Understanding the Basics of Options

In the world of finance, options are a type of derivative instrument that gives the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price. Options are often used by investors to manage risk, speculate on price movements, or generate income. There are two main types of options: calls and puts. A call option gives the holder the right to buy an underlying asset, while a put option gives the holder the right to sell an underlying asset. Understanding the differences between calls and puts is crucial in option trading, as it can significantly impact trading decisions. Additionally, volatility plays a vital role in option pricing, and understanding its effects is essential for making informed trading decisions. By grasping the basics of options, investors can set themselves up for success in the world of option trading, including understanding the concept of an option adjusted spread.

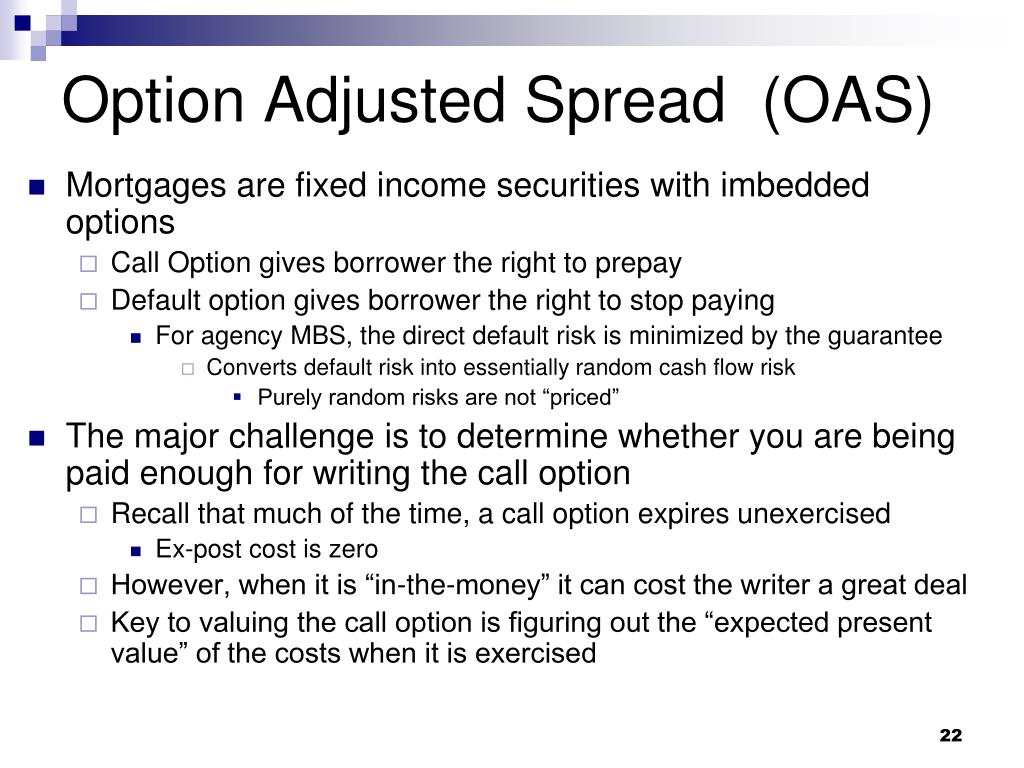

What is an Option Adjusted Spread?

An option adjusted spread is a measure of the difference in value between two options contracts with different underlying assets, strike prices, or expiration dates. It is a crucial concept in option trading, as it helps investors and traders to identify potential arbitrage opportunities, manage risk, and make informed trading decisions. Unlike other spread measures, an option adjusted spread takes into account the unique characteristics of options, such as volatility, time decay, and interest rates. By understanding what an option adjusted spread is and how it works, traders can gain a competitive edge in the markets and improve their overall trading performance. In essence, an option adjusted spread is a powerful tool that helps traders to unlock the secrets of option trading and make more informed investment decisions.

How to Calculate an Option Adjusted Spread

Calculating an option adjusted spread involves a step-by-step process that takes into account various factors, including the underlying asset’s price, volatility, interest rates, and time to expiration. The formula for calculating an option adjusted spread is as follows:

Option Adjusted Spread = (Call Option Price – Put Option Price) / (Strike Price of Call Option – Strike Price of Put Option)

In this formula, the call option price and put option price are the current market prices of the respective options. The strike price of the call option and put option are the predetermined prices at which the underlying asset can be bought or sold.

