Demystifying EBT: A Comprehensive Guide

In the finance industry, Electronic Benefit Transfer (EBT) has emerged as a vital tool for facilitating government benefits and social services. But what is EBT in finance, and how does it impact the lives of millions of individuals and families? Essentially, EBT is a system that enables the electronic transfer of benefits, such as food stamps and cash assistance, to eligible recipients. This innovative approach has revolutionized the way governments provide support to those in need, offering a convenient, secure, and efficient means of accessing essential resources. By understanding the significance of EBT in finance, individuals can better navigate the complex landscape of government benefits and social services, ultimately improving their overall well-being.

How to Leverage EBT for Efficient Benefit Disbursement

The Electronic Benefit Transfer (EBT) system is a powerful tool for facilitating government benefits and social services. But how does it work, and what are its advantages? Essentially, EBT is a digital platform that enables the efficient disbursement of benefits to eligible recipients. This innovative approach has revolutionized the way governments provide support to those in need, offering a convenient, secure, and efficient means of accessing essential resources. EBT supports a range of benefits, including SNAP (Supplemental Nutrition Assistance Program) and TANF (Temporary Assistance for Needy Families), among others. By leveraging EBT, governments can streamline their benefit disbursement processes, reduce administrative costs, and improve the overall experience for recipients. Moreover, EBT offers a range of advantages, including increased security, reduced fraud, and improved accountability. As a result, EBT has become an indispensable tool for governments seeking to provide effective support to their citizens.

The Evolution of EBT: From Paper to Digital

The Electronic Benefit Transfer (EBT) system has undergone a significant transformation since its inception. Initially, government benefits and social services were disbursed through traditional paper-based methods, such as checks and food stamps. However, these methods were often cumbersome, prone to fraud, and limited in their accessibility. With the advent of digital technology, EBT has evolved to become a more efficient, secure, and convenient means of accessing essential resources. Today, EBT enables the electronic transfer of benefits, such as SNAP (Supplemental Nutrition Assistance Program) and TANF (Temporary Assistance for Needy Families), among others. This digital shift has brought numerous benefits, including reduced administrative costs, increased security, and improved accountability. Moreover, EBT has become an indispensable tool for governments seeking to provide effective support to their citizens, and its continued evolution is expected to further enhance its impact in the finance industry. Understanding what is EBT in finance and its evolution is crucial for harnessing its full potential.

EBT Card: A Convenient and Secure Way to Access Benefits

The EBT card is a crucial component of the Electronic Benefit Transfer (EBT) system, providing a convenient and secure way for recipients to access their benefits. These cards are typically issued to eligible individuals and families, allowing them to purchase essential items and services. One of the primary advantages of EBT cards is their ease of use. Recipients can simply swipe their card at participating retailers or use it to withdraw cash at ATMs. Moreover, EBT cards offer a high level of security, with features such as PIN protection and encryption to prevent fraud and unauthorized access. In addition, EBT cards are widely accepted, making it easy for recipients to access their benefits at a variety of locations. Understanding what is EBT in finance and its associated benefits is essential for harnessing its full potential. By leveraging EBT cards, governments can provide effective support to their citizens, while also promoting financial inclusion and reducing poverty.

Understanding EBT Eligibility and Application Process

To access Electronic Benefit Transfer (EBT) programs, individuals and families must meet specific eligibility criteria. These criteria vary depending on the program, but typically include income requirements, family size, and other factors. For instance, the Supplemental Nutrition Assistance Program (SNAP) has income limits based on household size and composition, while the Temporary Assistance for Needy Families (TANF) program considers factors such as family size, income, and resources. To apply for EBT programs, individuals must submit an application, which typically requires documentation such as proof of income, identity, and residency. Understanding what is EBT in finance and its associated eligibility criteria is crucial for those seeking to access these essential benefits. By streamlining the application process and providing clear guidance, governments can ensure that eligible individuals and families receive the support they need. Moreover, EBT programs can help promote financial stability and reduce poverty, ultimately contributing to a more equitable society.

