Understanding the Concept of Beta in Finance

In the world of finance, beta is a crucial metric that measures the volatility of an asset or portfolio relative to the overall market. It is a fundamental component of modern portfolio theory, allowing investors and portfolio managers to assess the risk and potential return of their investments. Beta is calculated as a ratio of the asset’s price movement to the market’s price movement, providing a numerical value that indicates the asset’s sensitivity to market fluctuations. A beta of 1, for instance, indicates that the asset moves in tandem with the market, while a beta greater than 1 suggests higher volatility. As investors strive to optimize their portfolios, understanding beta is essential for making informed decisions. In fact, grasping the concept of beta is vital for answering questions like “what is the beta of a risk-free asset” and understanding its implications for investment strategies.

What is a Risk-Free Asset, and Why Does it Matter?

A risk-free asset is an investment that provides a fixed return with zero volatility, meaning its value remains stable regardless of market fluctuations. This characteristic makes risk-free assets an essential component of a diversified investment portfolio, as they help mitigate overall portfolio risk. In essence, risk-free assets serve as a benchmark for other investments, allowing investors to evaluate their performance relative to a stable, low-risk alternative. Examples of risk-free assets include U.S. Treasury bills and bonds, which are backed by the full faith and credit of the U.S. government. By including risk-free assets in a portfolio, investors can reduce their exposure to market volatility, thereby minimizing potential losses. Understanding the role of risk-free assets is crucial for answering questions like “what is the beta of a risk-free asset” and optimizing investment strategies.

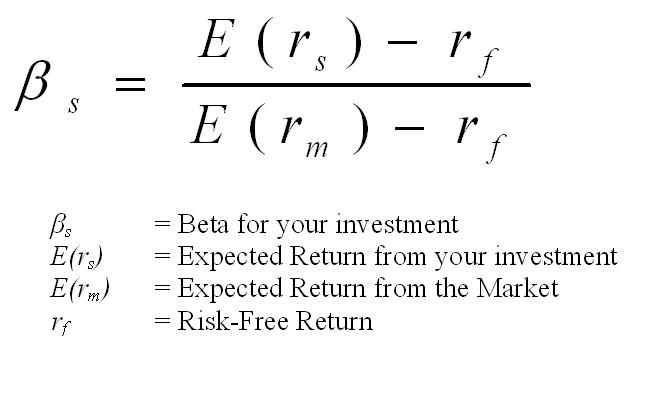

How to Calculate the Beta of a Risk-Free Asset

Calculating the beta of a risk-free asset is a straightforward process that involves understanding the asset’s historical price movements relative to the overall market. The beta calculation formula is: β = Cov(Ri, Rm) / σ^2, where β is the beta, Cov(Ri, Rm) is the covariance between the asset’s return (Ri) and the market return (Rm), and σ^2 is the market’s variance. Since a risk-free asset, by definition, has zero volatility, its beta is always zero. This means that the covariance between the risk-free asset’s return and the market return is also zero, resulting in a beta value of zero. To illustrate this concept, let’s consider an example. Suppose we want to calculate the beta of a U.S. Treasury bill, a classic risk-free asset. Using historical data, we can calculate the covariance between the Treasury bill’s return and the market return, which would be zero due to the asset’s risk-free nature. Plugging this value into the formula, we would get a beta of zero, confirming that the Treasury bill is a risk-free asset. Understanding how to calculate the beta of a risk-free asset, such as in this example, is essential for answering questions like “what is the beta of a risk-free asset” and making informed investment decisions.

The Beta of a Risk-Free Asset: What Does it Represent?

The beta value of a risk-free asset is a crucial concept in finance, and understanding its interpretation is essential for investors and portfolio managers. A beta of zero, which is characteristic of risk-free assets, indicates that the asset’s return is not correlated with the overall market return. This means that the asset’s value remains stable, unaffected by market fluctuations. In essence, a risk-free asset’s beta of zero represents its ability to provide a fixed return, regardless of the market’s performance. This characteristic makes risk-free assets an attractive option for investors seeking to minimize risk and maximize returns. For instance, when answering questions like “what is the beta of a risk-free asset,” investors can confidently assume that the asset’s beta is zero, indicating its low-risk profile. Furthermore, a risk-free asset’s beta of zero also implies that it is not susceptible to market volatility, making it an ideal component of a diversified investment portfolio. By understanding the implications of a risk-free asset’s beta, investors can make informed decisions and optimize their investment strategies.

