Understanding the Hierarchy of Market Data

Market data is the lifeblood of trading and investing, providing critical insights that inform investment decisions and drive business growth. In the financial ecosystem, market data is categorized into different levels, each offering a unique perspective on the market. At the foundation of this hierarchy lies Level 1 market data, which includes real-time quotes, trades, and order book data. This level of data provides a snapshot of current market conditions, allowing traders and investors to make informed decisions. However, for those seeking a more comprehensive understanding of the market, Level 2 market data offers a deeper level of insight. Level 2 market data provides a more detailed view of market activity, including order flow, liquidity, and market depth. This level of data is essential for traders and investors who require a more nuanced understanding of market dynamics. By understanding the different levels of market data, traders and investors can make more informed decisions, ultimately driving better trading outcomes.

What is Level 2 Market Data: A Deep Dive

Level 2 market data is a powerful tool used by traders and investors to gain a deeper understanding of market dynamics. But what is Level 2 market data, and how does it differ from its Level 1 counterpart? Level 2 market data provides a more detailed view of market activity, including order flow, liquidity, and market depth. This level of data is essential for traders and investors who require a more nuanced understanding of market dynamics. By analyzing Level 2 market data, traders and investors can identify trading opportunities, predict market trends, and make more informed investment decisions. In this article, we will delve into the world of Level 2 market data, exploring its definition, components, and benefits in modern trading and investing.

One of the primary benefits of using Level 2 market data is improved trading decisions. By gaining a deeper understanding of market dynamics, traders and investors can identify profitable trading opportunities and avoid potential pitfalls. Level 2 market data also provides enhanced market visibility, allowing traders and investors to stay ahead of the curve and make more informed investment decisions. Additionally, Level 2 market data can be used to identify market trends and patterns, providing traders and investors with a competitive edge in the market.