To illustrate this concept, let’s consider an example. Suppose we have a call option to buy 100 shares of XYZ stock at $50 per share, with a current market price of $5. We also have a put option to sell 100 shares of XYZ stock at $45 per share, with a current market price of $3. Using the formula above, we can calculate the option adjusted spread as follows:

Option Adjusted Spread = ($5 – $3) / ($50 – $45) = $2 / $5 = 0.40

This means that the option adjusted spread is 0.40, or 40 cents. This value can be used to identify potential arbitrage opportunities, manage risk, and make informed trading decisions.

The Benefits of Using an Option Adjusted Spread

Using an option adjusted spread can have a significant impact on a trader’s overall performance and profitability. By incorporating this valuable tool into their trading strategy, investors can enjoy a range of benefits, including improved risk management, enhanced trading decisions, and increased profitability.

One of the primary advantages of using an option adjusted spread is its ability to help traders manage risk more effectively. By taking into account the unique characteristics of options, such as volatility and time decay, traders can better assess the potential risks and rewards of a trade. This enables them to make more informed decisions and adjust their strategy accordingly.

In addition to improved risk management, an option adjusted spread can also enhance trading decisions by providing a more accurate picture of market conditions. By adjusting for the differences between call and put options, traders can gain a better understanding of market sentiment and make more informed decisions about when to buy or sell.

Furthermore, using an option adjusted spread can lead to increased profitability by identifying potential arbitrage opportunities and exploiting them. By taking advantage of price discrepancies between call and put options, traders can generate profits with minimal risk.

Overall, incorporating an option adjusted spread into a trading strategy can have a significant impact on a trader’s bottom line. By improving risk management, enhancing trading decisions, and increasing profitability, this valuable tool can help traders achieve their investment goals and succeed in the competitive world of option trading.

Real-World Applications of Option Adjusted Spreads

Option adjusted spreads have a wide range of practical applications in various trading scenarios, making them a valuable tool for traders and investors. In this section, we’ll explore some of the most common uses of option adjusted spreads, including hedging, speculation, and arbitrage.

Hedging is a common strategy used to manage risk by offsetting potential losses in one investment with gains in another. Option adjusted spreads can be used to hedge against potential losses in a portfolio by identifying mispricings in the options market. For example, if an investor is long on a stock and expects the price to fall, they can use an option adjusted spread to hedge against potential losses by buying a put option and selling a call option.

Speculation is another common use of option adjusted spreads. By identifying mispricings in the options market, traders can speculate on the direction of the underlying asset’s price movement. For instance, if an option adjusted spread indicates that a call option is undervalued relative to a put option, a trader may buy the call option and sell the put option, expecting the underlying asset’s price to rise.

Arbitrage is a trading strategy that involves exploiting price discrepancies between two or more markets. Option adjusted spreads can be used to identify arbitrage opportunities by comparing the prices of call and put options across different exchanges or markets. For example, if an option adjusted spread indicates that a call option is overvalued on one exchange relative to another, a trader may buy the call option on the cheaper exchange and sell it on the more expensive exchange, earning a risk-free profit.

In addition to these common applications, option adjusted spreads can also be used in more complex trading strategies, such as volatility trading and skew trading. By incorporating option adjusted spreads into their trading strategy, traders can gain a deeper understanding of market conditions and make more informed investment decisions.

Common Misconceptions About Option Adjusted Spreads

Despite their importance in option trading, option adjusted spreads are often misunderstood or misused by traders. In this section, we’ll address some common misconceptions and myths surrounding option adjusted spreads, and provide clarity on their limitations and potential pitfalls.

One common misconception is that option adjusted spreads are only useful for advanced traders. While it’s true that option adjusted spreads require a certain level of understanding of options and volatility, they can be used by traders of all levels. By incorporating option adjusted spreads into their trading strategy, traders can gain a better understanding of market conditions and make more informed investment decisions.