Why a Risk-Free Asset Has a Beta of Zero

A risk-free asset, by definition, has a beta of zero, which is a fundamental concept in finance. This is because a risk-free asset’s return is not correlated with the overall market return, meaning its value remains stable and unaffected by market fluctuations. The beta of a risk-free asset is zero because it does not respond to changes in the market, providing a fixed return regardless of the market’s performance. This characteristic makes risk-free assets an attractive option for investors seeking to minimize risk and maximize returns. When answering questions like “what is the beta of a risk-free asset,” investors can confidently assume that the asset’s beta is zero, indicating its low-risk profile. In different market conditions, a risk-free asset’s beta of zero ensures that its value remains stable, providing a hedge against market volatility. For instance, during a market downturn, a risk-free asset’s beta of zero means that its value will not decline, providing a safe haven for investors. In contrast, assets with higher betas are more sensitive to market fluctuations, making them more risky and volatile. By understanding why a risk-free asset has a beta of zero, investors can make informed decisions and optimize their investment strategies.

The Role of Risk-Free Assets in Modern Portfolio Theory

In modern portfolio theory, risk-free assets play a crucial role in portfolio optimization and risk management. By including risk-free assets in a diversified investment portfolio, investors can reduce overall portfolio risk and increase potential returns. The beta of a risk-free asset, which is zero, provides a stable anchor for the portfolio, allowing investors to take on more risk in other assets to achieve higher returns. In portfolio optimization, risk-free assets serve as a benchmark for measuring the performance of other assets, enabling investors to make informed decisions about asset allocation. Furthermore, risk-free assets can be used to hedge against market volatility, providing a safe haven for investors during times of uncertainty. For instance, when answering questions like “what is the beta of a risk-free asset,” investors can use this knowledge to construct an optimal portfolio that balances risk and return. By understanding the role of risk-free assets in modern portfolio theory, investors can create a more efficient and effective investment strategy. Additionally, risk-free assets can be used to create a risk parity portfolio, where the risk contribution of each asset is equalized, resulting in a more diversified and stable portfolio.

https://www.youtube.com/watch?v=7Q5pCcEfJkI

Real-World Examples of Risk-Free Assets and Their Betas

In practice, risk-free assets are essential components of a diversified investment portfolio. One of the most common examples of risk-free assets is U.S. Treasury bills and bonds. These government-backed securities offer a fixed return with minimal credit risk, making them an attractive option for investors seeking to minimize risk. The beta of U.S. Treasury bills and bonds is zero, indicating that their returns are not correlated with the overall market. For instance, when answering questions like “what is the beta of a risk-free asset,” investors can look to U.S. Treasury bills and bonds as prime examples of assets with a beta of zero. Other examples of risk-free assets include certificates of deposit (CDs) and commercial paper, which also offer a fixed return with low credit risk. In addition, some money market funds and short-term bond funds may also be considered risk-free assets, depending on their investment strategies and risk profiles. By understanding the characteristics and beta values of these risk-free assets, investors can make informed decisions about their investment portfolios and optimize their returns.

Conclusion: The Importance of Understanding Beta in Risk-Free Assets

In conclusion, understanding the concept of beta in risk-free assets is crucial for investors and portfolio managers seeking to optimize their investment portfolios. By grasping the significance of beta in risk-free assets, investors can make informed decisions about asset allocation and risk management. The beta of a risk-free asset, which is zero, provides a stable anchor for the portfolio, allowing investors to take on more risk in other assets to achieve higher returns. Furthermore, understanding the characteristics and beta values of risk-free assets, such as U.S. Treasury bills and bonds, can help investors construct a diversified portfolio that balances risk and return. When answering questions like “what is the beta of a risk-free asset,” investors can now confidently respond with a deep understanding of the concept and its implications for their investment decisions. By incorporating risk-free assets with a beta of zero into their portfolios, investors can create a more efficient and effective investment strategy that achieves their financial goals.