What Drives Property Value: The Role of Discount Rates

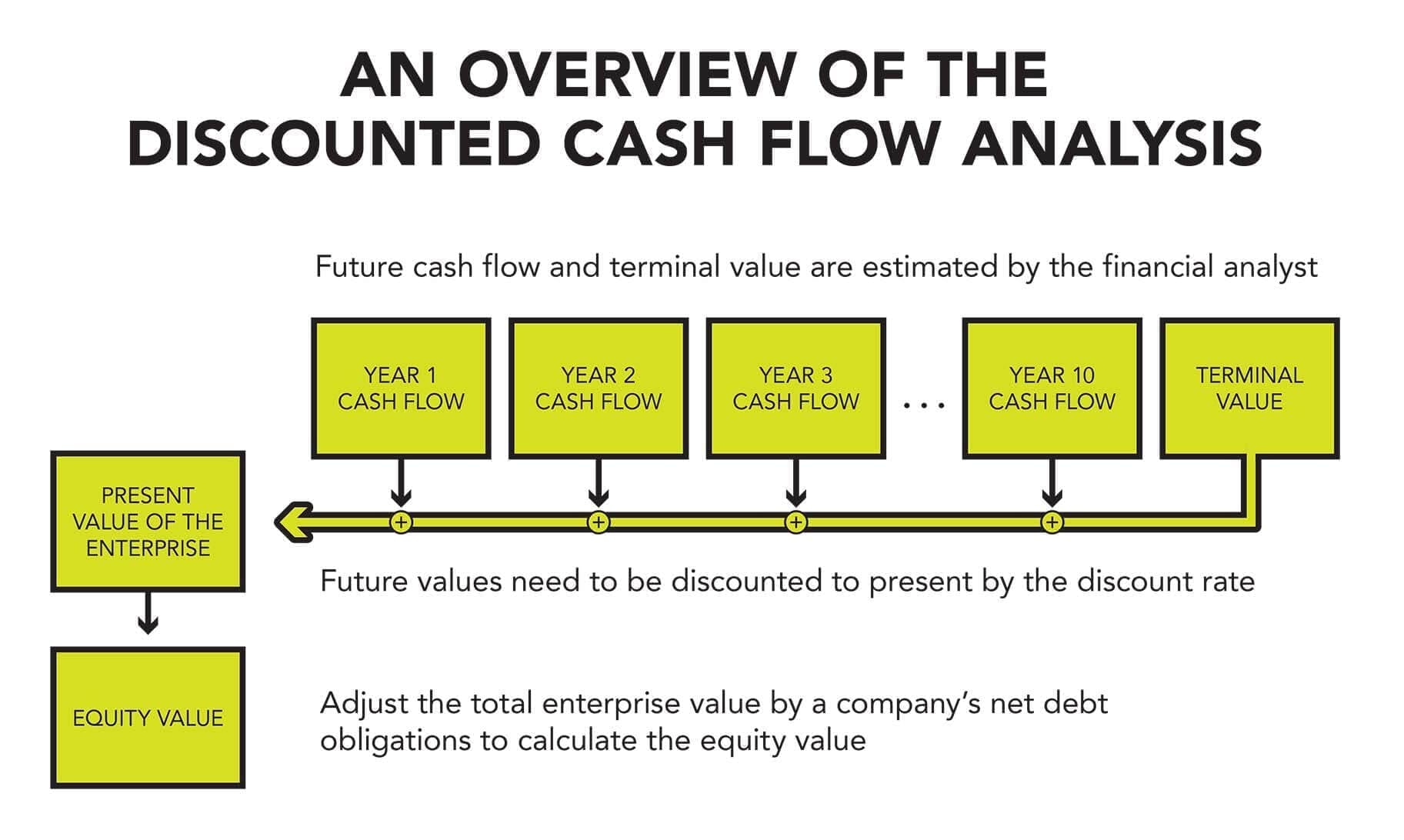

In the world of real estate investing, understanding the intricacies of property valuation is crucial for making informed investment decisions. One key concept that plays a significant role in determining property value is the discount rate. But what is a discount rate in real estate, and how does it impact investment decisions? A discount rate is a critical component in real estate investing, as it helps investors estimate the present value of future cash flows. In essence, it’s a rate that reflects the risk and opportunity cost associated with an investment. By applying a discount rate to projected cash flows, investors can determine the net present value of a property, which ultimately influences its market value. In real estate investing, understanding discount rates is vital, as it enables investors to make informed decisions about property acquisitions, dispositions, and refinancing. In this article, we’ll delve into the world of discount rates, exploring their significance, calculation, and application in real estate investing.

