Understanding the Essence of CVA

Credit Valuation Adjustment (CVA) is a critical concept in modern finance. It specifically addresses the credit risk inherent in over-the-counter (OTC) derivative transactions. In essence, CVA represents an adjustment to the theoretical, risk-free value of a derivative. This adjustment reflects the potential loss that a financial institution could incur if its counterparty defaults on the agreement. What is credit value adjustment? It is the market value of counterparty credit risk.

To fully grasp what is credit value adjustment, it’s crucial to distinguish between a risk-free valuation and one that incorporates credit risk. Traditional derivative pricing models often assume a world without default. However, in reality, counterparties do default. CVA bridges this gap by quantifying the expected loss due to this possibility. Without CVA, the valuation of derivatives would be incomplete. It would fail to account for a significant source of potential losses. Consider two identical derivative contracts. One is with a highly rated entity. The other is with a less creditworthy counterparty. The contract with the riskier counterparty will have a CVA charge applied. This charge reflects the increased credit risk.

The fundamental purpose of what is credit value adjustment is to provide a more accurate and realistic valuation of derivatives. It ensures that financial institutions adequately account for counterparty credit risk. This has become increasingly important since the 2008 financial crisis. Regulatory bodies now place a strong emphasis on CVA. They use it to ensure the financial stability of institutions that engage in OTC derivative trading. What is credit value adjustment also affects the pricing of the derivatives. The cost of credit risk is passed to the counterparty. CVA is a vital tool for risk management and regulatory compliance. It represents a fundamental shift towards a more comprehensive approach to derivative valuation. What is credit value adjustment? It allows firms to manage and price counterparty risk.

Unveiling the Mechanics: How CVA Works

The calculation of what is credit value adjustment, or CVA, involves quantifying the potential loss stemming from a counterparty’s default on an over-the-counter (OTC) derivative transaction. It essentially measures the difference between the risk-free value of a derivative and its value considering the possibility of counterparty default. Several key components underpin this calculation. These include the probability of default (PD), loss given default (LGD), and exposure at default (EAD). The PD represents the likelihood of the counterparty defaulting on its obligations within a specific timeframe. The LGD signifies the percentage of the exposure that would be lost in the event of default. EAD estimates the likely amount outstanding at the time of default.

To illustrate, consider a simple example. Imagine a bank has a derivative contract with a company. If the risk-free value of the derivative to the bank is $1 million, it means that without considering credit risk the bank would be receiving $1 million. However, there is a chance the company could default before the contract is complete. The what is credit value adjustment is based on the company’s credit rating and derivative’s characteristics. If the bank estimates the probability of the company defaulting is 2% and the loss given default is 50%, and the potential exposure is $1 million, the CVA would be 2% * 50% * $1 million = $10,000. This $10,000 represents the adjustment to the derivative’s value to account for the credit risk. The bank would therefore value the derivative at $990,000.

This calculation highlights the incremental valuation of derivatives when contrasting a default-free scenario with one incorporating potential counterparty credit risk. In a world without default risk, the derivative’s value is simply its expected future cash flows discounted at a risk-free rate. However, in the real world, counterparties can and do default. Consequently, what is credit value adjustment reflects the reduction in the derivative’s value because of this possibility. Sophisticated models are needed to estimate the probability of default, exposure at default, and loss given default. These inputs are critical for accurate CVA calculation and effective credit risk management.

Factors Influencing CVA Magnitude

Several factors influence the magnitude of Credit Valuation Adjustment (CVA). The creditworthiness of the counterparty is a primary driver. A counterparty with a higher probability of default will lead to a larger CVA. The volatility of the underlying asset also plays a significant role. Higher volatility increases the uncertainty of future exposure, potentially increasing CVA. What is credit value adjustment sensitive to creditworthiness of involved parties and assets?

