What are Government Securities?

Government securities represent a fundamental aspect of national finance. They are essentially debt instruments issued by a national government to raise funds. Think of them as IOUs from the government to investors. These securities promise to repay the borrowed amount, along with interest, over a specified period.

To understand “what is a sovereign bond”, it’s helpful to differentiate them from other types of bonds. Unlike corporate bonds, which are issued by companies, sovereign bonds are backed by the full faith and credit of a national government. This backing typically implies a lower risk compared to corporate bonds, although the risk level can vary significantly between countries. Municipal bonds, issued by state or local governments, are another type of debt instrument, often used for funding public projects within a specific region.

The issuance of government securities, including what is a sovereign bond, allows governments to finance various public expenditures. These can range from infrastructure development and education to healthcare and national defense. By understanding the basic concept of government securities, we lay the groundwork for a more in-depth exploration of sovereign bonds and their crucial role in the global financial landscape. The process of understanding “what is a sovereign bond” involves grasping the underlying principles of government finance and debt management.

Delving Deeper: Defining Sovereign Bonds

A sovereign bond is a debt instrument issued by a national government. These bonds can be denominated in the government’s domestic currency or a foreign currency. Understanding what is a sovereign bond requires recognizing its fundamental purpose: to raise funds for government spending. Governments issue sovereign bonds to finance various projects and cover budget deficits. These funds support public services, infrastructure development, and other essential government functions. Sovereign bonds also play a crucial role in managing a nation’s existing debt.

Governments turn to sovereign debt markets when tax revenues are insufficient to cover expenditures. The issuance of what is a sovereign bond allows governments to access capital from investors. These investors range from domestic institutions to international entities. The ability to issue bonds is vital for governments seeking financial flexibility. Credit rating agencies assess the creditworthiness of sovereign bond issuers. These agencies, such as Moody’s, Standard & Poor’s, and Fitch, assign ratings that reflect the perceived risk of default. A higher credit rating typically translates to lower borrowing costs for the government. Conversely, a lower rating signals higher risk and results in higher yields demanded by investors.

The market for what is a sovereign bond is significant in the global financial landscape. These bonds offer investors an opportunity to lend money to a government. In return, investors receive periodic interest payments, known as coupon payments, and the principal amount at maturity. The yield on a sovereign bond reflects the market’s assessment of the issuer’s creditworthiness and economic stability. Factors influencing sovereign bond yields include inflation expectations, economic growth prospects, and political stability. Sovereign bonds are essential tools for governments to manage their finances and fund their operations, as well as providing investors with a relatively secure investment option, albeit one that carries its own set of risks.

How to Evaluate the Risk of Investing in a Nation’s Debt

Evaluating the risk of investing in sovereign bonds requires a careful assessment of various factors. Understanding these elements is crucial before investing in what is a sovereign bond. Political stability is paramount. Countries with stable governments and predictable policies are generally considered less risky. Political unrest, corruption, or geopolitical tensions can negatively impact a nation’s ability to repay its debts. Therefore, investors should closely monitor political developments and assess their potential impact on the country’s financial stability. What is a sovereign bond is intrinsically linked to the stability of its issuer.

The economic outlook plays a significant role. Key indicators include GDP growth, inflation rates, and unemployment levels. A strong and growing economy is better positioned to meet its debt obligations. Conversely, a contracting economy or high inflation can signal potential difficulties. The debt-to-GDP ratio is a critical metric. It indicates the level of a country’s debt relative to its economic output. A high ratio suggests a greater burden of debt and potentially higher risk. A manageable debt-to-GDP ratio is a positive sign for investors considering what is a sovereign bond. Furthermore, the current account balance, which reflects a nation’s transactions with the rest of the world, provides insights into its external financial position. A persistent current account deficit can make a country more vulnerable to external shocks.

Credit rating agencies like Moody’s, Standard & Poor’s, and Fitch provide assessments of a country’s creditworthiness. These ratings reflect their opinion on the issuer’s ability and willingness to meet its financial obligations. Higher ratings generally indicate lower risk and result in lower yields for the bonds. Lower ratings, often referred to as “speculative grade” or “junk” bonds, signal higher risk and demand higher yields to compensate investors. These agencies consider the factors described above when assigning their ratings, but their analysis offers a valuable shortcut for investors evaluating what is a sovereign bond. By carefully analyzing these economic and political factors, investors can make informed decisions about the risks and rewards associated with investing in a nation’s debt. The yield offered on a sovereign bond reflects the market’s perception of these risks. Higher perceived risk translates to higher yields, and vice versa.