How to Access Level 2 Market Data for Informed Trading

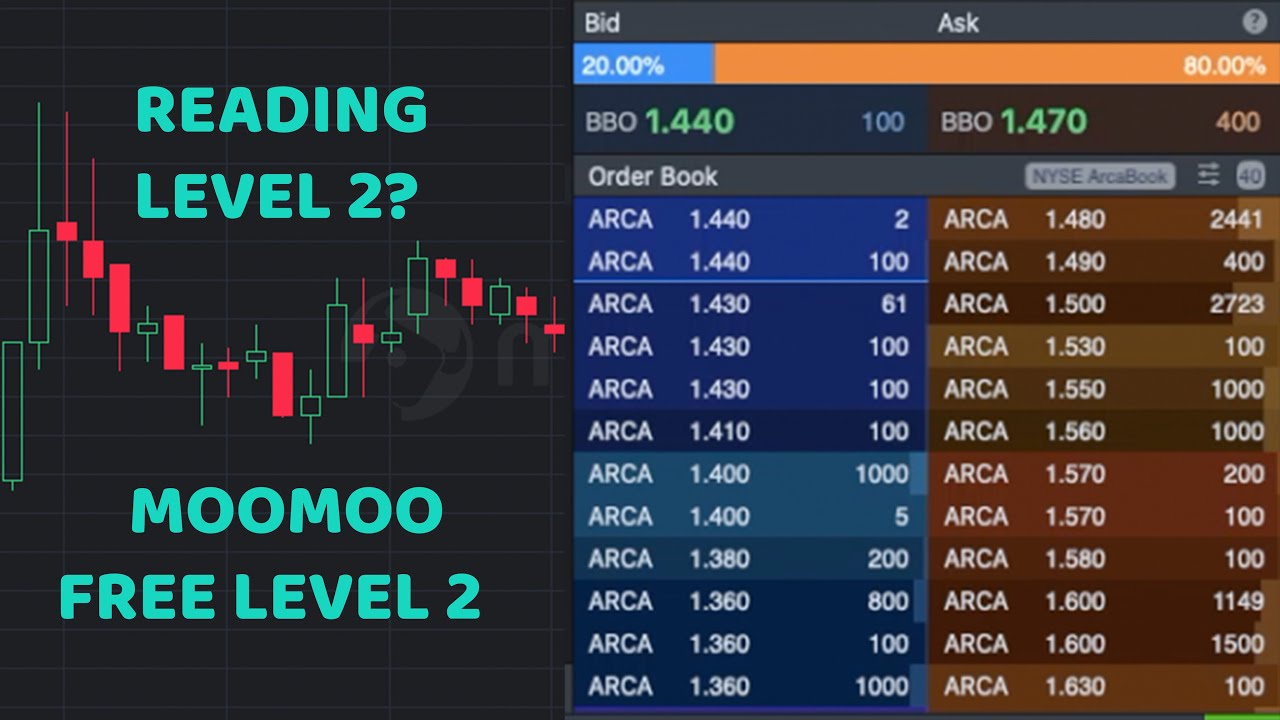

Accessing Level 2 market data is a crucial step in unlocking its potential for informed trading. There are several sources and providers of Level 2 market data, each with its own costs and benefits. In this section, we will explore the various options for accessing Level 2 market data, including exchanges, brokerages, and financial data vendors.

Exchanges are a primary source of Level 2 market data, providing direct access to market data feeds. Many exchanges offer Level 2 market data feeds, including the New York Stock Exchange (NYSE), NASDAQ, and the London Stock Exchange (LSE). The benefits of accessing Level 2 market data from exchanges include low latency, high-quality data, and direct access to market information. However, the costs of accessing exchange-provided Level 2 market data can be high, making it less accessible to individual traders and investors.

Brokerages are another source of Level 2 market data, offering access to market data feeds as part of their trading platforms. Many brokerages provide Level 2 market data, including Fidelity, Charles Schwab, and Interactive Brokers. The benefits of accessing Level 2 market data from brokerages include convenience, ease of use, and often lower costs compared to exchanges. However, the quality and latency of brokerage-provided Level 2 market data can vary, and may not be as high-quality as exchange-provided data.

