Defining Conditional Value at Risk: A Key Metric in Finance

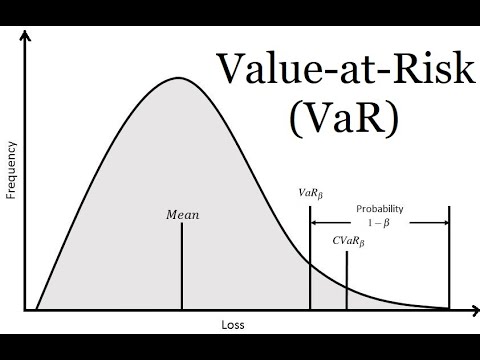

In the world of finance, understanding risk is crucial for making informed investment decisions. One metric that has gained significant attention in recent years is Conditional Value at Risk (CVaR). So, what is Conditional Value at Risk? CVaR is a risk management metric that measures the potential loss of a portfolio over a specific time horizon with a given probability. It provides a more comprehensive view of risk than traditional Value at Risk (VaR) by considering the tail risks, which are the extreme losses that can occur with a low probability. This metric is particularly useful for investors and financial institutions seeking to minimize potential losses and maximize returns. By understanding what is Conditional Value at Risk, financial professionals can make more informed investment decisions, optimize their portfolios, and develop effective risk management strategies. In essence, CVaR helps investors answer critical questions about their investments, such as “What is the potential loss of my portfolio if a certain event occurs?” or “How can I minimize my potential losses while maximizing returns?”

How to Calculate Conditional Value at Risk: A Step-by-Step Guide

Calculating Conditional Value at Risk (CVaR) is a crucial step in risk management, as it provides a more comprehensive view of potential losses than traditional Value at Risk (VaR). To calculate CVaR, follow these steps:

Step 1: Define the Confidence Level – Determine the confidence level (α) at which you want to calculate CVaR. A common confidence level is 95%, which means there is a 5% probability of exceeding the calculated CVaR.

Step 2: Calculate the VaR – Calculate the Value at Risk (VaR) using historical data or simulations. VaR is the maximum potential loss of a portfolio over a specific time horizon with a given probability.

Step 3: Calculate the Expected Shortfall (ES) – Calculate the Expected Shortfall (ES) using the VaR and the confidence level. ES is the average loss exceeding VaR.

Step 4: Calculate the CVaR – Calculate the Conditional Value at Risk (CVaR) using the ES and the confidence level. CVaR is the expected loss exceeding VaR, conditional on the event that the loss exceeds VaR.

The formula to calculate CVaR is: CVaR = ES / (1 – α)

Example: Suppose you want to calculate the CVaR of a portfolio with a 95% confidence level. The VaR is $100,000, and the ES is $150,000. The CVaR would be: CVaR = $150,000 / (1 – 0.95) = $3,000,000.

By following these steps, you can calculate the Conditional Value at Risk and gain a better understanding of the potential losses of your portfolio. This metric is essential in risk management, as it helps investors and financial institutions make informed investment decisions and develop effective risk management strategies.

The Difference Between Value at Risk and Conditional Value at Risk

In the realm of risk management, two metrics are often mentioned together: Value at Risk (VaR) and Conditional Value at Risk (CVaR). While both metrics are used to measure potential losses, they differ in their approach and scope. Understanding the distinction between VaR and CVaR is crucial for effective risk management.

VaR is a widely used metric that estimates the potential loss of a portfolio over a specific time horizon with a given probability. It provides a snapshot of potential losses, but it has some limitations. VaR only considers the losses up to a certain confidence level, ignoring the tail risks, which are the extreme losses that can occur with a low probability.

CVaR, on the other hand, takes into account the tail risks, providing a more comprehensive view of potential losses. CVaR measures the expected loss exceeding VaR, conditional on the event that the loss exceeds VaR. This metric is more sensitive to extreme events and provides a better understanding of the potential losses in the tail of the distribution.

The advantages of using CVaR over VaR are numerous. CVaR provides a more accurate representation of potential losses, especially in times of market stress. It also helps investors and financial institutions to better manage their risk exposure and develop more effective risk management strategies. Additionally, CVaR is a more conservative metric, which means it provides a higher estimate of potential losses, allowing for more robust risk management.

