. By closely monitoring and managing these components, businesses can optimize their liquidity and ensure they have sufficient resources to meet their short-term obligations. Therefore, a correct calculation of what is the change in net working capital, along with a deep analysis of each component, will lead the company to success.

How to Calculate Changes in Working Capital: A Step-by-Step Approach

Understanding what is the change in net working capital is crucial for assessing a company’s financial health. The calculation provides insights into whether a business’s short-term liquidity is improving or declining. The formula is straightforward: Change in Working Capital = Working Capital (Current Period) – Working Capital (Prior Period). First, determine the working capital for the current period. This is calculated by subtracting current liabilities from current assets. Next, calculate the working capital for the prior period you wish to compare against. Finally, subtract the prior period’s working capital from the current period’s working capital to arrive at the change in working capital.

The resulting figure indicates the absolute change in working capital between the two periods. For example, if a company’s working capital was $100,000 in the previous year and $120,000 in the current year, the change in working capital would be $20,000. Comparing working capital across different periods, such as quarterly or annually, is essential for identifying trends. This allows businesses to spot potential issues early and adjust their strategies accordingly. A positive change generally suggests improved liquidity. A negative change may indicate potential short-term financial difficulties. Analyzing these changes in conjunction with other financial metrics provides a more comprehensive understanding of a company’s financial performance. Monitoring what is the change in net working capital provides a valuable tool for management and investors alike.

To illustrate, consider a retail business. In Q1, its working capital is $50,000. In Q2, due to increased inventory and sales, it rises to $75,000. The change in working capital is $25,000 ($75,000 – $50,000), signaling positive growth in short-term liquidity. Conversely, if a manufacturing company experiences a decrease in accounts receivable collection and an increase in short-term debt, its working capital might decrease from $200,000 to $150,000. This results in a negative change of $50,000, indicating a potential strain on its short-term finances. Regular calculation and monitoring of what is the change in net working capital, coupled with a thorough understanding of the underlying factors driving these changes, enables informed decision-making and proactive financial management.

Interpreting Increases and Decreases in Working Capital

An increase in working capital generally signals improved liquidity. It suggests a company has more current assets relative to its current liabilities. This often translates to a greater ability to meet short-term obligations. However, this isn’t always the case. For instance, a significant build-up of inventory, while increasing current assets, might indicate slow sales or obsolete stock. This scenario reduces liquidity despite the higher working capital figure. Understanding what is the change in net working capital requires careful analysis. The change provides a valuable indicator of a company’s short-term financial health.

Conversely, a decrease in working capital can point to potential liquidity challenges. It might indicate that a company is struggling to cover its short-term liabilities with its current assets. This could stem from factors like delayed customer payments or increased short-term debt. However, a decrease is not always negative. Efficient cash management, such as quickly converting inventory to sales and minimizing accounts receivable, can lead to a lower, yet healthy, level of working capital. Furthermore, strategic investments in long-term assets, funded by current assets, will decrease what is the change in net working capital. This investment could improve future profitability.

Therefore, interpreting changes in working capital requires considering the specific circumstances of the business. Examining the underlying reasons for the increase or decrease is crucial. Analyze the components of current assets and current liabilities. Understand how they have changed and why. For example, a decrease in accounts payable, while decreasing current liabilities, might be due to better supplier relationships and negotiated payment terms. This is a positive sign. A decrease in cash, however, needs further investigation. Analyzing what is the change in net working capital in isolation can be misleading. A comprehensive understanding of the business’s operations and financial strategy is essential for an accurate assessment of its financial health. Effective management directly impacts the overall financial stability.

Factors Influencing Fluctuations in Business Finances

Several factors can influence what is the change in net working capital. Changes in sales volume significantly impact it. An increase in sales typically leads to higher accounts receivable and inventory levels. This, in turn, affects the company’s working capital. Conversely, a decrease in sales can reduce these current assets. However, it may also lead to excess inventory and potential write-offs. These will negatively affect profitability and what is the change in net working capital.

Inventory management practices also play a crucial role. Efficient inventory control minimizes the amount of capital tied up in stock. Just-in-time inventory systems, for instance, reduce holding costs and improve cash flow. Poor inventory management, such as overstocking or obsolete inventory, can strain working capital. Credit policies, both offered to customers and received from suppliers, greatly influence it. Lenient credit terms for customers may increase sales but also extend the accounts receivable cycle. Negotiating favorable payment terms with suppliers allows a company to delay payments. This frees up cash for other operational needs and is a key element of managing what is the change in net working capital.

Furthermore, investments in long-term assets can impact a company’s liquidity and, therefore, affect what is the change in net working capital. Significant capital expenditures, such as purchasing new equipment or property, can decrease current assets. This is especially true if these investments are financed with short-term debt. Effective financial planning is crucial to manage the impact of these investments on what is the change in net working capital. For example, a company might see that sales are increasing. They then decide to invest in new equipment. This affects the balance sheet. The increase in accounts receivable and the decrease in cash due to equipment purchase impacts working capital.

The Significance of Trends in Business Finances

Analyzing trends in working capital offers crucial insights into a company’s financial health. Focusing solely on a single period’s calculation provides a limited view. A comprehensive analysis requires examining changes in working capital over several periods—quarterly or annually—to identify consistent patterns and understand underlying trends. This longitudinal perspective helps to distinguish between temporary fluctuations and long-term issues. What is the change in net working capital over time? This question lies at the heart of effective financial analysis. A consistently increasing working capital, for example, might signal robust growth and efficient operations, while a persistent decrease warrants further investigation into potential problems like inefficient inventory management or difficulty collecting accounts receivable. Understanding the reasons behind these trends is critical.