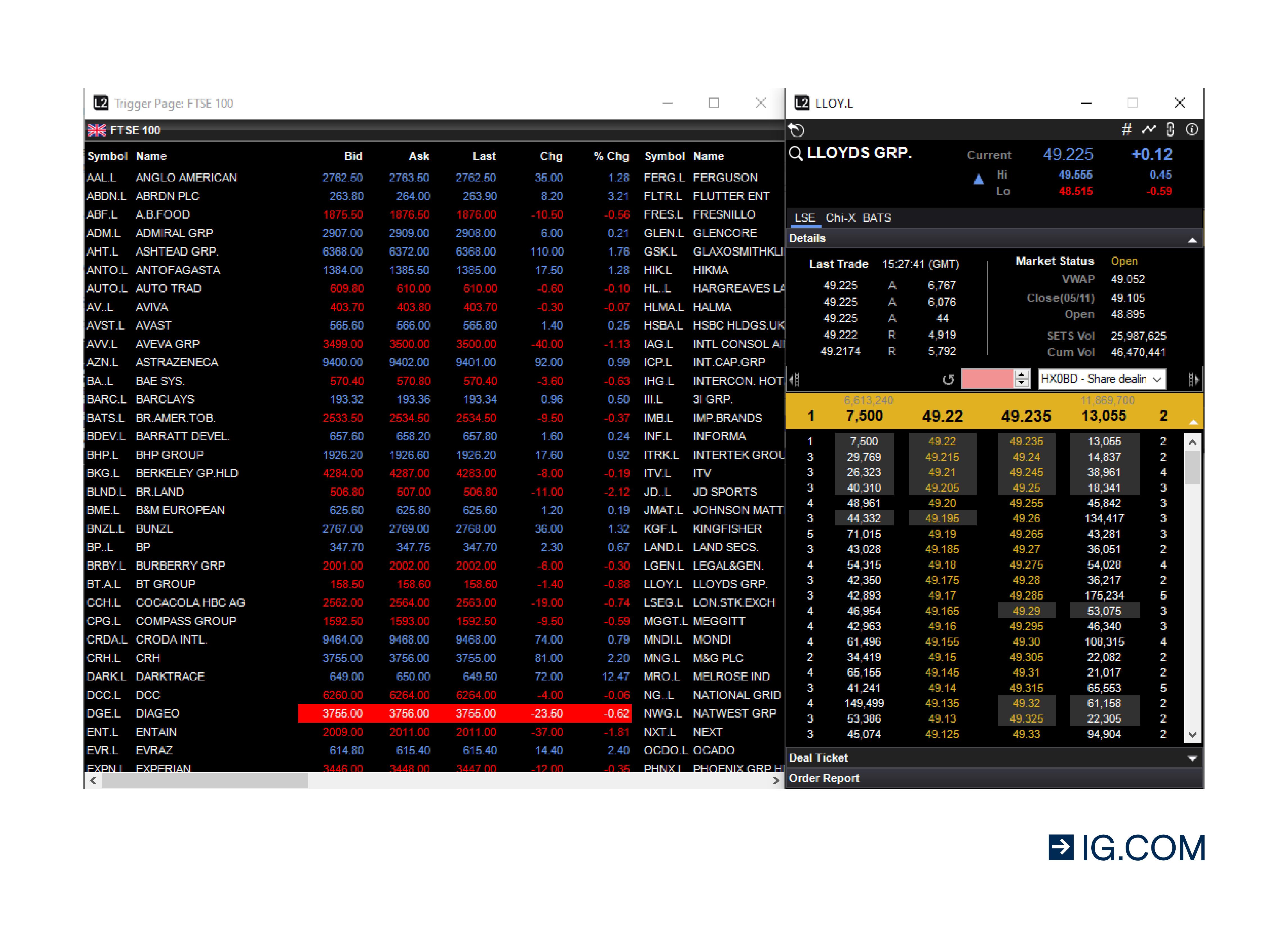

Financial data vendors are a third option for accessing Level 2 market data, offering aggregated market data feeds from multiple exchanges and sources. Many financial data vendors provide Level 2 market data, including Bloomberg, Refinitiv, and S&P Global Market Intelligence. The benefits of accessing Level 2 market data from financial data vendors include convenience, ease of use, and often lower costs compared to exchanges. Additionally, financial data vendors often provide value-added services, such as data analytics and visualization tools, to help traders and investors make sense of the data.

In conclusion, accessing Level 2 market data is a crucial step in unlocking its potential for informed trading. By understanding the various sources and providers of Level 2 market data, traders and investors can make informed decisions about how to access this valuable data. Whether through exchanges, brokerages, or financial data vendors, accessing Level 2 market data can provide a competitive edge in the market and improve trading outcomes.

The Role of Level 2 Market Data in Technical Analysis

In technical analysis, Level 2 market data plays a crucial role in helping traders and investors make informed trading decisions. By providing a detailed view of market dynamics, Level 2 market data enables technical analysts to identify trading opportunities, predict market trends, and optimize their trading strategies.

One of the key applications of Level 2 market data in technical analysis is the use of order book data. Order book data provides a detailed view of market liquidity, including the number of buy and sell orders at different price levels. By analyzing order book data, technical analysts can identify areas of support and resistance, predict market trends, and optimize their trading strategies.

Bid-ask spreads are another important component of Level 2 market data in technical analysis. Bid-ask spreads provide a measure of market liquidity, indicating the difference between the highest price that buyers are willing to pay and the lowest price that sellers are willing to accept. By analyzing bid-ask spreads, technical analysts can identify areas of high liquidity, predict market trends, and optimize their trading strategies.