How to Calculate Discount Rates: A Step-by-Step Guide

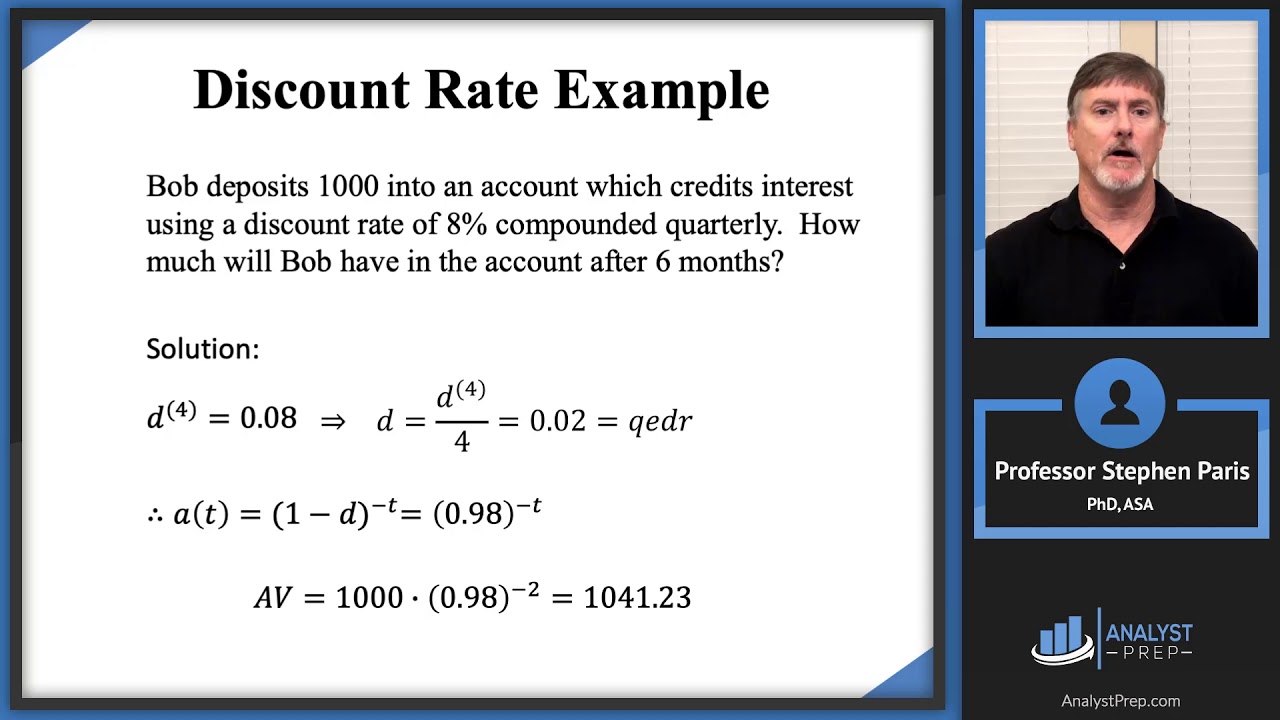

Calculating discount rates is a crucial step in real estate investing, as it enables investors to estimate the present value of future cash flows. But how do you calculate a discount rate? The process involves understanding the variables involved and applying the correct formulas. In this section, we’ll provide a step-by-step guide on how to calculate discount rates, making it easy to understand and apply in real-world scenarios.

The formula to calculate a discount rate is as follows:

Discount Rate = (Expected Return / Present Value) + Growth Rate

Where:

Expected Return is the rate of return an investor expects to earn from an investment.

Present Value is the current value of a future cash flow.

Growth Rate is the rate at which the investment is expected to grow.