Another misconception is that option adjusted spreads are a foolproof way to make profits. While option adjusted spreads can be a valuable tool for identifying mispricings in the options market, they are not a guarantee of profits. Traders must still conduct thorough research and analysis before making a trade, and be prepared to adapt to changing market conditions.

Some traders also believe that option adjusted spreads are only useful for short-term trading. However, option adjusted spreads can be used in both short-term and long-term trading strategies. By incorporating option adjusted spreads into a long-term trading strategy, traders can gain a better understanding of market trends and make more informed investment decisions.

Finally, some traders may believe that option adjusted spreads are too complex or difficult to calculate. While it’s true that option adjusted spreads require a certain level of mathematical sophistication, they can be calculated using widely available formulas and software. By understanding the underlying principles of option adjusted spreads, traders can gain a deeper appreciation for the options market and make more informed investment decisions.

By understanding these common misconceptions and myths, traders can gain a clearer understanding of the benefits and limitations of option adjusted spreads. By incorporating option adjusted spreads into their trading strategy, traders can gain a competitive edge in the options market and achieve their investment goals.

Advanced Strategies for Option Adjusted Spreads

Option adjusted spreads offer a range of advanced strategies and techniques for traders looking to take their trading to the next level. In this section, we’ll delve into some of the most innovative and effective ways to use option adjusted spreads, including volatility trading, skew trading, and spread arbitrage.

Volatility trading is a popular strategy that involves buying and selling options based on the expected volatility of the underlying asset. By using option adjusted spreads, traders can gain a better understanding of the volatility of the options market and make more informed trading decisions. For example, if an option adjusted spread indicates that the implied volatility of a call option is higher than the implied volatility of a put option, a trader may buy the call option and sell the put option, expecting the underlying asset’s price to rise.

Skew trading is another advanced strategy that involves exploiting the differences in implied volatility between call and put options. By using option adjusted spreads, traders can identify mispricings in the options market and take advantage of them. For instance, if an option adjusted spread indicates that the implied volatility of a call option is higher than the implied volatility of a put option, a trader may buy the call option and sell the put option, expecting the underlying asset’s price to rise.

Spread arbitrage is a trading strategy that involves exploiting price discrepancies between two or more markets. By using option adjusted spreads, traders can identify arbitrage opportunities and take advantage of them. For example, if an option adjusted spread indicates that a call option is overvalued on one exchange relative to another, a trader may buy the call option on the cheaper exchange and sell it on the more expensive exchange, earning a risk-free profit.

In addition to these advanced strategies, option adjusted spreads can also be used in more complex trading scenarios, such as iron condors and butterfly spreads. By incorporating option adjusted spreads into their trading strategy, traders can gain a deeper understanding of the options market and make more informed investment decisions.

By mastering the art of option adjusted spreads, traders can unlock new opportunities for profit and gain a competitive edge in the options market. Whether you’re a seasoned trader or just starting out, option adjusted spreads offer a powerful tool for navigating the complex world of options trading.

Conclusion: Mastering the Art of Option Adjusted Spreads

In conclusion, option adjusted spreads are a powerful tool for traders looking to gain a competitive edge in the options market. By understanding what an option adjusted spread is, how to calculate it, and its various applications, traders can make more informed investment decisions and improve their overall trading performance.

Throughout this article, we’ve explored the benefits of using option adjusted spreads, including improved risk management, enhanced trading decisions, and increased profitability. We’ve also delved into advanced strategies and techniques for using option adjusted spreads, such as volatility trading, skew trading, and spread arbitrage.

To incorporate option adjusted spreads into a comprehensive trading strategy, traders should start by understanding the underlying principles of options and volatility. From there, they can begin to calculate and analyze option adjusted spreads, using them to inform their trading decisions and improve their overall performance.

Remember, option adjusted spreads are not a magic formula for guaranteed profits, but rather a valuable tool for traders looking to gain a deeper understanding of the options market. By mastering the art of option adjusted spreads, traders can unlock new opportunities for profit and achieve their investment goals.

Whether you’re a seasoned trader or just starting out, option adjusted spreads offer a powerful tool for navigating the complex world of options trading. By incorporating them into your trading strategy, you can gain a competitive edge and achieve long-term success in the options market.