Market depth is another key application of Level 2 market data in technical analysis. Market depth provides a detailed view of market liquidity, including the number of buy and sell orders at different price levels. By analyzing market depth, technical analysts can identify areas of high liquidity, predict market trends, and optimize their trading strategies.

For example, a technical analyst may use Level 2 market data to identify a trading opportunity in a stock that is experiencing high buying pressure. By analyzing the order book data, the analyst may identify a large number of buy orders at a specific price level, indicating strong demand for the stock. The analyst may then use this information to make a trading decision, such as buying the stock at the current price or setting a stop-loss order to limit potential losses.

In conclusion, Level 2 market data plays a critical role in technical analysis, providing a detailed view of market dynamics and enabling traders and investors to make informed trading decisions. By analyzing Level 2 market data, technical analysts can identify trading opportunities, predict market trends, and optimize their trading strategies.

Level 2 Market Data vs. Level 1: What’s the Difference?

When it comes to market data, there are two primary levels: Level 1 and Level 2. While both levels provide valuable insights into market dynamics, they differ significantly in terms of their scope, depth, and application. In this section, we’ll explore the key differences between Level 1 and Level 2 market data, highlighting their advantages and limitations.

Level 1 market data, also known as quote data, provides real-time prices and basic market information, such as bid and ask prices, trade volumes, and order sizes. This level of data is suitable for basic trading decisions and is often used by retail traders and investors. However, Level 1 market data lacks the depth and granularity of Level 2 market data, making it less effective for advanced trading strategies and sophisticated market analysis.

Level 2 market data, on the other hand, offers a more comprehensive view of market dynamics, providing detailed information on market liquidity, order flow, and trading activity. This level of data includes order book data, bid-ask spreads, and market depth, making it ideal for advanced trading strategies, technical analysis, and quantitative analysis. Level 2 market data is particularly useful for identifying trading opportunities, predicting market trends, and optimizing trading strategies.

So, when should you use Level 1 market data, and when should you opt for Level 2? The answer depends on your trading goals and strategies. If you’re a retail trader or investor looking to make basic trading decisions, Level 1 market data may be sufficient. However, if you’re a professional trader, quantitative analyst, or market maker seeking to gain a deeper understanding of market dynamics, Level 2 market data is the better choice.

In terms of cost, Level 1 market data is generally more affordable than Level 2 market data, which can be a significant factor for individual traders and investors. However, the benefits of Level 2 market data, including improved trading decisions and enhanced market visibility, may outweigh the additional costs for professional traders and institutions.

In conclusion, while both Level 1 and Level 2 market data have their advantages and limitations, they cater to different trading needs and strategies. By understanding the differences between these two levels of market data, traders and investors can make informed decisions about which level of data to use, ultimately improving their trading outcomes.

Real-World Applications of Level 2 Market Data

In the world of trading and investing, Level 2 market data is a powerful tool that can be applied in various scenarios to gain a competitive edge. From high-frequency trading to market making and quantitative analysis, Level 2 market data provides the insights and visibility needed to make informed trading decisions.

One of the most prominent applications of Level 2 market data is in high-frequency trading. By analyzing order book data and bid-ask spreads, high-frequency traders can identify profitable trading opportunities and execute trades at lightning-fast speeds. This approach has become increasingly popular in recent years, with many firms relying on Level 2 market data to drive their trading strategies.

Market makers also rely heavily on Level 2 market data to manage their risk and maintain a competitive edge. By analyzing market depth and order flow, market makers can adjust their quotes and trading strategies to maximize profits and minimize losses. This is particularly important in fast-paced markets, where market conditions can change rapidly.

In quantitative analysis, Level 2 market data is used to develop and backtest trading strategies. By analyzing large datasets of Level 2 market data, quantitative analysts can identify patterns and trends that may not be apparent through traditional technical analysis. This approach has become increasingly popular in recent years, with many firms using Level 2 market data to drive their quantitative trading strategies.