For example, let’s say an investor expects a 10% return on investment, with a present value of $100,000 and a growth rate of 5%. The discount rate would be:

Discount Rate = (10% / $100,000) + 5% = 15%

This means that the investor would need to earn at least a 15% return on investment to justify the investment.

By understanding how to calculate discount rates, investors can make informed decisions about property acquisitions, dispositions, and refinancing. In the next section, we’ll explore how discount rates affect cash flow and returns on investment in real estate.

The Impact of Discount Rates on Cash Flow and Returns

Discount rates play a critical role in determining the cash flow and returns on investment in real estate. By applying a discount rate to projected cash flows, investors can estimate the present value of future income streams. This, in turn, affects the net operating income (NOI) and capitalization rate of a property.

The relationship between discount rates, NOI, and capitalization rates is as follows:

Capitalization Rate = Discount Rate / NOI

For example, if the discount rate is 12% and the NOI is $100,000, the capitalization rate would be:

Capitalization Rate = 12% / $100,000 = 0.12 or 12%

This means that the property’s value is 12 times its NOI. A higher discount rate would result in a lower capitalization rate, indicating a lower property value.

The impact of discount rates on cash flow is equally significant. A higher discount rate reduces the present value of future cash flows, making the investment less attractive. Conversely, a lower discount rate increases the present value of cash flows, making the investment more appealing.

For instance, if an investor expects a property to generate $10,000 in annual cash flow over the next 10 years, with a discount rate of 10%, the present value of those cash flows would be:

Present Value = $10,000 / (1 + 0.10)^10 = $38,554

If the discount rate were to increase to 15%, the present value would decrease to:

Present Value = $10,000 / (1 + 0.15)^10 = $24,849

This demonstrates how a higher discount rate can significantly reduce the present value of cash flows, affecting the investment’s attractiveness.

In the next section, we’ll explore the distinction between discount rates and capitalization rates, two often-confused concepts in real estate investing.

Discount Rate vs. Capitalization Rate: What’s the Difference?

In real estate investing, discount rates and capitalization rates are two crucial concepts that are often confused or used interchangeably. However, they serve distinct purposes and have different implications for investment decisions.

A discount rate is the rate at which future cash flows are discounted to their present value. It reflects the investor’s required rate of return, considering factors such as risk tolerance, market conditions, and property type. In essence, the discount rate represents the opportunity cost of investing in a particular property.

On the other hand, a capitalization rate (cap rate) is the rate of return on investment based on the property’s net operating income (NOI). It represents the ratio of NOI to the property’s value. The cap rate is often used to estimate the value of a property or to compare the performance of different investments.

The key difference between discount rates and cap rates lies in their application. Discount rates are used to evaluate the present value of future cash flows, while cap rates are used to estimate the property’s value based on its current income stream.

For example, consider a property with an NOI of $100,000 and a value of $1,000,000. The cap rate would be 10% ($100,000 / $1,000,000). If an investor requires a 12% return on investment, the discount rate would be 12%. In this scenario, the cap rate and discount rate are distinct, with the cap rate reflecting the property’s current performance and the discount rate reflecting the investor’s required return.

Understanding the distinction between discount rates and cap rates is essential for making informed investment decisions. By recognizing the differences and similarities between these two concepts, investors can better evaluate investment opportunities and optimize their portfolios.

In the next section, we’ll explore the various factors that influence discount rates in real estate, including property type, location, market conditions, and risk tolerance.

Factors Influencing Discount Rates in Real Estate

In real estate investing, discount rates are influenced by a range of factors that affect the risk and return of an investment. Understanding these factors is crucial for accurately calculating discount rates and making informed investment decisions.

One of the primary factors influencing discount rates is the property type. Different property types, such as office buildings, apartments, or retail centers, carry varying levels of risk and return. For example, a high-rise office building in a prime location may have a lower discount rate due to its stable cash flows and low risk, while a vacant land parcel may have a higher discount rate due to its uncertain development potential.

Location is another critical factor that affects discount rates. Properties located in areas with high demand, limited supply, and strong economic growth tend to have lower discount rates, while those in areas with declining populations or economic stagnation may have higher discount rates.