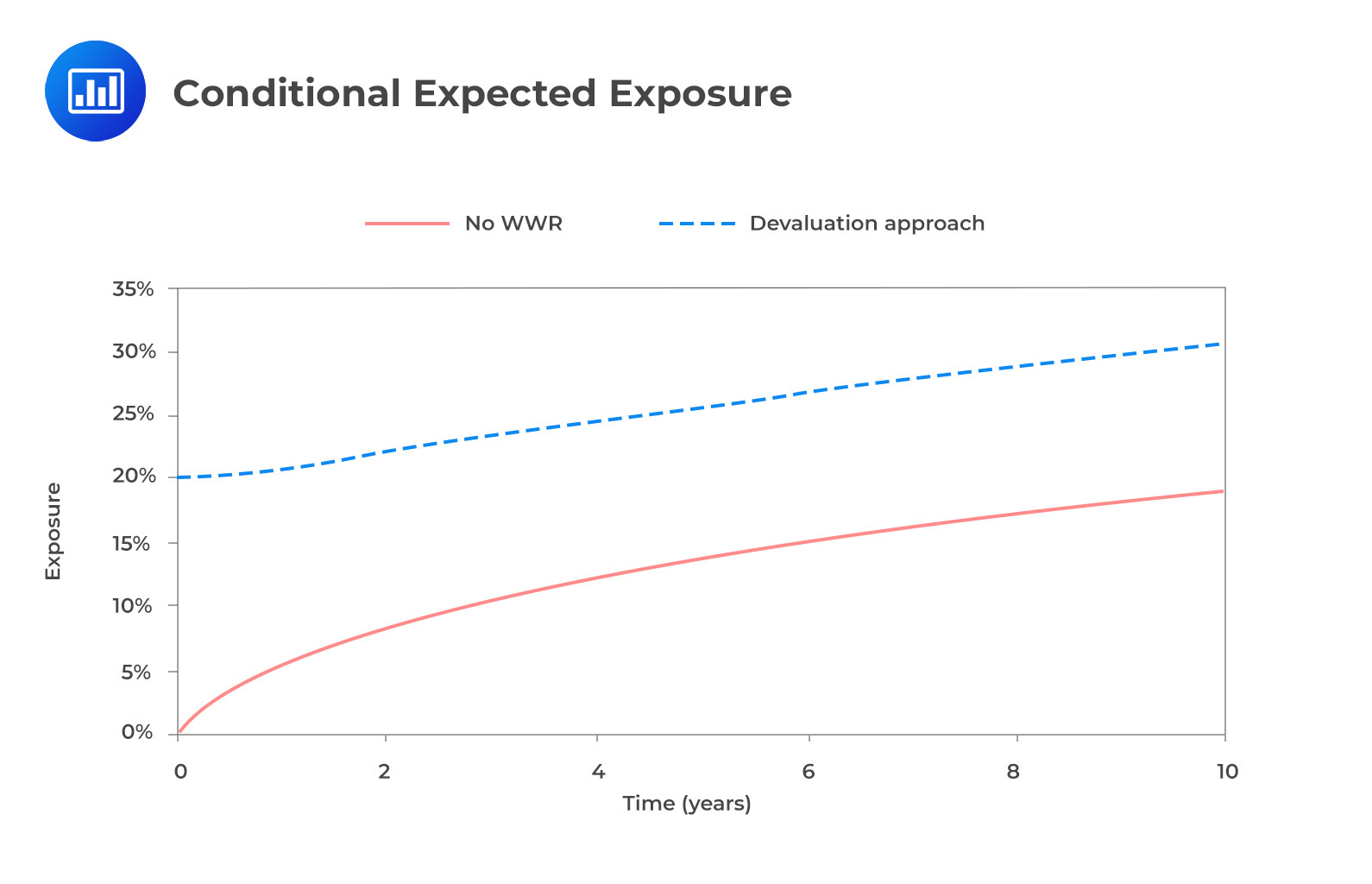

The maturity of the derivative contract is another key factor. Longer maturities generally result in higher CVA. This is because there is more time for the counterparty to potentially default. The correlation between the counterparty’s creditworthiness and the value of the derivative is crucial. A positive correlation, where the counterparty’s creditworthiness worsens as the derivative’s value increases for the firm, significantly elevates CVA. This is because the firm is more likely to suffer a loss when the counterparty defaults. What is credit value adjustment impact depends on the derivatives contract maturity?

Netting agreements and collateralization significantly impact CVA. Netting agreements reduce exposure by allowing offsetting of obligations across multiple transactions. Collateralization provides security in the event of default, reducing the potential loss. The effectiveness of these mitigation techniques directly lowers the CVA charge. For instance, a well-collateralized portfolio will have a much smaller CVA than an uncollateralized one. Furthermore, the firm’s own credit quality influences the CVA. If the firm’s creditworthiness deteriorates, the CVA calculation will reflect this increased risk of the firm defaulting on its obligations. The interaction of these factors determines the overall CVA charge, highlighting the complexity of assessing and managing counterparty credit risk. What is credit value adjustment, and how is it affected by collateral?