The Function of Sovereign Debt in Global Markets

Sovereign bonds play a critical role in the global financial system. As debt instruments issued by national governments, they serve as benchmark bonds. These benchmarks are used to price other assets, including corporate bonds and other fixed-income securities. The yield on a sovereign bond often reflects the perceived risk associated with lending to that specific country. Understanding what is a sovereign bond and its function is key to grasping international finance.

One significant function of sovereign debt is its role in portfolio diversification. Investors, from large institutions to individuals, use sovereign bonds to diversify their investment portfolios. This diversification helps to manage risk. Bonds from different countries offer varying levels of risk and return. Thus, they provide opportunities to balance a portfolio. International investment flows are significantly influenced by sovereign debt. A country with stable economic policies and a strong credit rating is more likely to attract foreign investment through its sovereign bonds. These bonds are a key component of what is a sovereign bond’s impact on global markets.

Furthermore, the yields on sovereign bonds serve as a barometer of investor sentiment regarding a country’s economic and political prospects. Higher yields typically suggest that investors demand a greater return for the perceived risk of lending to that nation. Factors influencing this sentiment include economic growth, inflation, political stability, and fiscal policy. A country’s ability to manage its debt and maintain a stable economic environment is crucial in maintaining investor confidence and keeping borrowing costs low. Therefore, what is a sovereign bond is more than just a debt instrument; it is a reflection of a nation’s financial health and prospects, impacting everything from currency values to foreign investment. Understanding these dynamics is essential for anyone participating in global financial markets. The concept of what is a sovereign bond is central to global economic stability, as the trading and valuation affect investment decisions worldwide.

Who Invests in Government Bonds?

A diverse range of investors participate in the sovereign bond market, each with specific motivations. Institutional investors, such as pension funds, insurance companies, and mutual funds, represent a significant portion of the market. These entities often seek secure, long-term investments to meet their obligations. Understanding what is a sovereign bond is crucial for them, as they factor in the risk and potential returns when making investment decisions. Pension funds, for example, invest in sovereign bonds to ensure they can pay out retirement benefits reliably. Insurance companies use them to guarantee the payouts on their insurance policies. Mutual funds, meanwhile, include sovereign bonds in their portfolios to offer diversification to their investors. Central banks also play a critical role, often holding significant quantities of sovereign bonds as part of their foreign exchange reserves. This helps maintain monetary stability and manage currency fluctuations. What is a sovereign bond to a central bank? It’s a key instrument for macroeconomic management.

Foreign governments are also prominent players in the sovereign bond market. They may invest in the debt instruments of other countries to diversify their assets and gain exposure to different economies. These investments can help foster international relations and economic cooperation. Individual investors also participate, albeit usually on a smaller scale. They might invest in sovereign bonds through brokerage accounts or mutual funds seeking relatively low-risk, fixed-income investments. The attractiveness of sovereign bonds for individual investors is often tied to factors like perceived safety and predictable returns. Many understand that what is a sovereign bond entails less volatility than other investment options. This perception, however, is contingent on the issuing country’s economic and political stability.

The motivations behind these investments vary. Safety and stability are paramount for many investors. Sovereign bonds, particularly those from highly-rated countries, are often considered among the safest investments available. Diversification is another key driver. Investing in sovereign bonds from various countries reduces overall portfolio risk. The yields offered, while often lower than those of riskier assets, provide a predictable stream of income. Finally, some investors see sovereign bonds as a hedge against inflation or currency fluctuations. The specific choice of bonds depends on individual investor needs and risk tolerance, and a thorough understanding of what is a sovereign bond is key for making informed decisions.