In summary, while VaR provides a general idea of potential losses, CVaR offers a more detailed and accurate picture of potential losses, including the tail risks. By understanding the difference between VaR and CVaR, investors and financial institutions can make more informed investment decisions and develop more effective risk management strategies. What is Conditional Value at Risk? It is a crucial metric that helps investors answer critical questions about their investments, such as “What is the potential loss of my portfolio if a certain event occurs?” or “How can I minimize my potential losses while maximizing returns?”

Real-World Applications of Conditional Value at Risk

In various industries, Conditional Value at Risk (CVaR) has proven to be a valuable tool for risk assessment and mitigation. By understanding the potential losses exceeding Value at Risk (VaR), organizations can develop more effective risk management strategies and make informed investment decisions.

In the banking sector, CVaR is used to measure the potential losses of loan portfolios, allowing banks to set aside sufficient capital to cover potential losses. This helps banks to maintain their financial stability and comply with regulatory requirements. For instance, the Basel Accords require banks to calculate CVaR as part of their capital adequacy requirements.

In the investment industry, CVaR is used to evaluate the potential losses of investment portfolios. By calculating CVaR, investors can identify potential risks and adjust their portfolios accordingly. This helps investors to minimize potential losses and maximize returns. For example, a hedge fund may use CVaR to evaluate the potential losses of its portfolio and adjust its investment strategy to minimize risk.

In the insurance industry, CVaR is used to assess the potential losses of insurance policies. By understanding the potential losses exceeding VaR, insurance companies can set aside sufficient reserves to cover potential claims. This helps insurance companies to maintain their financial stability and provide adequate coverage to their policyholders. For instance, an insurance company may use CVaR to evaluate the potential losses of its policyholders and adjust its premium rates accordingly.

In addition to these industries, CVaR has applications in other areas, such as asset management, pension funds, and regulatory bodies. By understanding what is Conditional Value at Risk, organizations can develop more effective risk management strategies and make informed investment decisions. CVaR provides a more comprehensive view of potential losses, allowing organizations to better manage their risk exposure and achieve their financial objectives.

Conditional Value at Risk vs. Expected Shortfall: Which Metric is Better?

In the realm of risk management, two metrics are often compared: Conditional Value at Risk (CVaR) and Expected Shortfall (ES). Both metrics aim to quantify potential losses, but they differ in their approach and scope. Understanding the strengths and weaknesses of each metric is crucial for effective risk management.

CVaR, also known as Expected Tail Loss, measures the expected loss exceeding Value at Risk (VaR) at a given confidence level. It provides a more comprehensive view of potential losses, including the tail risks. CVaR is a more conservative metric, which means it provides a higher estimate of potential losses, allowing for more robust risk management.

ES, on the other hand, measures the expected loss exceeding a certain threshold. It is a more general metric that can be applied to various types of risk, including market risk, credit risk, and operational risk. ES is a more flexible metric, which means it can be tailored to specific risk management needs.

So, which metric is better? The answer depends on the specific risk management goals and objectives. CVaR is more suitable for organizations that require a more conservative approach to risk management, such as banks and financial institutions. ES, on the other hand, is more suitable for organizations that require a more flexible approach to risk management, such as hedge funds and investment firms.

Both metrics have their strengths and weaknesses. CVaR provides a more comprehensive view of potential losses, but it can be more complex to calculate. ES is more flexible, but it may not provide a complete picture of potential losses. By understanding what is Conditional Value at Risk and how it compares to ES, organizations can make informed decisions about which metric to use in their risk management strategies.

In conclusion, the choice between CVaR and ES depends on the specific risk management needs and objectives. By understanding the strengths and weaknesses of each metric, organizations can develop more effective risk management strategies and make informed investment decisions.

Common Challenges and Limitations of Conditional Value at Risk

While Conditional Value at Risk (CVaR) is a powerful risk management metric, it is not without its challenges and limitations. Understanding these potential drawbacks is crucial for effective implementation and interpretation of CVaR in risk management strategies.

One of the primary challenges of CVaR is model risk. The accuracy of CVaR calculations relies heavily on the quality of the underlying models and assumptions. If the models are flawed or the assumptions are incorrect, the CVaR calculations may not accurately reflect the potential losses. This can lead to inadequate risk management and potential financial losses.

Data quality issues are another common challenge of CVaR. The accuracy of CVaR calculations relies on high-quality data, including historical returns and volatility. If the data is incomplete, inaccurate, or biased, the CVaR calculations may not accurately reflect the potential losses. This can lead to inadequate risk management and potential financial losses.