The Significance of CVA in Risk Management

Credit Valuation Adjustment (CVA) plays a crucial role in modern risk management, especially for financial institutions engaged in over-the-counter (OTC) derivatives trading. It allows these institutions to quantify and manage the credit risk arising from potential counterparty defaults. Without CVA, the valuation of derivatives would be incomplete, leading to an underestimation of the true risks involved. Accurately assessing this risk is vital for maintaining financial stability and protecting against potential losses. Therefore, understanding what is credit value adjustment becomes paramount.

CVA’s significance extends to regulatory capital requirements, notably under frameworks like Basel III. These regulations mandate that financial institutions hold capital reserves to cover potential losses from counterparty credit risk, including CVA. The CVA charge reflects the expected loss due to counterparty default, and adequate capital must be allocated to absorb these potential losses. Furthermore, the CVA charge is also a function of the firm’s own credit quality. This means that a financial institution’s own potential default impacts the CVA calculation, highlighting the interconnectedness of credit risk in derivatives transactions. Therefore, what is credit value adjustment directly influences capital adequacy and overall financial health.

In essence, CVA provides a mechanism for incorporating counterparty credit risk into the valuation of derivatives. It forces financial institutions to consider the possibility of default and its potential impact on their portfolios. By quantifying this risk, CVA enables better risk management practices, more accurate pricing of derivatives, and greater transparency in financial markets. Understanding what is credit value adjustment, its calculation, and its implications is crucial for risk managers, traders, and regulators alike. The concept ensures a more comprehensive and prudent approach to managing counterparty credit risk in the complex world of derivatives. Moreover, what is credit value adjustment allows financial institutions to meet regulatory expectations and maintain a stable financial position. Therefore, CVA is integral to risk management, regulatory compliance, and the overall health of the financial system.

Calculating CVA: A Practical Approach

A more detailed examination of the practical calculation of Credit Valuation Adjustment (CVA) is essential. This delves into modeling approaches, such as Monte Carlo simulation and closed-form solutions. Understanding these methods is crucial for accurately determining what is credit value adjustment. The Monte Carlo method involves simulating numerous potential future scenarios. These scenarios consider various factors impacting the value of the derivative and the counterparty’s creditworthiness. The closed-form solutions offer a more direct, mathematical approach under certain simplifying assumptions.

Estimating key input parameters poses significant challenges in CVA calculation. These parameters include the probability of default (PD) and the loss given default (LGD). The PD reflects the likelihood of the counterparty defaulting on its obligations. The LGD represents the expected loss in the event of default. Accurate estimation of these parameters requires sophisticated statistical modeling and access to reliable credit data. Historical data, credit ratings, and market-implied information all contribute to this process. What is credit value adjustment is significantly influenced by the precision of these estimations.

Model risk has a considerable impact on the overall CVA calculation. Different models and assumptions can yield varying CVA values. This highlights the importance of model validation and sensitivity analysis. Financial institutions must carefully assess the limitations of their chosen models and understand the potential range of outcomes. The complexity of derivative contracts and the dynamic nature of credit markets further exacerbate model risk. Regular model reviews and updates are vital for maintaining the accuracy and reliability of CVA calculations. Understanding model risk is integral to grasping what is credit value adjustment comprehensively. Moreover, proper regulatory reporting depends on accurate CVA calculations, making robust modeling practices paramount.

How to Mitigate CVA Risk Effectively

Mitigating Credit Valuation Adjustment (CVA) risk is crucial for financial institutions engaging in over-the-counter (OTC) derivatives transactions. Several strategies can be employed to reduce potential losses arising from counterparty default. Understanding what is credit value adjustment and its drivers is the first step toward effective mitigation. Collateralization is a primary method, involving the exchange of assets between parties to cover potential losses. This reduces exposure by ensuring that the party at risk has recourse to assets should the other party default. However, the cost of collateral, including opportunity cost and management expenses, needs to be carefully considered. Furthermore, collateralization can impact liquidity, particularly if substantial amounts of assets are tied up as collateral.