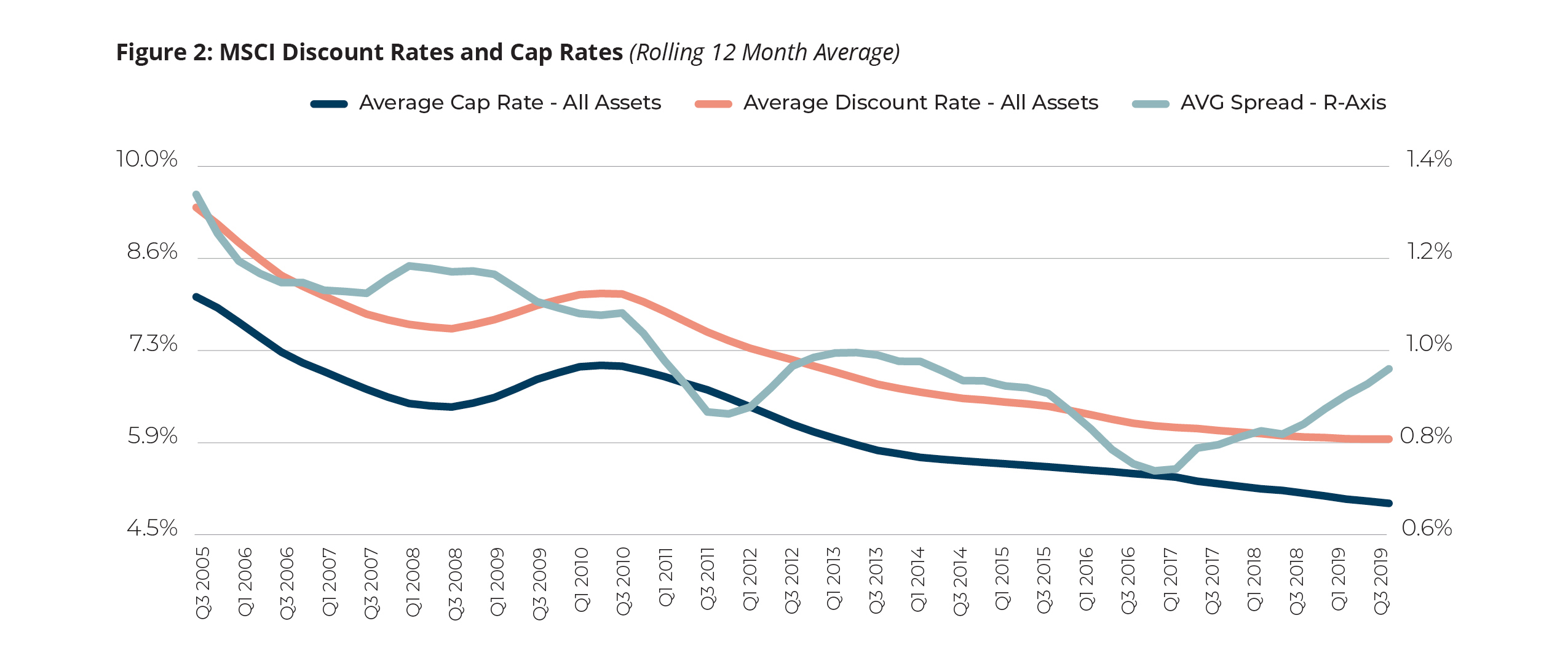

Market conditions also play a significant role in shaping discount rates. In a booming market with rising property values, discount rates may be lower, as investors are willing to accept lower returns in anticipation of future appreciation. Conversely, in a declining market, discount rates may be higher, as investors demand higher returns to compensate for the increased risk.

Risk tolerance is another essential factor that influences discount rates. Investors with a higher risk tolerance may be willing to accept lower returns and, therefore, use a lower discount rate, while those with a lower risk tolerance may require higher returns and use a higher discount rate.

Other factors that can influence discount rates include the property’s age, condition, and amenities, as well as the investor’s financing costs and tax situation. By considering these factors, investors can develop a more accurate and nuanced understanding of discount rates and make more informed investment decisions.

In the next section, we’ll explore real-world applications of discount rates in real estate, including case studies and examples of how discount rates are used in property acquisitions, dispositions, and refinancing.