Trend analysis helps businesses to proactively address potential problems. For instance, a declining trend in working capital might indicate a growing reliance on short-term debt to finance operations, a situation that can be unsustainable in the long run. Early detection of such trends allows companies to implement corrective measures, such as improving collection practices or negotiating better payment terms with suppliers. Conversely, identifying positive trends can reveal opportunities for further optimization. Perhaps improving inventory management is freeing up capital, enabling more strategic investments. What is the change in net working capital in relation to investment decisions? Analyzing this connection reveals important relationships between financial strategy and operational efficiency. The insights gained from trend analysis are invaluable for informed decision-making.

By tracking the fluctuations in working capital and understanding the underlying causes, businesses can refine their financial strategies. This may involve adjusting credit policies, optimizing inventory levels, or improving cash flow forecasting. Moreover, understanding the relationship between working capital trends and profitability is essential. Consistent monitoring allows businesses to adjust their strategies to improve their financial position and enhance long-term sustainability. This proactive approach, built upon careful analysis of working capital trends, enables businesses to navigate financial challenges successfully and seize opportunities for growth. What is the change in net working capital, and how does that change impact profitability and future growth strategies? The answer to this question guides informed decision-making in the business world.

Practical Examples: Illuminating Real-World Scenarios

Consider a retail company experiencing rapid growth. Sales are booming, but the company struggles to manage its increasing inventory levels. This leads to a significant increase in current assets, specifically inventory. However, if accounts payable (a current liability) doesn’t increase proportionally, the company might face a strain on its cash flow. Even though sales are high, a large portion of their assets are tied up in unsold goods. This scenario highlights how an increase in current assets doesn’t automatically translate to improved financial health and emphasizes the need to analyze what is the change in net working capital in relation to other financial metrics.

Alternatively, examine a software-as-a-service (SaaS) company. This company operates with relatively low inventory levels. Its primary current assets are typically cash and accounts receivable. The company negotiates longer payment terms with its vendors (increasing accounts payable, a current liability), and efficiently collects payments from its customers (maintaining healthy accounts receivable). In this case, the company demonstrates effective management of its business finances. While its overall what is the change in net working capital might not be exceptionally high, its efficient cash conversion cycle allows it to fund growth and maintain financial stability. This example demonstrates that focusing on optimizing the components of business finances, rather than simply maximizing the difference between current assets and current liabilities, can be more beneficial. Effective strategies positively influence what is the change in net working capital.

Now, let’s analyze a manufacturing company. This company invests heavily in new equipment to automate its production process. This investment might initially decrease business finances. The reason for this is the shift of cash (a current asset) to fixed assets. However, if this investment leads to increased efficiency and reduced operating costs in the long run, it could ultimately improve business finances and increase profitability. Furthermore, imagine the company has difficulty collecting payments from its customers, leading to a surge in accounts receivable and a decrease in cash. This will negatively impact what is the change in net working capital. These scenarios show that fluctuations in business finances should always be assessed in the context of a company’s overall strategy and industry dynamics. Understanding what is the change in net working capital requires careful consideration of all factors impacting a company’s financial performance.

Strategies for Optimizing Business Finances

Effective working capital management is crucial for a company’s financial health. Several strategies can be implemented to optimize working capital, freeing up cash and improving operational efficiency. One key area is inventory management. Implementing a just-in-time (JIT) inventory system can minimize the amount of capital tied up in raw materials and finished goods. This reduces storage costs and the risk of obsolescence. Regularly analyzing inventory turnover rates helps identify slow-moving items that can be discounted or eliminated.

Another important aspect is managing accounts payable. Negotiating extended payment terms with suppliers can provide a significant boost to cash flow. Building strong relationships with suppliers is key to securing these favorable terms. However, it is important to balance this with maintaining good credit standing and avoiding late payment penalties. Simultaneously, accelerating accounts receivable collection is vital. Offering early payment discounts can incentivize customers to pay invoices promptly. Implementing a robust credit policy and actively pursuing overdue accounts also contributes to improved cash flow. Efficient cash forecasting is equally important. Accurately predicting future cash inflows and outflows allows businesses to anticipate potential shortfalls and take proactive measures. This involves analyzing historical data, considering seasonal trends, and factoring in planned investments.

Furthermore, consider the impact of short-term investments. Excess cash can be temporarily invested in liquid assets such as money market accounts or short-term certificates of deposit. This generates a modest return while maintaining easy access to funds when needed. Regularly reviewing and optimizing these short-term investments can contribute to overall working capital efficiency. Managing “what is the change in net working capital” requires a holistic approach. By focusing on these key areas – inventory, accounts payable, accounts receivable, and cash forecasting – businesses can significantly improve their financial stability and operational performance. Understanding “what is the change in net working capital” also helps a business understand how these changes impact the cash flow. The goal is to minimize the amount of capital tied up in operations and maximize the availability of cash for investment and growth. Continual monitoring and adjustment of these strategies are essential to adapt to changing market conditions and maintain optimal working capital levels. Knowing “what is the change in net working capital” is of paramount importance.

:max_bytes(150000):strip_icc()/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)