Another application of Level 2 market data is in event-driven trading. By analyzing order book data and bid-ask spreads, traders can identify trading opportunities surrounding major events, such as earnings announcements or mergers and acquisitions. This approach requires a deep understanding of market dynamics and the ability to analyze large datasets quickly and efficiently.

In addition to these applications, Level 2 market data is also used in risk management, portfolio optimization, and algorithmic trading. Its versatility and depth make it an essential tool for traders and investors seeking to gain a competitive edge in today’s fast-paced markets.

By understanding the real-world applications of Level 2 market data, traders and investors can unlock its full potential and improve their trading outcomes. Whether you’re a high-frequency trader, market maker, or quantitative analyst, Level 2 market data provides the insights and visibility needed to succeed in today’s markets.

Overcoming the Challenges of Level 2 Market Data

While Level 2 market data offers a wealth of benefits for traders and investors, it also presents several challenges that must be addressed. In this section, we’ll explore the common challenges associated with using Level 2 market data and provide solutions and best practices for overcoming them.

One of the primary challenges of Level 2 market data is data quality issues. With large datasets and complex analytics, it’s essential to ensure that the data is accurate, reliable, and consistent. To overcome this challenge, traders and investors should work with reputable data providers and implement robust data validation processes.

Latency is another significant challenge associated with Level 2 market data. With high-frequency trading and algorithmic trading, every millisecond counts, and latency can have a significant impact on trading outcomes. To overcome this challenge, traders and investors should invest in low-latency infrastructure and optimize their data feeds for speed and efficiency.

Cost is also a significant challenge associated with Level 2 market data. With premium data feeds and advanced analytics, the costs can add up quickly. To overcome this challenge, traders and investors should carefully evaluate their data needs and budget, and explore cost-effective alternatives, such as cloud-based data solutions.

In addition to these challenges, traders and investors may also face issues with data integration, scalability, and security. To overcome these challenges, it’s essential to work with experienced data professionals and implement robust data management systems.

By understanding the challenges associated with Level 2 market data and implementing solutions and best practices, traders and investors can unlock its full potential and improve their trading outcomes. Whether you’re a high-frequency trader, market maker, or quantitative analyst, Level 2 market data provides the insights and visibility needed to succeed in today’s fast-paced markets.

By leveraging the power of Level 2 market data and overcoming its challenges, traders and investors can gain a competitive edge, improve their trading decisions, and drive business growth. With its versatility, depth, and accuracy, Level 2 market data is an essential tool for anyone seeking to succeed in modern trading and investing.

Conclusion: Unlocking the Power of Level 2 Market Data

In conclusion, Level 2 market data is a powerful tool that can help traders and investors gain a competitive edge in modern markets. By understanding the concept of Level 2 market data, its components, and its applications, traders and investors can make more informed trading decisions and improve their market visibility.

Throughout this article, we’ve explored the importance of Level 2 market data in trading and investing, its role in technical analysis, and its real-world applications. We’ve also discussed the challenges associated with using Level 2 market data and provided solutions and best practices for overcoming them.

As we’ve seen, Level 2 market data offers a range of benefits, including improved trading decisions, enhanced market visibility, and increased profitability. By leveraging the power of Level 2 market data, traders and investors can stay ahead of the curve and achieve their investment goals.

So, what is Level 2 market data? It’s a powerful tool that can help traders and investors succeed in modern markets. By understanding its concept, components, and applications, traders and investors can unlock its full potential and improve their trading outcomes.

In today’s fast-paced markets, having access to accurate, reliable, and timely market data is crucial. Level 2 market data provides the insights and visibility needed to make informed trading decisions and stay ahead of the competition.

Whether you’re a seasoned trader or an investor just starting out, Level 2 market data is an essential tool that can help you achieve your investment goals. So, take the first step today and explore the possibilities of Level 2 market data.