The Impact of Credit Ratings on Bond Valuation

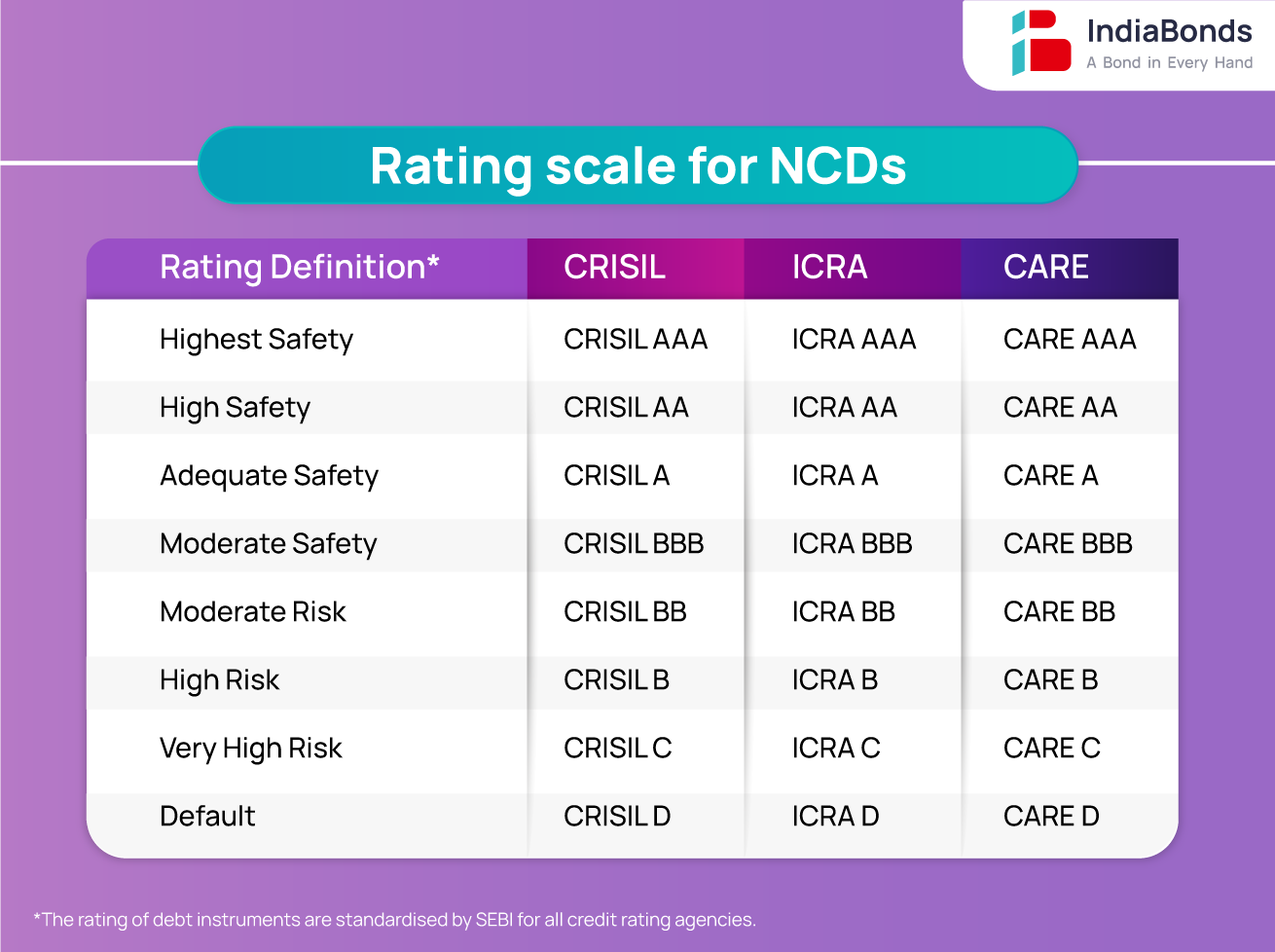

Credit rating agencies like Moody’s, Standard & Poor’s, and Fitch play a crucial role in assessing the creditworthiness of sovereign bonds. These agencies analyze various economic and political factors to assign ratings that reflect the perceived risk of default. A higher rating indicates a lower risk of default, while a lower rating suggests a higher risk. Understanding what is a sovereign bond and its rating is essential for investors. These ratings significantly influence investor decisions and market pricing of sovereign debt.

Investment-grade ratings, typically ranging from AAA to BBB-, signify a relatively low risk of default. Investors generally view these bonds as safer investments, demanding lower yields to compensate for the perceived lower risk. Conversely, speculative-grade or junk bonds, rated BB+ and below, are considered high-risk investments. Investors require significantly higher yields to compensate for the increased probability of default. The yield on a sovereign bond directly reflects the perceived risk. A higher perceived risk translates into a higher yield offered to attract investors.