The need for robust risk management frameworks is another limitation of CVaR. CVaR is a metric that provides a snapshot of potential losses at a given confidence level. However, it does not provide a complete picture of the risk management framework. A robust risk management framework is necessary to ensure that CVaR is used effectively in conjunction with other risk management metrics and strategies.

In addition to these challenges, CVaR also has limitations in terms of its interpretation. CVaR is a complex metric that requires a deep understanding of risk management and statistical concepts. If the results are not interpreted correctly, it can lead to inadequate risk management and potential financial losses.

Despite these challenges and limitations, CVaR remains a powerful risk management metric. By understanding what is Conditional Value at Risk and its limitations, organizations can develop more effective risk management strategies and make informed investment decisions. By addressing these challenges and limitations, organizations can ensure that CVaR is used effectively in their risk management strategies.

Best Practices for Implementing Conditional Value at Risk in Risk Management

Implementing Conditional Value at Risk (CVaR) in risk management strategies requires a thoughtful and structured approach. By following best practices, organizations can ensure that CVaR is used effectively to identify, assess, and mitigate potential risks.

First and foremost, it is essential to have a robust risk management framework in place. This framework should include clear risk management objectives, a well-defined risk appetite, and a comprehensive risk assessment process. CVaR should be integrated into this framework as a key metric for measuring potential losses.

Regular monitoring and review are critical components of effective CVaR implementation. This includes regularly updating CVaR calculations to reflect changes in market conditions, asset values, and risk profiles. It also involves reviewing CVaR results to identify potential areas of risk and opportunities for risk mitigation.

Another best practice is to use CVaR in conjunction with other risk management metrics, such as Value at Risk (VaR) and Expected Shortfall (ES). This provides a more comprehensive view of potential risks and allows organizations to develop more effective risk management strategies.

It is also important to ensure that CVaR calculations are based on high-quality data and robust models. This includes using historical data that is relevant and accurate, as well as models that are well-specified and regularly validated.

Finally, organizations should ensure that CVaR results are communicated effectively to stakeholders, including risk managers, investors, and regulators. This includes providing clear and concise reports that highlight potential risks and opportunities for risk mitigation.

By following these best practices, organizations can ensure that CVaR is used effectively in their risk management strategies. This includes understanding what is Conditional Value at Risk and how it can be used to identify, assess, and mitigate potential risks. By integrating CVaR into their risk management frameworks, organizations can make more informed investment decisions and improve their overall risk management capabilities.

The Future of Risk Management: The Role of Conditional Value at Risk

The risk management landscape is constantly evolving, with new challenges and opportunities emerging regularly. As the financial industry continues to grapple with the complexities of risk management, Conditional Value at Risk (CVaR) is poised to play an increasingly important role in shaping future risk assessment and mitigation strategies.

One of the key trends driving the adoption of CVaR is the growing recognition of the importance of tail risk management. As financial institutions and investors seek to better understand and manage extreme events, CVaR is emerging as a critical metric for measuring and mitigating tail risk.

Another trend driving the adoption of CVaR is the increasing focus on regulatory compliance. As regulatory bodies around the world continue to emphasize the importance of robust risk management practices, CVaR is becoming an essential tool for financial institutions seeking to demonstrate their commitment to risk management.

In addition, the growing use of advanced analytics and machine learning techniques is also driving the adoption of CVaR. By leveraging these technologies, financial institutions can develop more sophisticated risk models that incorporate CVaR and other metrics to provide a more comprehensive view of risk.

As the risk management landscape continues to evolve, it is clear that CVaR will play an increasingly important role in shaping future risk assessment and mitigation strategies. By understanding what is Conditional Value at Risk and its applications, financial institutions and investors can develop more effective risk management strategies and make more informed investment decisions.

In the future, we can expect to see CVaR being used in conjunction with other advanced analytics techniques, such as scenario analysis and stress testing, to provide a more comprehensive view of risk. We can also expect to see CVaR being used in a wider range of industries, including insurance, energy, and commodities.

Ultimately, the future of risk management is likely to be shaped by the increasing recognition of the importance of robust risk management practices and the growing adoption of advanced analytics techniques. As CVaR continues to play an increasingly important role in this landscape, financial institutions and investors will be better equipped to manage risk and make more informed investment decisions.