Netting agreements represent another effective approach. These agreements allow for the offsetting of positive and negative exposures across multiple transactions with the same counterparty. This reduces the overall exposure and consequently lowers the CVA charge. However, the enforceability of netting agreements across different jurisdictions is a critical consideration. Credit derivatives, such as credit default swaps (CDS), can also be used to hedge CVA risk. By purchasing protection on the counterparty’s creditworthiness, the financial institution can offset potential losses in the event of default. Diversification of counterparty exposures is yet another important strategy. By spreading risk across a wider range of counterparties, the institution reduces its reliance on any single entity and minimizes the impact of a potential default. This helps manage what is credit value adjustment for the overall portfolio.

Each mitigation strategy has its own benefits and drawbacks. Collateralization, while effective, can be costly and impact liquidity. Netting agreements depend on legal enforceability. Credit derivatives introduce basis risk and counterparty risk related to the CDS seller. Diversification may limit access to certain counterparties or markets. Therefore, a comprehensive approach to CVA risk management involves a combination of these strategies, carefully tailored to the specific characteristics of the derivatives portfolio and the risk appetite of the financial institution. Understanding what is credit value adjustment involves understanding these mitigation techniques. Real-world considerations, such as the cost of implementation, the operational complexity, and the regulatory requirements, must be taken into account when designing and implementing a CVA risk mitigation program. Ultimately, effective CVA risk management is essential for maintaining financial stability and protecting against potential losses in the derivatives market. The key is to deeply understand what is credit value adjustment and how it can be proactively managed.

The Impact of CVA on Derivative Pricing

The inclusion of what is credit value adjustment significantly alters the pricing of derivative contracts. Counterparties are now factoring in the cost of CVA, which reflects the credit risk inherent in the transaction. This adjustment is not merely a theoretical exercise; it directly translates into the prices observed in the market. The party bearing the credit risk, typically the seller of protection, will incorporate the CVA charge into the derivative’s price.

Consequently, the counterparty seeking to engage in the derivative transaction faces higher costs. This increase reflects the compensation required by the other party for assuming the potential loss due to default. The magnitude of the price difference due to what is credit value adjustment depends on several factors. These factors include the creditworthiness of the counterparty, the specific terms of the derivative contract, and prevailing market conditions. Derivatives trades with riskier counterparties will have higher CVA charges and thus higher prices.

The impact of what is credit value adjustment extends beyond individual transactions. It affects overall market liquidity and trading activity. As derivative prices become more sensitive to counterparty credit risk, trading desks must carefully assess and manage their exposures. This can lead to a decrease in trading volume, particularly for transactions involving less creditworthy entities. Furthermore, the need to account for CVA introduces complexities in pricing and valuation models. These complexities require sophisticated risk management systems and expertise. What is credit value adjustment influences the decision-making process of market participants. It ensures that credit risk is properly accounted for in derivative pricing. Ultimately, this leads to a more stable and transparent financial system.

CVA in the Context of Regulatory Frameworks

Credit Valuation Adjustment (CVA) holds significant importance within the landscape of regulatory frameworks governing financial institutions. Basel III, a globally recognized regulatory standard, addresses CVA explicitly, imposing capital requirements to mitigate the risks associated with counterparty credit risk in over-the-counter (OTC) derivatives transactions. These regulations recognize that a firm’s financial health is intertwined with the creditworthiness of its counterparties. Understanding what is credit value adjustment is critical for proper risk management.

The capital requirements under Basel III for CVA are designed to ensure that financial institutions hold sufficient capital to absorb potential losses arising from counterparty defaults. The regulations outline specific methodologies for calculating the CVA capital charge, taking into account factors such as the probability of default of the counterparty, the loss given default, and the exposure at default. These calculations can be complex, often involving sophisticated modeling techniques, to accurately assess the potential for losses. Understanding what is credit value adjustment requires also understanding these capital requirements. What is credit value adjustment is a core aspect of regulatory compliance for any institution that deals with OTC derivatives.

These regulations significantly impact financial institutions’ balance sheets. The CVA capital charge increases the overall capital requirements, potentially reducing the amount of capital available for other activities, such as lending or investments. Financial institutions must carefully manage their CVA exposures to optimize their capital usage. Furthermore, regulatory frameworks such as Counterparty Credit Risk (CCR) guidelines emphasize the broader management of risks associated with counterparties, encompassing aspects beyond just CVA. Firms must implement robust systems and controls to monitor and manage their counterparty credit risk exposures effectively, considering factors like netting agreements and collateralization. What is credit value adjustment is therefore not just a valuation adjustment, but a key metric in regulatory compliance. Understanding what is credit value adjustment and its regulatory implications is vital for financial institutions operating in the derivatives market.