The impact of credit ratings extends beyond yield. Ratings influence a country’s borrowing costs, access to international capital markets, and overall economic stability. A downgrade can trigger a sell-off of a country’s bonds, leading to higher borrowing costs and potentially exacerbating economic difficulties. Conversely, an upgrade can signal improved investor confidence, leading to lower borrowing costs and increased foreign investment. Therefore, credit ratings serve as a key indicator of a country’s fiscal health and its ability to meet its debt obligations. What is a sovereign bond? It is a critical component of a nation’s financial standing, heavily influenced by these credit rating assessments.

What Happens When a Country Defaults on Its Debt?

A sovereign debt default occurs when a country fails to make timely payments on its sovereign bonds. This event carries significant consequences, impacting both the country and its investors. Investors who hold the defaulted bonds face potential losses, possibly losing a portion or all of their investment. The extent of these losses depends on various factors, including the terms of the bonds and any subsequent restructuring agreements. Understanding what is a sovereign bond is crucial in assessing the risk of such defaults.

For the defaulting country, the economic repercussions can be severe. Access to international capital markets is likely to be restricted, making it difficult to secure future borrowing. This can hinder economic growth and development, leading to potential social and political instability. The country’s international reputation suffers, impacting its ability to attract foreign investment and engage in international trade. The impact can also extend to other countries, especially those with significant exposure to the defaulting nation’s debt. Historical examples, such as Argentina’s repeated defaults, illustrate the long-term economic and social costs of sovereign debt defaults. What is a sovereign bond, and how its default impacts a nation’s economy are interconnected concepts essential for financial literacy.

The aftermath of a sovereign debt default often involves complex negotiations between the defaulting country and its creditors. These negotiations can lead to debt restructuring, which typically involves a reduction in the principal amount owed or an extension of the repayment period. The terms of any restructuring will depend on various factors, including the country’s economic situation and the bargaining power of creditors. Even with restructuring, the recovery process can be lengthy and challenging, requiring significant economic reforms and policy adjustments. Investors considering sovereign bonds must understand this risk, analyze the potential for default, and diversify their portfolio to mitigate exposure. Understanding what is a sovereign bond and the risks associated with it is a critical step in responsible investing. The complexities involved underscore the need for thorough due diligence and a deep understanding of macroeconomic conditions before investing in sovereign debt instruments.

Sovereign vs. Corporate Bonds: Key Distinctions

Understanding the differences between sovereign bonds and corporate bonds is crucial for any investor. Sovereign bonds, a type of government security, represent debt issued by a national government. What is a sovereign bond? It’s essentially a loan made to a country. Corporate bonds, conversely, represent debt issued by companies. This fundamental difference in the issuer dictates many of the subsequent variations. Sovereign bonds are backed by the taxing power of a nation, making them generally considered less risky than corporate bonds, although this isn’t always the case. The risk profile of a sovereign bond is intrinsically linked to the economic and political stability of the issuing country. A country’s credit rating plays a significant role in determining the yield (return) on its bonds. Understanding what is a sovereign bond and how it differs from corporate bonds requires assessing this risk. A strong economy with low debt levels generally results in lower yields, while weaker economies with high debt may offer higher yields to compensate for increased risk.

Regulatory oversight also differs significantly. Sovereign bonds are typically subject to less stringent regulation than corporate bonds. This stems from the inherent nature of the issuer – a sovereign nation versus a private entity. Corporate bonds are subject to various regulations, including disclosure requirements and accounting standards, while the regulatory landscape for sovereign bonds varies depending on the jurisdiction. The potential returns from each differ as well. Generally, sovereign bonds provide lower returns but lower risk than corporate bonds. Corporate bonds, however, carry a higher risk profile as their value is tied directly to the financial health of the issuing company. This higher risk often translates into higher potential returns to compensate investors. The diversification of an investment portfolio benefits from the inclusion of both, given the contrasting risk and return profiles. What is a sovereign bond, in this context, becomes clearer when we consider its position within a balanced investment strategy.

Finally, a key area to consider is inflation-linked bonds. These bonds adjust their principal value according to inflation rates, protecting investors from the erosion of purchasing power. Both sovereign and corporate entities can issue inflation-linked bonds. In times of high inflation, these bonds offer an attractive hedge against rising prices. Understanding the nuances of sovereign bonds, compared to corporate bonds, is essential for effective portfolio management and making well-informed investment decisions. What is a sovereign bond ultimately hinges on understanding its unique characteristics within the broader context of the fixed-income market. This includes understanding the creditworthiness of the issuing government, the prevailing economic climate, and the overall risk-return profile of the investment.