Real-World Applications of Discount Rates in Real Estate

In real estate investing, discount rates play a critical role in evaluating investment opportunities and making informed decisions. Here are some real-world examples of how discount rates are used in various real estate investment scenarios:

Property Acquisitions: When acquiring a property, investors use discount rates to determine the present value of future cash flows. For instance, a real estate investment trust (REIT) may use a discount rate of 10% to evaluate the potential return on investment of a commercial property. If the property’s net operating income (NOI) is $1 million, the REIT would calculate the present value of the NOI using the discount rate, determining whether the investment meets their required return.

Property Dispositions: When disposing of a property, investors use discount rates to determine the sale price. For example, a property owner may use a discount rate of 12% to calculate the present value of the property’s future cash flows, determining a sale price that reflects the property’s value.

Refinancing: Discount rates are also used in refinancing scenarios to determine the feasibility of refinancing a property. For instance, a borrower may use a discount rate of 9% to evaluate the present value of the property’s future cash flows, determining whether refinancing at a lower interest rate would be beneficial.

Development Projects: In development projects, discount rates are used to evaluate the viability of a project. For example, a developer may use a discount rate of 15% to calculate the present value of the project’s future cash flows, determining whether the project meets their required return.

These examples illustrate the importance of discount rates in real estate investing, highlighting their role in evaluating investment opportunities, determining sale prices, and making informed decisions.

In the next section, we’ll discuss common mistakes to avoid when working with discount rates, providing tips on how to avoid these mistakes and ensure accurate calculations.

Common Mistakes to Avoid When Working with Discount Rates

When working with discount rates in real estate investing, it’s essential to avoid common mistakes that can lead to inaccurate calculations and poor investment decisions. Here are some common pitfalls to watch out for:

Incorrect Assumptions: One of the most common mistakes is making incorrect assumptions about the property’s future cash flows, such as overestimating rental income or underestimating expenses. This can lead to an inaccurate discount rate, which can result in a poor investment decision.

Miscalculations: Miscalculating the discount rate or using the wrong formula can lead to inaccurate results. For example, using a discount rate that is too high or too low can significantly impact the present value of future cash flows.

Ignoring Risk Tolerance: Failing to consider risk tolerance can lead to an inaccurate discount rate. Investors with a higher risk tolerance may be willing to accept a lower return, while those with a lower risk tolerance may require a higher return.

Not Accounting for Market Conditions: Failing to account for market conditions, such as changes in interest rates or property values, can lead to an inaccurate discount rate.

To avoid these mistakes, it’s essential to:

- Conduct thorough market research to ensure accurate assumptions about future cash flows.

- Double-check calculations to ensure accuracy.

- Consider risk tolerance when determining the discount rate.

- Account for market conditions and adjust the discount rate accordingly.

By avoiding these common mistakes, investors can ensure accurate discount rate calculations and make informed investment decisions.

In the next section, we’ll summarize the importance of understanding discount rates in real estate investing and provide a final thought on how mastering this concept can lead to successful investment decisions.

Conclusion: Mastering Discount Rates for Real Estate Success

In conclusion, understanding discount rates is crucial for real estate investors to make informed investment decisions. A discount rate is a critical component in evaluating the present value of future cash flows, and it plays a significant role in determining property value and investment returns. By grasping the concept of discount rates, investors can better navigate the complexities of real estate investing and make more accurate predictions about future cash flows.

As we’ve seen, discount rates are influenced by various factors, including property type, location, market conditions, and risk tolerance. By considering these factors, investors can determine an appropriate discount rate that reflects the property’s potential for growth and income generation.

Moreover, understanding the distinction between discount rates and capitalization rates is essential for accurate calculations and informed investment decisions. By avoiding common mistakes, such as incorrect assumptions and miscalculations, investors can ensure that their discount rate calculations are accurate and reliable.

In today’s competitive real estate market, mastering discount rates is essential for success. By incorporating discount rates into their investment strategy, investors can gain a competitive edge, make more informed decisions, and ultimately achieve their investment goals. Whether you’re a seasoned investor or just starting out, understanding discount rates is a critical component of real estate investing.

Remember, what is a discount rate in real estate? It’s a powerful tool that can help you unlock the secrets of real estate investing and achieve success in this lucrative market. By mastering discount rates, you’ll be better equipped to navigate the complexities of real estate investing and make informed decisions that drive returns.