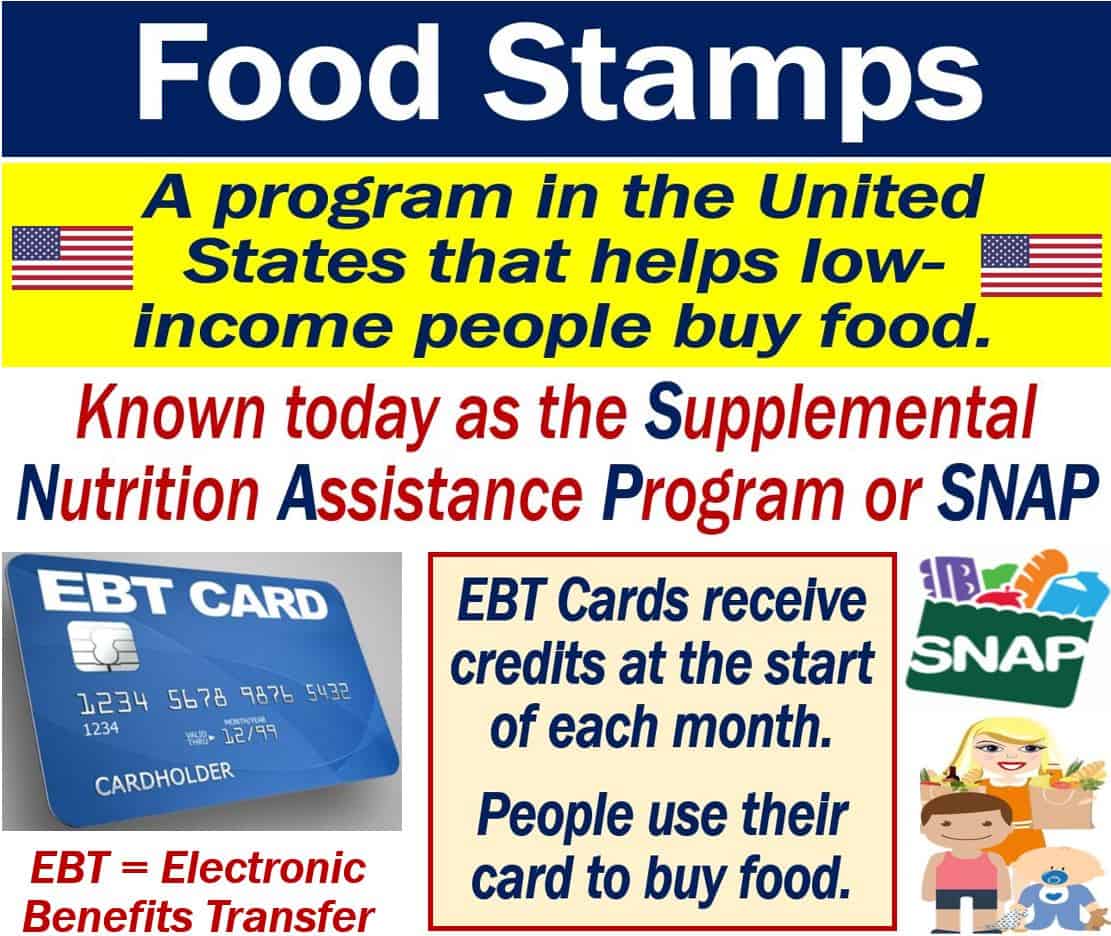

EBT and Food Stamps: What You Need to Know

The relationship between Electronic Benefit Transfer (EBT) and food stamps is a crucial aspect of understanding what is EBT in finance. EBT cards are used to disburse food assistance benefits, allowing recipients to purchase eligible food items at participating retailers. The Supplemental Nutrition Assistance Program (SNAP) is a prime example of an EBT-supported program, providing essential food assistance to millions of individuals and families. With EBT, recipients can easily access their benefits, making it a convenient and efficient way to purchase food and other essential items. Moreover, EBT eliminates the need for physical food stamps, reducing the risk of fraud and misuse. By leveraging EBT for food assistance, governments can ensure that those in need receive the support they require, promoting food security and overall well-being. As EBT continues to evolve, its role in facilitating food assistance will remain a vital component of its functionality.

Common Misconceptions About EBT Debunked

Despite its widespread use, Electronic Benefit Transfer (EBT) is often shrouded in misconceptions and myths. One common misconception is that EBT is complex and difficult to use, when in fact, EBT cards are designed to be user-friendly and accessible. Another myth is that EBT is insecure, when in reality, EBT cards are equipped with advanced security features to protect recipients’ benefits. Additionally, there is a stigma associated with using EBT cards, which is unfounded, as EBT is a vital tool for providing essential benefits to those in need. Understanding what is EBT in finance and its benefits can help dispel these misconceptions, promoting a more informed and supportive environment for EBT recipients. By addressing these misconceptions, governments and financial institutions can work to improve the overall EBT experience, ensuring that recipients can access their benefits with confidence and ease.

The Future of EBT: Trends and Innovations

The Electronic Benefit Transfer (EBT) system is poised for significant growth and innovation, shaping the future of government benefits and social services. Emerging trends, such as mobile payments and contactless transactions, are revolutionizing the way EBT benefits are accessed and used. For instance, mobile EBT apps are being developed to enable recipients to manage their benefits, check their balances, and make transactions on-the-go. Additionally, contactless EBT cards are being introduced, allowing for faster and more convenient transactions. These innovations are improving the efficiency and accessibility of EBT programs, making it easier for recipients to access their benefits and for governments to administer these programs. As the finance industry continues to evolve, understanding what is EBT in finance will become increasingly important, as EBT plays a critical role in facilitating government benefits and social services. By embracing these trends and innovations, governments and financial institutions can create a more streamlined and effective EBT system, ultimately benefiting those who rely on these essential services.